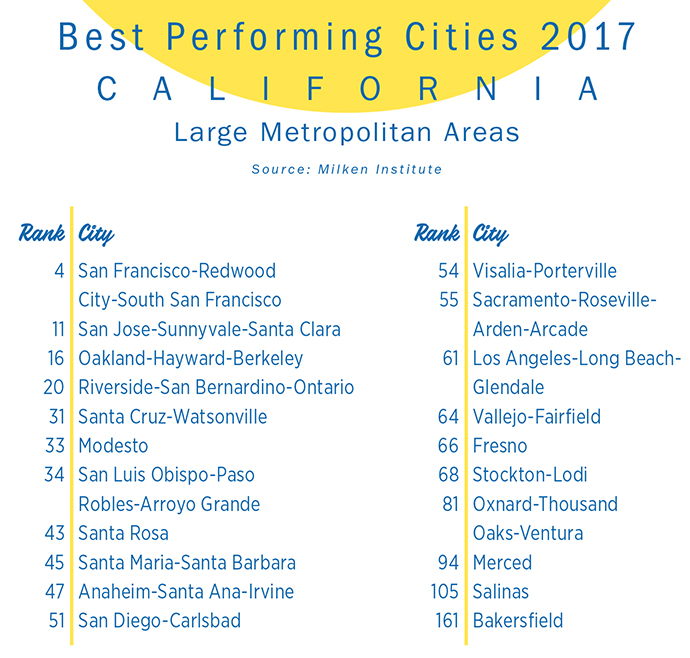

Looking at California and its economic growth in the past five years, it is clear that innovation has provided much of the fuel for its good fortune. While the Milken Institute’s annual Best-Performing Cities (BPC) index identifies the communities that are creating and sustaining jobs, our research into university technology transfer and commercialization highlights the contributions universities make to the California economy.

For the latest edition of Milken’s “Concept to Commercialization: The Best Universities for Technology Transfer” report, released in April 2017, we looked at patents issued, licenses issued and related income, and startup activity, to get a sense of which institutions were most effectively converting their research into intellectual property with market value and commercial applications.

Stanford University at the Heart of Silicon Valley

Unsurprisingly, Stanford University scored well on our technology transfer index and placed fifth overall, benefiting both from its strong connections to Silicon Valley and the entrepreneurial culture in key academic departments.

As noted in the report, the modern era of university commercialization commenced when collaborative research on recombinant DNA conducted in the 1970s by Stanley Cohen at Stanford and Herbert Boyer at University of California, San Francisco, led to the birth of the biotechnology industry. Human insulin — the first new drug based on Cohen and Boyer’s discovery — was approved for human use in 1982 after Genentech (still a major employer in the Bay Area) invested in follow-on R&D.

With a high-quality workforce and access to expert venture capital, the region is able to attract firms exploring new technologies. For example, SF Motors is making a major investment in Santa Clara to expand their autonomous vehicle R&D in the area. And biotech continues to lead the way: The 2018 California Life Sciences Industry Report released by the California Life Sciences Association and PwC US in November 2017 found that the Bay Area leads the state with over 72,600 direct life sciences jobs in the metro region — about 14,000 more jobs than second-place Los Angeles.

On our 2017 BPC index, the San Jose region dropped to 11th after two years in first place. Employment in high-tech industries is still growing, but in service industries outside of tech, job gains are slowing and recent data suggest the region may be nearing a plateau for employment. Rising costs are a concern, and after several years of positive net migration, in 2016 more people moved out of the region than moved in.

Los Angeles Universities Turn Research into IP and Startups

The University of California (UC) is a key asset to the state in many ways, performing cutting-edge research and educating top talent that graduates to join the local workforce in communities across the state. With varying strengths, the different campuses contribute through technology transfer as well.

The University of California, Los Angeles (UCLA) was the top school in the nation for its start-up performance, and was the highest ranked campus in the UC system on our index, placing 15th overall. Chancellor Gene Block has invigorated the school’s commercialization culture since joining UCLA in 2007, a year after Milken’s 2006 analysis of tech transfer placed the university 30 spots lower at 45th in the nation.

The California Institute of Technology (Caltech) placed ninth overall, and was the leading institution on our patents issued indicator, besting far larger schools in creating and protecting new ideas with market value. Caltech outperformed all its peers with more than 660 patents issued to the university between 2012 and 2015. Caltech startup firms are typically in the life or physical sciences, including some developing cancer treatments and medical technology.

