Every year corporations and communities come together to paint pictures of project success. And every spring Site Selection salutes the best corporate facility projects in the world, judged by investment, high-value and high-volume job creation, creativity in negotiations and incentives, regional economic impact, competition and speed to market.

Among the boldest brush strokes in 2011 were such topics as repurposing, reshoring, fuel costs, the flight toward emerging markets, the flight away from risk, energy innovation, and the convergence of high-end services with high-volume data.

For the stories behind many of these deals, visit SiteSelection.com. What you learn might help you create a winning portfolio of work in 2012 and beyond.

TOP DEALS IN NORTH AMERICA

ver the past two years, Amazon has invested in large numbers of order fulfillment facilities and huge numbers of permanent and seasonal staff, especially in the Volunteer State. As reported in our Nov. 2011 issue, the state reached a new sales tax deal with the company in October which figures to more than double its original employment goals in Tennessee. Under the agreement, Amazon will also begin to collect Tennessee sales taxes beginning Jan. 1, 2014, unless a national solution is addressed before that time. The jury’s still out on the company’s tax-avoiding location strategy and the legal questions surrounding nexus when it comes to Internet-based companies. But, as Chattanooga Mayor Ron Littlefield told us, “I think we made the right deal at the right time.”

“It’s a big deal for us,” said Paul Misner, Amazon vice president, of the October deal with the state. “As for the sales tax issue, it must be resolved in Congress. It’s the only way the state of Tennessee will be able to obtain all the sales tax revenue that can be collected for the state, and we are committed to going to Washington with the state’s leaders both here in Nashville and Washington, D.C., to obtain that sales tax legislation as soon as possible.”

________________________

Continental Tire the Americas

Sumter Co., S.C.

$534 million, 1,650 jobs

he first of three big tire plant projects to land in South Carolina in recent months (see p. 152 of this issue), Continental’s project, just east of Columbia, was initially destined for the state’s neighbor to the north, before political sniping screeched it to a halt and a quick 180-degree turn back south. Gov. Nikki Haley’s team was ready and waiting with the inaugural deployment of “SuperFee” legislation to maximize the development incentives for projects valued at over $400 million; anticipatory work to upgrade infrastructure in the area already in progress; and plans for a special international school for German expatriates. The company’s initial site list included dozens of locations; Louisiana was also a finalist.

The incentives package deployed the governor’s closing fund to offer land at no cost to the company, and Special Source Revenue Credits to offset startup costs for the project, which brings with it a total payroll estimated at $80 million. “We’ve been told this was the most complicated incentives deal in state history, even surpassing the BMW and Boeing deals,” says Rick Farmer, communications director at Sumter Economic Development.

Continental will also invest $4 million and add 80 jobs at its headquarters in Lancaster County, just south of Charlotte, where the company already employs nearly 350. And it’s investing in a major expansion at its plant in Mt. Vernon, Ill., which beat out finalist sites in Indiana and Mexico.

________________________

eBay

Draper, Utah

$110 million, 2,200 jobs

lready in Utah for over a decade, one of the original e-commerce giants reupped in a big way. “We express our appreciation to the State of Utah, Draper City, the Governor’s Office of Economic Development [GOED] and the Economic Development Corporation of Utah for the outstanding support they’ve provided that makes this project possible,” said Steve Boehm, senior vice president, Marketplaces, Global Customer Services, for eBay, when the deal was announced. GOED last helped eBay expand in 2009, when it added more than 400 jobs.

The GOED board approved for eBay a one-time, post-performance refundable tax credit of more than $38 million over 20 years. In addition to the new jobs and accounting for the construction of the new facility, the incentive combines and expands two previous job-based incentives (in May and October 2009) into a single comprehensive incentive. “This combined incentive is based on eBay expanding its work force by over 2,480 Utah employees at an average salary that will exceed 125 percent of the Salt Lake County average wage,” said GOED. If eBay meets these hiring goals it will result in more than $127 million in new state tax revenue over the 20-year project timeline.

________________________

GE Transportation

Forth Worth, Texas

$100 million, 750 jobs

o those who were intimately involved, Project Thomas was fast moving, intense, very complex and even fragile,” wrote Site Selection contributor Dean Barber in May 2011. But it came together instead of breaking apart, with 10-year city and county tax abatements, a work-force training and hiring package and approximately $8 million in roadway improvements paving the way for Fort Worth to win this locomotive manufacturing project over finalist sites in Erie, Pa.; Boston, Mass.; and Florida.

