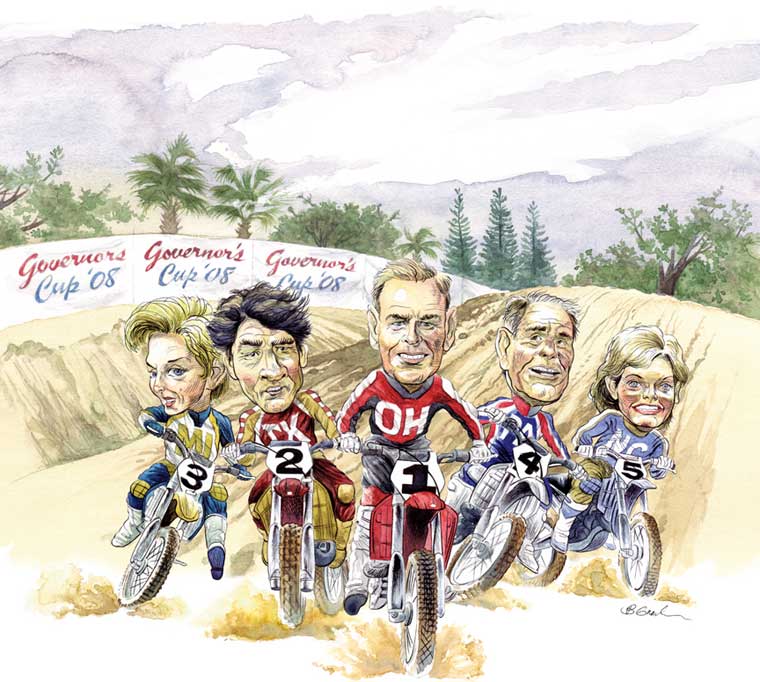

1st place: Gov. Ted Strickland of Ohio; 2nd place: Gov. Rick Perry of Texas; 3rd place: Gov. Jennifer Granholm of Michigan; 4th place: Gov. Ed Rendell of Pennsylvania; 5th place: Gov. Beverly Perdue of North Carolina.

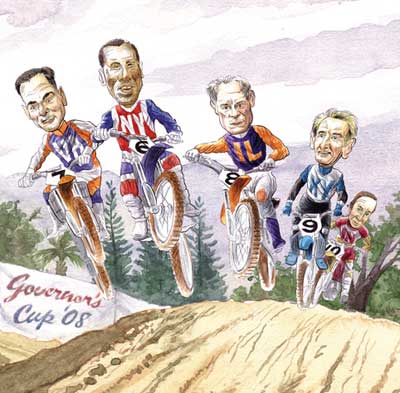

Below (front to back):

6th place: Gov. David Paterson of New York; 7th place: Gov. Timothy Kaine of Virginia; 8th place: Gov. Pat Quinn of Illinois; 9th place: Gov. Steve Beshear of Kentucky; 10th place: Gov. Mitch Daniels of Indiana.

here’s good economic news out there – you just have to look a little harder for it these days. In early February, the good news came looking for Ohio Gov. Ted Strickland and his economic development team, headed up by Lt. Gov. Lee Fisher. Ohio had won Site Selection’s prestigious Governor’s Cup for 2008, which recognizes the state with the most new or expanded capital projects the previous year as tracked by magazine publisher Conway Data Inc.’s New Plant Database. This is Ohio’s third Governor’s Cup in a row and its fourth in the past six years; it won the 2003 award as well.

Ohio’s 503-project finish narrowly edged runner-up Texas’ 497 qualified projects. Michigan, Pennsylvania and North Carolina complete the top five finishers with 296, 290 and 245 projects, respectively.

2008 numbers across the board are somewhat higher than in previous years in part due to inclusion of certain lease transactions – those that mirror comparable projects in the New Plant database in significance to an area’s economy. Like traditional projects, qualifying leases incur US$1 million or more in lease costs per year and either create 50 or more new jobs or involve 20,000 square feet (1,860 sq. m.) or more of new space.

