Hungary this week shut its border in hopes of preventing thousands more Syrian refugees from seeking asylum. But by next year Hungary and several other countries will open their doors for jobs from GE, thanks to the recent shutdown of the US export credit agency.

“I’m confident we can together reauthorize the Export-Import Bank of the United States, giving our businesses one more tool to compete,” said President Barack Obama from the stage of SelectUSA’s annual summit in Maryland early this year.

But it didn’t happen. So at midnight on June 30, the Bank’s authority lapsed, meaning an institution that approved $20.5 billion in total authorizations supporting $27.5 billion in export sales and some 164,000 US jobs was not allowed to process applications or conduct new business. (It continues, however, to focus on the management of its $107-billion portfolio of outstanding obligations.)

This week — four months after US Rep. Jeb Hensarling (R-Texas), chairman of the House Financial Services Committee and one of several prominent congressmen opposed to Ex-Im reauthorization, called GE’s threats to move jobs offshore “a bit of bluster” — GE decided it had to go conduct business elsewhere.

GE is currently bidding on $11 billion of projects that require export financing, and since July 1 had begun talks with several foreign export credit agencies (ECAs) in order to secure financing for customers. GE has reached an agreement with the French export credit agency (COFACE) to provide a line of credit for global power projects that will initially support potential orders in a number of international markets including Indonesia.

“Also, to access the required export credit for its customers of its aeroderivatives turbines, GE will move its final assembly from the US to Hungary and China,” the company announced. “As related projects are bid and won in these two product lines, GE will move approximately 500 jobs from Texas, South Carolina, Maine and New York to France, Hungary and China.”

On the same day, Boeing lost its second satellite deal in three months, from Singapore’s Kacific, because the customer needed the ECA backing. The first came in July from ABS.

Fortifying Belfort

According to GE, if the immediate contract is won, the first move of approximately 400 new jobs would be to France, where the company will develop a unique turboprop center of excellence in 50-hertz heavy-duty gas turbines in Belfort, located in the Franche-Comté region, halfway between Lyon and Strasbourg.

The nod to Belfort is driven by the Ex-Im kerfuffle. But it’s not the only attention GE is giving to France. In June 2014, GE acquired for $13.5 billion the power and grid businesses of France’s Alstom Group. It was the largest acquisition in GE history, and included a promise of 1,000 new jobs in France. The grid, offshore wind, hydroelectric, and steam turbines businesses will have headquarters in France. GE’s European power headquarters have been in Belfort since 1999, manufacturing among other products the world’s largest and most efficient gas turbine, the 9HA. A GE spokesperson confirms that the 400 jobs announced this week are over and above that 1,000-job pledge from the Alstom deal.

Belfort also is home to a locomotive and railcar design and manufacturing facility operated by Alstom. But the real behemoth in town is the giant sandstone sculpture of a lion located directly at the base of its signature citadel, sculpted by none other than Frédéric-Auguste Bartholdi, sculptor of France’s most famous gift to the United States, the Statue of Liberty.

According to the official list maintained by the OECD, there are 37 ECAs, with the US the only major economy in the world without one. (Other sources say the number is as high as 85.) GE customers often require guaranteed financing from an ECA in order to submit a bid. “With no US export financing available, GE must pursue non-US options,” the company explained. “Many of these ECAs have requirements similar to the US Ex-Im Bank’s that production and jobs must be invested in-country to qualify for financing. This will result in the loss of thousands of U.S. jobs — both at GE and at our suppliers.”

The moves by GE include the shift of packaging for its 50-hertz aeroderivative gas turbine product line from the US to Hungary and China, “where functioning ECAs will support our customers with critical financing,” said the company. “The move is expected to impact 100 people who currently work in the company’s facility outside Houston, Texas, and transition will take place in 2016.”

In the past three years, 80 percent of these products have been sold to countries where ECAs are required.

“Our customers rely on export credit agencies, like US Ex-Im, to finance their critical power projects,” said Jeff Connelly, vice president, Supply Chain, GE Power & Water. “While our preference is to continue producing power generation equipment in our best US factories, without customer access to the U.S. Ex-Im bank, we have no choice but to move our work to places that will offer export credit financing of these projects.”

Just the Beginning?

“We do not make today’s announcements lightly, and in fact, have done everything in our power to avoid making these moves at all, but Congress left us no choice when it failed to reauthorize the Ex-Im Bank this summer,” said John Rice, vice-chairman of GE. “We know this will have an impact not only on our employees but on the hundreds of US suppliers we work with that cannot move their facilities, but we cannot walk away from our customers.

