The year is 2030. Three-quarters of a million electric vehicles manufactured in Thailand are released into local and international markets. PTT, an energy giant once synonymous with oil and gas, is now Thailand’s leading provider of electric vehicle (EV) charging services. Thailand has cut emissions by 40% and is well on its way to achieving carbon neutrality.

If this sounds far-fetched, it may be closer to reality than you think. In fact, the Kingdom’s leading automotive players, government actors and industry leaders are joining forces to ensure it becomes a reality. Thailand has a vision: to become the Southeast Asian hub for electric vehicles and a model economy for green energy. And it is only just getting started.

60-Year Journey to No. 1

Thailand’s automotive sector as we know it dates back to the early 1960s, when Japanese giants Toyota and Nissan each established their first production plants on the outskirts of the capital city of Bangkok. By 1979, they would be joined by Mercedes-Benz, the first of a handful of European brands to enter the market. Over the following decades, the Thai government would go on to introduce packages of incentives to attract foreign investment that would lure the likes of Honda, BMW, Suzuki and more. Today, nearly every leading car maker in the world — Japanese, American, European, and Chinese — has established production facilities in Thailand.

It’s not just cars; alongside the 21 major vehicle assemblers, there are 12 motorcycle assemblers. A little higher on the supply chain exist more than 2,200 auto parts suppliers, almost a quarter of which are classified as Tier 1. These suppliers and assemblers are clustered along Thailand’s eastern seaboard — from Samut Prakan all the way through the Eastern Economic Corridor (EEC) — as well as in Bangkok’s northern neighbors Ayutthaya and Pathum Thani.

Thailand is now the No. 1 car manufacturing country in Southeast Asia and the 10th largest automotive-producing country in the world, and it is still growing. According to the Federation of Thai Industries (FTI), in the past year alone, Thailand’s automotive industry grew by 11.7%, bringing its automobile production up to an estimated 1.88 million vehicles annually.

Supportive EV Ecosystem

Even as Thailand’s traditional automobile industry booms, uncertainty around oil and gas prices and larger, ever-growing environmental, social and governance (ESG) concerns have placed sustainability top-of-mind for manufacturers worldwide in the automotive and transportation sectors. In order to be competitive in the market, many companies are advancing sustainability initiatives, incorporating batteries and other cutting-edge technology to curb carbon emissions and improve fuel efficiency. Thailand, with its commitment to achieving carbon neutrality by 2050, has demonstrated eagerness to join these efforts. Given its automobile sector’s already strong foundation, it may be well poised to do so.

A supportive ecosystem for Thailand’s EV development is burgeoning, with public and private stakeholders alike excited about the prospect. The National Electric Vehicle Policy Committee set the 2030 goal to produce 30% of the total vehicle production or about 750,000 EVs, and by 2040 the number of EVs will increase to 2.5 million. In the same period, PTT intends to carve out its place as the Kingdom’s primary EV charging service provider, with the number of charging stations ambitiously projected to increase to 7,000 from the company’s current number of 139. Additionally, the Electricity Generating Authority of Thailand (EGAT) and partners from six leading automobile companies including Audi, BMW, Mercedes-Benz, MG, Nissan, and Porsche have signed an agreement to cooperate in the field of charging stations, linking application data and promotions. At present, there are approximately 2,572 EV charging stations across the country in total, according to the Electric Vehicle Authority of Thailand (EVAT).

