Does tech investment follow tech talent or the other way around? It’s actually some of both.

The question going forward, says Colin Yasukochi, executive director of the Tech Insights Center at CBRE, is the extent to which the COVID-19 pandemic could upset longstanding equations and trends as 2021 unfolds into the post-COVID era.

“The pandemic,” says Yasukochi, “could slow the growth of tech talent in some of the major markets if remote work takes hold, if people really do leave town and hiring starts to take place outside of those markets. It’s going to be very, very interesting.”

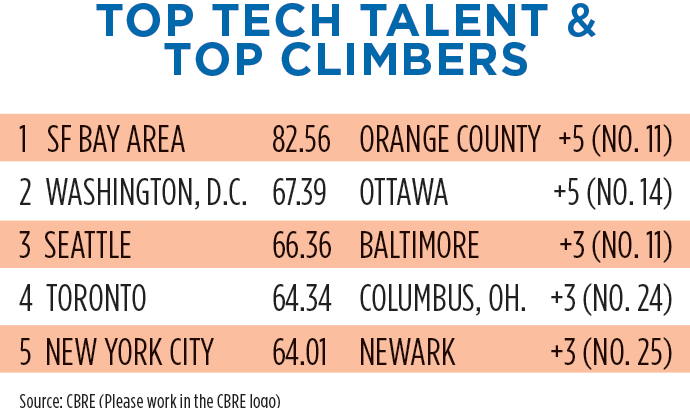

CBRE’s 2020 Scoring Tech Talent report, based largely on pre-pandemic data, might thus be viewed as a marker, a dividing line, in years ahead. While it affirms the pre-eminence of traditional tech talent hotspots such as the San Francisco Bay Area, it also identifies fresh locations whose talent pools are growing and poised to grow further. The annual ranking of markets in the U.S. and Canada is based on 13 criteria grouped under headings that include Tech Talent Supply, Innovation Infrastructure, Tech Industry Outlook and Real Estate Market Outlook.

Markets to Watch

The pandemic’s combined effects, including the emergence of remote work, could serve to strengthen the hands of tech workers relative to employers in expensive, established markets.

“I think the true test is probably going to come in the late summer and into fall, when many tech companies expect their workforces to return to the office,” says Yasukochi. “There are a lot of variables that are still to be determined. But tech workers are increasingly wondering about the costs of living and working, say, in the Bay Area.”

Yasukochi believes that markets poised to flourish include lower-cost metros in the shadows of universities that are churning out tech graduates. Orange County, California, home to the University of California at Irvine, was one of the survey’s top gainers, having climbed five ranking spots to No. 21. Baltimore (No. 11) and Columbus, Ohio, (No. 24), both of which rose three ranking spots, enjoy the presence of major universities and research labs, as do Madison, Wisconsin (No. 27) and Pittsburgh (No. 30).

With the growing interest in second-tier markets, CBRE expanded its annual ranking from 50 markets to include a “Next 25” of up-and-coming locations, ranked separately by a slightly narrower set of criteria. Yasukochi points to a handful that bear watching.

“Colorado Springs (No. 4) is close to Denver and enjoys the presence of the Air Force Academy. Huntsville, Alabama (No. 2), has aerospace. Tucson (No. 14) is becoming kind of a hotbed for tech companies with its universities. Tulsa (No. 15) stands out with everything going on there in the energy sectors.”

Don’t Forget Canada

Another trend Yasukochi discerns is the emergence of Canada, anchored by powerhouse Toronto, which finished No. 4 among the Top 50, and Vancouver (No. 12). Ottawa rose five spots to No. 14, and Waterloo ranked No. 1 among the “Next 25.” The cost of Canadian labor remains lower, Yasukochi says, even as the quality of talent has risen.

“It’s something that hasn’t necessarily been taken advantage of by a lot of the tech industry, and yet Toronto and Vancouver have consistently moved up a couple of spots every year. In Canada, you see a lot of specialized skills.”

Relative to the U.S., he notes, Canada is taking full advantage of the abundant supply of global tech talent. As the United States, under the Trump administration, imposed far-reaching immigration restrictions, Canada made a concerted effort to attract tech workers to its shores. There are over 100 different options for tech workers who want to obtain permanent residence or a work permit in Canada.