Colliers International’s “Global Logistics Report: From First Mile to Last Mile” examines the primary factors expected to drive dramatic changes in global logistics over the next 25 years: from digital, population and consumption trends to global trade flows and new infrastructure paradigms. One key set of findings from the report looks at the growing importance of global industrial hubs in relation to these evolving market trends.

Increasing containerized trade flows and the global integration of supply chains means that port-centric clusters are an increasingly important part of the logistics market, enabling a more efficient and cost-effective flow of goods. This is increasingly visible from the huge sums of investment going into making ports capable of handling larger containerized vessels, creating a clearer hierarchy of global ports and trans-shipment feeder ports.

In the more established consumer markets of North America and Europe, linking ports to an efficient, continental transportation network is paramount. Poor road infrastructure and trucker shortages in North America, combined with the ability and willingness of railroad operators to get involved in building and maintaining an efficient rail network, has helped drive a new generation of large intermodal freight hubs—connecting containerized sea freight with inland distribution options.

The development of this market over the last 10 years (and longer) has created a new series of large-scale, high-value assets, which have taken a first-mover advantage in staking their claim as the dominant centers of the North American logistics market. This is an important signal for other global markets in terms of “what happens next.”

Intermodal Intel

In Europe, only the UK has developed a genuine intermodal network and set of facilities, but it has yet to play a significant role in freight handling. This will change over time, however, as schemes such as London Gateway, by DP World, establish themselves as key UK port-centric, intermodal logistics facilities. UK policy and road freight pressures support the growth of such facilities, but a lack of rail operator efficiency and internal intermodal facilities has held the market back to date.

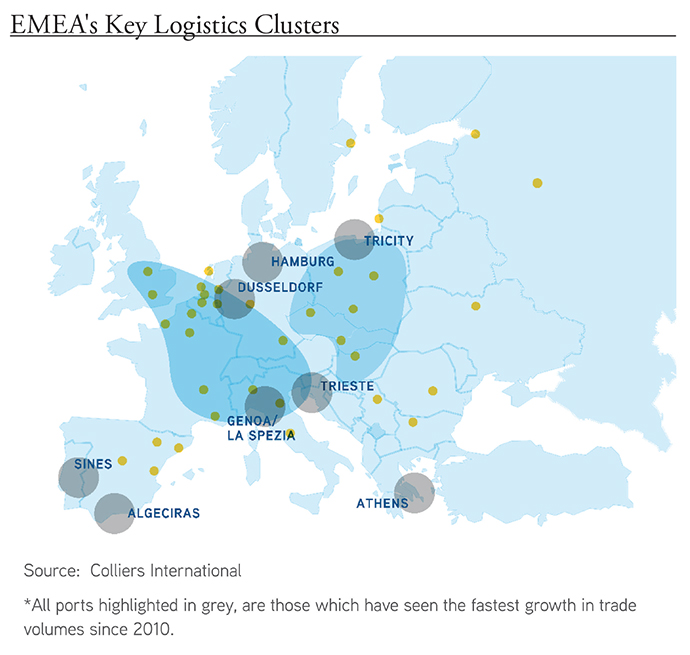

This is very much the same pattern in continental Europe, but the EU TENs project (Trans-European Networks) has been developed to improve the operational capacity of intermodal freight. This is finally starting to feed into an increase in intermodal freight—goods from Athens and Gdansk can now be transshipped into key distribution hubs on the continent by rail, and inland waterways are being put to better use in the core distribution markets to take the pressure off congested road freight. The fact that Athens and Gdansk are the fastest-growing ports in Europe since 2010 in terms of handling containerized freight is evidence of this shift.

In AsiaPac, this form of freight is yet to be developed. Although in Australia, big-ticket infrastructure projects including Moorebank Intermodal and the North West Rail Link in Sydney illustrate that this is becoming an increasing feature of this market. As global giants such as China and India develop their port-centric facilities and link these to a developing rail infrastructure, the growth in AsiaPac intermodal logistics is set to become very, very big.

Why It Makes Sense

The benefits to the use of intermodal are clear:

- It reduces road congestion, CO2 emissions and an over-reliance on dwindling trucker resources.

