You’re looking to establish a new location to serve the growing global need for software development and support services, but you want to avoid the places baseball legend Yogi Berra once described as only he could: “Aw, nobody ever goes there. It’s too crowded.” Josefien Glaudemans and the team at BCI Global have scoured the planet to find 24 locations that fit the bill, followed by a Q&A with Glaudemans about what trends and places could be emerging next. -Ed.

The landscape of tech and support centers is undergoing major changes driven by technology, globalization, working from home and the increasing need for efficiency and cost-effectiveness. No matter how appealing remote work is, physical locations are still required for most tech (software development) and support centers — shared services centers (SSCs), global business services (GBS), back offices, business process outsourcing (BPO) or call centers.

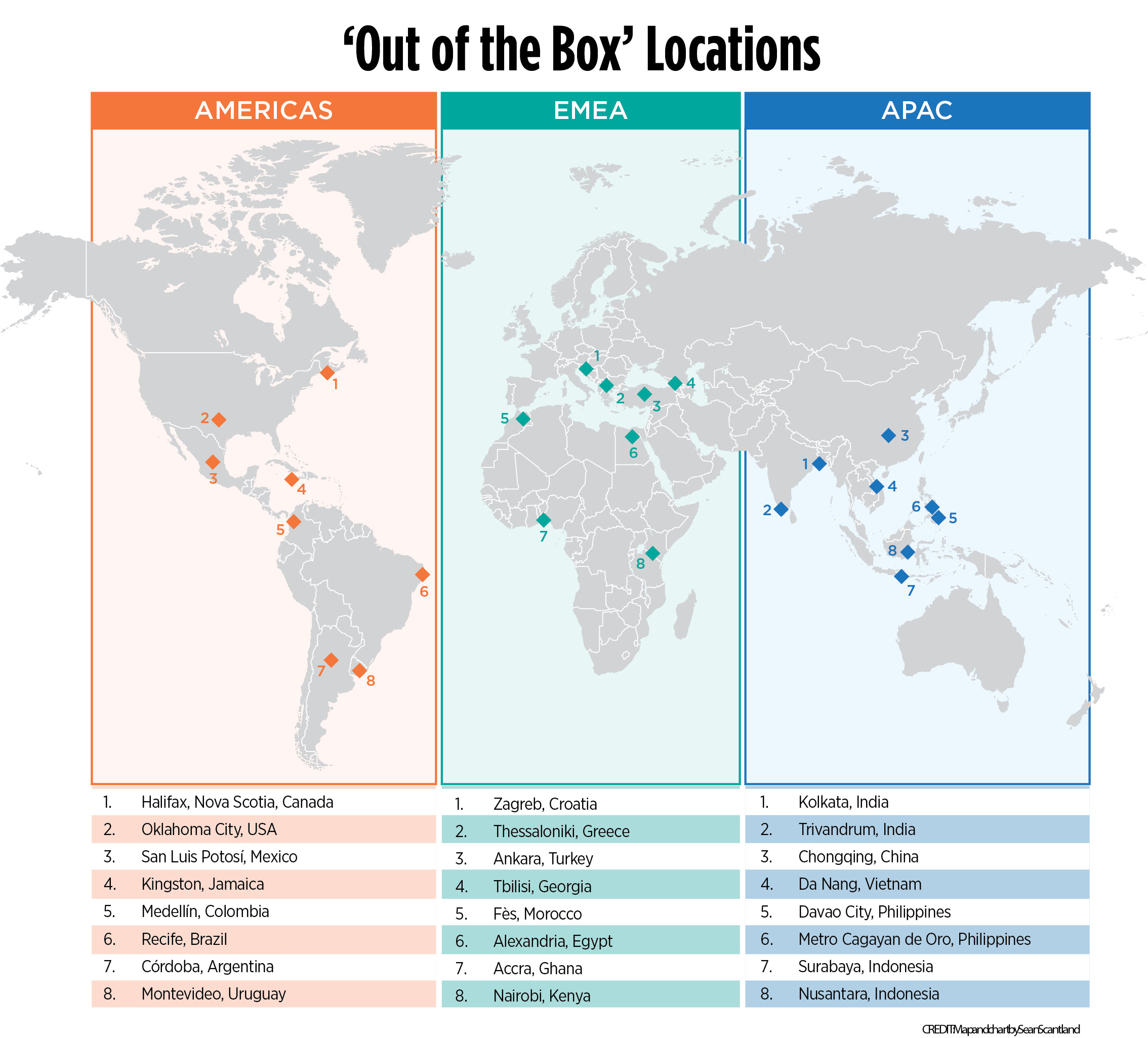

When companies are considering new locations for their international expansion, the well-known and more mature locations often come to mind. In discussion with clients, a team at BCI Global searched for “out-of-the-box” locations and selected eight emerging locations each within three geographical areas: the Americas, EMEA and APAC (including India and China).