“The site and its infrastructure presented a series of unique challenges,” says the Fort Worth Chamber of Commerce, the lead contact on the project, “including but not limited to: rail right-of-way issues; traffic lights during the construction process; construction of an access road adjacent to Interstate 35W; accelerated permitting requirements and labor-related issues. The Fort Worth Chamber coordinated with the appropriate entities necessary to address each of the issues, scheduled weekly meetings in our office and communicated directly to GE.”

The project represents GE Transportation’s first foray outside Erie in 100 years. It also represents approximately $45 million in payroll.

________________________

Honda

Celaya, Guanajuato, Mexico

$800 million, 3,200 jobs

fter the March earthquake in Japan, Honda in late May pledged to recover North American production to 100 percent of its plan by August. Once it reached August, it improved on that plan, announcing it would build subcompact cars for the North American marketplace at a new Mexican facility. Expected to produce 200,000 units at full capacity, the 61-million-sq.-ft. (5.66-million-sq.-m.) plant will be located about 210 miles (338 km.) east of Honda de Mexico’s two existing plants in El Salto, Jalisco, which build automobiles, motorcycles, auto parts and ATVs.

The plant will begin operation in 2014 with production of the Honda Fit subcompact. Officials laid the foundation stone for the new facility in late March 2012. “Considering the needs of the Mexican market, which is expecting continued growth in the future, and also serving as a global production base for the North American region and beyond, we decided to make the Fit the first product to be produced here,” said Takanobu Ito, president & CEO of Honda Motor Co., Ltd. “Also, we will create a highly efficient production system that allows us to provide high quality products at an affordable price both by expanding the use of local parts and by utilizing global parts sourcing.”

________________________

Intel

Chandler, Ariz.

$5 billion, 1,000 jobs

t’s another multibillion-dollar, mega-job-creating project from Intel, at one of its favorite spots for expansion. But nothing is taken for granted when it comes to such momentous investment decisions by this giant, whose site search scope is nearly always the globe itself.

The Greater Phoenix Economic Council worked closely with its stakeholders and partner organizations to encourage Intel’s construction of the Fab 42 campus, analyzing and modeling the corporate sales factor for manufacturing investments, which helped secure legislative change (the Arizona Competitiveness Package) that allowed Intel to utilize a 100-percent elective sales factor — a key consideration in Intel’s decision. A pending bill supports infrastructure work that would support Fab 42’s water and wastewater expansion needs.

Work-force training partners include the re-authorized Arizona Job Training Program, community colleges and Arizona State University’s Ira A. Fulton Schools of Engineering, all of which ensure that students can receive the proper education to be considered for careers with Intel. Arizona’s Foreign-Trade Zone (FTZ) property tax rate reduction also played a role in Intel’s decision. The property tax relief provision allows domestic manufacturers classified as foreign-trade zone projects, like Intel, an 80 percent reduction in real and personal property tax liability and in perpetuity. Without this provision, Intel would have to pay a 20 percent property tax — something one observer called “a near-impossible feat for the capital-intensive, 640-acre [259-hectare] campus.”

________________________

The Jackson Laboratory

Farmington, Ct.

$1.1 billion

s documented in our pages in early 2011, then again in November, this search by Maine-based Jackson Lab for a major research campus devoted to the emerging fields of personalized medicine and system genomics first was headed to Florida. But support for the project was tepid. Mike Hyde, the company’s vice president for advancement, told us Jackson had inquiries from about 10 local and state entities after it finally withdrew its Florida plans.

One of them was from a team led by Catherine Smith, commissioner of Connecticut’s Department of Economic and Community Development, which cold-called Jackson. “We had really not intended to explore another opportunity immediately, but the people from Connecticut were extremely well organized, persuasive and thoughtful and set themselves apart,” said Hyde. Helping make the state’s case was the $864-million Bioscience Connecticut initiative, approved in July 2011, which will expand research capacity and incubator facilities at the University of Connecticut Health Center.

A key meeting between Jackson scientists and scientists from the University of Connecticut and Yale University helped cement things quickly. The Jackson Laboratory for Genomic Medicine will be housed in a 173,500-sq.-ft. (16,118-sq.-m.) building to be erected near the Health Center campus. The deal, approved by state bond commission officials in late January 2012, calls for the state to provide $291 million in support over 10 years for construction, equipment and operations. Jackson can avoid paying back a $192-million loan portion of the package provided it hires 300 people in the first 10 years, 30 percent of whom must be senior scientists. The total 20-year capital and research budget for the institute is projected to be $1.1 billion, with Jackson providing $809 million through federal research grants, philanthropy and service income.

