It’s been a scary few weeks for the Obama Administration, what with the health-care website nightmare, two weeks of haunted house from the government shutdown, the still-lurching approach of the debt ceiling deadline and international furor over the creepy tactics of the National Security Administration.

So what better time than Halloween and All Saints Day to reassure that same international community that the hallowed venue known as the United States of America is not a frightening place to invest?

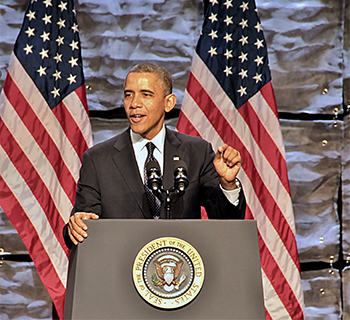

On Oct. 31-Nov. 1 the US Dept of Commerce, President Barack Obama and several members of the Obama cabinet were all business, as the SelectUSA Investment Summit welcomed nearly 1,200 individuals representing 58 countries, 47 states, and 633 companies to the Marriott Wardman Park Hotel in the nation’s capital.

Staged with the assistance of The PONT Group (a wholly owned subsidiary of Site Selection publisher Conway Data), the event was the inaugural inward investment summit hosted by SelectUSA, a Commerce effort launched in June 2011 by executive order of President Obama that incorporates the previously established Invest in America. It appears more such summits might be on the horizon — nearly 700 would-be registrants were turned away because the venue had reached its limits.

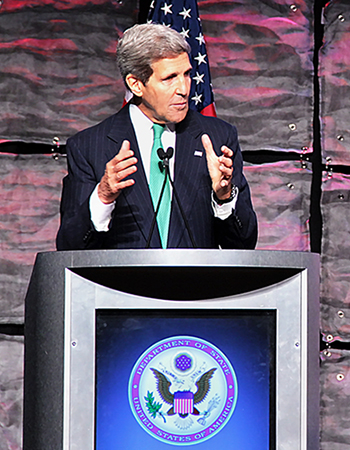

That sort of enthusiasm notwithstanding, it was evident the United States is still getting its feet wet in the inward investment game, which most countries (and every US state) have pursued for years, if not decades. In global economic development, no two stock phrases are more frequently uttered than “one-stop shopping” and “open for business.” Both were summarily trotted out on this occasion too, emanating from the mouths of such pitchmen and women as President Obama himself, Secretary of State John Kerry, Secretary of Labor Thomas Perez, Senior Advisor to the President Valerie Jarrett and Secretary of Commerce Penny Pritzker, who played the role of emcee.

“In a very short period, we’ve successfully guided over 20 companies through what it takes to invest here,” said Pritzker in her welcome speech, “and helped to close major deals worth millions of dollars.” State economic development leaders in attendance might have been forgiven for stifling a guffaw at those figures, which leading FDI-attracting states might attain in a year’s time.

But you have to start somewhere. And as with any game, behind the pyramid of cheerleaders there were actual plays developing. Here are a few snapshots from the field:

Broadened Portfolio

The first step when you’re late to the party is recognizing you have a problem.

As Gene Sperling, director of the White House’s National Economic Council, put it, “Obviously we have to give a greater sense of stability — more manufacturing, and less manufactured crisis. We haven’t been at our best in the past month.”

Larry Fink, CEO of BlackRock, the world’s largest money manager with $4.1 trillion in assets, had this to say on the subject:

“I’m very bullish on America, but Washington is making it more difficult to be bullish. We are the standardbearer of principles of democracy. We have had the luxury of being … the reserve currency of the world,” he said, and have used that luxury to borrow trillions of dollars overseas. “Over 50 percent of the outstanding debt of the US Treasury is held by foreigners,” he explained. “When you have a narrative that’s talking about default, it goes against all the principles. I challenge anyone in the room to go to the bank and say you’re not going to pay on your loan. If we continue to act in this petulant way … I was a source for many angry phone calls from angry foreigners who have been investing in US debt.”

