The financial technology or FinTech industry is a hot market. Shifts in consumer behavior to digital financial and insurance services is creating a new generation of companies. According to a recent U.S. Treasury Department report, from 2010 to 2017, more than 3,330 FinTech firms have been founded attracting $22 B globally in financing. Regions across the U.S. are competing for FinTech companies and one recent corporate site location project in Columbus, Ohio proved that FinTech can grow in the heartland.

Root Insurance is a $1 billion, three-year old startup company who is revolutionizing the insurance marketplace. Root Insurance sets rates based primarily on actual driving behavior, using variables that drivers control to give fair and accurate auto insurance rates. Root is the nation’s first carrier to leverage mobile technology and data analysis to base rates primarily on how individuals drive. While most traditional insurers calculate rates by categorizing drivers into demographic risk pools, Root takes a more personalized approach by using mobile technology to accurately understand which drivers are least likely to be involved in road incidents. Root Insurance gained early stage venture capital investment from a local Columbus venture capital firm but then also secured larger investments from Silicon Valley venture capitalists.

While Root Insurance was founded in Columbus, Ohio, success in the insurance marketplace, success in the venture capital market, an expiring lease, and being located in a building not able to accommodate the company’s growth drove Root Insurance to engage in a corporate site location process. Any corporate site location process begins with defining the project to learn about the industry, number of jobs, payroll and capital investment planned that leads to a state and regional target list for the company’s project. Root Insurance’s growth plans were substantial—creating 497 high-wage jobs, primarily computer software engineers and customer service workers, in a 65,000 square foot office with a $1,000,000 capital investment in an urban environment.

Successful corporate site location projects focus on an analysis of national, state and regional macroeconomic and demographic data, industry cluster, automation, workforce, infrastructure, and cost of doing business data. FinTech companies like Root Insurance often focus on Ohio, Texas, Florida, North Carolina, Tennessee and Indiana as growing markets with urban centers primed for high-tech development.

As the graph above illustrates, Texas and Florida surpass competitors in economic growth, population growth, and most other economic and demographic measures, but all the states in question have growing economies.

Companies seeking a large pool of highly-skilled workers in their industry will look to large to mid-sized urban markets as targets for future economic growth. Measuring that pool of workers is done through an industry cluster analysis that provides a snapshot of regional industry strengths now and in the future. A location quotient is a method of measuring the industries that are a strength of a region and that are growing with a measure above 1.0 indicating economic strength.

As the table above illustrates, all the counties selected, except Indianapolis’ Marion County, have an IT worker base above the national average.

Measuring existing economic and industry strength is important, but how automation will impact the region in the future also matters. The Montrose Automation Index measures the job and wage impact of automation by comparing a region’s existing jobs with those that are likely to be automated. The higher the Montrose Automation Index, the closer that community will be to winning in the Age of Automation. As the chart below outlines, tech centers like Austin fair the best.

Demographic data provides critical population and wealth measures such as population size and growth, homeownership rates, median family incomes, level of education and poverty rates. All of this data impact the long-term economic vitality of a region and a company’s decision to locate in the region.

Regional State Demographic Benchmark Comparison

| Fact | Raleigh | Columbus | Austin | Nashville-Davidson | Tampa | U.S. |

| Population | 464,758 | 879,170 | 950,715 | 667,560 | 385,430 | 325,719,178 |

| Population Growth 2010-17 | 15.00% | 11.40% | 18.50% | 10.60% | 14.8% | 5.50% |

| Homeownership Rate | 51.10% | 45.00% | 45.30% | 53.50% | 48.4% | 63.60% |

| Median Household Income | $58,641 | $47,156 | $60,939 | $49,891 | $45,874 | $55,322 |

| Bachelor’s Degree | 49.20% | 34.80% | 47.70% | 37.60% | 35.5% | 30.30% |

| Poverty Rate | 14.90% | 21.20% | 16.70% | 18.00% | 21.2% | 12.30% |

The demographic data for the remaining target cities illustrate the challenge Tampa has as a smaller urban center compared to its peers, eliminating it from the fin-tech project.

With the retirement of the Baby Boomer generation, regions everywhere are struggling to find the answer to the workforce development puzzle. The volume of college educated workers matters to white collar and high-tech companies. As the table below illustrates, all the target cities in the FinTech case study have college graduation rates well above the national average.

The volume and costs of that skilled workforce for a company’s industry matter even more than the level of college graduates. The table below illustrates that Austin, Raleigh and Columbus have a high volume of higher paid software developers. While Nashville has a lower wage rate for these workers, the low volume of software developers in this market would create challenges for many FinTech projects.

