From Site Selection magazine, May 1999

Championship Caliber:

Site Selection‘s 1998 Top 10 Development Groups

b y T I M V E N A B L E

Hundreds of growing companies played the location game with skill and poise last year, capitalizing on the championship-level services of Site Selection‘s 1998 top development groups. Those organizations chipped in for eagle and hit winners down the line time after time last year, attracting an average of US$586 million in corporate capital investments and 8,800 new jobs.

In golf, it’s competitors like David Duval and Tiger Woods. In tennis, it’s Pete Sampras and Martina Hingis. In golf, it’s competitors like David Duval and Tiger Woods. In tennis, it’s Pete Sampras and Martina Hingis.

What do they have in common? They’re winners, even champions in their respective fields. They’re recognized as the best.

The economic development field has its champions too. SS has named its slate of top-performing economic development organizations for the past 15 years, and we’ve picked a new group of winners for 1998 (see chart). From Quebec to Florida and Pennsylvania to Colorado, those organizations produced championship-level results – and played a key role in the location decisions of companies like Chase Manhattan, MCI WorldCom, Level 3 Communications and GE Capital Information Technology Solutions.

Eschewing the go-it-alone route, those companies and many others chose to work with the best of today’s professional, experienced and savvy economic development organizations – and for good reason. After all, who wouldn’t want Tiger Woods on their team in the next four-ball tournament? Or Pete Sampras as a doubles partner?

Besides the critical location assistance they provided to their corporate clients, this year’s group of top 10 development organizations also proved valuable assets for their service areas, attracting an average of $586 million in corporate capital investments and 8,800 new jobs in 1998.

To evaluate the many nominations received this year for the top development groups honor, Site Selection considered new corporate capital investment and new jobs, plus per-capita capital investment and per-capita jobs. The per-capita measures were used to provide a balanced perspective on the success of development organizations serving smaller service areas, such as a single city or county.

We also reviewed each nomination for evidence of new, value-adding services and programs to benefit both prospective new firms and existing companies, as well as economic development leadership, problem solving, innovation and cooperation.

Here, then, are this year’s 10 championship-caliber organizations: Site Selection‘s 1998 top development groups.

A Site Selection Online Exclusive

View the Award Ceremony

held in Boston, Massachusetts

on Sunday, April 25, 1999.

|

Broomfield Economic Development Corp.

Broomfield, Colo.

$188 million investment, 2,172 jobs

If communities were stocks, you’d want to invest in this one.

The Broomfield, Colo., area is going in one direction – up. Evidence of the city’s continuing surge is found in the $188 million in corporate capital investments and 2,172 new jobs lured by the Broomfield Economic Development Corp. (BEDC) last year.

Broomfield (pop. 37,000) is halfway between Denver and Boulder, Colo., and BEDC President and CEO Donald Dunshee – a longtime veteran of the economic development trenches – says “location, location and location” are three of the biggest reasons for his organization’s success. The area’s location and attractive quality of life helped land some high-tech heavy hitters recently, including firms like Level 3 Communications and Sun Microsystems.

Telecommunications concern Level 3 is building a campus that will employ between 3,000 and 5,000 people within the next four years (see top deals feature for more details).

“Level 3’s location decision happened really fast,” Dunshee recalls. “A consultant brought the company here for the first time in the second week of October 1997, after beginning a search in late summer and early fall. The company asked its potential work force, ‘Where would you like to live?’ and Denver came out at the top of the list. Quality of life is one of the key factors that drove the decision, something for which Colorado and Denver have been known a long time. Quality of life is a particularly big draw for young, highly educated people, and it’s a strength for us.”

Computer hardware and software leader Sun Microsystems continues its heady expansion in Broomfield (right), part of a major initiative announced a little over two years ago. “Phase 1 has 11 or 12 buildings, and it’s being finished up now,” Dunshee reports. “Plans for Phase 2 are before the city now, and that might mean another 550,000 sq. ft. (51,100 sq. m.) of space.” Computer hardware and software leader Sun Microsystems continues its heady expansion in Broomfield (right), part of a major initiative announced a little over two years ago. “Phase 1 has 11 or 12 buildings, and it’s being finished up now,” Dunshee reports. “Plans for Phase 2 are before the city now, and that might mean another 550,000 sq. ft. (51,100 sq. m.) of space.”

