As technology firms look for locations in the U.S. to innovate and build their high-tech components, a large number of companies have recently chosen to establish their base of operations in Arizona — chiefly, in the Greater Phoenix metro area. These investments come from a range of high-tech industries, including logistics and high-tech manufacturers making everything from electric vehicles to semiconductors.

Greater Phoenix has long been known as a hub for advanced manufacturing, with tech companies like Intel, Honeywell and Boeing operating facilities in the region. Its innovative, business-friendly climate, coupled with its sizable talent pool, has led to a year of significant investments and the creation of thousands of new jobs.

One of the region’s most recent wins came from electric vehicle manufacturer, ElectraMeccanica, which selected the city of Mesa for its U.S.-based assembly plant. The company’s yearlong search took it to five different states for its new site. Ultimately, the company’s decision to locate in Mesa hinged on finding the right environment for its technical and workforce needs. When operational, the facility is expected to create up to 500 new jobs and produce 20,000 electric vehicles, called SOLO EV, per year. Altogether, the site will feature a light vehicle assembly plant and a state-of-the-art engineering technical center, including multiple labs and vehicle chassis, battery pack and power electronics testing workshops.

“I want to thank Governor Ducey, his team, the state of Arizona and everyone who’s been involved in this process for helping to bring ElectraMeccanica’s U.S. operations to life,” said CEO Paul Rivera. “This decision is monumental for our business and will be transformative for our host city and state. When fully operational, we anticipate creating hundreds of new jobs for the local economy. We believe Mesa’s population size and density provides a great talent pool as we look forward to contributing to the growing high-tech environment.”

Talent Draws Tech Investment

Maricopa County’s talent pool is indeed a deep one. Home to approximately 4.4 million people, Maricopa County is the nation’s fourth-largest county for population. More than half of the state’s population resides in Maricopa County, including Phoenix, Mesa, Chandler and others.

Emsi ranked Maricopa County the No. 1 large county in its annual 2020 Talent Attraction Scorecard. The report points to the region’s broad appeal for industries and recent activity in the semiconductor sector as a contributing factor. “Perhaps what is most striking about Maricopa’s economy is the breadth and depth of industries,” the report notes. Citing major investments in the advanced manufacturing and semiconductor industries, the scorecard says expansions like Intel’s Fab 42 plant contribute to Maricopa County’s status as a national leader in advanced manufacturing and semiconductor production, contributing to the county’s 18% growth in skilled jobs. The report nods to a positive feedback loop in the region — in which the presence of skilled talent attracts investments, which in turn attracts more talent and investments.

The region’s workforce is bolstered by the talent coming out of Arizona State University’s (ASU) Fulton Schools of Engineering, one of the top-ranked engineering and technology programs in the country, as well as Northern Arizona University and the University of Arizona (both of which have a full range of engineering and industrial programs.) Additionally, ASU has earned the No.1 most innovative school designation from U.S. News & World Report for five consecutive years.

Arizona is the Place for Fabs

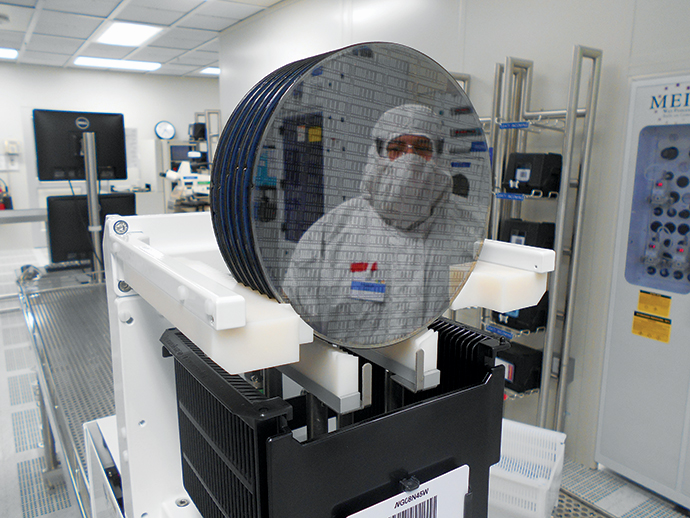

The last year has unveiled several new semiconductor projects in Arizona, including Intel’s massive $7 billion investment in Chandler, which was completed in October.

Intel’s Fab 42 was one of the largest construction projects in the U.S. — a $7 billion investment that created 3,000 new Intel jobs and 10,000 new Arizona jobs overall. Shortly after the company officially opened its new fab, it announced its $20 billion plan to expand its Ocotillo campus in Chandler significantly. The company said it would immediately start planning and construction on two new fabs. Intel will have six factories on the 700-acre campus with the two new facilities, making the location its largest manufacturing site in the world. The Intel Ocotillo campus is the company’s first mega-factory network, with four factories connected via a mile-long automated superhighway.

