If you like challenges, here’s one: Pick up today’s Wall Street Journal and highlight companies that don’t depend on technology. Flip the pages, scan the articles, and read carefully. Try to find an organization that is placing less value on how technology can impact their company’s direction. You can’t, because they don’t exist.

As greater value is placed on technology to help drive business, top level executives have more exposure to the process and capital spent to meet these initiatives. Executives today are tasked with ensuring their company stays ahead of the technology curve while keeping costs down and minimizing risk. The desire for flexible, low cost and reliable solutions have made their way to the desk of corporate real estate executives who now must execute a process to select the optimum location and solution to meet these guidelines. If you play a role in leading your company through the data center site selection and acquisition process – and want to succeed – pay close attention to the following five points.

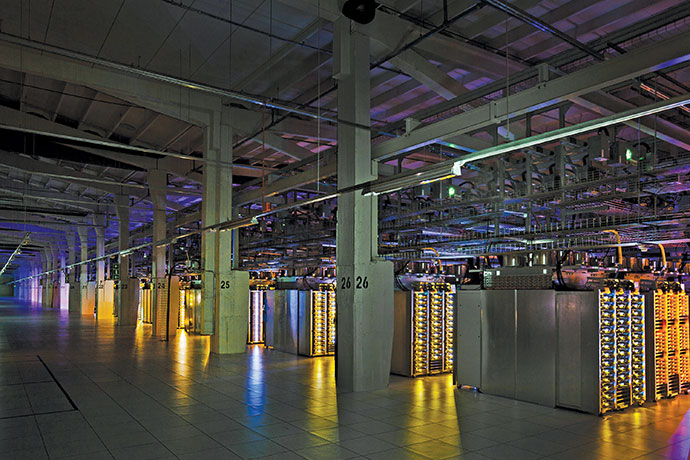

Inside a Google campus network room, such as this one in Council Bluffs, Iowa, routers and switches allow data centers to talk to each other. The fiber optic networks connecting sites can run at speeds that are more than 200,000 times faster than a typical home Internet connection. The fiber cables run along the yellow cable trays near the ceiling.

1) One Size Does Not Fit All

From outfitted shipping containers, colocation, cloud, build to suits and more, the options available to data center users have never been greater. Neither has the challenge to select the right solution.

Executives today must weigh the financial, operational and risk considerations for each approach. Often times, several solutions are selected within a single company as different business segments can vary in their risk and operational profile and underlying budget. Understanding the business units’ operations will assist the corporate real estate executive in selecting optimum market locations and balancing the financial premium expended for increased uptime. Certain strategies like active-active solutions are limited by latency thresholds dictating the location of the data center itself. For example, while Inland Washington may offer some of the lowest cost, greenest electricity nationally and serve as a great location for many Internet and software providers, the remote access and latency to a NYC-based engineering firm may be too great for the business to operate effectively. This identification and separation of business units and applications based on operational, risk and financial goals and guidelines results in balanced, cost-effective solutions.

Server floors like these require massive space and efficient power to run the full family of Google products for the world. Here in Hamina, Finland, Google chose to renovate an old paper mill to take advantage of the building’s infrastructure as well as its proximity to the Gulf of Finland’s cooling waters.

2) Evaluate Financial Considerations

While electricity cost can be the largest operating expense for a data center, it’s not the only one. Despite the cost reduction created for every one cent per kilowatt hour saved, other financial considerations are important to recognize and evaluate in the process.

Net taxes after incentives can be a large differentiator between markets and locations. Working with a trained economist who specializes in the area of data center incentive negotiation can result in tens of millions of dollars in savings. Washington, Oregon, Nebraska, Iowa, Ohio, Texas, North Carolina, and Tennessee are examples of states that have successfully adjusted their tax legislation to attract data center development by offering sales tax and personal property abatements, grants and other incentives to qualifying companies. Net taxes after incentives can dramatically impact market costs over an analysis period. CBRE’s Location Strategy and Incentives team recently secured incentives packages valued from a low of $10 million to a high of $88 million. On a per-megawatt basis, these incentives packages generated between $132,000/MW up to as high as $1 million/MW each year over a 20-year period. It should be noted the incentives packages are mostly for new construction. The impact will vary with existing buildings and co-location facilities.

A rare look behind the server aisle. Here, in Mayes County, Okla., hundreds of fans funnel hot air from the server racks into a cooling unit to be recirculated. The green lights are the server status LEDs reflecting from the front of Google servers.

For over 10 years, Google has been building some of the most efficient data centers in the world.

Other important factors such as construction costs, rental rates, free cooling (the opportunity to utilize outside air to cool equipment, thus lowering electricity consumption), labor, network and others all factor in to the total cost of operations.

The cost of downtime can far surpass the financial benefits of any one location. A few minutes of downtime can result in millions of lost financial trades or loss in worker productivity.