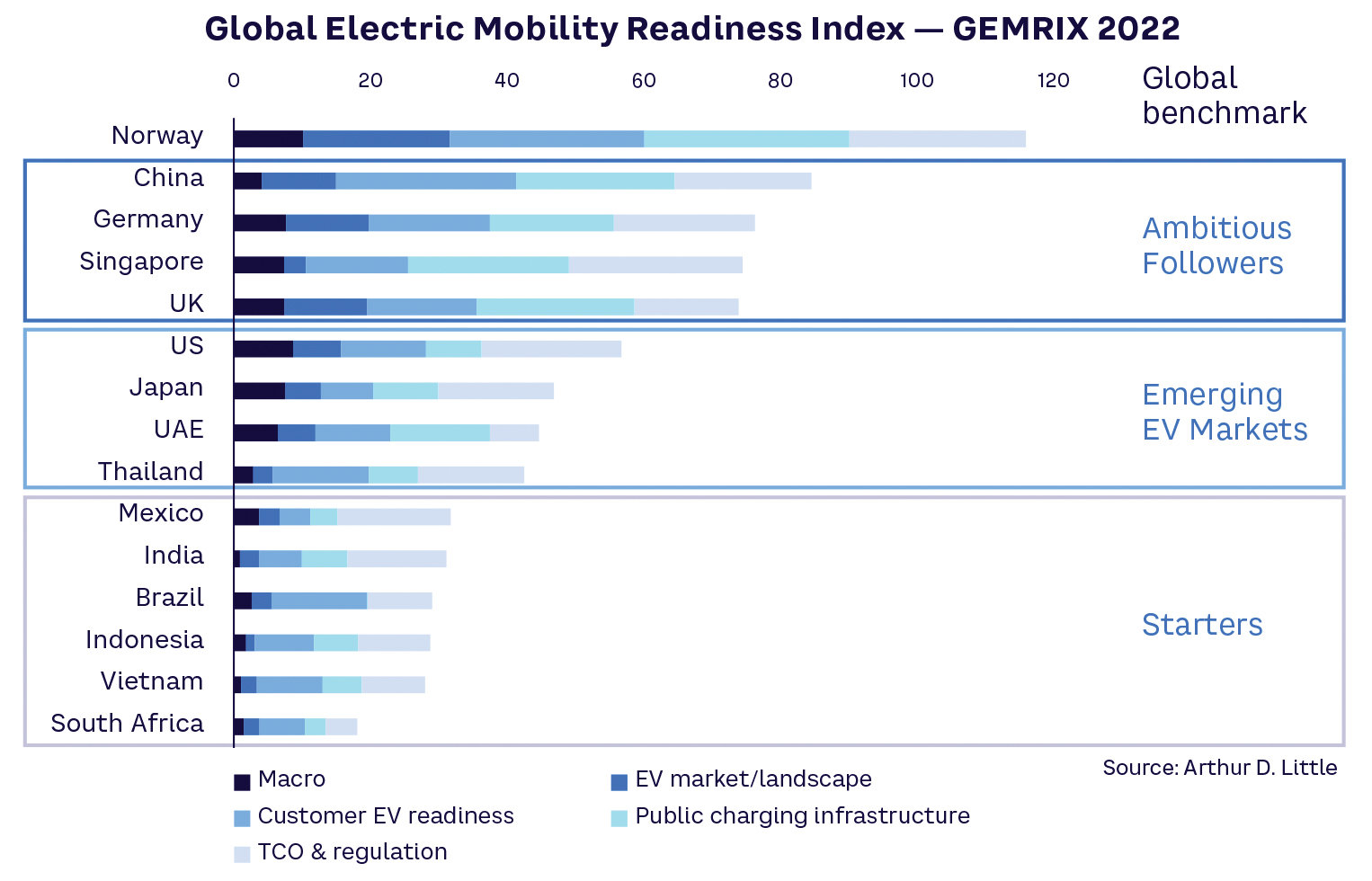

These efforts are building on the Kingdom’s already strong infrastructure for imports and exports, as well as a robust automotive labor force, to make Thailand competitive among emerging EV markets, placing the Kingdom in the same group with countries that are ready to invest heavily to catch up with the global leaders in EV.