Both Level 3 and Sun chose sites in the Interlocken business park, “certainly the premier business park in Colorado, and one of the top 10 in the country,” Dunshee claims. “It’s a park that’s really out ahead of itself. It has 963 acres (390 hectares), dual-fed power and multiple fiber optics.”

Other major corporate moves include Ball Corp.’s decision to relocate its headquarters to Broomfield from Muncie, Ind. “The company decided to consolidate operations here because they had so many people from Muncie coming to Colorado all the time,” Dunshee reveals. “This will cut back on management travel time.”

In another major ’98 accomplishment, Broomfield (which currently is in four counties) will become its own city and county on Nov. 15, 2001. The BEDC’s two past chairmen led the campaign to pass the issue in the November 1998 statewide election. “This will allow the city and county to deliver services that previously had been fragmented in four counties,” Dunshee says. “Residents and businesses will get better quality service, plus taxes will go down a little.”

Dunshee is quick to praise the community spirit of major newcomers like Level 3 and Sun. “They’ve both become deeply involved in the community – in the schools, in the civic organizations. They’ve jumped in like they’ve lived here all their lives.”

Greater Tampa Chamber Of Commerce, Committee of 100

Tampa, Fla.

$401 million investment, 6,441 jobs

It’s one thing to sing your own praises. Economic development organizations do it, and so do companies.

The most telling testimonials, though, come from your customers – the people who use your products and services. Judging by that standard, the Greater Tampa Chamber of Commerce’s Committee of 100 (TCC) is eminently deserving of its place in Site Selection‘s top development groups for 1998. Consider these high-powered votes of confidence:

“Capital One has grown and continues to grow in Tampa largely because of the overwhelming support from the Greater Tampa Chamber of Commerce Committee of 100,” says Capital One Site Director Celeste Watson. “The Committee of 100 possesses an entrepreneurial spirit that closely matches the spirit of Capital One. This is an organization that gets the job done.”

“We deal with many EDCs across the country, and Robin Ronne and his staff is one of the most responsive, sophisticated and conscientious we have dealt with,” says CLW Realty Group Principal Douglas C. Rothschild. Adds Citibank Vice President Joseph F. McCarthy, “Citibank has the opportunity to work with many domestic and international economic development groups, and the Tampa Committee of 100 ranks at the top of the list.”

You get the picture. The TCC clearly is getting the job done, a conclusion amply supported by the $401 million in corporate investments and 6,441 jobs the organization helped bring to its service area of 919,000 last year. Citicorp — left — (making a $200 million to $300 million investment), Capital One (adding 1,250 jobs), Chase Manhattan (a $52 million project, adding 750 jobs) and PricewaterhouseCoopers (a $95 million investment) are just a few of the many high-profile firms making big location moves on Florida’s west coast. You get the picture. The TCC clearly is getting the job done, a conclusion amply supported by the $401 million in corporate investments and 6,441 jobs the organization helped bring to its service area of 919,000 last year. Citicorp — left — (making a $200 million to $300 million investment), Capital One (adding 1,250 jobs), Chase Manhattan (a $52 million project, adding 750 jobs) and PricewaterhouseCoopers (a $95 million investment) are just a few of the many high-profile firms making big location moves on Florida’s west coast.

“Those big deals have raised the bar for us,” says TCC Director Robin Ronne. “We can no longer be characterized, as we have been by some in the past, as just bringing in lots of low-end, back-office operations. We’ve demonstrated that it’s just the opposite.”

The organization’s secret for success? “We never forget who the client is,” Ronne says. “We admonish the staff about that on an ongoing basis. That’s the reason we’re in business, to answer the phone and provide information, either to a consultant or the end user. We do our very best. We always strive to provide the highest level of responsive service. If you mess up, you don’t get a second chance to make a first impression.”

The TCC’s development chief deflects credit from himself, preferring to give it to his extended team. “We could not hope to do the kind of work we do and close projects without a great deal of help from our local government officials and the private-sector people who invest in our organization,” he says. “Pulling together as a team, we can do it. Alone, we’d fail miserably.”

Invest-Quebec

Montreal

$2.9 billion invesment, 15,735 jobs

Money talks. And it’s speaking pretty loudly these days in the Canadian province of Quebec, where the unique facility-financing capabilities of Invest-Quebec (officially, Investissement-Quebec) helped the agency attract some $2.9 billion in corporate capital investments and 15,735 jobs last year. Invest-Quebec (IQ) serves the entire province, which has a population of 7.5 million.