- Distances over 200 miles (some operators claim as low as 120 miles) can be served more cost-effectively from both a monetary and environmental perspective — and response times are also faster.

- It is a natural fit for increasing levels of containerized freight traffic, and it ties into a more efficient, automated and integrated global supply chain.

All of which leads to a downward effect on the cost of managing transportation and logistics, enabling a more effective implementation of supply chain management.

Having inland intermodal hubs and facilities is obviously a critical piece of this jigsaw, and we can see how Atlanta, Dallas (Fort Worth) and Chicago have become leading players in the North American market — combining their distribution capabilities with a strong consumer market.

A review of current prime logistics yields versus their retail counterparts shows just how important logistics assets are in these locations, surpassing the yields currently paid for retail. This is an important message for the investment community. As Colliers’ report shows, there are clearly a large number of long-term intermodal and port-centric opportunities to consider globally.

As this report highlights, the next part of the supply chain, where logistics markets continue to evolve and many more opportunities remain, is in the development of both “First Mile” and “Last Mile” logistics facilities — managing the distribution and return of consumer products in an increasingly digital world.

Director and Head of EMEA Research for Colliers International, Damian Harrington previously served as the company’s head of Eastern European Research. Based in Helsinki, Finland, he has worked within the real estate profession across EMEA for 20 years, living and working from bases in London, Dubai and Prague.

Giant Footsteps

A conversation with GLP’s Chuck Sullivan, President and COO, US Operations, Global Logistic Properties (GLP)

Global Logistic Properties was founded in 2008 when the late Prologis leader Jeffrey Schwartz and GLP CEO Ming Z. Mei partnered with Singapore’s GIC Pte to buy Prologis’ China operations and a stake in its Japanese property funds. GLP serves some 4,000 customers across a 521-million-sq.-ft. (48-million-sq.-m.) portfolio. Chuck Sullivan, former head of global operations at Prologis, was named president and COO of GLP’s US operations in February 2015 as a part of its acquisition of Blackstone’s IndCor Properties.

Site Selection: GLP’s growth curve has been incredibly rapid. Describe the company’s evolving global perspective on location choices.

Chuck Sullivan: Strategically, we’re focused on being the best operator. We create value through development and our fund management platform. How do we make the location decision? We spend a lot of time with our customers. We understand logistics costs, and we understand how our customers’ logistics channels work. We are organized by industry internationally. That gets us closer to the customer. We understand where they want to be, why hubs are important to them, and how we can ensure their presence in the key markets.

Our business customers are looking for optimization of their supply chains, and they’re looking for best in class. It’s easy to drive cost out of other parts of companies, and eventually they get to supply chain. We’re also seeing more leasing than owning of facilities.

We have the network effect — tying our platform to the customers’ needs. The portfolio in the States mirrors the nature of our international portfolio, in 32 key markets. In China we are in 36 key markets. In Japan, 86 percent [of the GLP portfolio] is in Osaka and Tokyo — those markets are 2.1 percent and 2 percent vacant, respectively. In Brazil, 88 percent is in Rio and Sao Paulo. We see a great opportunity for growth in meeting logistics needs. In the US it’s termed “same-day.” In China, a huge emerging middle class is driving frankly unprecedented consumption. And there’s a huge emerging middle class also in Brazil.

Site Selection: Where are the globe’s most challenging logistics locations, where capacity is needed, but infrastructure deficits, government policies or corruption are hampering forward progress?

Chuck Sullivan: While logistics is our focus, transportation and logistics go together. Logistics and transportation infrastructure in Brazil — and even energy infrastructure — have not kept pace with growth. That’s one reason we are so focused on just Sao Paulo and Rio, because, frankly, that’s where the major progress has been made. There are political and economic headwinds right now, and we believe in the long run it will catch up … There is some talk they’ll have to slow down the infrastructure investment. Procter & Gamble, Unilever and Colgate have opted to do business with us because we’re delivering a modern logistics facility. In Brazil, modern only accounts for about 20 percent of the total supply.