Time will tell in January when the next debt ceiling deadline comes around. But, said Fink, “This process has to be much smoother. It’s important to drop the conversation about default. The CEOs I’ve spoken to — it doesn’t matter what industry — they’re putting a pause on hiring, and putting a pause on investing … I’m alarmed. If Washington understood how many tens of millions of dollars were wasted with companies setting up contingency plans in case of default …”

In announcing a new expansion of SelectUSA’s reach and mission on Oct. 31, President Obama, in declaring the need for fully funding the agency, said, “A lot of this is coordination. It’s not necessary to spend a lot of money, it’s important for us to do what we do more wisely. But making America even more attractive to investment should be something that everybody can agree on, Democrats and Republicans. We’ve got to work together to get that done.

“At the macro level,” he said, “that means getting beyond gridlock and some of the manufactured crises that we’ve seen come out of Washington, because I assume if you ask any CEO here if shutting down the government makes them more confident about wanting to bring jobs to America the answer will probably be no. The notion of not paying our bills on time doesn’t inspire confidence.”

Here are the facets of the SelectUSA expansion that seek to build that confidence:

- Making job-creating foreign investment a core priority: “For the first time, domestic and overseas teams at Commerce and State will make recruiting business investment one of their core priorities, alongside their traditional focus on export promotion and commercial advocacy.”

- First-ever coordinated, global teams led by Ambassadors to actively work to bring jobs to U.S.: “For the first time, the U.S. will organize dedicated investment teams led by Ambassadors to actively encourage and track job-creating investment into the U.S. This will begin in 32 priority markets which represent over 90 percent of foreign direct investment into the U.S.”

- First coordinated advocacy process to include senior-most Administration officials, including all the way up to the President: “Historically, on an ad hoc basis, senior government officials have been involved in advocacy for business investment in the U.S. But going forward, the Administration is creating the first-ever coordinated advocacy process to link international teams with senior government officials all the way up to the President to recruit businesses to bring jobs to the U.S.”

- For the first time, there will be a single point of contact for ready investors looking to bring jobs and production to the U.S.: “For the first time, SelectUSA will create single points of contact for businesses looking to bring jobs and production to the U.S. This will include greater coordination between SelectUSA headquarters in Washington D.C., in-country resources at the Embassy, and state-based economic development organizations.”

- First ever effort to coordinate support for states and localities to attract investment: “For the first time, we will help regional, state, and local economic development organizations attract investment, improving coordination to increase their success rate and connecting them with overseas markets and investors through our Missions.”

“You will have one stop shopping [!],” Gene Sperling told the assembled investors, whether it’s visa, regulatory, state, local or federal issues, “and when it’s helpful, talk to someone in the White House. Twenty or 30 years from now, I think you’ll still see this working, and people will wonder why the US didn’t do it earlier.

Letting foreigners be part of the team may help. On Nov. 1, Sec. Pritzker announced revisions to the membership eligibility requirements for the Department of Commerce’s Manufacturing Council that for the first time will allow representatives of U.S. subsidiaries of foreign-owned or controlled firms to join the advisory panel. A Federal Register notice seeking applications from manufacturing firms to fill five current vacancies on the Council will be issued shortly.

Views From Across Both Oceans

Christian Koenig knows FDI, as a longtime corporate communications pro with ThyssenKrupp, and now as managing partner and president of Koenig Communications, which helps German and other companies navigate the road to successful FDI in the United States. He worked with SelectUSA as ThyssenKrupp’s huge manufacturing complex in southern Alabama took shape, as well as on other projects, and calls the agency “very helpful.” Its more proactive agenda may prove more helpful in reaching the German mittelstand, those medium-sized, largely family-owned companies that are Germany’s economic backbone.

“In terms of establishing a go-to place on a federal level, this is markedly different from 10 or 15 years ago, and helpful to the mittelstand,” says Koenig. “Companies will do their own due diligence. A number of mittelstands are aware of SelectUSA, and have talked to the people. Then they talk to the states. But in terms of overall promotion, I think it’s a helpful tool.”

Koenig says German FDI into the US has been healthy, including some 60 German companies that have created 8,000 jobs in Kentucky alone. Among the lead attractors are energy prices up to two-thirds less expensive than in Europe.