“We’re more than an investment promotion agency, because we’re also a financial institution,” IQ President and CEO Louis Roquet (right) explains. “Not only do we have a mandate to make Quebec known worldwide as a favorable investment site, we also finance projects. When investors talk to us, they’ll be talking to not only promotion and marketing people, but also people with a strong corporate financial background.” “We’re more than an investment promotion agency, because we’re also a financial institution,” IQ President and CEO Louis Roquet (right) explains. “Not only do we have a mandate to make Quebec known worldwide as a favorable investment site, we also finance projects. When investors talk to us, they’ll be talking to not only promotion and marketing people, but also people with a strong corporate financial background.”

Still, the reader shouldn’t get the impression that IQ has a huge stash of cash to throw at expanding firms. “Quebec has (only) 7.5 million people, so our financial resources are not huge,” Roquet cautions. “We can’t compete with other areas of the world and offer companies $200 million to set up shop in Quebec. We don’t have the resources to do that. We simply have to be very strategic and targeted in our marketing.”

Among the many companies IQ assisted last year is Harris Corp., which is spending $46 million to expand its Montreal wide-band wireless systems plant. Excel Communications’ new Canadian head office in Montreal will create 500 jobs, and Nortek is expanding its Anjou plant, adding 230 jobs.

Call centers are finding Canada fertile soil, and Quebec is no exception. Call centers have created about 4,000 jobs in the province during the past year, with two firms (Microcell Solutions and Future Electronics) accounting for 2,300 jobs.

Montreal’s Cit? du Multim?dia, or Multimedia City, is an area near the waterfront that targets multimedia firms, and Quebec offers special financial incentives to attract them. “We have a good supply of very qualified people in multimedia,” Roquet says. “I don’t know if it’s the meeting of North American and European cultures that makes them so creative, but they do wonders. Our projections are that we could get 10,000 jobs over the next five years or more. We’ve already seen 3,000 jobs after just six months of this new initiative. And those jobs aren’t being relocated from somewhere else. They’re being created anew.”

High-tech operations have long been a Quebec strength. In fact, according to IQ, 50 percent of all the high-tech, high-risk venture capital in Canada is concentrated in Montreal. But IQ intends to pursue other kinds of projects as well, Roquet says.

“Even though Montreal and Quebec in general are growing like wildfire in the high-tech area, we realize that not everybody is a Ph.D., and not everybody can work in the laboratory or in R&D. So we are also working to attract investors who are interested because of factors like manpower stability and availability of resources. We want a broad variety of jobs.”

Loudoun County Dept. of Economic Development

Leesburg, Va.

$518 million investment, 8,429 jobs

If recent high-profile U.S. facility locations were an earthquake, the epicenter might well be Loudoun County, Va. It’d be tough to find an up-and-coming area with more energy and momentum in the chase for new business.

MCI WorldCom, for instance, has tapped Loudoun for a 1.3 million-sq.-ft. (120,800-sq.-m.) facility employing some 4,000, with an estimated capital investment of $200 million. America Online’s new office brings 2,100 jobs, and Orbital Sciences’ 750,000-sq.-ft. (69,675-sq.-m.) satellite engineering and manufacturing expansion adds 2,500 more jobs. Those three projects led the way in a highly successful year for the Loudoun County Dept. of Economic Development (LCDED), which helped attract $518 million in corporate investments and more than 8,400 jobs last year to its service area of 133,500.

1998’s cornucopia of location success comes on the heels of an oustanding ’97, which included Dutch software leader Baan Co.’s announcement of a $40 million, 2.5 million-sq.-ft. (232,250-sq.-m.) headquarters on a 281-acre (112-hectare) site with Potomac River frontage.

“In Loudoun County, economic development is a team sport,” LCDED Director Larry Rosenstrauch says. “The team is bigger than our economic development department alone. We’ve really written ‘Economic Development’ with capital letters across the government, including everyone from our board chairman all the way down to the fire inspector. It’s as broad as that. “In Loudoun County, economic development is a team sport,” LCDED Director Larry Rosenstrauch says. “The team is bigger than our economic development department alone. We’ve really written ‘Economic Development’ with capital letters across the government, including everyone from our board chairman all the way down to the fire inspector. It’s as broad as that.