“This is good news in the midst of what too frequently is unhappy news,” says Gov. Strickland. “We are working in different ways to make Ohio among the most competitive states in the nation, with our tax structure being one of them. Our emphasis on high quality and affordable education at every level is another. We’re doing the best we can in the midst of difficult circumstances.”

As Ohio has demonstrated once again, winning the Governor’s Cup even in challenging economic times requires keeping the end goal of job creation in mind while making tactical adjustments as necessary.

“We cannot allow challenges of the moment to deter us from doing the things that will enable us to participate fully in the recovery that will come,” says the governor. “We have to maintain our commitment to those efforts that will be essential once the economic storm has passed.”

Staying the course with respect to investment in education at all levels is one example. A two-year-old tuition freeze at community colleges and state college and university campuses will remain in effect for another year, making attendance more feasible for more Ohioans. “I don’t think there is another state in the nation that has been able to hold the line on the cost of higher education, so we’re pleased about that,” says Gov. Strickland.

But more significant to businesses in the location hunt is the state’s tax structure, he points out. Ohio has been lowering and eliminating business taxes in recent years, making the business climate more hospitable to companies already drawn to the Buckeye State’s strong logistics attributes.

On the tactical side of things, Gov. Strickland gives lots of credit to Lt. Gov. Fisher, whose 10-year economic-development plan for the state “has been received quite positively by the business community,” he says. “The very intense, focused efforts that our Department of Development (ODOD) has taken are the key.”

“One of the reasons we have won the Governor’s Cup for the last two years,” says Lt. Gov. Fisher, “is that we have been operating on three simultaneous levels of economic development. The first is the tactical, or the everyday blocking and tackling of economic development, in which we have been very, very aggressive.”

During the last two years, Fisher says, ODOD has funded more than 3,600 economic and community development projects that leveraged more than $14 billion in non-state investments. “We have assisted in the creation of more than 53,000 jobs and the retention of 195,000 jobs,” he adds. As of mid-February, about 800 economic development projects were in the pipeline. “If all of them were successful, we would leverage an additional $15 billion in private investments, create an additional 30,000 jobs and retain an additional 50,000 jobs. So we’re doing deals, if not every hour, at least every few hours.”

The second driver behind the state’s strong performance is a series of strategic investments made over the past year that Fisher says are now paying off.

“We were one of the first states to pass a bipartisan stimulus plan in the amount of $1.57 billion that targeted funds for infrastructure, higher education internships, and targeted industries of growth, like advanced energy and bioscience,” explains Fisher. “We anticipate this bill will create more than 55,000 jobs.”

About $250 million is being invested in a higher education work force initiative, which among other things subsidizes college-level work internships.

“Research shows those are the best way to keep Ohio students in the state of Ohio after graduation,” says Fisher of the plan’s first component.

“The second is that we passed an energy bill that has the third-most-aggressive advanced energy portfolio standard in the country.

“Third, we made some unprecedented investments in our first budget in early childhood education and higher education that are beginning to pay dividends,” he continues.

A third track is strategic and long-term planning, including the first-ever strategic plan for ODOD. The department historically has done well at analyzing the state’s economy but has not put together a plan involving goals and performance metrics.

The plan was unveiled in September 2008 with five goals: (1) to share the Ohio story within the state and on the national and international levels; (2) to strengthen Ohio’s strengths, which means to make more investment in the nine industry sectors deemed essential to economic success; (3) to cultivate top talent and a world-class work-force development system; (4) to invest in the state’s regional assets – its unique geographical and infrastructure attributes; and (5) to focus more on customers, or investors, and to operate at the speed of business rather than that of government.

Ohio’s advanced energy sector should continue to benefit from the energy bill the lieutenant governor mentioned. In fact, it’s been on the front burner for a while now.