Jiro Hashimoto knows Kentucky FDI too, having helped attract more than 150 Japanese companies to the commonwealth over his three decades as the state’s chief representative in Japan before his retirement from state government earlier this year. Now he’s a partner at Mozaic Investor Relations, helping to bring together economic development organizations and Japanese companies on the hunt for growth. He too is positive about SelectUSA.

“I’m sure a proactive approach/enthusiasm on the part of the US government will be welcomed by Japanese businesses for the most part,” he says from Tokyo after returning from the Summit. But the very nature of prospective investment works against displaying that enthusiasm. “A number of major companies, if they have new projects, would want to keep a low profile because of confidentiality’s sake and prefer not to participate in an event like this,” he says.

By some indicators, inward FDI in the US is already quite healthy, owing to a blend of market attractiveness, high-quality higher education, a hunger for regionalized supply chains and low energy prices, among other factors.

Last Thursday, the Commerce Department and the President’s Council of Economic Advisors released a report documenting that the United States has been the world’s largest recipient of FDI since 2006. Among the highlights:

- In 2012, net U.S. assets of foreign affiliates totaled $3.9 trillion. FDI inflow since 2006 totals $1.5 trillion, with $166 billion coming in 2012.

- The U.S. manufacturing sector draws a considerable share of FDI dollars, led by pharmaceuticals, petroleum and coal products.

- Since 2010, Japan, Canada, Australia, Korea, and seven European countries collectively have accounted for more than 80 percent of new FDI. Although still small, flows from emerging economies like China and Brazil are growing rapidly.

- In 2011, value-added by majority-owned U.S. affiliates of foreign companies accounted for 4.7 percent of total U.S. private output. These firms employed 5.6 million people in the United States, or 4.1 percent of private-sector employment, and account for 15.9 percent of US private R&D spending. About one-third of jobs at U.S. affiliates are in the manufacturing sector.

- Compensation at U.S. affiliates has been consistently higher than the U.S. average over time, and the differential holds for both manufacturing and non-manufacturing jobs.

Statistics from the United Nations Conference on Trade and Development (UNCTAD) corroborate the report’s findings on inward FDI. But they show a much bigger influx between the end of 2011 and the end of 2012, at more than $422 billion. Accumulated FDI stock has inched upward in the US since 2008’s total of nearly $2.5 trillion, which represented a more than $1-trillion drop from total FDI stock in 2007.

Moreover, while it’s common knowledge that countries variously known as “emerging,” “transition” or “developing” continue to climb in FDI attraction rankings, not so widely known is the steadily increasing rate of FDI into developed economies from companies based in those emerging nations.

UNCTAD statistics show that total outward FDI from developing nations has more than quadrupled from just over $1 trillion in 2003 to more than $4.4 trillion in 2012. The trend is most pronounced in Southern Asia (virtually synonymous with India where FDI is concerned), where the total has leapt from just over $7.1 billion in 2003 to more than $123 billion in 2012. Much of that is landing in the United States, via conglomerates such as Tata Group and Essar. And some of it is coming in industry sectors that exactly reverse the outsourcing narrative:

Madhu Vuppuluri, executive vice chairman and CEO, Essar Steel Minnesota LLC, spoke at the Summit of his company’s huge mining and manufacturing investments in Minnesota and Canada. But Essar is also active in the call center space, having purchased two centers during the peak of US outsourcing to India.

“There were about 2,000 employees then in these two companies,” he said. “One of the initial comments we heard was we would ship these jobs to India. Today we have over 6,500 Americans working in six states. We were one of the first to invest in downtown New York immediately after 9/11. And we have a call center right across from the Goldman Sachs building, with about 350 people working for us.”

Where Trade, Investment and Immigration Coalesce

What’s going to help sustain the healthy FDI trend? Reform, for one thing. That will come in two forms, said Administration leaders: passage of comprehensive immigration legislation, and a reformulated business tax scheme.