“Our customers tell us they’re wowed by the speed, the personal service and high quality of the information we provide. For instance, an MCI WorldCom executive called our chairman, saying he couldn’t believe he was dealing with government at the speed we were moving. We hire people who are impatient to give their customers good service.”

Loudoun County, Rosenstrauch says, is “a very special place. Two-thirds of our county is a beautiful rural area. People here love this community, and that’s a big motivating factor for everyone involved.”

The county is rapidly becoming the next star among the nation’s high-tech leaders. In fact, local development officials say it’s becoming the Internet capital of the United States. Nearly half of all U.S. Internet traffic runs through the Washington, D.C., metro area, and Loudoun County, with major American Online and MCI WorldCom Internet-related investments, is a big part of that picture.

Smart money says 1999 will bring more of the same robust business expansion for Loudoun County. “There’s a huge demand for jobs here,” Rosenstrauch says. “According to the February 1 issue of Newsweek magazine, the Washington metro area is the fifth fastest-growing job market in the country.”

Michigan Jobs Commission

Lansing, Mich.

$3.3 billion investment, 15,074 jobs

Led by Gov. John Engler and the Michigan Jobs Commission (MJC), Michigan’s economic renaissance continued apace in 1998. In fact, the MJC helped attract more than $3 billion in corporate capital investments and some 15,000 jobs to Michigan – its service area of 9.3 million residents.

A sampling of large new ’98 investments includes National Steel Corp.’s $150 million galvanized steel plant in Ecorse, L&W Engineering’s $50 million metal stampings factory in Blissfield and K-Mart Corp.’s $109 million, 425-employee data processing office in Troy. MJC officials say one key in attracting new facilities of that ilk is to create an atmosphere which supports existing companies.

“Our biggest focus is on service after the sale,” explains MJC CEO and Department Director Doug Rothwell. “We really pride ourselves on having a strong business retention program. We go out and meet with the largest 4,000 companies in Michigan every year. That keeps us in touch with our customers’ needs. But we also try to anticipate their needs before there are any problems. When we’re trying to bring a new business to the state, it’s very helpful to tell them not only will we put a good package together, but we’ll be there to make sure there’s a successful outcome years down the road.

“We also have a strong desire to customize our service for the needs of the individual company. We act as a consultant to custom-tailor a strong strategy that meets their needs. We have programs that are equal to or better than those of any state in the country, but we forbid our account managers from talking merely about programs.” “We also have a strong desire to customize our service for the needs of the individual company. We act as a consultant to custom-tailor a strong strategy that meets their needs. We have programs that are equal to or better than those of any state in the country, but we forbid our account managers from talking merely about programs.”

A reorganization of the MJC figures to help make the agency’s service delivery better still. “The new organization is the Michigan Economic Development Corp.,” Rothwell says. “It will provide longer-term continuity for the program that we’ve built over the last few years. We will have a private-sector board of directors, and we’ll be operating even more like a business than we have in the past. We think this will give us greater flexibility to respond to customer needs, just like a business does.”

Besides auto, furniture and other traditional Michigan strengths, software and

other high-tech companies have been a big part of Michigan’s recent success. “We now have the third-greatest concentration of software development in the nation, behind only California and Massachusetts,” Rothwell reports. “People don’t think of Michigan as a technology state, but we are. Our manufacturing base has attracted a great many technology companies. Once here, they expand their service to other sectors. Michigan has also become a leader in venture capital. We’ve gone from 34th in the country in the level of venture capital just a few years ago to 15th , all due to growth in the technology sectors.”

A new medical research center modeled after the Salk Institute is developing in western Michigan, thanks to Amway Corp. founders’ sizable financial donation. The new facility will extend the state’s medical corridor from Detroit and Ann Arbor to Grand Rapids.

An MJC priority in the months ahead is development of “smart parks.” “We think Michigan needs more high-technology sites, and we want to work with local partners to put together unique value-added sites to show our customers,” Rothwell says.

North Carolina’s Northeast Partnership

Edenton, N.C.

$413 million investment, 1,413 jobs

It’s not exactly a “worst to first” story. But it’s certainly a dramatic turnaround.

Just three years ago, the 16-county northeastern region of North Carolina recorded only one new industrial announcement. The barrage of new plants, offices and distribution operations in the state’s high-growth cities, like Charlotte and Raleigh, never seemed to make it to the northeastern counties.

But today the state’s favored areas are making room at the table for the northeastern region, thanks to the development efforts of North Carolina’s Northeast Partnership (NCNP). The organization helped land approximately $413 million in new corporate capital investments and more than 1,400 jobs last year for its service area of 330,000.