These locations are meant as a teaser, as there are many more options across the globe. They are primarily selected to invite more out-of-the-box thinking and to broaden the horizon of companies looking for new locations for software development and/or support centers. As it happens, Site Selection’s Conway Projects Database has documented more than 400 corporate facility investment projects in these 24 locations over the past decade, including:

- Dozens in Halifax, Nova Scotia, Canada, from IT services firms such as Cognizant, Avenade and Humetis Technologies;

- A 100-job office from Microsoft in Nairobi, Kenya;

- Projects from Caci International, Paycom Software, Dell and others in Oklahoma City;

- Investments from Google and Millicom International Cellular in Accra, Ghana;

- Sites from Baidu and Acer in Chongqing, China;

- Operations from NTT and NXTRA Data in Kolkata, West Bengal, India; and

- Offices from Accenture, Teleperformance and Astound Commerce in Medellin, Colombia.

To qualify as out of the box, locations must be non-conventional and emerging — well-known, mature markets with intense labor competition are avoided. In addition, they must be cost-effective from an onshore, nearshore or offshore perspective. In order to offer scalability, metropolitan areas with more than 1 million inhabitants are included. The infrastructure (for example international airport, digital hub, highways) should be available or currently under development, and other companies should already conduct software and/or support activities there.

As a result, the mature, expensive and competitive countries in Western or Northern Europe and Asia are excluded from this overview. Also excluded are the tighter markets in Central and Southern Europe. These markets may still offer interesting opportunities, but they are no longer out of the box or emerging.

Oklahoma City, Oklahoma

Photo: Getty Images

‘Out of the Box’ Locations in the Americas

In North America, Canada is a mature market for both software and support. Toronto, Montréal, Vancouver, Calgary and Québec City especially are mature locations. So Halifax, a software hub on the east coast of Canada, is selected. It is a smaller market, with low risk and a high quality of life. The cost of living and salaries are on the higher end compared to other global locations, but real estate costs are attractive.

The United States is a large and mature market both for software and support activities. There are 57 metropolitan areas with over 1 million inhabitants. Oklahoma City is picked as there is still room to develop. Although labor costs are on the higher end compared to the other locations, they are attractive from a U.S. onshore perspective. Plus, quality of life is high.

Mexico is a popular U.S. nearshore location, mature for both software and support. Mexico City, Monterrey and Guadalajara are the most popular. Mexico has about 20 metropolitan areas with over 1 million inhabitants. San Luis Potosí is more out of the box, as the skills are there, but not yet the heavy labor market competition as in other Mexican locations. The costs of operations are attractive, especially from a U.S. nearshore perspective, so more software and support center activities are expected.

In Latin America, Kingston, Jamaica, is a mature call center and BPO market, due to having English as the official language and being in the Eastern Standard Time zone. The city offers a favorable business environment, a well-developed infrastructure and a growing talent pool. Several multinational companies (such as Xerox, Sutherland and Scotiabank) have set up support centers in Kingston. It is only a matter of time before more international companies invest.

To qualify as out of the box, locations must be non-conventional and emerging — well-known, mature markets with intense labor competition are avoided.

Colombia is hot at the moment. Bogotá is chosen frequently for both software and support activities, in part due to the attractive operating costs. Medellín is regarded as an emerging location. It is a large city with 4 million inhabitants, with lower competition and more attractive labor costs and conditions compared to Bogotá.

Brazil, a large software and support market, has more than 20 cities with over 1 million inhabitants. São Paulo, Rio de Janeiro, Belo Horizonte and Florianopolis are amongst the most popular destinations in Brazil. Recife is an interesting alternative, more for software than for support activities, as there are lower-cost options in a better time zone for the U.S. market.

Argentina is a well-known outsourcing location, especially for software activities, mainly due to the attractive costs. As Buenos Aires is the most mature market in Argentina, a good alternative is Córdoba. It has even more attractive labor costs, but as the country is dealing with hyperinflation and exchange rate risk, it’s also a higher-risk location.

Lower risk at higher costs is offered by Uruguay, where Montevideo is an interesting option. It has low risk, acceptable quality of life and there are several support centers active already (e.g. Genpact, Telus and TMF).

‘Out of the Box’ Locations in Europe, the Middle East and Africa

Zagreb, Croatia is a nearshore European language hub with support center potential. Zagreb has 1.1 million inhabitants speaking many of the different European languages, low risk, an acceptable quality of life and attractive labor costs, especially compared to the much higher western and northern European salaries.

In Greece, Thessaloniki is selected. The city has low risk, an attractive quality of life and attractive cost levels compared to the rest of Europe. Some larger multinationals (such as Siemens and Pfizer) have software development centers in Thessaloniki and there are several support centers (such as TaskUs and Teleperfomance) using the location’s multilingual workforce.

