Aqaba emerges as a magnet for investment in Jordan.

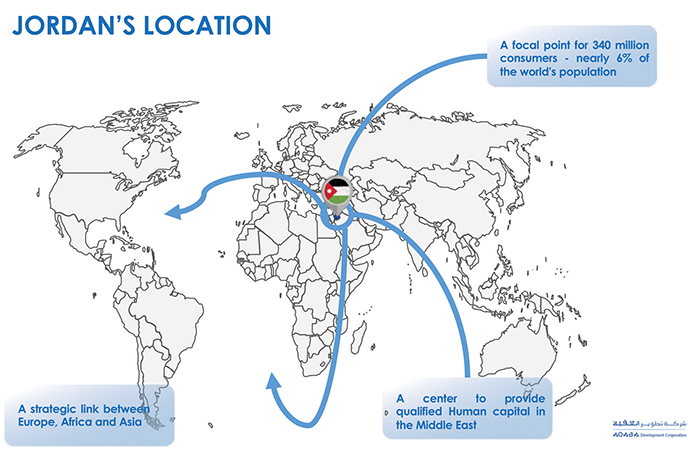

Occupying a historic position in the Red Sea region, the ancient town of Aqaba begins in a grove of date palms abutting the crystal blue waters of the Gulf of Aqaba. From there it ascends toward rugged, red mountains that flank a small plain. Jordan’s only port city, Aqaba has for centuries been a vital crossroads connecting trade routes linking Asia, the Middle East and Europe.

In the 17 years since it was launched, the Aqaba Special Economic Zone (ASEZ) has blossomed into a regional trade hub. A vision of His Majesty King Abdullah II, the ASEZ is a semi-autonomous special economic zone within the Kingdom of Jordan, and a "test case" for how a streamlined, business-friendly environment can create jobs and promote economic growth.

In a recent speech, the King emphasized:

"This is Jordan’s goal: re-launching growth and investment while deepening reform and inclusion. For this end, public-private partnerships are our building blocks. Today," he continued, "Jordan’s forward-looking economic growth plan focuses on high-value-added sectors across the country. We have identified close to $15 billion in public-private partnership opportunities in fields as diverse as renewable energy, ICT, infrastructure, construction, healthcare, tourism and financial services. Whether it is free-trade-access manufacturing or green economy projects, or professional services, or an entirely new opportunity that you create: Jordan is open for business."

The King’s special interest in the Aqaba project has been key to its success.

"The support of His Majesty King Abdullah II has been instrumental to Aqaba’s ability to flourish as a model of decentralization," says His Excellency Nasser Shraideh, Chief Commissioner of the Aqaba Special Economic Zone Authority (ASEZA). "The Zone," says Shraideh, "aspires to reclaim its historical role as a trade center and strengthen its position as a transport and logistics hub serving Jordan and the region."

The Special Economic Zone covers 145 sq. miles (375 sq. km.) of land plus the entirety of Jordan’s 17-mile (27-km.) coastline. Its law and regulations — including low flat-rate income tax, zero tariff and import taxes, no foreign equity restrictions and multi-use commercial, tourist and residential zoning — are designed to facilitate rapid expansion. ASEZA, responsible for the management and development of the Zone, is committed to providing:

- A one-stop investment center to facilitate business start-up and smooth operations.

- A world-class business environment that maximizes private sector participation in a tax-advantaged and continuously improving investment climate.

- A model approach to governance and environmentally sustainable development.