Nucor Corp.’s new $300 million steel plant, being built in Hertford County, set a new state record for capital investment by a manufacturing firm. The facility will create 300 jobs paying an average annual salary of $60,000.

“Nucor’s investment in Hertford County will transform the region,” Gov. Jim Hunt said in announcing the location decision. “This company is an outstanding corporate citizen and a magnet for supplier industries.”

Another chart-topping investment is Wisconsin Tissue’s new $180 million paper recycling plant in Halifax County, just outside Weldon. “This type of opportunity is phenomenal, and we’re thrilled for Halifax, for the region and the state,” North Carolina Secretary of Commerce Rick Carlisle says. “Wisconsin Tissue’s decision simply reinforces our reputation as a great state in which to work and live.”

Besides the aggressive recruitment efforts of the NCNP, incentives have played a big role in attracting those large capital investments. Nucor’s incentives package is estimated at $155 million, Wisconsin Tissue’s at $31 million. NCNP President and CEO Rick Watson points to the landmark William S. Lee Quality Jobs and Business Expansion Act of 1996 as one of the key sparks that ignited the fire of business growth in the region.

“The law enabled North Carolina’s rural communities to compete,” he says. “We were determined not to give away the whole state in terms of incentives, but the law provided rural areas like ours the tools to attract investment. It came about through the wisdom of Gov. Hunt and Marc Basnight, President Pro Tem of the North Carolina Senate. Eight of our 16 counties are considered Tier 1 counties, meaning that our incentives packages for those counties are as large as any in the state.”

Despite the past year’s robust economic growth, Watson says there’s plenty of room for more quality local employers. “We have perhaps 20,000 people commuting out of our region every day for job opportunities, many of whom are skilled individuals. It’s very easy for us to document a well-trained work force that would much rather stay here and work.”

Pennsylvania’s Governor’s Action Team

Harrisburg, Pa.

$1.1 billion investment, 15,403 jobs

Governmental economic development agencies can learn much from the private sector, and Pennsylvania’s Governor’s Action Team (PGAT) has.

“We’ve changed our orientation with respect to economic development,” agency director Steve Kohler says. “We’ve developed much more of a customer service orientation, and that’s a lesson we’ve learned from some of our private-sector partners. We encourage our staff to understand the customer’s business as much as we can and remove as much of the development process from their responsibility as we can, so they stay focused on their business and we stay focused on ours.”

The PGAT’s enhanced customer focus, just part of Pennsylvania’s dramatic business-climate improvements in recent years, helped the agency lure some $1.1 billion in capital investments and 15,403 jobs last year to its service area of 12 million.

One of the state’s biggest recent successes is Lucent Technologies’ $165 million semiconductor plant expansion in the Lehigh Valley area of eastern Pennsylvania. “That’s potentially 1,600 new jobs,” Kohler says. “It’s an industry we were focusing on attracting – technology.”

Other big wins include Echo Star Communications’ new satellite communications office in Pittsburgh, employing about 2,000, and Higher Dimension Medical’s new medical devices plant in Williamsport, employing about 750. Echo Star Communications picked a brownfield site for its customer service center, renovating an old steel mill to accommodate the new facility.

Other recent PGAT accomplishments include the Pennsylvania Career Link (www.pacareerlink.state.pa.us), a one-stop employment resource for both businesses and job seekers, and the Keystone Opportunity Zones program.

“The Keystone Opportunity Zones program, recently announced by Gov. Ridge, will establish a dozen opportunity zones throughout the state that are totally tax free from a state and local perspective for the next 12 years,” Kohler reports. “This program is creating a lot of interest from the business community. The specific zones should be named before the end of this month (February), and we think they’ll really boost our ability to attract large-scale investment projects. Each zone has the capacity to go up to 500 acres (202 hectares).”

What’s ahead for the PGAT? “We’re going to continue identifying opportunities to work with private-sector organizations and businesses to establish beachheads for whole new industries,” Kohler says. “The Kvaerner Shipbuilding project in Philadelphia (left) is the first example of that (see the January 1999 SS for more details). We identified a company that we felt could create an entire industry, and negotiated a partnership in which we would jointly invest in a large-scale project. We look to repeat that.” What’s ahead for the PGAT? “We’re going to continue identifying opportunities to work with private-sector organizations and businesses to establish beachheads for whole new industries,” Kohler says. “The Kvaerner Shipbuilding project in Philadelphia (left) is the first example of that (see the January 1999 SS for more details). We identified a company that we felt could create an entire industry, and negotiated a partnership in which we would jointly invest in a large-scale project. We look to repeat that.”