“We call on Congress to promptly reauthorize Ex-Im,” Rice continued. “The truth is that Ex-Im supports thousands of U.S. jobs and has returned $7 billion to the US Treasury over the last 20 years — a rare government program that supports the economy while cutting the deficit. In a competitive world, we are left with no choice but to invest in non-US manufacturing and move production to countries that support high-tech exporters.”

The door is open for more where that came from, if the Ex-Im Bank continues to languish in its current “authority has lapsed” purgatory.

“These American jobs losses are a direct result of the failure of Congress to act on Ex-Im reauthorization,” said National Association of Manufacturers (NAM) President and CEO Jay Timmons, going so far as to call the consequences of that failure a “tragedy in the making.”

“This is not a debate about abstract ideas, as opponents would have you believe,” Timmons said this week. “Congress’s refusal to support American manufacturing workers is having real-world consequences. This decision will have a multiplier effect — impacting suppliers and job creators of all sizes and further hampering the ability of manufacturers to compete globally … While Washington plays political games, hundreds of families are losing their paychecks. Those who oppose the Ex-Im owe the country some answers. Why do they support ceding good manufacturing jobs to foreign countries? Why don’t they support American workers? Manufacturers cannot wait any longer, leaders on both sides of the political aisle need to come together on this issue and pass a reauthorization now.”

Linda Dempsey, NAM’s vice president of international economic affairs, says US Ex-Im requirements are among the most stringent in the world, with rigorous domestic content requirements and applications to establish the viability of the sale and purchaser. Asked how Ex-Im backing matters to companies’ bottom lines, she says, “Ex-im financing and other Ex-Im services can be critical to making or not making key export sales. Given the growing importance of exports for manufacturers and their workers — with some exporting 20, 40 or even 80 percent of their US products — reviving Ex-Im Bank is critical. Ex-Im services are a particularly strong part of the bottom line of companies in sectors that are involved in long-term projects, such as infrastructure, projects or sales in emerging economies, and for sales where governments need to play a role, such as nuclear energy or state-run hospitals.”

Why It Matters

It’s not just the conglomerates that are suffering. According to NAM, a company that makes green structures for quick assembly in territories affected by war had a contract in Nigeria, but now that the loan is not going through, that project is on hold. Another firm affected by the expiration of Ex-Im authority is Air Tractor in Texas, which manufactures aircraft for agricultural use. And Rhode Island’s Cooley Group, which makes products such as a stadium wrap used on the London Olympic Stadium and a proprietary material used in Formula One’s fuel tanks, is seeing its plans for continuing export growth put on hold.

“The private sector simply will not do what the Ex-Im does for small and mid-sized companies like Cooley,” said Daniel Dwight, Cooley’s president and CEO, earlier this summer. “It’s become a critical part of our revenue growth. We are not GE — without the Ex-Im Bank, our international revenue would be a fraction of what it is today.”

Asked to assess the competitiveness and structure of non-US export agencies, NAM’S Linda Dempsey notes first of all that most every country but the US has one.

“In a report released by the NAM last year, we identified the biggest and most competitive ECAs to include China, South Korea, Canada, and Germany,” she says. “Countries like China and also Brazil have major levels of financing available from their official ECAs, but also from other lending entities. Canada and Korea have levels of export credit totaling over 5 percent of their GDP. China, Canada and Korea have appeared to expand the most, and Canada’s ECA supports approximately 20 percent of its exports while China’s official ECA supports 12 percent of its exports. Both countries are huge exporters, and ECA activity has helped propel their competitiveness.”

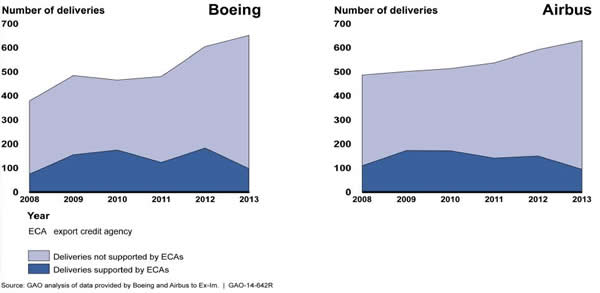

Indeed, a GAO report issued in August that examines comparative positions of the US and China via-a-vis ASEAN markets states, “In 2014, Ex-Im estimated in an annual report to Congress that China provided $111 billion worldwide in official export support in calendar year 2013, far more than Ex-Im’s $15 billion in calendar year 2013. Ex-Im’s report noted that Chinese export credit agencies — along with those of Japan and South Korea — have multiple advantages, including greater funding capacity, the ability to lend in dollars at competitive rates, and lending programs that are not bound by OECD agreements.”