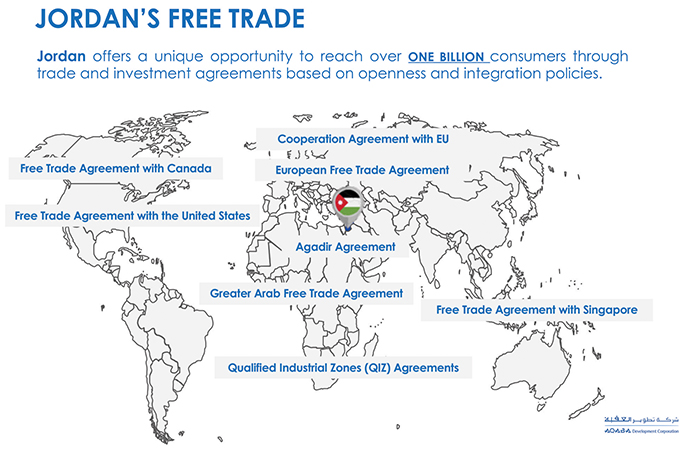

Industries located within the ASEZ benefit from Jordan’s preferential access, for products of Jordanian origin, to members of the World Trade Organization and Arab countries. Products manufactured in Jordan enjoy quota-free access to the U.S. market through the Free Trade Agreement and to the European Union through the Euro-Jordanian Association Agreement.

Since the establishment of the Special Economic Zone, investment attracted to the ASEZ has reached about $20 billion, far surpassing the $6 billion goal that was initially targeted for 2020. This surge in capital has effectively turned the desert outpost into a bustling city, with Aqaba’s population more than tripling from the late 1990s, increasing from 60,000 to over 190,000 people today and paralleled by increasing job creation and living standards.

Being the second-largest Red Sea port, Aqaba is an international city whose uniqueness derives largely from the fact that it is a multi-faceted economic zone; Aqaba’s Land Use Master Plan envisions a mix of 50 percent tourism, 30 percent logistics and 20 percent industry. ASEZA aims to develop the Special Economic Zone as the epicenter of best practices in Jordan and throughout the Middle East.

“This is Jordan’s goal: re-launching growth and investment while deepening reform and inclusion.”

"The idea is to be a hub that is unique to the area," says Ghassan Ghanem, CEO of the Aqaba Development Corporation (ADC), ASEZA’s central development arm. "Our standards are different," Ghanem tells Site Selection, "not only in tourism but also in logistics and industry. We want to exceed international standards by developing state-of-the art facilities in ports, industry and real estate development."

ADC, owned jointly by the government of Jordan and ASEZA, manages and leads development of Aqaba’s seaports, King Hussein International Airport (KHIA) and strategic parcels of land. It is tasked with operating and expanding key facilities, building new infrastructure and creating necessary business enablers including the development, modernization and expansions of Aqaba Ports Community and KHIA, as well as strategic logistics and transport projects. The Port of Aqaba has undergone major modernization and expansions and KHIA has been upgraded to the tune of $141 million.

Setting up Shop

The number of companies setting up shop in Aqaba is growing steadily. A key area for industrial development is the 18,298,647-sq.-ft. (1,700,000-sq.-m.) Aqaba International Industrial Estate (AIIE), run by PBI Aqaba, a private company. Established in 2005, AIIE offers open lots, fully serviced land and finished buildings for lease or sale. Investors benefit from ASEZ’s regime of financial incentives.

"The government owns most of the land in this region, and one of the services we’re providing is to add infrastructure and improve land belonging to the government and then selling it or renting it to investors," says Sheldon Fink, CEO of PBI Aqaba. "But our major job is a service job, which is to facilitate the investors coming here through licensing and permitting, finding local partners, finding local suppliers, sometimes financing. We’re really a service company that’s attached to a real estate function."

“The Zone aspires to reclaim its historical role as a trade center and strengthen its position as a transport and logistics hub serving Jordan and the region.”

Total investment in AIIE is in the range of $600 million, with an associated 3,500 jobs and more than 100 different companies. In two years, Fink expects to be up to about $1 billion of investment and 6,000 jobs. The volume of business in and out of the estate, says Fink, is between $400 million and $500 million a year.

In 2015, PBI Aqaba signed a memorandum of understanding with China’s Shenzhen Chamber of Investment to develop and operate an industrial and logistics estate as an expansion of AIIE. The initial investment of $700 million is to create some 2,500 jobs.