Savannah Economic Development Authority

Savannah, Ga.

$130 million investment, 2,344 jobs

“The British are coming! The British are coming!”

It was a cry that evoked fear and foreboding in Boston in 1775, but in Savannah, Ga., some 223 years later, it was wonderful news.

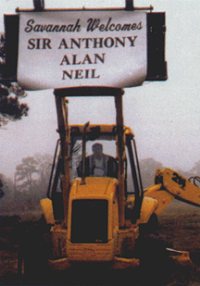

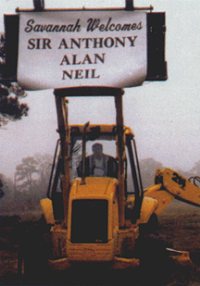

After considering 30 U.S. locations, British-based J.C. Bamford Excavators last year chose Georgia’s chief port city for a $62 million, 500,000-sq.-ft (46,450-sq.-m.) construction equipment plant that initially will employ about 500 workers. The project was easily the biggest among several new and expanded facilities worked last year by the Savannah Economic Development Authority (SEDA), which attracted a total of $130 million in capital investments and 2,344 jobs to its service area of 283,000. After considering 30 U.S. locations, British-based J.C. Bamford Excavators last year chose Georgia’s chief port city for a $62 million, 500,000-sq.-ft (46,450-sq.-m.) construction equipment plant that initially will employ about 500 workers. The project was easily the biggest among several new and expanded facilities worked last year by the Savannah Economic Development Authority (SEDA), which attracted a total of $130 million in capital investments and 2,344 jobs to its service area of 283,000.

While attempting to outpoint 30 competitors for the new plant might’ve seemed a revolutionary idea to some communities, the SEDA staff – led by President Richard D. (Dick) Knowlton – rose to the challenge.

“With only two days to prepare, we hosted a dinner at the Telfair Museum of Art with a few local business and government leaders,” Knowlton relates. “The Gadsden Elementary School Choir was asked to learn and perform God Save the Queen in honor of JCB’s chairman and managing director, Sir Anthony Bamford. On top of that, every piece of property Sir Anthony visited had a JCB backhoe-loader on site.”

On Anthony’s second visit to Savannah, Knowlton rode out to meet his plane on – you guessed it – a JCB backhoe-loader. The machine sported a banner with a simple message: “Welcome Back. Please Stay.” The combination of Savannah’s location advantages and its we-really-want-your-business attitude clicked with the British firm, and the plant, now under construction, will open later this year.

Knowlton makes it clear that winning the big project wasn’t a Lone Ranger episode. “I’ll bet there were 50 people who played a key role in bringing J.C. Bamford here: the state, the power company, the mayor of Pooler, county officials and others,” he says.

Other companies contributing to the SEDA’s superlative year include Pitney Bowes, which announced plans for a 300-employee customer service center, and Lummus Corp, which is building a 275,000-sq.-ft. (25,500-sq.-m.) cotton gins plant in the Crossroads Business Park. “The cotton gin was invented in Savannah, so this project brings it back home,” Knowlton says.

Tri-County Economic Development Corp.

Covington, Ky.

$654 million investment, 9,176 jobs

A record-setting year propelled the Covington, Ky.-based Tri-County Economic Development Corp. (TCEDC) into SS‘s 1998 top development groups.

The TCEDC, which serves a three-county area of 303,000 people in northern Kentucky, just below Cincinnati, helped land about $654 million in capital investments and 9,176 new jobs last year. “1998 was the best year in the 12 years of Tri-Ed’s existence,” exclaims TCEDC President Danny Fore. “It far and away exceeds any other year.”

One of the biggest new companies to choose northern Kentucky is GE Capital Information Technology Solutions, which announced plans for a 1,000-employee corporate headquarters that consolidates offices in Minnesota and Connecticut. “Kentucky offers a competitive atmosphere for doing business, has a longstanding and successful history with GE and can provide the kind of technical training and support we need for our business,” company President and CEO James E. Mohn says.