________________________

Navistar

Muscle Shoals, Ala.

$87 million, 1,800 jobs

ometimes a Top Deal goes sour, making way for something even better. That appears to be the case in The Shoals, where Navistar, which may eventually hire 2,200 people, is filling the breach left by the departure of the Canadian company behind the National Alabama railcar plant, which had promised 1,800 jobs. Navistar too plans to make railcars, as well as work trucks, at the complex in the Barton Riverfront Industrial Park near Cherokee. Navistar will initially lease it for 10 years from Retirement Systems of Alabama, which had already committed $600 million to build the original plant, in which it took over complete equity in August 2011.

A key to the success of the deal was RSA’s relationship with Navistar, stemming from RSA’s support for the company’s successful engine plant in Huntsville, Ala. Navistar’s interest in The Shoals was piqued by a call from RSA CEO David Bronner. By September the deal was done. Navistar gets to step into the incentive agreement drawn up for National Alabama, and it plans to keep all 120 employees that had worked at National Alabama. The company took over the facility on Jan. 1, 2012. As of March employment was up to 185.

“Navistar stands to receive $7.67 million from the incentive package when its work force at the plant reaches 900,” reported north Alabama paper The Florence Times Daily. “From there, funds are added based on hiring benchmarks. The most Navistar could receive is $23 million if its employment total reaches 1,800 workers by Dec. 31, 2015.” The incentive money comes from a half-cent sales tax increase that was passed in 2007.

“Navistar has made a public commitment that it’s going to grow from a $14 billion company to a $20 billion company, and this facility is going to be a key piece of that growth,” Paul Martin, vice president of business development for Navistar, told the Times Daily.

________________________

Pratt & Whitney Canada

multiple locations

$1 billion

riginally announced in late 2010, this major investment is expected to create and maintain an average of more than 700 highly skilled jobs during the project work phase and more than 2,000 jobs during the 15-year benefits phase. The project’s R&D work, which will take place in Longueuil, Que., and Mississauga, Ont., will lead to lighter aircraft engines with more power, better fuel consumption and improved durability. For its part, the Government of Canada is making a $300-million repayable investment through its Strategic Aerospace and Defence Initiative (SADI).

“This major investment will enable us to sustain our engineering centers of excellence in Ontario and Quebec and reinforce our position as a leader in the global aerospace industry,” said John Saabas, president, Pratt & Whitney Canada. “We are currently recruiting more than 200 engineers to support our development programs, which will bring our engineering work force to more than 1,500 in Canada.”

This latest R&D investment will allow for continued collaboration with leading universities across Canada. “Every year, we invest $12 million in research projects with more than 20 Canadian universities to develop new technologies and encourage the next generation of aerospace engineers,” said Benoît Brossoit, senior vice president, Global Operations. With approximately $400 million in annual R&D investment, P&WC ranks No. 1 in Canadian R&D spending for the aerospace sector.

P&WC has major facilities in Alberta, Manitoba, Ontario, Quebec and Nova Scotia employing more than 6,200 people. In April 2011, Pratt & Whitney Canada received an additional $13.9-million grant from the Province of Ontario Queen’s Park that will help the aircraft engine manufacturer pay for $140 million in new projects and investments in the province by 2014. The company’s plans are estimated to create about 80 new jobs and support 49 existing positions.

________________________

Sasol

Westlake, La.

$10 billion, 850 jobs

n September the South African energy and chemicals group Sasol said it had chosen the Lake Charles area in southwestern Louisiana as the site for a planned gas-to-liquids (GTL) facility. The project is slated to be the first plant in the U.S. to produce GTL transportation fuels and other products. The project is the second “first of a kind” announced by Sasol in the U.S. in less than a year: In December 2010, Sasol announced the world’s first ethylene tetramerization unit, also to be built in Calcasieu Parish, with an investment of $175 million.

Salaries at the GTL plant will average $89,000. And the plant would consume approximately 305 billion standard cubic feet of natural gas, which would represent roughly $1.3 billion to $1.5 billion per year in natural gas purchases in Louisiana from gas produced by plays in the Haynesville Shale and elsewhere. Once the Sasol GTL complex is fully operational, it would lead to additional economic activity in the state of almost $919 million a year.

