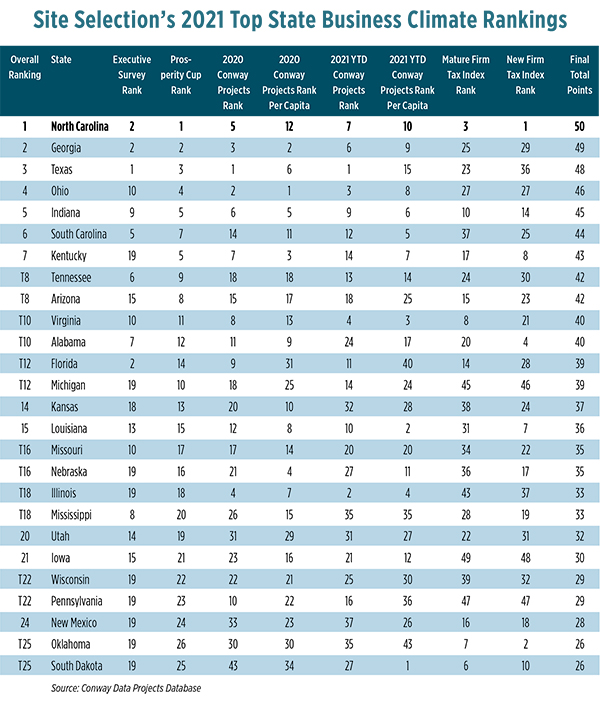

After tying with Georgia for a first-place finish in last year’s Site Selection Business Climate Rankings, North Carolina stands alone in the top spot this year. Georgia’s eight-year run as the top state for business comes to an end, but a second-place finish means it beat 48 other states in the ranking. Could this signal the Tar Heel State’s return to business climate dominance? It had its own several-year, first-place run in recent years.

Texas, Ohio and Indiana round out the top five states, but the order shifts somewhat on the list of site selectors’ picks for the best business climates, which is a key piece of the index used to arrive at the overall top states. That list shows Texas in first place followed by Florida, Georgia and North Carolina in a three-way tie for second place. South Carolina places fifth. Most index components are purely objective and based on project data housed in the Conway Projects Database. See the full Business Climate Rankings methodology on page 97.

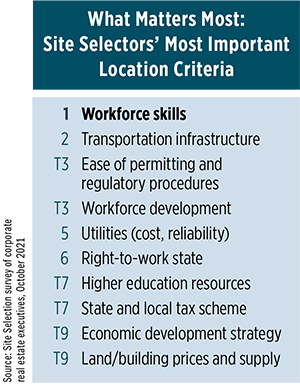

Some observations concerning the most important location criteria to site selector survey respondents: Quality of Life didn’t make this year’s Top 10, nor did Incentives. Newcomers to the 2021 list relative to last year’s are Higher Education Resources at 8th place and Land/Building Prices and Supply and Economic Development Strategy, tied for 9th.

Transportation Infrastructure moved from third to second place, which may reflect some jitters associated with this year’s supply chain disruptions.

Site Selection asked survey respondents to list some factors that were behind their lists of the best states for business. Here’s a sampling of their comments:

- “Proximity to ports, ease of working with the municipality and taxes.”

- “The main one is overall operating expense, which is affected by tax and regulatory policies and utility costs. Increasingly, the cost of living for employees ranks higher than I’ve seen before.”

- “Transparency/candor of state and local officials, lack of which is a deadly sin; quality of education, especially K-12 and technical education; a pro-business attitude and the leadership quality of state and local officials.

- “Access to the supply chain.”

- “A combination of incentives and workforce training programs.”

- “Low taxes, low regulations and workforce.”

- “A stable tax/fiscal environment and government efficiency in the execution of role to enable and support private-sector investment.”

In July, the North Carolina Department of Commerce introduced a Strategic Economic Development Plan — a component of the state’s First in Talent workforce development strategy. It wouldn’t have contributed to this year’s Top Business Climate ranking, but it will likely help in the years to come. The Plan identifies three goals, each with several strategies for attaining them. The goals are (1) to prepare North Carolina’s workforce for career and entrepreneurial success; (2) to prepare North Carolina’s businesses for success by growing and attracting a talented workforce; and (3) to prepare communities across North Carolina to be more competitive in growing and attracting a talented workforce and businesses.