In other moves, specialty chemical and auto products leader Ashland chose to move its headquarters and 110 top executives from Ashland, Ky., and A-Carb LLC, a division of the French firm Messier-Bugatti, is building a $38 million carbon brakes plant.

“We also had three big cargo-related or passenger-related projects last year, including DHL Airways, Comair and Mesaba Airlines,” Fore says. “Those three projects will create more than 1,700 jobs. Airport-related activity is one of the greatest strengths for this community. The Cincinnati-Northern Kentucky International airport, located here in northern Kentucky, is a huge asset for us. You can’t overestimate how important it is to our growth.”

Critical in the DHL, Comair and Mesaba location decisions was passage of state legislation that caps Kentucky’s jet-fuel sales tax at $1 million per year – a vast improvement, from those firms’ perspective, over the former 6 percent tax with no cap. The TCEDC and Northern Kentucky Chamber of Commerce teamed up to spearhead the successful lobbying effort.

Finding enough skilled workers is a concern nationwide, and TCEDC, Northern Kentucky Chamber of Commerce and Northern Kentucky University have launched the Work-Force Collaborative to help address the area’s future work-force needs. The program will recruit 1,000 skilled workers to the area, help 500 “working poor” job seekers get the necessary training for better jobs and retrain an additional 1,000 workers for higher productivity.

Virginia Economic Development Partnership

Richmond, Va.

$2.1 billion investment, 47,653 jobs

Virginia is for lovers – and business investment.

That last part, at least, is evident from the $2.1 billion in corporate capital investments and 47,000-plus jobs that the Virginia Economic Development Partnership (VEDP) helped attract to the state (pop. 6.8 million) in 1998.

As discussed above, Loudoun County is a particularly hot location. But Virginia’s facility-location success is distributed throughout the state. MCI WorldCom, for instance, has announced a 1,100-employee office in Chesapeake. GEICO Direct’s new customer service and sales center in Virginia Beach will create an estimated 4,500 new jobs. And Bristol Compressors’ $20 million expansion of its heating and air-conditioning compressors plant in Washington County will add 350 jobs.

“We’re blessed in Virginia with great natural attributes,” VEDP official Rick Richardson says. “We have become a very aggressive marketer of a very good product over the past few years. Our record job performance in 1998 certainly speaks of that. We went from a record of 30,000 jobs in 1995 to nearly 48,000 in 1998. That’s a major improvement in performance.”

The VEDP not only works hard to recruit technology, it incorporates it fully in its day-to-day operations.

“We try to give our project management team as much technology as is available in the marketplace,” Richardson says. “All our people travel with laptops, and they have direct network access on the road – even internationally.”

The VEDP’s new $1 million Prospect Decision Support System combines the latest in GIS and videoconferencing technology. “We can basically show a prospect the entire commonwealth of Virginia in a relatively short time, and that’s important, because prospect time has become a very scarce commodity,” Richardson says. “And localities that might not be as close to airports as others no longer need have their fortunes determined by the amount of time a prospect has in the state. In time-critical situations, we can make a very convincing presentation for any region.” Telecom provider GTE contributed $350,000 toward the new system’s videoconferencing facilities.

The VEDP currently is without a permanent executive director, owing to development veteran Wayne Sterling’s departure for a new position in South Carolina earlier this year. But the organization is hardly without strong leadership in the interim.

“The way I look at it, we may have a vacancy in the head coach position, but Gov. Jim Gilmore is our general manager, and he is fully involved in economic development,” Richardson emphasizes. “He had a wonderful year in 1998 as our new governor. We’re very fortunate that he views economic development as a top priority of his administration.”

SS

|

In golf, it’s competitors like David Duval and Tiger Woods. In tennis, it’s Pete Sampras and Martina Hingis.

In golf, it’s competitors like David Duval and Tiger Woods. In tennis, it’s Pete Sampras and Martina Hingis. Computer hardware and software leader Sun Microsystems continues its heady expansion in Broomfield (right), part of a major initiative announced a little over two years ago. “Phase 1 has 11 or 12 buildings, and it’s being finished up now,” Dunshee reports. “Plans for Phase 2 are before the city now, and that might mean another 550,000 sq. ft. (51,100 sq. m.) of space.”