“Intel is proud to expand our U.S. manufacturing presence with two new factories in Arizona,” said Keyvan Esfarjani, Intel senior vice president in Manufacturing & Operations. “For more than 40 years, Arizona has been vital to Intel’s ability to create the world-changing technology we all depend on. This new investment will advance the ecosystem of innovation we’ve helped create in Arizona and increase U.S. semiconductor manufacturing capacity.”

“For more than 40 years, Arizona has been vital to Intel’s ability to create the world-changing technology we all depend on. This new investment will advance the ecosystem of innovation we’ve helped create in Arizona and increase U.S. semiconductor manufacturing capacity.”

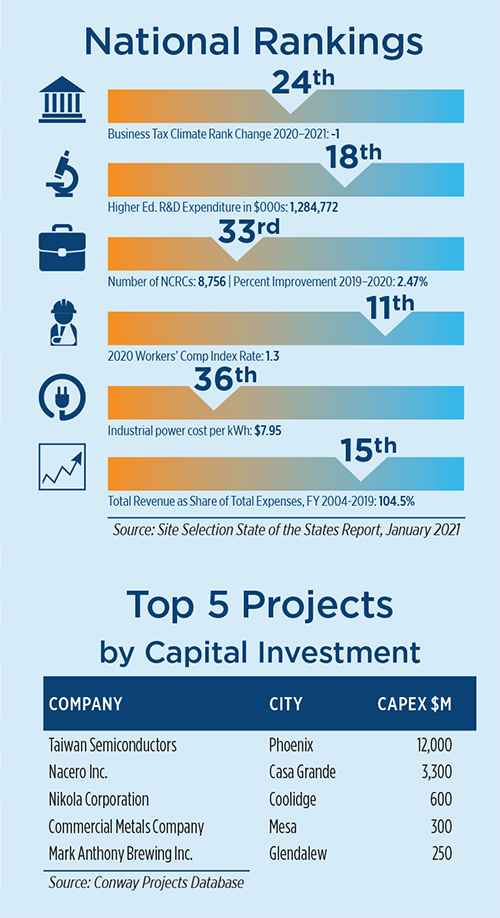

Intel is just one of many new fabs coming online in Greater Phoenix. NXP also officially opened its 150-mm. (6-inch) RF Gallium Nitride (GaN) fab in Chandler in September 2020. The new fab will support 5G base stations and advanced communication infrastructure in the industrial, aerospace and defense sectors. GaN power transistors have emerged as the new gold standard in 5G size and power requirements. The fab is set to ramp up quickly, with NXP leveraging its Chandler-based team and their longstanding expertise in compound semiconductor manufacturing. Additionally, Taiwan Semiconductor Manufacturing Company’s (TSMC) $12 billion investment in a new 5-nm. foundry in Phoenix is expected to create over 1,600 high-tech professional jobs directly and thousands of indirect jobs in the semiconductor ecosystem when it’s operational in 2024.

Samsung is also reportedly looking to Arizona as a potential site for its new $17 billion, 1,800-job semiconductor fab. The company has filed documents with Arizona, New York and Texas and is expected to decide in 2023.

Momentum Building for Stateside Semiconductor Incentives

As reported by Adam Bruns in the November issue of Site Selection, momentum is building for industry incentives to bring more fabs to the U.S. The Semiconductor Industry Association (SIA), in partnership with the Boston Consulting Group (BCG), recently released a study analyzing the impact of proposed federal incentives for domestic semiconductor manufacturing. The report noted how 70 years ago, the U.S. made the entirety of the world’s semiconductors. But today, the U.S. share of the sector’s global fabrication hovers at only 12%, meaning 88% percent of the semiconductor chips used in America’s computers, phones, vehicles and appliances are made outside the country.

In April, Biden’s $2 trillion infrastructure investment plan includes $50 billion to boost the country’s semiconductor manufacturing and innovation, called the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act.

“The country that leads in advanced chip research, design, and manufacturing will have a big leg up in the global race to deploy new game-changing technologies, such as 5G, artificial intelligence and quantum computing,” said John Neuffer, SIA president and CEO. “Leaders in Washington should seize this opportunity, level the global playing field to attract chip production, and invest boldly in domestic manufacturing incentives and research initiatives that will strengthen U.S. tech leadership for decades to come.”

According to the SIA report, federal incentives would reverse the country’s declining chip production trajectory and create as many as 19 major semiconductor manufacturing facilities (fabs) and 70,000 high-paying jobs in the U.S. over the next 10 years. The report notes some of the countries leading in the sector (including Taiwan, South Korea, Singapore and China) invest tens of billions of dollars annually into the industry.

The SIA report notes, “The global semiconductor industry is expected to increase manufacturing capacity by 56% in the next decade. With a $50 billion federal investment, the U.S. is projected to capture nearly a quarter of new global capacity that is not yet in development, compared to only 6% with no government action.”