Turkey is a large market with 10 cities exceeding 1 million inhabitants and is a mature market for both software and support activities. Most activity is focused in Istanbul, so Ankara is a promising alternative, with less competition on the labor market. Ankara has a large labor market, acceptable quality of life and an attractive cost structure. There are some software and support centers in Ankara, and it’s just a matter of time before more international players enter.

Georgia (in Europe, not the U.S. state) is marketing itself internationally, especially for support activities. Tbilisi is an upcoming software and support hub especially for low cost European nearshore activities. There are large call centers and a few support centers active in Tbilisi at the moment from companies such as Majorel, Teleperfomance and BDO.

Tbilisi, Georgia

Photo: Getty Images

In North Africa, Morocco is a mature software, support and BPO market and has 10 cities with over 1 million inhabitants. Fès is included as there is still room to develop without strong labor market competition and cost levels are attractive, especially for European services.

Another North African option is Egypt. Egypt’s potential for software and support activities is now finally utilized. As most investments go into Cairo, Alexandria is more out of the box. Quality of life on the Mediterranean coast is high. It has more than 5.5 million inhabitants, an attractive cost structure (junior gross salaries are below US$500 per month) and limited competition on the labor market. There are a handful of international support operations in Alexandria (such as Vodafone, IBM and Xceed), and it is just a matter of time before more international companies will follow.

In Sub-Saharan Africa, Ghana is of British heritage, in the UK time zone and English is the formal language. Accra has acceptable risks and quality of life with gross monthly salaries for junior roles below US$500 per month. Mainly due to the lack of modern Class A office space, commercial rent is higher. The first larger international support centers in Accra (e.g. Xerox and Nestle Global Business Services) are proving its potential.

Finally, Kenya offers English as a formal language along with other European languages such as French. Nairobi is a mature market for BPO but emerging for software and support, with acceptable risk and quality of life and very attractive cost levels. Microsoft in 2019 launched its first Africa Development Centre (ADC) with a five-year, $100 million investment at two initial sites in Nairobi and Lagos, Nigeria, where the company planned to hire as many as 500 people by 2023.

‘Out of the Box’ Locations in Asia-Pacific

India, a large, popular and mature software and support market, offers no fewer than 48 metropolitans with over 1 million inhabitants. Digital business services firm Teleperformance in summer 2023 said it plans to hire as many as 60,000 in India over the next two years to bring its head count in the country to 150,000, and opened a 500-job site in Hyderabad in August. But other locations are ready too.

Biswa Bangla Gate, Kolkata, West Bengal, India

Photo: Getty Images

Kolkata, West Bengal (Northeast India) has a large labor pool, English speaking skills, attractive cost levels and lower labor market competition compared to other popular Indian cities. Traditionally, West Bengal was less business oriented, but in 2022 it was identified as the easiest state in which to do business in India, and multinational companies are currently building up their presence there.

Also in India, but all the way south in the tropical region, is Trivandrum. The state of Kerala was also not known for its business orientation. However, the city has 1.7 million inhabitants, a nice climate, a relatively good quality of life (especially for Indian standards), acceptable risks and very attractive cost levels. The first software and support centers (from Nissan and Allianz) are entering the market.

India, a large, popular and mature software and support market, offers no fewer than 48 metropolitans with over 1 million inhabitants.

China is a huge and important software and support market. There are 155 cities (!) with over 1 million inhabitants. The coastal cities tend to be very expensive and competitive, so new investments now focus on more central locations. Chongqing is a good example. It has 31 million inhabitants, medium risk levels, lower quality of life but attractive costs. The Chongqing Municipal Commission of Commerce reported in 2021 that 2020 welcomed 287 new foreign-invested enterprises in Chongqing, a year-on-year increase of 28.7%, with contractual foreign investment reaching nearly $5.8 billion, a yearly increase of 84.97%. As China is no longer used as a hub for APAC services and most companies only serve China for China, only one location in China is included in this overview.

Vietnam is also a popular software market, especially Ho Chi Minh and Hanoi. Da Nang is centrally located between the two other markets, with new highways being developed, Da Nang could be an interesting upcoming software location.

The Philippines is a large and popular market for U.S. support activities. A lot of American companies are trying to find “the next Philippines” as the most popular markets of Manilla and Cebu are becoming competitive. Therefore, two less mature locations in the southern part of the Philippines are interesting. Davao City, with 2.4 million inhabitants, has some BPO players active, but enough room for development for other support activities. The same goes for Metro Cagayan de Oro: It has 1.7 million inhabitants, acceptable quality of life and attractive cost levels. As a result, more international support activities are expected to land there.

Last is Indonesia, an upcoming market both for software and support activities. As most attention goes to Jakarta, Surabaya is an emerging alternative. Surabaya is a port city and the country’s second logistics hub. The metropolitan area has 10 million inhabitants, with lower risk, better quality of life, lower cost and less competition on the labor market compared to Jakarta. More international companies are expected.

