How big is Maryland’s big, new deal?

It’s so big that just the initial investment in a package of tech-heavy, indoor fish farms reflects the state’s most lucrative private project since 2016, when Marriott expanded its headquarters in Bethesda to the tune of $600 million. Ultimately, Norway’s AquaCon, a new and aggressive player in the indoor seafood sector, projects five-year capital spending toward three salmon farms on Maryland’s Eastern Shore in the range of $1 billion.

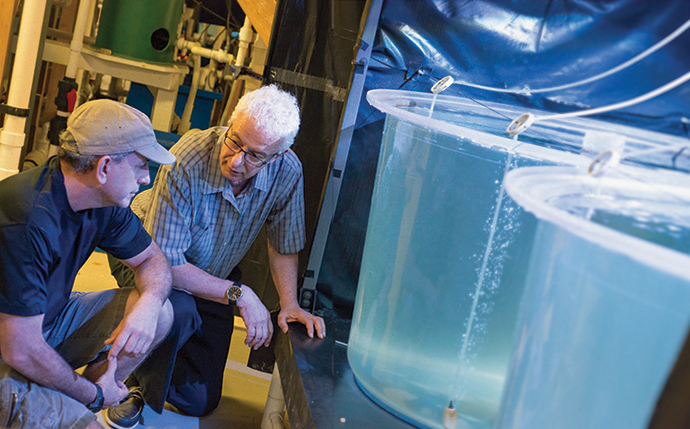

As partners in the project through a memorandum of understanding signed in March, the University of Maryland, Baltimore County (UMBC) and the state’s Institute of Marine and Environmental Technology (IMET) are to contribute expertise gleaned from decades of research related to Recirculation Aquaculture Systems. RAS, by filtering water from indoor tanks for re-use, dramatically reduces the amount of space required for intensive, indoor seafood production. UMBC’s aquaculture program is among the country’s most prestigious.

“This is like a dream come true,” says Yonathan Zohar, UMBC professor of marine biotechnology, director of IMET’s Aquaculture Research Center and an RAS pioneer. “The concepts that myself and my team have been working for so many years are going to be realized here in Maryland.”

AquaCon, formed in late 2019, is anchored by industry professionals, including a chief technology officer who has helped to design some 75 RAS facilities around the world. AquaCon officials, aided during site location by RAUCH inc., a Maryland engineering firm, met with Zohar last November and again in March.

“We were impressed by both IMET and Dr. Zohar,” AquaCon CEO Paal Halderson tells Site Selection. “It is important to AquaCon to be part of future research at IMET and to give IMET’s researchers and students access to the facilities we will build.”

Maryland’s Eastern Shore locations, Halderson says, outshone other sites the team considered along the East Coast.

“The Eastern Shore has everything we were looking for. The prime attributes to our Eastern Shore sites are high access to quality groundwater and municipal wastewater plants. We’ll be in a seafood area with tradition and history that’s also close to consumer markets. We have 70 million people within three hours’ distance, and this region has the highest U.S. average for seafood consumption.”

Halderson says AquaCon expects to break ground on its first Maryland facility in early 2021, with production to commence in 2024. The initial operation in Federalsburg, on the Delmarva peninsula that Maryland shares with Delaware, is expected to produce 15,000 metric tons of salmon a year, as are two subsequent RAS farms to be built in Cambridge, which sits on the banks of the Choptank River, a tributary of Chesapeake Bay.

AquaCon promises “green” operations, in areas that include turning salmon waste to fuel, fish food using algae, and solar power at each of its plants. Such attention to environmental matters could serve to spare AquaCon from some of the grief that’s befallen Norway’s Nordic Aquafarms, whose RAS project in Belfast, Maine has been stalled by opposition from local activists (see “Some Kettle of Fish,” Site Selection, July 2019). Nordic, which had planned to break ground a year ago, is awaiting approval of a discharge permit recommended in August by Maine’s Board of Environmental Protection.

Haldorsen says AquaCon is aware of the Nordic delays but says he expects to void similar travails, citing “positive and enthusiastic people at the town, county and state level.

