According to new research on clean energy financing in G-20 nations released by The Pew Charitable Trusts earlier this month, The United States attracted $48 billion in clean energy investment in 2011, a 42-percent increase over 2010, and just beating out China’s $45.5 billion to claim the No. 1 ranking.

Pew said the U.S. investment helped propel the addition of 6.7 gigawatts (GW) of wind and, for the first time, more than 1 GW of solar energy, enough to power 800,000 homes. Total U.S. installed renewable energy capacity at the end of 2011 was 93 GW, second to China.

“However, America will be hard-pressed to sustain last year’s success in the wake of now-expired Treasury grants and the Department of Energy’s loan guarantee programs,” said Pew. “Also, the production tax credit concludes at the end of this year.”

“In 2011, the global clean energy sector grew again, the U.S. reclaimed its lead as the top destination for private investment, and consumers reaped the rewards of significantly reduced prices for clean energy technologies, such as solar panels, which are now nearly 50 percent cheaper than a year ago,” said Phyllis Cuttino, director of Pew’s Clean Energy Program. “And yet, the yo-yo effect of U.S. clean energy policy hurts the ability of the United States to consistently compete and turn U.S.-led innovation into manufacturing, deployment, and export opportunities. Creative, stable, and transparent policies remain a critical signal to private investors.”

Vestas has been the most public of the renewable energy manufacturing companies in its dissatisfaction with the looming PTC expiration, implying it would draw down drastically on its substantial manufacturing footprint in the U.S. and take its money and jobs to such locations as Brazil.

In a March blog at HuffingtonPost, Cuttino applauded Sen. Jeff Bingaman’s (D-N.M.) recent introduction of legislation calling for a Clean Energy Standard. Under the plan, “all generators of clean energy are given credits based upon their carbon emissions; greater numbers of credits are given to generators with lower emissions per unit of electricity,” said Bingaman’s news release. “This flexible framework naturally allows a wide variety of sources (solar, wind, nuclear, natural gas, coal with carbon capture and storage, etc.) to be used to meet the standard, allows market forces to determine what the optimal mix of technologies and fuels should be, and makes it easy for new technologies to be incorporated.”

Recaptured Heat Could Recapture Mojo

Cuttino writes among the laudable components of the bill “are provisions promoting technologies that help companies capture waste heat and use it for both electricity generation and heating purposes … Manufacturing and power generation create large amounts of heat, which typically escapes through smokestacks into the atmosphere. Hundreds of facilities across the United States are already using technical innovations to capture this energy for other purposes. Altogether, utilizing harnessed heat contributes 85 gigawatts of electricity capacity annually, or almost 9 percent of the nation’s output.”

Oak Ridge National Laboratory, she wrote, says greater energy efficiency in the industrial and manufacturing sector alone could create up to 1 million highly skilled jobs” and drive “up to $200 billion in new private financing.”

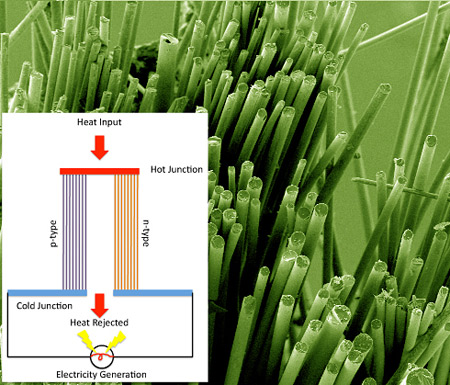

One example of industrial efficiency technology is being developed at Purdue University, where researchers are developing a technique that uses nanotechnology to harvest energy from hot pipes or engine components to potentially recover energy wasted in factories, power plants and cars.

“The ugly truth is that 58 percent of the energy generated in the United States is wasted as heat,” said Yue Wu, a Purdue University assistant professor of chemical engineering. “If we could get just 10 percent back that would allow us to reduce energy consumption and power plant emissions considerably.”

Purdue says the researchers have coated glass fibers with a new thermoelectric material they developed. When thermoelectric materials are heated on one side electrons flow to the cooler side, generating an electrical current.

“Coated fibers also could be used to create a solid-state cooling technology that does not require compressors and chemical refrigerants,” says the university in a release. “The fibers might be woven into a fabric to make cooling garments.”

The glass fibers are dipped in a solution containing nanocrystals of lead telluride and then exposed to heat in a process called annealing to fuse the crystals together. Such fibers could be wrapped around industrial pipes in factories and power plants, as well as on car engines and automotive exhaust systems, to recapture much of the wasted energy.

Today’s high-performance thermoelectric materials are brittle, and the devices are formed from large discs or blocks. The new flexible devices would conform to the irregular shapes of engines and exhaust pipes while using a small fraction of the material required for conventional thermoelectric devices.

More Findings

Globally, says the Pew report, clean energy investment grew to a record $263 billion in 2011, a 6.5-percent increase over the previous year. The U.S. led venture capital and private equity investments in the field with $6 billion, as well as accounting for 30 percent of total corporate R&D and 31 percent of government R&D investments.

“The combination of falling clean energy technology prices and growing investments accelerated installation of clean energy generating capacity by a record 83.5 GW in 2011, bringing the total to 565 GW globally,” said the report. “This was nearly 50 percent more than installed nuclear power capacity worldwide at the end of last year. Experts increasingly agree that solar and wind will become cost-competitive with conventional electric generating capacity this decade and therefore will be preferred investments in emerging economies.”