“In the past two years, ODOD has funded more than 450 advanced energy projects with investments of about $175 million, including investments in wind, solar, biofuel, biomass and fuel cells,” says Fisher. “Because of our advanced energy portfolio standards, I consider that to be the ticket of admission to the alternative energy competition.”

Ohio was late to the game in enacting a portfolio standard, Fisher acknowledges, but it leapfrogged over many other states once it was in place. Gov. Strickland signed Senate Bill 221 into law on May 1, 2008. It is designed to ensure predictability of energy prices and maintain state controls to protect Ohio jobs and businesses.

As for the tough standard piece, the law requires that 25 percent of the energy sold in Ohio must come from advanced and renewable energy technologies, such as clean coal and wind turbines, by 2025.

“We will attract the jobs of the future through an advanced energy portfolio standard,” said the governor at the bill signing, “and today’s action by Ohio means that a majority of states now agree that these technologies represent the future of energy in the United States.”

Because Ohio is the third-largest manufacturing state, adds Fisher, “We have a built-in supply chain for wind and solar that is the envy of the country.”

The state is working with a non-profit organization of manufacturers and suppliers called the Great Lakes Wind Network to identify those companies that do or could provide component parts for wind-energy systems if they had the training and funding resources to develop them. The list of such companies is well over 100, says Fisher.

Ohio participated for the first time in the American Wind Energy Conference in 2008, where Fisher says interest in Ohio was “robust” due to its supply chain, “and the fact that we’re being very aggressive with regard to offering financial incentives to alternative energy businesses that make capital investments and create jobs in Ohio.”

The state is investing in other sectors as well with an eye to stimulating economic growth, including $100 million in the logistics and distribution industry for infrastructure projects, $100 million in bioscience companies and $100 million in bioproducts companies, all as part of the state’s stimulus package.

“We have established competitive application processes so that we can identify the best applications,” says Fisher, “and in most cases the money is going directly to businesses rather than to research and development and universities, so we can stimulate job creation more quickly.”

Meanwhile, at press time, Ohio was slated to receive $8.2 billion from the federal economic stimulus package signed into law in February, including $981 million for education and $1.5 billion for infrastructure projects.

Besides those already mentioned, the industry sectors most likely to benefit from state resources going forward are environmental technologies, aerospace and aviation, agriculture and food processing, bioscience and bioproducts, automotive, polymers and advanced materials and logistics.

Akron kept two major players and leading state employers – Bridgestone and Goodyear – from leaving. In fact Bridgestone’s expansion in 2008 involved a $100-million investment and kept 1,000 jobs, and Goodyear’s 2007 announcement was no less significant.

As reported in the May 2008 issue of Site Selection, state economic developers and the governor, among other community leaders, played key roles in NetJets Inc. deciding to keep and expand its operational hub in Columbus.

“That was a very intense competition between us and Raleigh, North Carolina – it was a $200-million project that would create about 800 jobs and retain 2,000 others,” says Fisher. “We also had a successful retention of Cooper Tire and Rubber that saved about 1,000 manufacturing jobs.

While implementing more components of the strategic plan, says Fisher, state officials will focus on the recently introduced budget that includes new tax credits and broadening of the job-retention and job-creation tax credits. New film industry tax credits are in the works, as is a new markets tax credit “to give cities and towns a proven tool to spur investment and bring life to downtown centers,” says Fisher.

“We’re extending the tuition freeze to a third year for all University System of Ohio schools,” he adds. “By the end of fiscal year 2011, Ohio will have held tuition growth to the lowest rate for a four-year period since before 1970.”

Finally, a second jobs-stimulus plan will be introduced later this year to build on the one already in place.

Fisher says the new plan “is likely to include, among other things, an expansion of our Third Frontier program” for cultivating Ohio’s high-tech research capabilities.

Site Selection Online – The magazine of Corporate Real Estate Strategy and Area Economic Development.

©2009 Conway Data, Inc. All rights reserved. SiteNet data is from many sources and not warranted to be accurate or current.