“Congress should finish comprehensive immigration reform and send a bill to the President for his signature,” said Secretary of the Treasury Jack Lew. “The Senate has already passed bipartisan legislation, and it is awaiting passage in the House of Representatives. This immigration legislation would strengthen our borders, chart a path to earned citizenship, and increase economic growth by more than a trillion dollars. It drives growth by attracting highly skilled scientists, engineers, and entrepreneurs to our country. It will bring greater investment in the United States from beyond our shores, create new job opportunities, ignite new consumer demand, and spark business activity. It would do all this while increasing payroll tax revenue that will reduce our deficit and put Social Security and Medicare on a more stable footing.”

As for business tax reform, said Lew, “Let me be clear — the President is committed to business tax reform. This will help create and retain good jobs in the United States.”

However, that commitment is not unconditional.

“The fact is, the United States now has one of the highest statutory corporate tax rates in the world. But as high as that rate is, it only raises about an average amount of revenue as a share of GDP when compared to other advanced economies,” said Lew. “Our tax code is also full of special interest tax breaks and loopholes, allowing some companies to pay little or nothing in taxes while hurting others that are investing in the United States. We can do better. And we can do this by broadening the tax base and lowering tax rates in a way that does not add a dime to the federal budget deficit. The President has put forward the details of his approach to business tax reform, and he has made clear his commitment to budget-neutral business tax reform paired with an infrastructure package, paid for with one-time revenue.

“We have a real opportunity ahead to seize the mantle of tax reform and establish a simpler, fairer, and more competitive business tax system in the United States,” said Lew. “The plans currently being considered in Congress right now share much in common with the approach the President has put forward, and there is no reason why we cannot start with the substantial policy areas that we agree on and come together to find common ground.”

Trade agreements are another way forward for FDI. In his own speech the next day, US Secretary of State John Kerry highlighted what needs to happen next on the international stage. Two agreements are on the table.

“The Trans-Pacific Partnership, which will integrate a region, represents 40 percent of global trade,” Kerry observed. The Transatlantic Trade and Investment Partnership (TTIP) with Europe would open up another 40 percent of the world’s market. “Those efforts will dramatically expand our market reach and they will strengthen rules-based trading so that we engage in a race to the top, not a race to the bottom,” he said.

Following Kerry, U.S. Trade Representative Michael Froman appeared on a panel with Tennessee Governor Bill Haslam, BMW North America CEO Ludwig Willisch and Caterpillar CEO Doug Oberhelman that put some numbers on what the trade agreements could mean. Froman said the Trans-Pacific talks are “in the end game.”

Haslam noted that his state exports about $2 billion in goods to China, and is home to about 880 foreign companies.

“If the TTIP treaty happens, we think exports to Europe wil grow by about 35 percent,” he said, with exports from Eastman Chemical potentially increasing by around $800 million a year. He also noted that Audi’s recent choice to put a plant in Mexico instead of Tennessee was at least partly driven by 10-percent US tariffs on exports to Europe and 30-percent to South America. “Full implementation of TTIP would increase auto exports by about $900 million,” said Haslam, noting that Tennessee’s exports to countries with which the US has FTAs are 16 times higher than to those with which the US doesn’t have them.

Caterpillar’s Doug Oberhelman had just come from a ribbon-cutting Oct. 30 for his company’s new 1,400-job bulldozer and excavator factory in Athens, Ga., which will be producing machines formerly made only in Japan. Cat made a similar move with a plant in Victoria, Texas, last year. And it plans to export some of those machines to South America and Europe. The company has invested about $6.5 billion in US facilities and $10 billion in R&D over the past five years, with 80 percent of production for export only.

“Over the past five years, our total exports have exceeded $82 billion, destined for every country in the world,” he said, noting that 95 percent of Cat’s customers are abroad. “I cannot over-emphasize the benefits of trade. Globalization sometimes has a tough context in the small towns where our plants are. But it’s a message we have to work on — Without access to those 95 percent, I don’t know where we’ll be.”

BMW’s Willisch noted that his company’s South Carolina plant now is the hub of an economic ecosystem all its own, with 40 suppliers in state and 170 nationwide supporting a plant that now employs 7,000 people and brings $8 billion in activity to the economy. The company has invested more than $6.3 billion at the site, growing from 50,000 vehicles a year at the outset to 300,000 in 2012.