The second and last location in Indonesia is Nusantara. Following the examples of Brazil and Malaysia, Indonesia has an ambitious project to relocate the capital city. In order to build a new Indonesia, a new government capital is being built right in the geographical center of the country, 1,250 kilometers from Jakarta and in the primary rainforest of Borneo. The new capital is to be inaugurated in August 2024. Next to the government offices, a green “new smart metropolis” is planned. As a result, Nusantara is regarded as an out-of-the-box location, especially for green software development activities.

Regarding the choice of physical tech and support center locations, the world still holds many interesting out-of-the-box opportunities. All have different pros, cons, costs and conditions. Companies also have their own specific sets of criteria, needs, wants and “nice to haves.”

So, finding your own sweet spot anywhere in the world is the key to long-term success. At the end of the day: If you are the preferred employer in the right location, there is no lack of talent.

Q&A: How Workplace Trends Impact Emerging Locations

Site Selection: We are hearing from all corners the concern about hollowed-out office buildings in city centers. Give me a sense of which among your 24 locations has the most vibrant downtown office/talent scene (as opposed to the latest narrative of abandoned city blocks).

Josefien Glaudemans: Downtown office locations have become increasingly distressed, especially in the U.S. where most megacities have become unaffordable for working people, much more so than in other cities around the world. However, these downtown locations are not typically the location of choice for our tech and support center clients. All the selected 24 ‘out of the box’ locations have a dynamic talent pool which is supply driven: focused on a growing pool of highly educated and skilled talent. As a result, most of the new tech and support centers will locate in accessible (by public transport) locations either near a university campus where (often younger) talent lives, or they cluster together in special economic zones (for tax purposes) both of which are available in the locations presented.

Site Selection: On a related note, we’ve noticed many companies will announce a new physical services center location, but also will declare that a certain proportion of the new jobs at the center will be allowed to be hybrid or remote positions. What have you and the BCI Global team observed with this trend.

Glaudemans: The exact future percentage of working from home versus working in the office is still challenging and not defined yet for quite a number of companies. This also has a big impact on the priority and size of new center needed and how to lay out and fit out the new workspaces needed based on utilization levels. As a result, some companies prefer not to make a long-term office rent commitment amid this uncertainty and prefer to use temporary (often more expensive) flexible office space from popular providers until this is crystalized further.

The latest research on this topic indicates that nine out of 10 employers will require employees to be back in the office in 2024 and that only one out of 10 allows a full remote/work-from-home model. As a result, the large majority of tech and support centers operate with a hybrid model blending the flexibility of remote work with the benefits of the traditional office. A hybrid working model positively improves the corporate culture, employee engagement, collaboration/mentoring, and retention by having everyone — at least some of the time — physically occupying the same workplace.

However, it is important to keep in mind that work-from-home opportunities are significantly lower in developing countries due to, amongst other things, the housing/living conditions, infrastructure (and security) limitations and internet access. Typically, in developed countries, employees of tech and support centers work from home an average of two to three days per week, while in developing countries the average drops to one to two days per week. This means that the prevalence and significance of working-from-home is lower in the more developing countries on our list, in comparison to locations in developed countries like Canada and the United States.

Site Selection: You write, “These locations are meant as a teaser, as there are many more options across the globe.” Share some hints about the “next 24” if you will, and the kinds of things government and corporate leaders can do to cultivate an emerging tech hub in their communities.

Glaudemans: There are plenty of upcoming smaller (often tertiary) cities in amongst others the included countries with strong universities and a growing young talent base. These locations are gearing up to be the next hubs for tech and support centers, waiting for the first investments to arrive. The key to success for these up-and-coming locations is strengthening the triple helix framework amongst government, business and the universities. In this framework, the government and businesses collaborate with universities to create, amongst other things, incubators and accelerators.

In the university-industry interaction the transfer of knowledge through, for example, the co-op programs — which aim at integrating an industry approach to the students’ curricula — is critical. In the university-government interaction the key to success is the government’s relationship to and policies toward higher education. The relationship between government and industry depends on the government’s attitude to the market and their role in regulation of the industry. The government has a strong and leading responsibility in making the triple helix a success to attract new innovative tech and support centers.

Additionally, governments may consider expanding the local investment incentives available for new tech and support centers to also include the remote/hybrid work performed at home. They can redevelop empty office space into residential units as most cities have a shortage of housing, to retain the much-needed labor. By building more affordable homes, effective infrastructure (including public transport systems, roads, airports, and telecommunications), and strong schools/universities, governments can make a difference in cultivating emerging tech hubs in their communities.

Josefien Glaudemans is a partner at Netherlands-based research, advisory, project management and strategy firm BCI Global. For more information visit bciglobal.com.