Regional Benchmarking Software Developers for Applications Worker Wages & Jobs

| Occupation code | Raleigh | Austin | Columbus | Nashville |

| Software Developers, Applications Average Wage | $100,960 | $105,430 | $107,770 | $94,130 |

| Software Developers, Applications Jobs | 8,520 | 13,680 | 12,000 | 3,070 |

Infrastructure factors at the site and in the region would also be considered. The FinTech industry is focused on the number of direct airline flights to Northern California and global markets, and the general concern about traffic congestion. All the remaining target communities had good but not great direct flight access and traffic congestion issues due to growth.

Finally, a cost of doing business analysis provides an economic measure of the wage rates, construction, real estate, and tax structure of multiple regions and states that determines quality of life measures for the region.

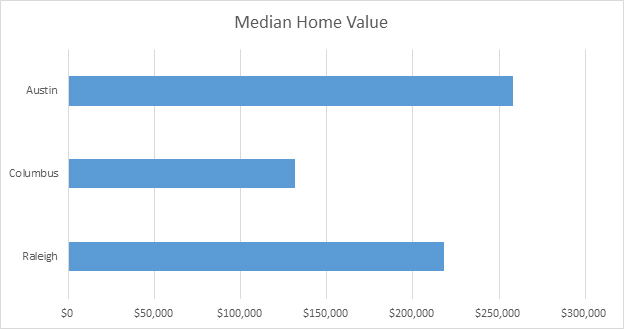

Columbus, with its dramatically lower housing costs and other costs of living measures, is a location that is highly competitive for FinTech jobs compared to better known high-tech centers like Austin and Raleigh. What is taxed and tax rates are also measured as a cost of doing business factor. The chart below illustrates a high-level tax comparison for Raleigh and Columbus and shows a lower state tax rate in Ohio but a higher tax rate at the local government level in the Buckeye State.

Raleigh v. Columbus Tax Comparison

| Tax | Raleigh | Columbus |

| State Corporate Income Tax | 3% | None |

| State Corporate Franchise Tax | $1.50 per $1,000 | .0029 on gross receipts |

| State Personal Income Tax | Flat 4.59% | 1.980% up to 4.997% |

| Municipal Income Tax | None | 2.5% |

| County Sales Tax | 7.25% | 7.50% |

| Property Tax | .861% | 2.029% |

The cost of real estate also matters. The explosive growth rate of the Raleigh market has general office average asking rents at $23.12 a square foot compared to Columbus’ lower rate of $18.76, providing some level of cost of doing business balance for Ohio.

Ohio offers property tax abatements, tax increment financing for infrastructure, JobsOhio (a private sector led state economic development corporation) grants and loans for workforce, infrastructure and redevelopment costs, and the Ohio Job Creation Tax Credit as a refundable tax credit for state taxes a company pays. To off-set the cost of local government taxes, Columbus offers a municipal income tax credit that refunds 50% of the company’s municipal income tax its employees and the company pays if they grow new jobs in Downtown Columbus. North Carolina offers tax incentives for projects in Wake County that create 40 jobs at an average wage of 110% of the county average wage or the state average wage, whichever is lower. The City of Raleigh offers very limited tax incentives for projects in Downtown Raleigh that in essence are access to a regional workforce development program.

Based upon North Carolina economic guidelines for the FinTech case study, the company should expect a $5,000,000 economic development incentive grant from the state but the location in Downtown Raleigh may create a challenge for the receipt of local incentives. Combining the state of Ohio Job Creation Tax Credit, JobsOhio workforce grant and Columbus Downtown Municipal Job Creation Tax Credit, Root Insurance received a $13,000,000 incentives offer. In addition, while wage rates are comparable for Raleigh and Columbus, the likely higher Raleigh rent would add $1,700,400 to the cost of the project in North Carolina. Even if you add in the $2,500,000 in municipal income tax the Root Insurance and their employees would pay after the city incentives kick in, the Ohio tax incentive offer makes staying in Ohio more attractive than moving to another location. While Columbus is not known as a tech center like Raleigh or Austin, their retention and expansion of Root Insurance illustrates they can grow FinTech companies based upon early stage capital investments, regional economic and workforce strengths, strong base of computer software workers, lower real estate costs and an aggressive tax incentive package.

As Root Insurance’s decision to grow in Columbus illustrates, states and regions often win or lose the project well before economic development incentives enter the discussion, but the incentives can prove a tipping point in the final moments.

David J. Robinson, Principal of Montrose Development Advisors, LLC and the leadership of the firm negotiated $1.2 B in economic development deals through a corporate site location process for public and private sector clients and recently published the Montrose 2018 Corporate Site Location Guide & Tax Incentive Update.