“We expect to grow to over 350,000 units this year,” he said. “Seventy percent of these vehicles are shipped overseas, to about 140 countries worldwide. We are the largest exporter of vehicles in the US.” But tariffs and regulatory differences such as crash-testing and emissions standards that might be eventually bridged by TTIP add about $550 million in annual costs to the ledger. But it could be worse: Brazil just raised its duties to 30 percent.

“It’s the same globe, it’s the same human being sitting in the car, but different standards,” said a frustrated Willisch. “To the tune of hundreds of millions [of dollars], we have to develop different cars. Not having these additional costs would have a huge impact on our competitiveness.”

Panels of Power

A number of panel discussions at the Summit offered telling insights from high-ranking executives and officials not afraid to tell it like it is.

Exhibit A: The event’s very first group discussion, featuring Valerie Jarrett, senior White House advisor to the President; Larry Fink of Blackrock; Andrew Liveris, President, Chairman and CEO, Dow Chemical; Bill Simon, president and CEO, Walmart U.S.; and Gene Sperling.

Fink stressed the resilience of US capital markets, the nation’s speed in resolving its banking crisis (relative to Europe’s ongoing rounds of stressing banks), a still nascent housing comeback, a much-maligned but still superior educational system (Blackrock has hired 1,100 this year so far, 80 percent coming from US universities) and the amazing turnaround in the nation’s energy picture, which is directly affecting Blackrock operations.

“At Blackrock we have two major data centers, one on the Columbia River and one in Buffalo, New York,” he said. “We’re paying approx. 3.5 cents per kilowatt. If I’d built them in Europe, in Germany it’s over 80 cents per kilowatt.”

Dow’s Andrew Liveris, an Australian who’s spent 22 years of his career in Asia (mostly in China) said when he came back to the US over a decade ago, “I was struck by the conversation going on in America that did not include manufacturing. The brand was assemlby line and smokestack. The notion that labor costs drove the manufacturing sector had become what everyone believes.”

So he wrote a book called ‘Make it in America’ that emphasized the need to use the tremendous innovation and R&D ecosystem found on America’s factory floors and in its university labs. From what he’s seen in his constant global travel, it’s high time, as the R&D footprint from foreign companies in China, for example, has mushroomed. In some ways, it’s a self-image problem.

“I talk to CEOs worldwide, and in every conversation, they’re asking how [they] can find more opportunities in the US,” said Fink of BlackRock. “So many manufacturers are trying to replicate what Andrew and Dow are doing. The cost of manufacturing is as much as 75 percent cheaper here. And because of our educational system, more technology companeis from Korea, Japan, and even China are looking to establish a foothold in the US.

“We are not an accident in this country,” he said. “We alway undersell ourselves as a nation … Every time I travel overseas, they ask me, ‘Why aren’t you more bullish? Why is your country acting like you have a problem?’

Jarrett noted the apparent enthusiasm from the business community for immigration law reform, and asked how that factored into the already positive equation for the United States.

“One of the more important leaders of Europe said to me, ‘If the US passes immigration law, shame on the rest of the world, because we haven’t passed it, and we’ll all be envious,’” said Fink “I believe it would be dramatic in the future growth rates of the US. We have 12 million people living in fear.”

Noting how a path toward citizenship and clearing up visa issues for foreign students and workers in the US would drive economic activity, he said passage of reform would do even more: “The bill will be a standard that will set us apart as a nation. That will drive more commerce here.”

Liveris said the business community understands the need for changes to immigration policy “because it sees gaps and deltas we’re all filling in some way” when it comes to talent, training and skills. “I can think of no more pressing issue for Team USA than immigration reform.”

The Walmart Equation

Finding a place to land your capital on US shores is not just a trend for foreign firms, as an increasing number of Walmart suppliers are discovering.

Walmart U.S. CEO and President Bill Simon was on hand in Washington on Halloween, which also happens to be the anniversary of his company’s incorporation. But he was there to celebrate a whole lot more, as three domestic manufacturers announced at the Summit their commitments to reshored operations, part of Walmart’s commitment announced earlier this year to buy an additional $50 billion in US-made products over the next 10 years.