Asked what she’s heard about other companies as potential candidates for making Ex-Im Bank-driven location decisions driven by strategic factors similar to GE’s, Dempsey says, “We have heard from a significant number of small, medium and large companies that are concerned about losing sales overseas as a result of the Ex-Im expiration. Some had bids on projects before Congress allowed the Bank to lapse on June 30th, and are now wondering if their bids will be eligible. For many small companies, the loss of Ex-Im means that they can’t get credit to even make the export sales. Without Ex-Im, businesses like these are left in a ‘holding pattern,’ with companies re-evaluating how to continue their export activities.”

Keeping Aircraft Aloft

Earlier this year, the Ex-Im Bank presented its Deal of the Year and Renewable Exporter of the Year awards to Siemens Energy Inc., which thanks to Ex-Im financing was able to export wind turbines manufactured in Hutchinson, Kan., and Fort Madison, Iowa, to Peru, helping to support approximately 400 jobs in the Midwest.

“Ex-Im Bank played a critical role in the export of our American-made wind turbines for these renewable energy projects in Peru,” said Jacob Andersen, CEO of Siemens Wind Power & Renewables Onshore Americas. “The ability to export equipment is helping sustain manufacturing jobs here in the United States. Through our factories in Iowa and Kansas, Siemens has made a long-term commitment to the success of America’s wind industry, and we will continue to seek opportunities to work with Ex-Im as we grow our exporting capacity and expand our footprint.”

Since 2009, Ex-Im Bank has authorized nearly $2 billion to support the export of U.S. goods and services related to renewable energy production. At SelectUSA this year, Siemens USA President and CEO Eric Spiegel said the company is a net exporter from its 70 US facilities to the tune of about $5 billion.

Meanwhile, Boeing confirmed today that China President Xi Jinping will visit the company’s Everett, Wash., factory on Sept. 23 during his visit to the United States. “We’re honored that President Xi will see our factory and meet the Boeing employees who worked to deliver a record 155 airplanes to China last year,” said Jim McNerney, Boeing chairman and CEO, and chairman of the President’s Export Council. “China’s rapidly growing aviation market plays a crucial role in our current and future success.”

How crucial? So far this year, Chinese customers have taken delivery of about 25 percent of Boeing’s commercial airplane production. Over the next 20 years, China will be Boeing’s largest commercial airplane market with a projected need for 6,330 new airplanes, worth an estimated $950 billion.

While the lapse gives Boeing competitors such as Bombardier and Brazil’s Embraer a competitive advantage (Brazil’s ECA is BNDES), it also affects those competitors too. Frederico Fleury Curado, president and CEO, Embraer SA, was also on stage this year at SelectUSA, invoking the company’s six US sites it’s built out over the past 35 years, including its latest in Florida’s Space Coast region. Being close to the US market is nice, he said, but isn’t the end goal.

“In the attempt to globalize our company, we’re not investing in the US for the domestic market,” he said. “We intend to transform our position in the US as a global platform for exports. We are gradually moving our center of gravity to the US — the supply chain, and the culture of globalization, is here.” As recently as 2012, Ex-Im Bank officials expressed openness to the idea of supporting financing of deals involving Embraer aircraft coming off the Florida assembly line.

To date, EXIM Bank has not financed an Embraer business jet from the Melbourne, Fla., plant, an Ex-Im spokesperson says. “Due to a lapse in EXIM Bank’s authority, as of July 1, 2015, the Bank is unable to process applications or engage in new business or other prohibited activities. Prior to the lapse of EXIM’s authority, Embraer business jets that were completed and delivered from its Melbourne, Fla., location were eligible for EXIM support under the Bank’s current content policy.”

According to a 2014 Ex-Im presentation to a business council in Brazil, more than 48 percent of the bank’s total portfolio is devoted to aircraft deals.

In an April speech supporting the updating of the US government’s Trade Promotion Authority, Beoing’s McNerney took time to note another crucial global trade issue as the Ex-Im reauthorization deadline loomed.

“Customers of American exporters are very worried that Ex-Im will not be there in the years ahead to help them with their financing needs, and our competitors are eagerly awaiting the impending unilateral U.S. withdrawal from the kind of common-sense financing support virtually all developed countries offer their exporters’ customers,” he said. “U.S. jobs and businesses will suffer the consequences.”