G-20 investments in solar increased 44 percent to $128 billion, leading the way among clean-energy technology. Meanwhile, investments in both wind and energy efficiency fell by 15 percent.

“The clean energy sector received its trillionth dollar of private investment just before the end of 2011, demonstrating significant growth over the past eight years,” said Michael Liebreich, CEO of Bloomberg New Energy Finance, Pew’s research partner. “Solar installations drove most of the activity last year as the falling price of photovoltaic modules, now 75 percent lower than three years ago, more than compensated for weakening clean energy support mechanisms in a number of parts of the world.”

Other key findings from the report include:

- China attracted $45.5 billion in clean energy investment, which spurred deployment of 20 GW of wind power, the most of any nation.

- Germany ranked third for the second year in a row among the G-20 members, with $30.6 billion and 7.4 GW of solar power installed. Italy attracted $28 billion and deployed a world record of nearly 8 GW of solar power. India drew more than $10 billion and had the world’s second-highest annual growth rate for clean energy investment.

- India, driven by its “National Solar Mission” to have 20 GW of power installed by 2020, saw clean-energy investment rise 54 percent to $10.2 billion.

- Led by 42 percent growth in the United States and 15 percent in Brazil, investment in the Americas region grew by more than 21 percent to $63.1 billion, faster than any other region.

- The clean energy sector in the Asia/Oceania region increased more than 10 percent to $75 billion. “Relatively flat investment in China was mitigated by sharp gains in India, Japan, and Indonesia, which were among the fastest-growing clean energy markets in the world,” said the report.

- Significant investment growth in Italy, the U.K. and Spain helped to offset declines in other European Union member states. “Germany and Italy continue to lead the world in deployment of small, distributed solar photovoltaic power installations, accounting for more than 50 percent of worldwide solar capacity additions, and 38 percent of G-20 solar technology investments.”

- “There is unmistakable progress in the Brazilian clean energy sector, which has recorded the third fastest installed capacity growth over the past five years. Brazil surpassed 1 GW of installed wind capacity in 2011, and the sector is primed to expand in the coming years.”

- In 2011, just over half of the investments in Canada were directed to wind resources ($2.8 billion), enabling addition of 1.3 GW of wind generating capacity.

Who’s Using It?

The following Top Partner Rankings from the Green Power Partnership highlight the annual green power purchases of leading organizations within the United States and across individual industry sectors. Purchase amounts reflect U.S. operations only and are sourced from U.S.-based green power resources. Organizations can meet EPA purchase requirements using any combination of three different product options (1) Renewable Energy Certificates, (2) On-site generation, and (3) Utility green power products. According to the Partnership, “purchase figures are based on annualized Partner contract amounts (kilowatt-hours), not calendar year totals:

| Annual On-site Green Power Usage (kWh) | On-site % of total Electricity Use* | On-site Resources | Purchased Green Power (kWh) |

| 1. Kimberly-Clark Corporation | |||

| 193,347,000 | 8% | Biomass | 3,300,000 |

| 2. Wal-Mart Stores, Inc. / California and Texas Facilities | |||

| 114,909,088 | 4% | Biogas, Solar, Wind | 757,473,000 |

| 3. BMW Manufacturing Co. / Greer, SC Facilities | |||

| 61,863,438 | 37% | Biogas | 0 |

| 4. U.S. Air Force | |||

| 39,732,226 | <1% | Biogas, Solar, Wind | 226,045,600 |

| 5. City of San Francisco, CA | |||

| 31,593,977 | 4% | Biogas, Solar | 0 |

| 6. Nassau County, NY | |||

| 29,121,457 | 15% | Biogas | 0 |

| 7. City of San Jose, CA | |||

| 27,525,018 | 15% | Biogas, Solar | 0 |

| 8. SC Johnson & Son, Inc. | |||

| 26,800,000 | 14% | Biogas | 34,500,000 |

| 9. Kohl’s Department Stores | |||

| 24,655,000 | 2% | Solar | 1,500,001,000 |

| 10. City of San Diego, CA | |||

| 20,344,825 | 8% | Biogas, Small-hydro, Solar | 0 |

| 11. City of Portland, OR | |||

| 13,813,550 | 8% | Biogas, Small-hydro, Solar, Wind | 24,000 |

| 12. Encina Wastewater Authority | |||

| 11,964,000 | 70% | Biogas | 0 |

| 13. Adobe Systems Incorporated | |||

| 11,666,667 | 17% | Biogas | 52,342,000 |

| 14. City of Tulare, CA / Wastewater Treatment Plant | |||

| 11,320,000 | 45% | Biogas, Solar | 0 |

| 15. Google Inc. | |||

| 10,663,093 | <1% | Biogas, Solar | 92,740,044 |

| 16. Safeway Inc. | |||

| 9,190,000 | <1% | Biogas, Solar, Wind | 107,500,000 |

| 17. University of Iowa / Main Campus Buildings | |||

| 8,694,754 | 3% | Biomass | 0 |

| 18. Zotos International | |||

| 6,500,000 | 50% | Wind | 0 |

| 19. Macy’s, Inc. / 26 California and Hawaii Stores | |||

| 5,180,527 | 26% | Solar | 0 |

| 20. City of Santa Cruz, CA / Wastewater Treatment Facility | |||

| 4,636,955 | 39% | Biogas, Solar | 0 |

| *Reflects the amount of green power generated on-site as a percentage of total electricity use. Partners choosing to purchase green power in an amount exceeding 100 percent of their U.S. organization-wide electricity use are listed as such. | |||