I did an interview with you many years ago, when I’d gone to Mexico and started up a Mexican operation with Prologis. It was similar [to Brazil] at the time. That Latin American country is a blueprint. They recognize what is needed, and they do make the investments. People typically think of energy and roads, but it’s ports too. I was down there not too long ago — all of the things they’d talked about doing many years ago that would have taken 25 years [back then], got done very quickly. In China, the infrastructure has moved much more dramatically forward than anyone would have expected. Every city has new roads and new feeder roads, pretty impressive transit, and new airports … the necessary infrastructure that the logistics industry really needs.

Site Selection: Describe your own team’s internal logistics when it comes to site visits and asset evaluation across such an instantly huge portfolio.

Chuck Sullivan: When we look at an acquisition, we get down to the asset level — we spend a great deal of time looking at who our customers are, and what they are looking for. In the US, a great degree of the portfolio built up by Blackstone as IndCor was infill markets. No one has a perfect definition of what infill might mean, but we like to say “very proximate to population bases, and close to last mile of delivery.” In excess of 70 percent of our US portfolio is infill in nature. As we see an emerging e-commerce trend in the US and globally, that becomes more valuable. Amazon gets the headlines, but every other customer is giving thought to better, faster, cheaper ways to deliver the end product. So you need to have facilities proximate to population centers as ever. You’re not going to deliver a box for free from 1 million square feet in the heartland to the East Coast. I can’t overstate that, because China is leapfrogging it — they’ve moved well beyond the traditional bricks-and-mortar retail store in terms of e-commerce.

Site Selection: How do you and your colleagues collaborate devise a logistics solution for a client looking for space in multiple geographies?

Chuck Sullivan: We have approximately 50 global clients today. The top 10 are a mix of retailers and 3PLs [third-party logistics providers]. We survey them, and their driving force for location decisions is proximity to population centers and speed of delivery. We use our network effect to effectively avail to them our portfolio, and our operational expertise in those markets. In the US, the logistics market is fairly mature, and in many cases commoditized. However, when you get into the infill markets, it’s a bit more of a challenge to those customers. A lot of these folks want to be very, very close to the urban center. But you don’t put a 1-million-square-foot building next to downtown Chicago.

Site Selection: As e-commerce principles become more and more a part of the manufacturing world and the “Internet of Things,” do you see GLP getting more involved in B2B and corporate internal supply chain logistics?

Chuck Sullivan: In the US, we do not do that today. Frankly, there’s a fairly sophisticated group within the US in the third-party consulting and the 3PLs, who do it quite well. As you move into the less developed markets, there are opportunities to provide customers network data and information. We particularly are focused on that in China — we survey customers and ask them if that would be a value proposition. Also food and cold chain logistics — there are value-add opportunities in supply parks. It’s not a new concept — you have auto manufacturing, and the logistics hub-and-spoke around that. It’s not our business to be in auto manufacturing, but it is our job to manage logistics for that. In China, our folks are industry-specific — we have colleagues specifically focused on automotive, for instance, to provide better value.

Site Selection: Cold chain in particular seems beset by slowdowns in ports because of customs.

Chuck Sullivan: A lot of the very high-value-added product traditionally moves by air, and even then we’ve seen slowdowns. Today, we’re seeing a lot of that shift toward rapid movement through ports. Candidly, there are a lot of things going on in the supply chain that can expedite the process. In fast-track movement of goods through ports, from ports to intermodal facilities those goods go long distances before they pass through a slowdown or a customs blockage. But customers are typically somewhat cynical about government’s ability to service that, so they set up redundancies in the system. And the costs in the system are in those redundancies. I’m not certain, in the current political environment we’re in, whether those costs can be wrung out. There could be more border stoppage down the line. But we talk to customers about their major concerns, and the movement of goods seemed to have been improving. There are lots of examples of how goods are moving more efficiently and faster.

Site Selection: You were a big part of pioneering logistics developments and innovations in your years with the late Jeff Schwarz at Prologis. How do you see your team’s work carrying forward his legacy as you envision logistics facility and network innovation and design five years or 10 years from now?

Chuck Sullivan: He was a very good friend of mine. I started with Jeff in the business many, many years ago. He was very forward thinking — probably one of the first to contemplate serving the customer on a global basis in the industrial arena. If not for his vision, we wouldn’t be talking today. He brought together one heck of a team. The GLP management team were working together because of Jeff many years ago. I think he’d be very proud to see where we are today, and certainly where we’re headed.