Computer hardware and software leader Sun Microsystems continues its heady expansion in Broomfield (right), part of a major initiative announced a little over two years ago. “Phase 1 has 11 or 12 buildings, and it’s being finished up now,” Dunshee reports. “Plans for Phase 2 are before the city now, and that might mean another 550,000 sq. ft. (51,100 sq. m.) of space.” You get the picture. The TCC clearly is getting the job done, a conclusion amply supported by the $401 million in corporate investments and 6,441 jobs the organization helped bring to its service area of 919,000 last year. Citicorp — left — (making a $200 million to $300 million investment), Capital One (adding 1,250 jobs), Chase Manhattan (a $52 million project, adding 750 jobs) and PricewaterhouseCoopers (a $95 million investment) are just a few of the many high-profile firms making big location moves on Florida’s west coast.

You get the picture. The TCC clearly is getting the job done, a conclusion amply supported by the $401 million in corporate investments and 6,441 jobs the organization helped bring to its service area of 919,000 last year. Citicorp — left — (making a $200 million to $300 million investment), Capital One (adding 1,250 jobs), Chase Manhattan (a $52 million project, adding 750 jobs) and PricewaterhouseCoopers (a $95 million investment) are just a few of the many high-profile firms making big location moves on Florida’s west coast. “We’re more than an investment promotion agency, because we’re also a financial institution,” IQ President and CEO Louis Roquet (right) explains. “Not only do we have a mandate to make Quebec known worldwide as a favorable investment site, we also finance projects. When investors talk to us, they’ll be talking to not only promotion and marketing people, but also people with a strong corporate financial background.”

“We’re more than an investment promotion agency, because we’re also a financial institution,” IQ President and CEO Louis Roquet (right) explains. “Not only do we have a mandate to make Quebec known worldwide as a favorable investment site, we also finance projects. When investors talk to us, they’ll be talking to not only promotion and marketing people, but also people with a strong corporate financial background.” “In Loudoun County, economic development is a team sport,” LCDED Director Larry Rosenstrauch says. “The team is bigger than our economic development department alone. We’ve really written ‘Economic Development’ with capital letters across the government, including everyone from our board chairman all the way down to the fire inspector. It’s as broad as that.

“In Loudoun County, economic development is a team sport,” LCDED Director Larry Rosenstrauch says. “The team is bigger than our economic development department alone. We’ve really written ‘Economic Development’ with capital letters across the government, including everyone from our board chairman all the way down to the fire inspector. It’s as broad as that. “We also have a strong desire to customize our service for the needs of the individual company. We act as a consultant to custom-tailor a strong strategy that meets their needs. We have programs that are equal to or better than those of any state in the country, but we forbid our account managers from talking merely about programs.”

“We also have a strong desire to customize our service for the needs of the individual company. We act as a consultant to custom-tailor a strong strategy that meets their needs. We have programs that are equal to or better than those of any state in the country, but we forbid our account managers from talking merely about programs.” What’s ahead for the PGAT? “We’re going to continue identifying opportunities to work with private-sector organizations and businesses to establish beachheads for whole new industries,” Kohler says. “The Kvaerner Shipbuilding project in Philadelphia (left) is the first example of that (see the January 1999 SS for more details). We identified a company that we felt could create an entire industry, and negotiated a partnership in which we would jointly invest in a large-scale project. We look to repeat that.”

What’s ahead for the PGAT? “We’re going to continue identifying opportunities to work with private-sector organizations and businesses to establish beachheads for whole new industries,” Kohler says. “The Kvaerner Shipbuilding project in Philadelphia (left) is the first example of that (see the January 1999 SS for more details). We identified a company that we felt could create an entire industry, and negotiated a partnership in which we would jointly invest in a large-scale project. We look to repeat that.” After considering 30 U.S. locations, British-based J.C. Bamford Excavators last year chose Georgia’s chief port city for a $62 million, 500,000-sq.-ft (46,450-sq.-m.) construction equipment plant that initially will employ about 500 workers. The project was easily the biggest among several new and expanded facilities worked last year by the Savannah Economic Development Authority (SEDA), which attracted a total of $130 million in capital investments and 2,344 jobs to its service area of 283,000.

After considering 30 U.S. locations, British-based J.C. Bamford Excavators last year chose Georgia’s chief port city for a $62 million, 500,000-sq.-ft (46,450-sq.-m.) construction equipment plant that initially will employ about 500 workers. The project was easily the biggest among several new and expanded facilities worked last year by the Savannah Economic Development Authority (SEDA), which attracted a total of $130 million in capital investments and 2,344 jobs to its service area of 283,000.