Sasol started working with Louisiana Economic Development’s Business Expansion and Retention Group in mid-2010, using GIS mapping technology to recommend locations that would optimize a variety of customized site-selection criteria. “They probably helped us save a year off our schedule,” Sasol spokesman Michael Hayes told Site Selection of the help from LED, the Southwest Louisiana Economic Development Alliance and the Port of Lake Charles. “Louisiana is a state that is very business friendly with a leadership that wants this economy to grow. Having a governor like Bobby Jindal and an LED secretary like Stephen Moret are huge advantages for this state.”

A complete customized incentive package will be announced in 2013. The company elected to forego a similar major investment in China shortly before accelerating its site selection and final feasibility at the Westlake site, where the affordability and predictability of natural gas prices, the highly developed pipeline infrastructure and the reliable regulatory environment made investment a more prudent option than China; Sasol also is pursuing joint-venture GTL projects in Uzbekistan and Canada.

INTERNATIONAL TOP DEALS

________________________

Amazon.com

Hyderabad, Andhra Pradesh, India

$90 million, 3,300 jobs

nnounced by the Andhra Pradesh government in November, this project aims to add as many as 5,000 jobs to a development center that already has grown to approximately 4,000 employees since the online retailer arrived in 2005.

According to published reports, Amazon had leased 150,000 sq. ft. (13,935-sq. m.) in late 2011 and was still looking for another 500,000 sq. ft. (46,450 sq. m.). Andhra Pradesh Minister for Information Technology Ponnala Lakshmaiah said working out legal issues surrounding the land for the acquisition was key to negotiations with Amazon.com Vice President of Global Real Estate and Facilities John Schoettler over moving to owned instead of leased premises. Those issues were still being ironed out in February as Schoettler met with other state officials about the 10-acre (4-hectare) parcel.

An unnamed source told some publications that the company could be aiming for as many as 5,000 new jobs and 1 million sq. ft. (92,900 sq. m.) of space.

________________________

Audi

Gyor, Hungary

$1.3 billion, 2,100 jobs

y 2013 Audi’s Hungarian factory, located in northwest Hungary, will be able to produce up to 125,000 cars per year. Audi is the largest foreign employer and investor in Hungary and has invested nearly $5.5 billion in the country since 1993.

The Budapest Business Journal reports that Audi officials are pleased with the expansion’s progress since laying the cornerstone for the new facility in July 2011. According to the paper, Hungarian Prime Minister Viktor Orbán talked of plans to further improve the country’s business environment, and specifically pledged to work closely with Audi officials on vocational and adult education and training.

Over 15,000 people throughout the region will benefit directly or indirectly from the operations of Audi Hungaria once the plant has been expanded. The Audi expansion, combined with Daimler’s continuing growth at its Kecskemet facility, have prompted a number of supplier locations and expansions in Hungary.

________________________

Caracol Industrial Park

Caracol, Haiti

$224 million, 20,000 jobs

n late November the Government of Haiti, together with the U.S. government, the Inter-American Development Bank (IDB), and Korean apparel manufacturer Sae-A Co. Ltd., officially laid the foundation stone for the 608-acre (246-hectare) Caracol Industrial Park. Haitian President Michel Martelly, along with former U.S. President Bill Clinton, presided at the ceremony for the park. “The Caracol Industrial Park shows the positive impact foreign investment can have in building Haiti back better,” said Clinton.

As reported in Site Selection in early 2011, Sae-A Co. Ltd. is investing $78 million to develop operations in the park and has committed to hiring at least 20,000 Haitians to work there. It is the largest single investment in modern Haitian history. The IDB is providing $55 million for the initial phase of Caracol’s construction. It is also financing programs to foster the creation of local small and medium-sized enterprises to supply goods and services to the industrial park’s tenants and workers. “Caracol can have a phenomenal multiplying effect in this region,” said IDB President Luis Alberto Moreno. The U.S. government has committed more than $124 million in funding to build at least 25 megawatts of electrical power generation, improve regional health facilities, construct up to 5,000 housing units near the towns of Ouanaminthe, Fort Liberte, Terriere Rouge, Trou Du Nord, Caracol, and Quartier Morin in Northern Haiti in partnership with the IDB and Food for the Poor, and modernize regional port facilities.

The CEO of Sae-A has alluded to a goal of helping Haiti double its apparel export volume in eight years. Operations at the park were expected to begin this spring.

________________________

China Motor Corp.

Harrismith, South Africa

$1 billion, 2,500 jobs

nown for their resource plays in Africa, Chinese companies are warming to manufacturing there as well, as they seek to put their domestically successful special economic zone model to work in what may be the world’s next emerging market.