For these reasons, data center users traditionally want to be in areas with little to no operational risk, including areas free of natural hazards (seismic zones, hurricanes, tornadoes, floods, etc.), and certain distances from potential man made threats (highways, rail lines, flight paths, manufacturing facilities, chemical plants, etc.). Weighing operational risk to financial benefit and eliminating areas prone to wide area disruption are key to the decision making process.

Google’s site in Hamina, Finland

3) Flexibility & Scalability Are Key

“Healthy things grow. Growing things change. Changing things challenge us.” This quote by author James Ryle resonates well with IT departments today. As applications and data center equipment continue to evolve, so do the physical requirements to support them.

Challenged with planning for technologies yet to be created or adapted, corporate real estate and IT executives are looking for physical solutions which can accommodate future change.

Technological obsolescence is another major concern, making it difficult for many to justify large capital expenditures for solutions which may quickly become obsolete. As corporate real estate executives look to identify sites and solutions which meet these goals, many are choosing to pursue modular builds with existing shell space for future development, or negotiating expansion, contraction and ramp-in rights with third party providers.

In an effort to increase financial flexibility and limit overall long-term investment risk, more companies are choosing to outsource operations to third parties, moving from a capital to operating expense model. Because of this paradigm shift, the colocation market has seen significant growth over the last five years. Colocation providers have engineered solutions that provide users the ability to scale and shift operational risk while keeping capital in their pocket.

In November 2013, Google announced a further $608-million expansion of its site in Hamina, Finland.

An overhead view of one of Google’s cooling plants, where seawater from the Gulf of Finland entirely cools the data center.

Pipes aren’t the only colorful things at the firm’s data centers. These cables in The Dalles, Ore., are organized by their specific hue. On the floor, this can make things less technical: “Hand me a blue one.”

As part of its commitment to keeping users’ data safe, Google destroys all failed drives, on site, such as here in St. Ghislain, Belgium.

In addition, cloud computing can be a cost-efficient model that increases a user’s storage capability while providing easy access to information on an as needed basis. As market dynamics continue to change, the solutions will be adjusted to match the expectations of data center users in the market – expectations corporate real estate executives are required to understand

4) Follow the Changing Landscape

In the past, tenants had the choice to lease multi-tenant data centers in large cities or to build and own facilities in remote locations, with few options in-between. Landlords and developers were driving the locations of leased data center solutions. Today, the opposite exists. As more aggressive capital targets the data center space and new operators enter the market, end users are pushing varying solutions in locations which best serve their operations.

Historically, the majority of growth in the colocation industry has occurred in markets with large populations, large business climates, reasonable power costs and deep labor and vendor talent. Atlanta, Chicago, Dallas, New Jersey, New York, Northern Virginia, Phoenix, Seattle, and Silicon Valley continue to be hubs of colocation activity. However, data center suppliers are now also active in new markets such as Charlotte, Denver, Houston, Minneapolis, Nashville and Raleigh. The demand in these areas is driven by companies utilizing colocation while maintaining close proximity to a headquarters or regional office location.

Quincy, Wash.; Prineville, Ore.; Omaha, Neb.; Des Moines, Iowa; Columbus, Ohio; and rural North Carolina are examples of areas that have attracted large data center users that chose to build and own their facility. These areas traditionally have low power costs, cool climates for free cooling and have adjusted legislation to provide tax abatements to data center users. In recent years, large tenant requirements have driven traditional colocation into secondary and tertiary markets, such as Prineville, Ore., and Quincy, Wash. It is important that real estate executives allow ample time in the site selection process to evaluate all current and potential development solutions.

5) Prove Your Process

While site selection has evolved, one thing hasn’t – the importance of an auditable process. Given the large amounts of capital behind a data center acquisition, it’s not uncommon for these decisions to need board level approval. A team’s ability to navigate, record, and display the data center acquisition process from start to finish is paramount to transaction success.

In addition, corporate real estate is becoming more involved in negotiating data center leases. These leases and master services/service level agreements are not your traditional real estate document. While some of the main lease components are included in both, data center agreements differ in that they are quite technical and certain sections can be challenging to negotiate. Understanding the most appropriate points to negotiate as it relates to cost/kW/month, power cost, PUE, cross connect charges, power and space expansion, pass-throughs, relocation, service level credits and penalties including continuous and chronic outage cures, termination options, and operation/maintenance agreements are key to a functional relationship with a third party provider, especially considering most have different expectations of what is acceptable.

Your company’s dependence on technology and data center infrastructure is a trend that’s here to stay. Organizations are asking questions and seeking to understand solutions and their cost and risk implications. Real estate executives are expected to provide answers to these important questions. However, the most important question you will need to answer is … will you be ready?

David Liggitt is vice president with CBRE’s Data Center Solutions Group. Contact him at david.liggitt@cbre.com. Kristina Metzger is a member of CBRE’s Data Center Solutions Group. She can be reached at kristina.metzger@cbre.com.