“We have strong support,” he says. “Our ambition is to meet environmental standards for the next 25 years, using less than 10% of the natural resources used today by traditional salmon producers.”

AquaCon’s executive chairman, Henrik Tangen, told the Baltimore Sun in July that the Eastern Shore facilities could produce 500 jobs within five years. Zohar expresses excitement at the prospect that his students will be among those to claim them. Workforce training efforts are included in the parties’ MOU.

“Many of the jobs are very specific and require a good amount of training,” Zohar says. “Workforce development for this booming industry is becoming increasingly important.”

Delaware on the Fintech Path

Delaware’s long-standing ties to Barclays, the global financial services giant based in London, have produced a welcome dividend in the form of a $6.9 million investment that’s to create in excess of 300 jobs. Leveraging $2.5 million worth of incentives approved June 29 by Delaware’s Council on Development Finance, Barclays has launched extensive capital improvements to its U.S. headquarters in Wilmington to accommodate more customer service workers.

“The addition of more than 300 new jobs from Barclays is welcome news as we work to bolster our economy from the impact of COVID-19,” said Delaware Governor John Carney.

Delaware’s impressive brand power in the financial services industry also includes JPMorgan Chase, Discover Bank, Capital One, M&T Bank, WSFS Bank and Citibank. Financial services “has grown exponentially” and accounted for 9% of all jobs in Delaware, according to a 2019 report by the Delaware Prosperity Partnership.

To that extent, a new project at the University of Delaware plays to the strengths of the First State. Crews broke ground in July on a projected $39 million FinTech Center on UD’s Science, Technology and Advanced Research Campus (STAR) in Newark. The STAR campus sits on 272 acres (110 hectares) abandoned in 2007 by Chrysler, which closed an assembly plant there.

“The FinTech building will bring together computer science, engineering and business experts in cybersecurity, human-machine learning, data analysis and other emerging financial technologies,” says Levi Thompson, dean of the College of Engineering.

The six-story, 100,000-sq.-ft. (9,290-sq.-m.) facility, to open in about a year, springs from a partnership involving UD, Delaware-based Discover Bank and Delaware Technology Park (DTP), the incubator that opened on the STAR campus in 2016.

J. Michael Bowman, DTP’s president and CEO, tells Site Selection that half of the new building is to be leased to the university for its colleges of engineering, computer science and business, with the other half dedicated to incubation.

“It’s an unusual model,” says Bowman. “You can think of it as a hub of excellence. We want it to be a center of experiential learning, one that’s collaborative in terms of research and attraction.”

Here Comes HQ2

That big hole in the ground in Arlington, Va., across the Potomac River from Washington, D.C., represents the genesis of Amazon’s HQ2. Bethesda-based Clark Construction Group is leading construction of two 22-story towers for the $2.5 billion project that’s to create some 25,000 full-time jobs. Excavation alone could last up to a year, with Amazon employees expected to start filing into the complex in 2023.

Amazon in June affirmed that it remains committed to its 25,000 jobs projection. The company’s June 30 statement announced the hiring of HQ2’s initial 1,000 employees, who include a program lead tasked with ensuring that the HQ2 workforce is inclusive and diverse.

“Access to talent was one of the key factors in our search for a second headquarters — and we are very happy with the caliber of the talent we’ve been able to hire in Arlington and the DMV region,” said Brian Huseman, Amazon’s vice president of public policy. DMV stands for “District of Columbia, Maryland, Virginia.”

Arlington County green-lighted the project late last year after Amazon pledged $20 million toward affordable housing and $14 million for public open space to include recreation areas, a dog park and farmers markets. The company also committed to developing new retail space and a daycare center available to area residents and Amazon employees, in addition to covered bus stops, protected bike lanes and a bikeshare station.

Amazon expects to power HQ2 through a Dominion Energy solar project being built in southern Virginia’s Pittsylvania County. Amazon founder and CEO Jeff Bezos has promised to shift to 100% renewable energy by 2030 and net-zero carbon emissions by 2040. The company expects HQ2 to be certified LEED Platinum, the highest energy-efficiency designation offered by the D.C.-based U.S. Green Building Council.