Some details about this project continue to be hazy. But this much is known: Harrismith, the “Jewel of the Free State,” is located on the busy N3 highway and almost equidistant from Durban (with its crucial port) and Johannesburg. It is also close to the borders of several provinces and is located near the middle of the country, setting up an attractive logistics scenario, according to Imran Moola, director of CMC Auto.

The new plant, located in Harrismith’s industrial development zone, will make minibus taxi and pickup vehicles. It will eventually build 50,000 vehicles a year to qualify for state Automotive Production and Development Program incentives. The plant may also be able to take advantage of the proposed 26-country African free trade area.

________________________

Ford Motor Co.

Sanand, Gujarat, India

$1 billion, 5,000 jobs

ord India in March 2012 laid the foundation stone for its new integrated manufacturing facility at a 460-acre (186-hectare) site in Sanand. When complete in 2014, the facility will have the capacity to produce an additional 240,000 new Ford vehicles and 270,000 engines per year for Indian customers and for export markets.

“Today we lay the foundation for Ford’s continued expansion in India, and plant the seed for a brighter future for our employees, suppliers, dealers and customers, and for the people of Gujarat and India,” said Michael Boneham, president and managing director, Ford India. Ford has announced that it will bring eight new vehicles to India by mid-decade.

Evidence of the spinoff already has occurred, as the company, in order to provide for maximum local sourcing for parts, has attracted 19 high-level supplier operations to date that will manufacture components close to the Sanand facility. Moreover, in addition to operating a plant in Chennai, Ford leaders have hinted at the possibility of a vehicle export facility at the port in Gujarat.

________________________

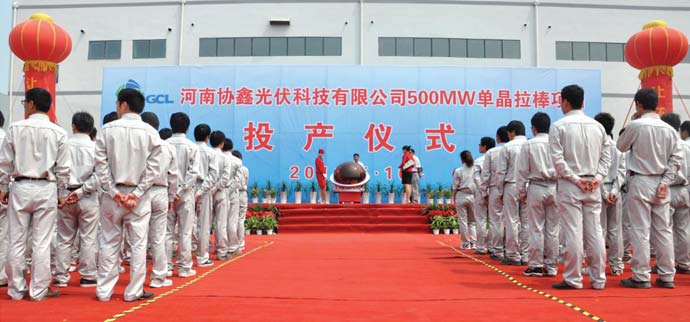

GCL-Poly

Jiangsu Province, China

$2.2 billion

ong Kong-based polysilicon and wafer producer GCL-Poly Energy Holdings Ltd. announced in February its approval of polysilicon and wafer facility investments at its existing plants in Xuzhou, Wuxi, Suzhou and Changzhou in 2011 and 2012. After only beginning to produce wafers in-house in December 2009, the company swiftly moved through a series of acquisitions, technical improvements and investments to become the world’s largest wafer producer. Among its major deals was the acquisition of wafer producer Konca Solar in China.

Driving the new wave of investment is a series of long-term polysilicon products and wafer supply contracts with such firms as India’s Indosolar Ltd., Canadian Solar and China Sunergy. To date, GCL-Poly’s aggregate long-term wafer supply contracts for the period of 2011 to 2016 have exceeded 50 GW. Company Chairman Zhu Gong Shan said a co-location strategy at customer sites has been important to the GCL-Poly’s success. So has a co-gen power plant strategy. The sky’s the limit:

“Apart from our current wafer production bases in Xuzhou, Wuxi, Changzhou and Suzhou, we will build new wafer facilities in Yangzhou, Taicang, Quanzhou and Henan such that our global competitiveness in the silicon materials business will be strengthened,” the chairman said last March. “We expect that by the end of 2011, our wafer production capacity will be ramped up to 6.5 GW and wafer output will reach 5.5 GW for the year 2011.”

________________________

General Electric

Dammam, Saudi Arabia

$250 million, 2,000 jobs

ast June GE launched this Energy Manufacturing Technology Center (Gemtech), with Prince Mohammad Bin Fahd, governor of the Eastern province, welcoming the project at Dammam’s second industrial city. Half of the jobs are destined to be filled by Saudi citizens.

At the ceremony, GE announced it would invest an additional $160 million in a manufacturing plant to make specialized equipment for the energy sector.