A passage from the executive summary explains the significance of the Plan: “Every business survey conducted — nationally and in-state — identifies acquiring and growing the right talent as a crucial factor. The ability to find high-quality employees is essential to a business’s success. It is also what enables individuals and communities to advance their economic situation — making it the single most important issue to ensure North Carolina’s competitiveness. For this reason, this economic development strategic plan is focused on the universally recognized importance that talent has for business growth, career success, and community preparedness. A location’s talent pool remains its key competitive advantage; or when neglected, a glaring disadvantage. This truth applies to rural communities and in blue collar sectors as equally as it does to our largest metros and high-tech industries. In fact, talent is the key to returning our most challenged communities and traditional industries to prominence.”

‘Our Greatest Asset — Talent’

In October, Site Selection reached out to North Carolina Secretary of Commerce Machelle Sanders for her take on First in Talent.

“Unlike traditional economic development plans, this is focused on our greatest asset, which is talent,” she explains. “Others might focus on recruitment strategies and incentives and other things that are important to us, but this one is focused on preparing our communities, our businesses and our people for sustainable success, which will come through talent development.”

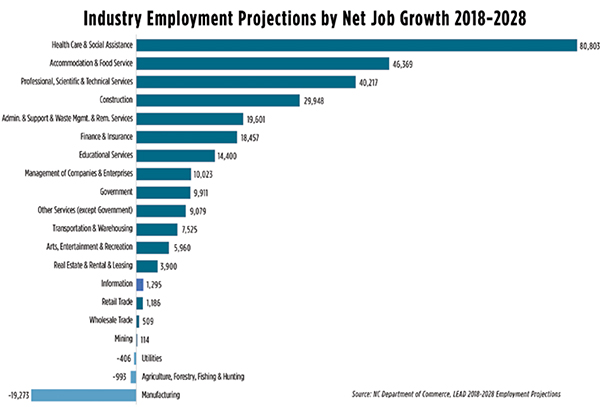

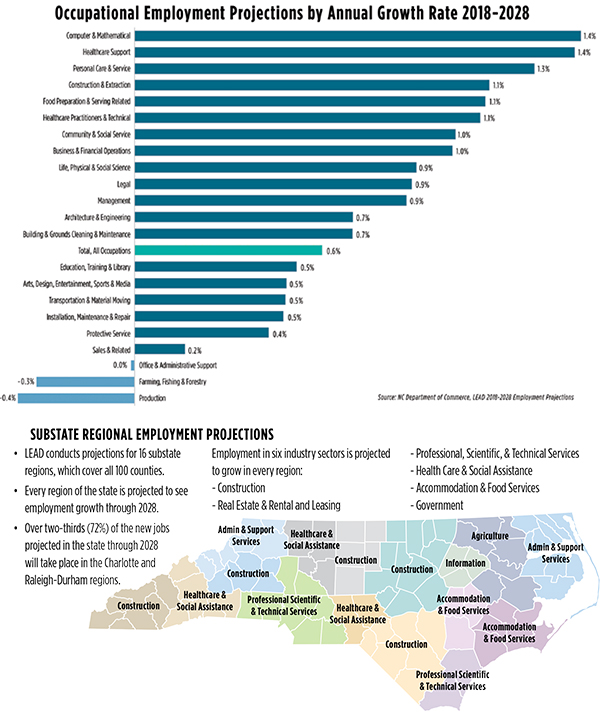

North Carolina Employment Projections (2018-2028)

Every two years, the North Carolina Department of Commerce’s Labor & Economic Analysis Division (LEAD) publishes 10-year employment projections at the state and regional levels, in conjunction with the U.S. Department of Labor’s Employment and Training Administration. The employment projections are an estimate of the future demand for workers based on historical employment data and various economic factors. Policy makers, job seekers, education training providers, and businesses use projections data to make informed workforce decisions and help ensure that North Carolina’s workforce is prepared for tomorrow’s job opportunities and economic growth in the state. The following summary provides highlight of both state and sub-state projected employment growth during the 2018 – 2028 period.

Industry Employment Projections

- North Carolina is projected to add more than 302,000 new jobs between 2018 and 2028, reflecting an annual growth rate of 0.6 percent.

- Nearly 89% of all net new jobs will be added in service-providing sectors.

- Health Care & Social Assistance is projected to add the most new jobs (81,000) and have the second highest growth rate of 13.7% over the 2018-2028 period.

- The Professional, Scientific, & Technical Services industry is projected to be the fastest growing industry with 15.8% growth.

- Most industries are projected to grow, but three sectors are projected to decline in employment over the projections period: Manufacturing (-19,300 or -4.1%), Utilities (-400 or -2.7%), and Agriculture (-1,000 or -2.0%).

- Most projected job openings are expected to come from the need to replace people leaving their occupations rather than growth from new job creation.

- Occupations that require a Master’s, Doctoral or professional degree are projected to have the fastest annual growth — slightly higher than those requiring a bachelor’s degree.

