We comb through the data from Cushman & Wakefield’s report on the world’s priciest retail avenues.

This year a European shopping district beat out New York’s Upper Fifth Avenue for the first time as Via Montenapoleone in Milan, Italy, was declared the world’s most expensive retail street.

Photo by Andrei Domanin: Getty Images

If you associate the idea of Main Street with your hometown hardware store, a well-worn tavern, two shoe stores, the drugstore and a decent family-owned restaurant on the corner, then your concept differs markedly from the avenues featured in the 34th year of Cushman & Wakefield’s “Main Streets Across the World” report.

This report offers “insights into headline rents across 138 cities, tracking year-over-year (YOY) changes while accounting for foreign exchange rates and local metrics,” says the global real estate service provider of its survey of the world’s glitziest shopping districts. “The global ranking includes one street per market (country), while regional rankings share unfiltered headline rent prices per square foot for all tracked cities within each region (APAC, EMEA and the Americas).”

Here are the 10 most expensive:

| Global Ranking 2024 | Global Ranking 2023 | Market | City | Location | Rent (US$/sq. ft./yr.) |

|---|---|---|---|---|---|

| 1 | 2 | Italy | Milan | Via Montenapoleone | $2,047 |

| 2 | 1 | U.S. | New York City | Upper 5th Avenue (49th to 60th Sts) | $2,000 |

| 3 | 4 | United Kingdom | London | New Bond Street | $1,762 |

| 4 | 3 | Greater China | Hong Kong | Tsim Sha Tsui (main street shops) | $1,607 |

| 5 | 5 | France | Paris | Avenue des Champs-Elysees | $1,282 |

| 6 | 6 | Japan | Tokyo | Ginza | $1,186 |

| 7 | 7 | Switzerland | Zurich | Bahnhofstrasse | $981 |

| 8 | 8 | Australia | Sydney | Pitt Street Mall | $802 |

| 9 | 9 | South Korea | Seoul | Myeongdong | $688 |

| 10 | 10 | Austria | Vienna | Kohlmarkt | $553 |

By and large the 25 most expensive retail streets were the same as last year’s, with the largest jumps only two spots, as Malaysia’s Suria KLCC in Kuala Lumpur rose from No. 21 to No. 19 and Stockholm’s Biblioteksgatan entered the upper echelon at No. 25 from No. 27 last year. The largest declines were only by one position, including Fifth Avenue’s fall from grace to No. 2 and slight drops from Hong Kong’s Tsim Sha Tsui (to No. 4), Ho Chi Minh City’s Dong Khoi (to No. 14) and Dublin’s Grafton Street (to No. 17).

Curiously, Váci Utca in Budapest led Europe in rental growth with YOY rents growing 27%, even as a separate report forthcoming from Cushman & Wakefield in the January issue of Site Selection identifies the Budapest market overall as one of the few Western European markets deemed tenant favorable when it comes to office rents.

The report notes that overall the world has passed a “significant benchmark with rents on average now sitting above pre-pandemic levels. This feat had long been achieved in the U.S., but Asia Pacific has now crossed this mark and Europe continues to eat away at the deficit. Together, this has resulted in rents now being on average almost 6% higher than before the onset of the pandemic. In numerical terms, 72 (52%) locations are at or above pre- pandemic levels, while 66 (48%) are still yet to fully recover.”

Among the report’s headline takeaways on headline retail destinations:

- Over half of the 138 locations tracked saw YOY rental growth, with Tokyo’s Ginza District (No. 6 overall) leading the way at 25% growth.

- The only districts in the top 50 to show drops in rent were Vietnam’s Dong Koi (-6%), No. 37 Ilica Street in Zagreb, Croatia (-7%), No. 46 Kalku St./Valnu St./Audeju St./Terbatas St./Kr.Barona St. in Riga, Latvia (-3%) and No. 49 Calle Florida (Av. Cordoba to Av. Corrientes) in Buenos Aires, Argentina (-20%).

- London’s Regent Street and New Bond Street saw rental growth of 16% and 13%, respectively. The report says positive rental growth “was experienced across many locations in Western and Southern Europe, reflective of the strong tourism inflows not only associated with this being an Olympics year but also ongoing strong demand from U.S.-based tourists.”

- Reflective of India’s strong economy overall, “rent growth across the 16 locations tracked across India averaged a 9% increase YOY.”