GE Vice-Chairman John Krenicki said that the center — comprising manufacturing, service and repair, and training facilities — will provide solutions to GE customers throughout the Middle East, in addition to other countries in Asia, Africa and Europe. Since making its first turbines for the nation’s oil industry 80 years ago, GE now is tightly connected to Saudi Arabia’s electricity and water infrastructure. The company is positioning itself to remain so as the country aims for ambitious development goals by 2020, by which time it hopes to generate 10 percent of its power needs with solar energy, as well as be operating its first nuclear power plant.

________________________

IBM

Cyberjaya, Malaysia

$318 million, 3,000 jobs

BM announced in November this investment over the next six years to build a new IT Global Delivery Center, which will be a Center of Excellence for software distribution and packaging. To help develop the necessary local skills, IBM is basing an international leadership team in Cyberjaya to ensure ongoing sharing and development of knowledge and expertise. Since first partnering with the Malaysian government 50 years ago, IBM has established 21 shared services centers in Malaysia.

“This center is an outstanding example of a project that brings together economic development and highly skilled jobs in a way that can help transform our economy in the 21st century,” said Prime Minister Dato’ Sri Mohd. Najib Abdul Razak. “IBM has been a supportive partner to Malaysia’s efforts to build a competitive and modern shared services hub.”

The center will offer clients from various industries across the globe server systems operations, security services, project management and end-user services, including maintenance and monitoring of computer hardware and software systems.

“This center is critical to IBM’s ability to provide clients support at any level — regional and global — offering flexibility, scalability and security our clients expect,” said Patt Cronin, general manager, Global Technology Delivery and Delivery Excellence, IBM Corp. “We selected Malaysia for our newest facility based on the strong public-private partnership with the country and Cyberjaya, its competitive business model, and the talent and skills that the Malaysian people have to offer.”

Multimedia Super Corridor Malaysia is the national initiative formed by the Malaysian Government and managed by Multimedia Development Corporation (MDeC). Since 2003, IBM’s collaboration with MDeC has helped set world-class standards for the global delivery business model. MDeC will work closely with IBM to identify and place qualified candidates under MSC Malaysia K-Workers Development Initiatives (KDI) in the new center.

________________________

Infosys Technologies

Shanghai, China

$130 million, 4,000 jobs

pread across 15 acres (6 hectares) and with a capacity for as many as 8,000 employees, this campus at Zizhu Science and Technology Park will have everything from data centers and software labs to an auditorium, training facilities and gymnasium. It will be the Indian company’s largest overseas software development center.

The 4,000 employees were scheduled to be added in a mere 18 months from May 2011. Infosys Technologies (China) CEO Rangarajan Vellamore said when the campus is completed in three years the company will employ 10,000 people in Shanghai alone. In addition to a sales office in Hong Kong, other investments have occurred at Shanghai Pudong Zhangjiang HiTech Park, Hangzhou Binjiang HiTech Park, Beijing China Oversea Plaza and Jiaxing Science city.

Speaking at the foundation stone ceremony last May, Infosys Chief Mentor and Chairman of the Board N. R. Narayana Murthy said, “I would like to thank the Shanghai Municipal Government and the Chinese Government for their support in starting this project. As the second largest economy in the world, China will lead the world in economic growth in the future and we see exciting times ahead.”

________________________

Nissan

Resende, Brazil

$1.5 billion, 2,000 jobs

issan is among the leading cheerleaders for increased investment in the Americas, and followed up this October 2011 announcement with a January 2012 announcement of a $2-billion, 3,000-job new plant in Aguascalientes, Mexico (an early Top Deal candidate for next year).

The new Brazilian factory site was chosen over a more costly site option at Acu Port. Resende was chosen “for its proximity to the high-quality ports of Itaguai and Rio de Janeiro, a short time to start of production and good access to skilled labor and suppliers,” said the official company release.

Scheduled to begin production in the first half of 2014, the new plant will have the capacity to produce up to 200,000 units annually of Nissan’s ’V’ platform products for sale in Brazil. The factory is projected to create at least 4,000 indirect jobs within the supply chain and wider community. Nissan aims to attain at least five percent market share in Brazil by 2016. The company is investing in a separate $283-million expansion at its Renault-Nissan Alliance plant in Curitiba, and is planning to increase the number of Nissan retail outlets in the country from 117 to 239 by 2016 — the year the Olympic Games arrive.

“Brazil has clearly emerged as the engine of Latin American growth, and we look forward to contributing to Brazil’s economic landscape and its automotive manufacturing base in the 21st century,” said Carlos Ghosn, Nissan chairman and CEO.