"We’ve moved into international the past three years," says Fink, "and right now, that’s the most active part of what we’re doing. Among others, we have Chinese, we have Germans, we have Canadians, Americans, Iraqis, Syrians, Saudis, Israelis, Russians and Turks."

AIIE’s investors include Orbit Aluminum Industries, a Canadian company; Wiosun for Renewable energy, a German/Iraqi venture; Sydney Garments, a Hong Kong/Indian company; and Bareeq Li Tiknolojia Tarsheed Al-Taqah Co., an LED lighting company based in Shenzhen, China.

"We are very happy we have chosen to be in Aqaba International Industrial Estate," says Mumtaz Daaboul, CEO of Orbit Aluminum Industries, citing "continuous support" from AIIE.

"We chose Aqaba because of its unique location in the Middle East," says Adele Yan, managing director of Bareeq. "With its free trade agreements with the U.S., EU and other Middle East countries, we believe that having our advanced LED products made here can help us expand our market all over the world. Costs here are reasonable compared to China, which makes our ‘Made in Jordan’ products more price competitive in the market."

AIIE is located about six miles (10 km.) from Aqaba Container Terminal, 11 miles (18 km.) from the general cargo port and less than a mile from the airport. PBI Aqaba currently is looking at two additional pieces of land for expansion.

"There’s a big future here," says Fink. "We are increasing our staff and we’re talking to much bigger customers than we used to talk to."

Gateway to the Levant

The world is taking note of Aqaba’s rise. In late October, the city hosted the 15th Trans Middle East Conference and Exhibition, the region’s premier logistics gathering. Highlighting the city’s emergence, the two-day conference included some 400 senior government officials, transportation and logistics industry principals, terminal operators and representatives of leading shipping companies. Speakers included Dr. Yossi Sheffi, director of the MIT Center for Transportation and Logistics.

"Aqaba has the potential," said Sheffi, "to be a major hub of international flow of goods where value-added activities create a large number of jobs and help the economic growth of Jordan and the region. Aqaba sits in a geographically strategic location between Asia and Europe and is central to the Middle East."

Wolfgang Lehmacher, head of supply chain and transport industries at the World Economic Forum, another speaker at the conference, believes that Aqaba’s role could transform the flow of goods throughout the Middle East.

"In today’s fractured but also more balanced world of global trade and commerce," Lehmacher said, "the importance of geographic regions and their connectivity, capabilities and ability to collaborate with other markets has risen significantly. The way Jordan is going to ramp up its logistics platform will not only impact its own position, but the future role that other parts of the region might be able to play."

The Kingdom of Jordan represents a bastion of stability in a region that includes Israel, the Palestinian territories, Saudi Arabia, Syria, Iraq and Egypt. As a testament to the city’s resolve, Aqaba’s expansion has continued apace despite the years-long closures of Jordan’s borders to Syria and Iraq, the latter one of the city’s main trade routes.

“The idea is to be a hub that is unique to the area.”

"Despite all the instability that neighboring countries tragically went through," says Shraideh, "Jordan’s unwavering commitment and belief in a better future, a peaceful and prosperous one, are evident in the Kingdom’s nonstop efforts to build for the future, not only Jordan’s future but the region’s as a whole."

With the Syrian border having re-opened in mid-October, and with the Iraqi border re-opened in 2017, prospects for resumed cross-border commerce loom large.

"If you’re trying to ship goods to Syria and Iraq, the best way is to go through Aqaba," MIT’s Sheffi tells Site Selection. "Someone will have to rebuild Syria, and this will take decades, so a lot of stuff is going to flow into Syria."

Before the conflict in Syria began in 2011, cross-border commerce with Jordan was estimated at nearly $600 million per year. Trade with Iraq was far greater.