Among the 30 markets tracked in the report’s regional rankings, the most dramatic rise has taken place in Miami, where the Design District has vaulted from No. 11 to No. 5 with YOY rent growth of 67%, part of 150% growth over the past four years.

| Americas Ranking 2024 | Americas Ranking 2023 | Market | City | Location | Rent (USD/sq. ft./yr) |

|---|---|---|---|---|---|

| 1 | 1 | U.S. | New York City | Upper 5th Avenue (49th to 60th Sts) | $2,000 |

| 2 | 2 | U.S. | New York City | Madison Avenue (57th to 72nd Streets) | $1,250 |

| 3 | 3 | U.S. | Los Angeles | Rodeo Drive (Beverly Hills) | $1,100 |

| 4 | 4 | U.S. | New York City | SoHo (Broadway to West Broadway, West Houston) | $875 |

| 5 | 11 | U.S. | Miami | Design District | $500 |

| 6 | 5 | U.S. | Honolulu | Kalakaua Avenue | $500 |

| 7 | 6 | U.S. | San Francisco | Union Square | $495 |

| 8 | 8 | U.S. | Chicago | Oak Street | $465 |

| 9 | 7 | U.S. | Las Vegas | Las Vegas Blvd. | $441 |

| 10 | 9 | U.S. | Boston | Newbury Street | $440 |

The Design District is one of four markets among those 30 that are located in Miami, including No. 16 Brickell Boulevard Corridor where rents have risen by 33%. Two other Florida locations among those 30 top markets are in Palm Beach and one is in Fort Lauderdale.

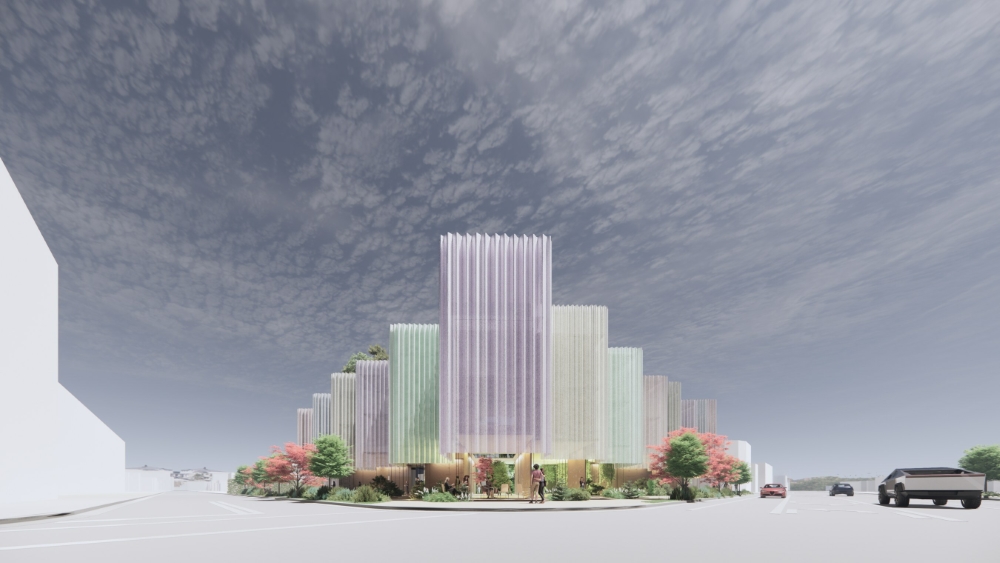

The report makes note of (but does not name) a proposed 65,000-sq.-ft. mixed-use project in the Design District that combines retail and 40,000 sq. ft. of high-end office space. Its name? The $1 billion MIRAI Design District, the first mixed-use project in the United States from Japan’s Kengo Kuma and Associates. Lionheart Capital, Leviathan Development and Well Duo are the developers of the project, which is anticipated to be complete by the end of 2025. In Japanese, “mirai” means “the distant future.”

The forthcoming MIRAI Design District mixed-use project in Miami aims to blend Japanese aesthetics and the Florida landscape.

Rendering courtesy of MIRAI Design District and Kengo Kuma and Associates

Where will things go in the nearer future? “The U.S. economy, which has shown incredible strength and resilience over the past several years, is forecast to slow as some softening in the labor market will dent business expansion and domestic consumption,” Cushman & Wakefield reports. Meanwhile, on the other side of the world, “recent fiscal stimulus measures in the Chinese mainland should help provide support to the wider economy by reviving the property sector and increasing consumer confidence, with the government likely to reaffirm a growth target of around 5% in 2025.”

The report also notes that devotion to top-notch physical space is not restricted to luxury brands only.

“There is perhaps no clearer articulation of this than IKEA, traditionally an occupier of suburban retail warehouse space, opening a new store in London’s Oxford Street in 2025 and committing to a new development on New York’s Fifth Avenue scheduled for completion in 2028,” the report says. “IKEA is not alone; other retailers have been drawn to super-prime retail locations as well. Sporting footwear brands On and Hoka have experienced significant growth and are targeting expansion of flagship stores in North Asia. Examples of this trend are truly global, highlighting the universal appeal of these locations.” — Adam Bruns

In a playful gesture in anticipation of its new store on London’s Oxford Street, IKEA in November combined a sense of luxury with its democratic design aesthetic with the opening of ‘Hus of FRAKTA’, a luxury pop-up dedicated to “one of the most iconic bags in the world, the blue IKEA FRAKTA.”

Photo courtesy of IKEA