“Already, two-thirds of what we sell in the US is sourced here,” Simon said at a special press conference adjacent to the Summit ballroom. “Our job at Walmart is to provide everyday low prices. If it wasn’t about effective economics, it wouldn’t be sustainable.”

The company held its own summit in August around the reshoring theme, attracing 530 suppliers from 34 states, eight governors and nearly 1,500 total attendees.

“The supplier commitments on that day amounted to 1,000 new jobs,” said Simon. “There have been over 300 meetings, and now 140 active projects are in play that will bring manufacturing opportunities closer to the point of consumption. There have been over 1,600 job commitments since the summit,” he said. They include ride-on toy manufacturer Redman & Associates’ $6.5-million, 74-job investment in a new manufacturing and distribution facility in Rogers, Ark.; Korona Candles’ $18.5-million project that will generate 170 jobs in Virginia to produce Mainstays Tealight Candles; and kitchen utensil manufacturer Tailor Made Products’ $2-million investment that will add 12 new manufacturing jobs in Wisconsin.

The three new investments:

- Elan-Polo, Inc., a global footwear and 35-year Walmart supplier, will start production of injection-molded footwear in March 2014 at a factory in Hazelhurst, Ga., as part of a joint venture with McPherson Manufacturing. Once at full capacity, this new facility will create 250 jobs and produce 20,000 pairs of shoes per day. Previously, the company manufactured the shoes overseas in China, wher the company currently ships 200,000 shoes per day.

- EveryWare Global, Inc., which manufactures bakeware, beverageware, tabletop and household glassware, will produce Mainstays Canning Jars for Walmart in its Monaca, Pa., facility. The company is investing $1.8 million to expand factory capacity and establish a new product line made in the U.S. The agreement will create new manufacturing jobs in the Monaca facility. Founded in 1905, Anchor Hocking, an EveryWare Global brand, has been supplying products to Walmart for over 25 years and has 1,811 employees in the United States.

- Louis Hornick & Company, a leading manufacturer and importer of window coverings and home textiles, will invest $2.5 million to establish a new manufacturing facility in Allendale County, S.C. The investment is expected to create 125 new jobs over the next three years. The company has been supplying Walmart for 40 years.

“We aren’t just building a facility — we are moving to South Carolina,” said Louis “Tripp” Hornick III, COO of Louis Hornick & Company, sounding as if a move from Manhattan to the Lowcountry might indeed be counted as “foreign” direct investment. “The fact that three Manhattan residents are doing so is testament to our dedication, but, equally, reflects on the wonderful people in the great state of South Carolina.

Hornick’s company was founded in 1918 by his grandfather. He says the South Carolina site is “not only cost-competitive with China and India, but reduces our lead time by 25 percent.” That reduction in time, he says, means a store showing an item as out of stock should be able to have it back on the shelf within one week.

“We’ve asked all of our suppliers to look at their supply chain and their process.”

“The tipping point was Walmart’s challenge for us to see within our organization if we could develop a concept that would bring footwear production back to the US,” said Joe Russell, CEO of Elan Polo. “We concluded that injection molding had reached a point in demand and the process that it could be effectively reached in the US. “

“We’ve asked all of our suppliers to look at their supply chain and their process,” said Simon, noting some have found up to 50-percent improvement in lead times. “Market to market, costs on certain items are already lower or competitive in the US. There are categories that are not, but will evolve to be in a five- to 10-year horizon. For our part, we’ve been making longer-term commitments than we usually do. Our typical buying would be for a season.

“The most efficient way for retailers to get to market is to produce close to the market,” he explained. “This will not result in shutdowns outside the US. Plants outside the US will continue to grow and develop and serve the populations where they are. The emergence of hte middle class and growing wages in Asia are creating a demand for products made in Asia.”

Of course, it’s that same Asian wage growth that’s making America look more attractive all the time. It’s all about a changing equation, he said, and trends that take a long time to play out.

“The migration out was a 30-year cycle,” Simon said of the outsourcing exodus. He thinks coming back home is a trend that will endure too.

“We believe we’re on the front end,” he said, “of a very long cycle.”