"Our transportation of commodities between Aqaba Port and Iraq as a whole can be huge," says ADC’s Ghanem. "At one time it was 40 percent of our total throughput from the ports. As the borders are re-opened, that means that we can expect our ports to begin working overtime."

Iraq has set a goal of exporting 4 million barrels of oil per day in 2019, one-fourth of which it plans to ship through the Port of Aqaba.

"We are proud to report," says Shraideh, that Aqaba is ready and willing to function as a gateway to Iraq."

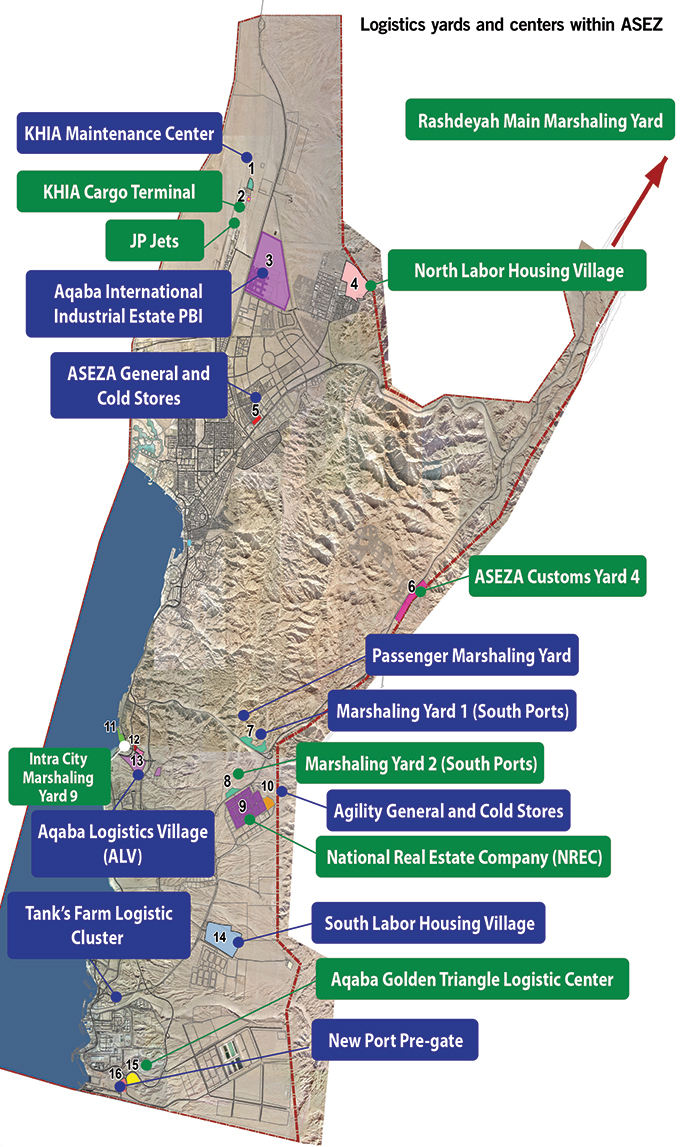

Transportation and Logistics

The Ports of Aqaba consist of 12 terminals stretching over 32 specialized berths. In 2017, the general cargo port handled 20 million tons of cargo. Aqaba Ports Community is comprised of Aqaba New Port (general cargo, dry bulk, roll-on/roll-off), the Middle Port (general cargo/dry bulk) the Ferry Terminal, Cruise Ship Harbor, Liquids Terminal, Aqaba Container Terminal (ACT), the Industrial Terminal, Phosphate Terminal, Oil Terminal, Liquid Petroleum Gas Terminal and Liquid Natural Gas Terminal.

Aqaba Ports Community has deep berths ranging between 40 ft. (12 m.) and 46 ft. (14 m.) and is equipped with state-of-the-art handling equipment. The ports include serviced storage space and are well-connected via modern road networks with logistics centers and industrial estates in the Zone.