Government Support

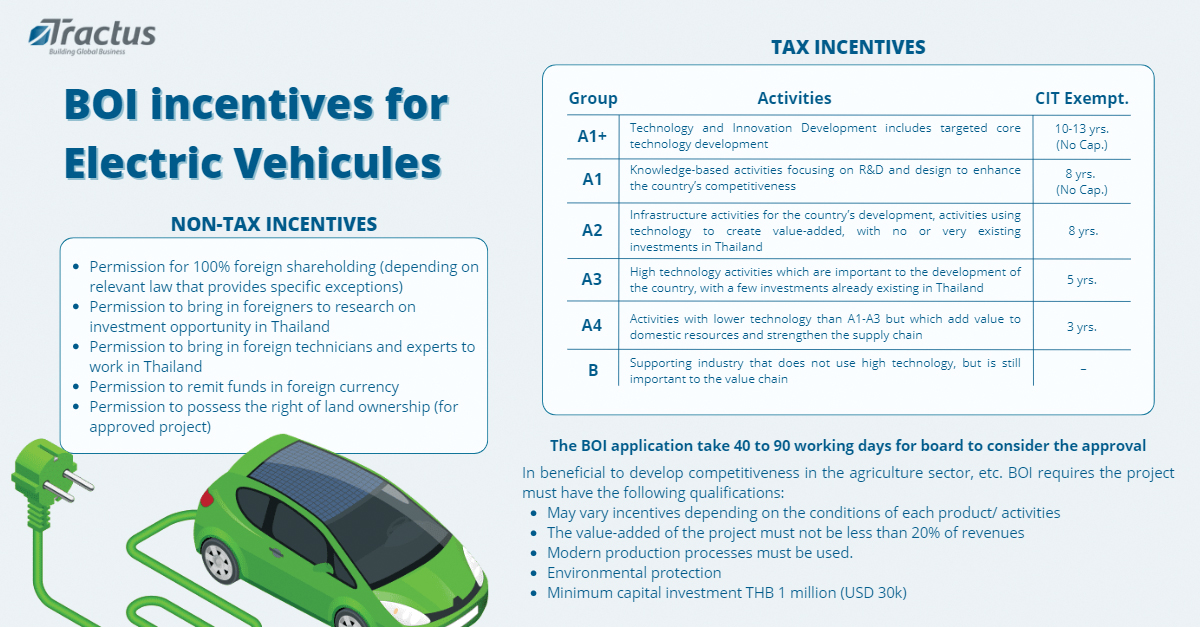

For its part, the government is offering an attractive set of incentives for both manufacturers and consumers looking to support Thailand’s automotive industry in its efforts to transition to the region’s EV production hub. For manufacturers, Thailand’s Board of Investment (BOI) plans to offer both tax and non-tax incentives, including an exemption on corporate income tax for up to eight years, across the EV value chain. This includes electric vehicles (BEV, PHEV, HEV); battery-electric motorcycles, tricycles, buses, and trucks; EV charging stations and equipment; parts and components, such as front and rear axles for EV buses; and batteries.

The high cost of EVs is a major deterrent to EV sales growing rapidly in Thailand. The Thai government hopes to lower the cost of EVs to the end-user, thus raising demand. Buyers of EVs may qualify for up to THB 150,000 (US$4,545) in subsidies, depending on the type and model of the vehicle.

Growing Investment

Between its strong automotive ecosystem and continuous government support, Thailand already has many investments from Chinese, Japanese, and European EV car makers.

China’s largest EV producer, Shenzhen-based BYD, plans to set up a 96-hectare (237-acre) facility in Rayong, where it will produce 150,000 electric passenger vehicles per year beginning in 2024. The $500 million project was approved by Thailand’s Board of Investment in August 2022.

Another Chinese EV maker, Great Wall Motor (GWM), has a plan to invest $685 million to turn Thailand into their ASEAN hub for EV business as well as establish an EV R&D unit, which is slated for completion in 2024. GWM acquired an auto assembly plant in Rayong Province from General Motors in 2020.