With Caltech, UCLA, and the University of Southern California (USC) all ranking in the top 30 of our technology transfer index, it should not be surprising that Amazon placed Los Angeles on its short list of potential locations for its HQ2. The Los Angeles region continues to build up its sizeable and diverse high tech industry, containing established clusters in aerospace, and growing sectors including pharmaceutical and medical manufacturing. Among other projects, AcuraStem Inc. will invest in a research laboratory in Los Angeles County to conduct stem cell research to treat amyotrophic lateral sclerosis (ALS).

Another Year of Stellar Growth in San Francisco

The Bay Area continues its exceptional run of economic performance, with the San Francisco metropolitan division holding firm at fourth place on the BPC index, despite ongoing concerns about cost of living and cost of doing business in the city and its surrounding region.

The advantage of being located in the high-tech cluster — with access to its world-class workforce, venture capital, and entrepreneurial energy — continues to support growth several years into the economic expansion. The highly skilled labor force fuels the knowledge economy in the San Francisco region, with 54 percent of the population over 25 having earned at least a bachelor’s degree. Service-based technology firms and cloud computing have risen in importance, with data processing, hosting, and related services adding 8,500 jobs in the San Francisco region, more than anywhere else in the nation between 2011 and 2016.

Recent economic figures suggest that the region’s economy is slowing down, but the economy remains on solid footing with low unemployment. With space within the metropolitan area at more of a premium than in competing inland cities, the geographic characteristics of the region and the regulatory structure combine to inhibit growth. Some may see this as a loss locally, but from a national perspective, distributing some high-tech related prosperity to less-space-constrained emerging clusters can help spread opportunities to new communities.

The Oakland-Hayward-Berkeley metropolitan area continues to benefit from this outward pressure, and climbed two spots to 16th on our BPC index, in part thanks to the diversity of the growing high-tech sector. The clustering of the University of California, Berkeley; California State University, East Bay; the Lawrence Berkeley National Laboratory and the Lawrence Livermore National Laboratory not only provides government jobs, but also forms a strong R&D foundation.

The City of Oakland is doing its part with a different kind of research, launching two new free apps in January to simplify the process for opening a business. The Zoning Check and Business Permitting tools, available in English, Chinese and Spanish, “quickly inform entrepreneurs whether their business venture is allowable at a particular location, what types of City licenses and permits are required, and how much the related fees will be,” said a city release.

“Those looking to invest in Oakland now have a one-stop source for policies and regulations from our Planning, Building, Zoning, Fire, and Revenue divisions, all in one place,” said Mark Sawicki, director of the city’s Economic & Workforce Development Department. “Research shrinks to a few minutes, allowing for agile decision-making and business planning.”

Inland Empire Takes a Different Approach

The biggest climb in the top tier of our 2017 BPC index — and an exception to the tech-driven California metros in that group — was the Riverside-San Bernardino-Ontario metropolitan area, which rose 24 places to 20th. The Inland Empire continues to see new investments in distribution, and the warehousing and storage sector added more jobs (5,700) in the region than in any other large metropolitan area in the country in 2016.

New flights between the Ontario International Airport and several Asian cities will contribute to the development of logistics and trade activities. United Parcel Services, Inc.’s commitment to a $275-million investment in the Moreno Valley facility over the next few years is just one example. Beyond warehousing and distribution, software developer CU Direct Corporation plans to invest $43 million in Ontario.

Biotech Still Bright in San Diego

The University of California, San Diego is another innovation powerhouse. Its strength in biotech commercialization played a central role in the development of one of the premier biotech clusters in the world. This is underscored by the firms choosing to invest in the San Diego region, which in 2017 included Custopharm Inc., a pharmaceutical manufacturer that will invest $48 million in Carlsbad, and Koam Engineering Systems, Inc., a cybersecurity consulting and services firm.

Technology-driven growth has supported exceptional economic expansion over the past five years in California’s innovation hubs, but competition for labor and real estate have continued to drive up costs. While their talent and venture capital pools are smaller, cities like Raleigh, North Carolina, and Dallas, Texas, have been able to leverage their attractive business climates to create their own opportunities for innovation-driven economic growth.

But California’s family of higher education institutions has a lead in spurring innovaiton that, if not insurmountable, is at least formidable. As we reported last spring, “In the 21st century, public and private research universities are the seed capital for creating knowledge that fosters scientific- and technology-based economic development … Creating human capital and conducting research, along with its efficiency as measured by output (patents, licenses executed, licensing income, and startups) relative to input (research expenditures), depict the production of good universities delivering on their mission.”

In the long term, California’s universities continue to deliver, and will continue to create commercial opportunities through innovation and technology transfer.