The imposing Aqaba Container Terminal (ACT) is a joint venture between ADC and APM Terminals, part of the mammoth Maersk group. APM assumed management in 2004 and promptly halved berthing times by computerizing and streamlining port operations. APM has invested some $300 million in the terminal and employs more than 1,000 people there.

ACT handled 804,000 TEU in 2017 and has the capacity to take on more. With its deep draft and state-of-the-art facility, ACT has been able to handle ever-increasing vessel sizes, going from 5,500 TEU in 2014 to more than 14,700 TEU today. The 10 largest global shipping lines — jointly controlling more than 80 percent of global container line capacity — all call on ACT.

Aqaba’s King Hussein International Airport (KHIA) is poised for growth, as well. KHIA has an annual capacity of 2 million passengers and a 9,840-ft. (3,000-m.) runway capable of handling all types of aircraft. It also has an air cargo terminal managed by National Aviation Services. Plans call for construction of an Aerospace Industrial Park, Logistics Park and Airport Business Park.

KHIA is currently served by Royal Jordanian Airlines, which runs daily service between Aqaba and the Jordanian capital, Amman. Turkish Airlines operates three flights per week between Aqaba and Istanbul. As of November, low-cost carrier Ryanair offers flights between Aqaba and several European cities. EasyJet is launching service to Aqaba from London and Berlin. Officials say that ASEZA plans to launch Fly Aqaba Airline to ensure additional connectivity to the city.

Logistics and industry being key components of Aqaba’s ecosystem, the National Real Estate Company Jordan (NREC) was established in 2006 as a private shareholding company owned by ADC and National Real Estate Company, a Kuwaiti company.

NREC Jordan is responsible for developing South Aqaba Investment Park located seven miles (12 km.) southeast of Aqaba city center and four miles (6 km.) from Aqaba Container Terminal. The park sits on the main highway that connects Aqaba with Saudi Arabia, Iraq and Syria.

South Aqaba Investment Park offers 645,835 sq. ft. (60,000 sq. m.) of warehousing units and more than 5 million sq. ft of serviced and developed land plots available for companies seeking to leverage Aqaba’s strategic location for regional storage, import and export activities, as well as light and medium industries.

With a footprint of more than 16 million sq. ft. (1.5 million sq. m.), the project has been developed as a gated business park with abundant support services such as 24/7 security, customs service and advanced telecommunications. Investors currently operating at the Park include tobacco processing, food processing, automotive, and chemicals.

Situated adjacent to Aqaba Container Terminal, Aqaba Logistics Village (ALV) offers warehousing, logistics and cargo support services, and is a key component of the effort to establish ASEZ as a regional logistics center.

"ALV was built to be a hub not only for Jordan but for the region, including Iraq," says general manager Hakam Abul Feilat. "We provide facilities for storage and warehousing in addition to providing value-added services for customers like cross docking, packaging, office rental services and whatever any customer requests for their cargo," Feilat tells Site Selection.

With a footprint of 1,030 acres (417 hectares), ALV is being developed in phases. Phase I, covering 1.5 million sq. ft. (140,000 sq. m.) and completed in 2008, consists of two warehouses for container freight and distribution, plus an open yard for storing imported vehicles and other large equipment. Phase II, completed in 2015, has roughly 100,000 sq. ft. (10,000 sq. m.) of warehouse space and additional open yard storage. A third phase is in the planning stage.

Also next to the General Cargo Port, the $28.2-million Golden Triangle Logistic City includes a 2.8-million sq.-ft. (260,000-sq.-m.) building and 1.5 million sq. ft. (140,000 sq. m.) of land for customs services, making it the biggest project of its kind in the region, according to the project’s CEO Mohammad Shwaikini.