Zhejiang’s Neta — Neta Auto (Thailand) — also announced plans to cooperate on EV business with the local conglomerate PPT Plc to push Thailand to serve as the center of the company’s EV business in ASEAN.

Horizon Plus, a joint venture between Arun Plus (owned by Thai conglomerate PPT Plc) and a Taiwanese electronics manufacturer of Hon Hai Precision Industry Co., has a plan worth $1 billion to $2 billion to assemble EVs in Thailand. It is scheduled to operate in 2024 with a capacity of 50,000 units per year and plans to reach 150,000 passenger EVs by 2030.

Mitsubishi Motors, the first foreign company to export cars from Thailand in 1988, is investing heavily in plug-in hybrid electric vehicles (PHEV) in Thailand, and Mercedes has already completed production of its first fully electric Mercedes-EQS in the Kingdom at the end of 2022. Mercedes has chosen to manufacture not only its EQS but also the vehicle’s high-performance lithium-ion batteries. Even electronics maker Foxconn Technology Group has plans to make Thailand one of its first two locations in the world to construct EVs.

Limiting Factors

All of this investment signals a great transformation in Thailand’s automotive industry. The plans are ambitious, and the conditions are ripe. Onlookers who are excited for a greener Thailand overnight, however, may have to temper their expectations. Consumers across Asia are adopting EVs at different paces, with ASEAN and India lagging behind the more developed markets of China and Japan. Despite gradually increasing demand, EVs comprise an insignificant percentage of total new vehicle sales in Southeast Asia. Subsidies will help, but customer enthusiasm remains low due to perceived costs and problems users might face after purchasing.

Thailand’s green energy goals support its plans for development in the EV sector, but the two should not be conflated. Currently, more than half of the vehicles produced in Thailand are exported. This is unlikely to change soon.

Challenges to Investors

Thailand is on its way to being a hub of EV production for the growing domestic and regional market that its automobile manufacturing sector has long served. China is the largest supplier in the EV chain. Suppliers producing auto parts, batteries and the downstream battery materials needed in EV production are now considering opportunities to expand production facilities outside of China. Thailand presents opportunities for these future production bases, although there are challenges that an industrial site selection process can mitigate.

The industrial areas along the main hub of automobile manufacturing in Thailand’s Eastern Economic Corridor (EEC) will be the focus of a site selection. However, plots, especially the mega-plots above 50 hectares (124 acres), are very limited in this area. Industrial estates have expansion plans to meet the growing demand for industrial real estate, but the timing for the development of these zones may pose risks to meeting the rapid investment schedule that companies are pursuing.

To be successful as an EV hub, Thailand will need to attract investment in battery and battery materials production. Thailand’s Ministry of Natural Resources and Environment has put in place stringent air-emission regulations. Producers of battery materials and other products may have to consider if the air-emission levels are too restrictive for their investment early in the site selection process to ensure compliance with the regulations. Also, industrial zones typically have a large cross-section of investors from many industrial sectors. Those zones with more tenants have stricter regulations on environmental factors to protect existing investors.

The other challenge that can arise is identifying sites in the EEC that provide sufficient water volumes necessary for production. The EEC’s robust industrial development and its corresponding population growth are putting a large demand on the water supply. Most zones in the EEC have water quotas and many have established their own reservoirs to accommodate any restrictions that the Thai government may impose, but this is not without risk, and should be carefully analyzed and considered in any investment decision.

As with any site selection, there exist risks and challenges, especially in a fast-emerging market such as Thailand. However, its historically strong automotive sector, supportive ecosystem and government support make Thailand a promising option for current and future EV makers.

This article was contributed by Dennis Meseroll, executive director; Arunrat Chumroentaweesup, consulting manager; and Sarah Urtz, research analyst, of Tractus, all based in the Bangkok office. Tractus has been assisting companies in making informed decisions about where to invest and how to expand their business in Asia and beyond for over 25 years. For more information, visit www.tractus-asia.com.