- The share of North Carolina occupations requiring no more than a high school diploma is projected to decline through 2028, despite still accounting for the majority of jobs and openings.

- Three occupation groups are projected to grow the fastest: Computer & Mathematical, Healthcare Support and Personal Care & Service.

The state is looking for greater collaboration with its stakeholders and partners across the state, says Sanders. One strategy is to increase the employment rate of those most disproportionately affected by the pandemic, particularly minorities and women.

“We’re partnering with our community college system, the Department of Public Instruction and others to increase the availability of education and job training for in-demand, high-potential fields,” adds Sanders. “There also are expanded opportunities for doing this in a very targeted way, such as work-based learning, an area in which we’re working to become a leader. The plan also elevates the importance of targeting untapped talent that has been excluded at times from our economy, such as those previously incarcerated, disconnected youth — we’re focusing in a more intentional way on making that a new work string for us.

“A key part of what we’re doing in Commerce since my appointment is advocating for policy,” adds Sanders. “We’re advocating for increased funding for childcare for working families, for increasing the labor force participation in keys areas. We believe we can have a great impact — we’re fierce advocates for the economy and the foundational points that are needed in a thriving economy. It’s not just about creating jobs but it’s about infrastructure like health care and education advancement. We are strong advocates for policies that will ensure that companies will continue to select North Carolina as a place they can grow. Companies and their employees make choices about where they want to be.”

What Pandemic?

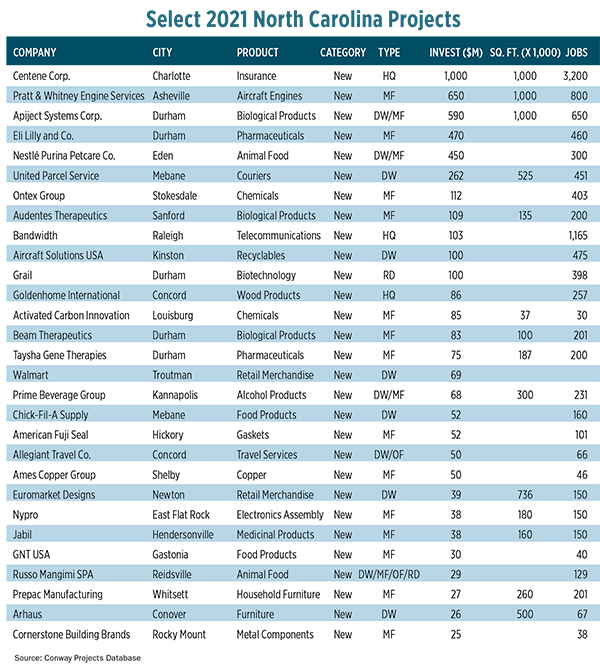

Apparently, lots of them want to be in North Carolina, if the state’s rate of new projects and expansions this year and last is any indication. If capital investment contracted during the pandemic, it wasn’t very noticeable there.

“Some of that speaks to the fundamental advantages North Carolina had prior to the pandemic, which haven’t changed during the pandemic,” says Chris Chung, CEO of the North Carolina Partnership of North Carolina. “Some of the areas that were booming before the pandemic, like some of the largest cities, perhaps took a step back. But North Carolina isn’t overwhelmingly dense or urban nor overwhelmingly rural. It’s that sweet spot you can imagine both companies and individuals would be seeking out.

“Nowadays,” he adds, “if you look where the mobile or remote workforce is focused coming out of the pandemic you can see why a state like North Carolina would be very attractive in terms of affordability and quality of life, health care and education access. If you look at what people are looking for in normal times, we appeal to that. Perhaps some people now are done with life in New York City or Chicago and D.C. in terms of congestion and high cost. If they don’t have to be living in those places and are empowered to work remotely, this is very attractive option. North Carolina has the mix of qualities that would appeal to an individual who is seeking greener pastures post-pandemic.”

One of North Carolina’s competitive advantages for several years has been its 2.5% corporate tax rate — the lowest of the 44 states that levy such a tax.

“When I got here in 2015, the state was already a couple of years into the process of reforming taxes and reducing a lot of credits and incentives in favor of a broader tax base but a lower rate,” says Chung. “The net result of that is a tax climate where, whether it’s an expansion or a new firm locating here, we do very well in just about every imaginable scenario. There are some capital investment-intensive situations where things like our franchise tax do result in, comparatively speaking, a higher tax burden than what other states may have. But we’re no worse than top 20 in those situations and in the rest, we’re top 10 if not top five. If we show up very well, it’s not like we’d hear about it from companies. We’d hear about it if it were a problem.”