Infrastructure: Opportunities for Investment

The ASEZ offers businesses and residents a planned environment consisting of high-quality core infrastructure built to international standards. Electricity is provided from a 600-megawatt thermal power station and a national grid. Water is abundantly supplied from nearby aquifers, with expansion plans for desalination plants to meet future needs. Businesses locating in Aqaba have access to the Fiber-Optic Link Around the Globe (FLAG) that passes through the ASEZ. Telecommunications services are available at regionally competitive rates.

With its mandate to expand existing infrastructure, the Zone has launched projects of far-reaching potential, perhaps none more consequential than the Ma’an Land Port, 80 miles (130 km.) northeast of Aqaba. The Port is envisioned as a means to ease congestion at the Ports of Aqaba and to spread the benefits of Aqaba’s success to other parts of the country. The new port at Ma’an, projected to create needed jobs for the city, will connect with Aqaba Port through the Aqaba Railway. The project aims to rehabilitate existing railway infrastructure and connect Ma’an Land Port with both Aqaba Container Terminal and Aqaba General Cargo Port.

Other major projects on the drawing board include Aqaba-Ma’an Crude Oil Pipeline transporting crude oil from Aqaba Oil Terminal to Ma’an Land Port and Al Quweira Industrial and Logistics Zone.

There are incentives offered to boost Aqaba’s logistics sector such as:

- 40% Discount on Handling of Transit Goods

- 50% Discount on Containers Exported From ASEZ

- 50% Discount on Suez Canal Fees for Goods Shipped to ASEZ.

In addition, high-end real estate projects are underway in Aqaba to accommodate the city’s growing population and an expected influx of tourists from Jordan and abroad. Abu Dhabi-based Eagle Hills Properties is developing Marsa Zayed, a $10-billion project featuring apartments, villas, commercial spaces and a cruise ship terminal.

Eagle Hills is also behind Saraya Aqaba, a $1.5-billion mixed-use project that envisions a total of 850 residential units, four 5-star hotels and a conference center. The $1.2-billion Tala Bay resort features hotels, apartments, retail and a marina.

Ayla Oasis Development Company, a private shareholding company owned by the Saudi Astra Group and Bahrain’s AlMaserah Co. has invested close to $1 billion in Ayla Oasis, another ambitious mixed-use development. Ayla Oasis enjoys 835 ft. (255 m.) of Red Sea frontage and 11 miles (17 km.) of waterfront created along a system of three lagoons.

Attractions include a beach club and a championship golf course designed by Greg Norman. When complete, the development will cover more than 46 million sq.-ft. (4.3 million sq. m.) of residential and commercial space.

"Ayla will be developed in stages over the course of 20 years," says Eng. Saul Dudin, Managing Director, Ayla Oasis Development Company. "We are seeking a balance," Dudin tells Site Selection, "which means residential, commercial, and hospitality and leisure to create a destination. The growth will reflect the demand. At the moment the demand is on residential."

“Obviously, we are confident in our investment.”

Alya presently has 350 residential units, 60 percent of which have been sold, and a new Hyatt Regency Hotel with 286 rooms. Total investment upon completion is expected to be $2.5 billion.

"The project is designed to handle around 50,000 people when it’s fully developed," says Dudin. "We should have more than 3,000 residential units and around 1,500 hotel rooms for tourists."

Dudin is bullish on Aqaba’s future as a destination for travelers. The coral reefs of the Gulf are renowned among divers. Aqaba’s sandy beaches are known throughout the Middle East. And the otherworldly desert landscape of Wadi Rum and the rose-red city of Petra, along with Aqaba, form Jordan’s "Golden Triangle."

"We’re only hour from Wadi Rum," says Dudin. "We’re an hour and a half from Petra. We’re two hours from the baptism site of Jesus Christ and two-and-a-half hours from Jerusalem. We’ve spent close to a billion dollars here at Ayla Oasis. Obviously, we are confident in our investment."

This Investment Report was prepared under the auspices of PBI Aqaba and the Aqaba Special Economic Zone Authority. For more information, visit www.pbiaqaba-jo.com and www.aqabazone.com.