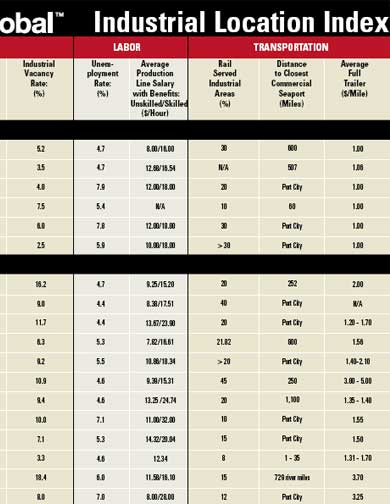

SITE SELECTION/NAI GLOBAL INDUSTRIAL LOCATION INDEX

From Site Selection magazine, March 2006

| To view the chart below as a printable PDF file, click here. |

|

|

|

|

|

Here we consider the overall economy; real estate market conditions; labor market

conditions; and transportation and logistics, to determine which markets offer the

greatest opportunity. With growing global demand for goods and cross-border commerce

on the rise, we remain bullish about the industrial sector.

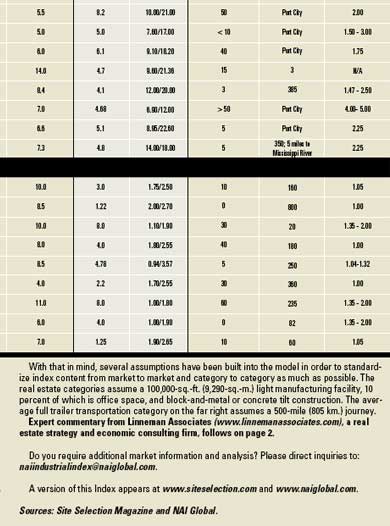

The majority of lease rates fall into the $3-7 (NNN) per square foot range, regardless of national borders. In comparison to our survey six months ago, several of the U.S. markets have experienced notable increases including: Cleveland ($1.00- $4.50 psf vs. $1.00-$14.00 psf); Denver ($1.95-$7.00 psf vs. $2.42-$10.00 psf); Los Angeles ($4.00-$7.00 vs. $3.60-$15.00 psf); and Miami ($4.00-$7.75 psf vs. $6.00- $8.25). In Canada, Edmonton and Montréal exhibited slight lease rate increases, as did Juarez, Mexico. From a construction cost perspective, Mexican markets are consistently lower ($18-$35 psf), in comparison to markets in Canada ($32-$78 psf) and the U.S. (most falling in the $30-$65 psf range). In comparison to six months ago, construction costs in Montréal, Juarez, Nuevo Laredo, and Reynosa have edged up. In the U.S., Atlanta, Miami, New Orleans, Phoenix, and Seattle have also experienced rising construction costs during that time, with Phoenix posting the largest increase ($40- $80 psf vs. $56-112 psf). Land costs are generally comparable across borders, with a few notable exceptions (including Miami, Los Angeles, New York, San Francisco, Seattle, and Mexico City). Investors often lose sight of the fact that replacement cost (at reasonable land values) is the key to successful investing in industrial properties, as it is not a complicated product to create or permit. Rental rates fall when markets are oversupplied, and because of the short development cycle for industrial product, excess demand conditions are usually short-lived. Industrial property down-cycles tend to last longer than the up-cycles. Using a 7-percent vacancy rate as a benchmark for an industrial market that is "in balance", New Orleans, New York, Newark, San Francisco, and Seattle appear to be in balance, while Houston and St. Louis are near the cusp. Note that New Orleans, San Francisco, and St. Louis did not make the cut six months ago, while Buffalo and Chicago fell out of balance over the last six months. In Canada, only Ottawa (7.5 percent) is (slightly) above this vacancy rate benchmark. In Mexico, only Monterrey, Reynosa and Tijuana fall below 7 percent. Mexico City showed the greatest improvement, dropping from a 20-percent vacancy rate six months ago to 8.5 percent today. Turning to labor costs, Mexico holds the clear wage advantage, with average production line wages running about $1.00-$3.50 per hour, versus about $7.00-$32.00 per hour in the U.S., and $8.00-18.00 per hour in Canada. These lower labor costs are the main factor which makes the overall cost of doing business in Mexico significantly lower than its northern neighbors, although some of this is offset by lower efficiency levels. Examining transportation, it costs about $1-$2 per mile to ship a full trailer in both Canada and Mexico. In contrast, comparable shipping costs in the U.S. range from $1.20 per mile to $5.00 per mile in Dallas/Ft. Worth and San Francisco. Many of the U.S markets with higher transportation costs are port cities, while the Mexican markets are often hundreds of miles from the nearest port. Expect oil prices to fall to roughly $30 per barrel by 2007’s end, absent meltdowns in Saudi Arabia, Kuwait, Russia, Iraq or Iran.

|