In the agricultural world, GM has nothing to do with automobiles. But research into and production of genetically modified food and other crops has revved up into a major business in

“Genetically modified seeds have become widely accepted and have led to ease of production,” says Dan Basse, president of AgResource Company, a

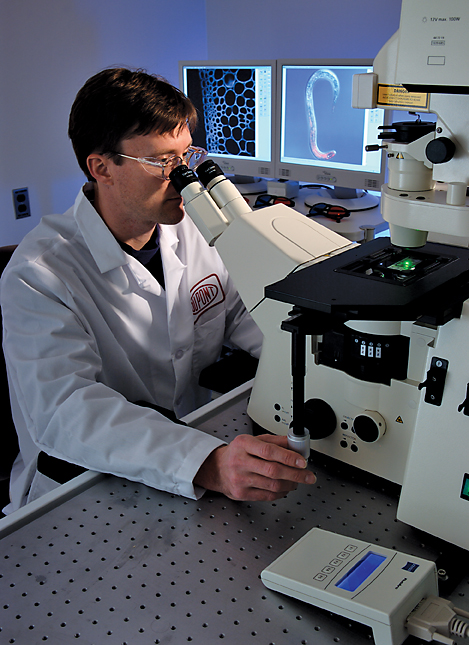

Several of the sector’s major companies, including industrial icons DuPont, Monsanto, Dow and Bayer, have announced R&D expansions in recent months. DuPont announced in March that it would invest US$40 million in a new genetics research facility at its Pioneer Hi-Bred business in

DuPont selected Johnston, a Des Moines suburb, for the expansion after looking at other company locations around the globe, including Wilmington, Del., the San Francisco area, China and India, says spokeswoman Julie Kenney. The Pioneer division includes about 100 research centers, with

“We have a great relationship with the city and state,” Kenney says. “We also looked at where we can attract employees and what other research we are doing in the area.”

Construction is set to begin on the three-building, 200,000-sq.-ft. (18,580-sq.-m.) facility in September with occupancy in 2012.

“Certainly the demand for products is there,” Kenney says. “We need to be developing advanced solutions to provide food for a growing population.”

Pioneer has several other active expansions in

A $55-million commercial and parent soybean seed production plant will be built on a 129-acre (52-hectare) site in

Monsanto Expands Dole Ties at NCRC

Missouri-based Monsanto announced early in 2010 that it would become a tenant in the North Carolina Research Campus in

“The North Carolina Research Campus offers the opportunity for new relationships between companies like Monsanto and the academic institutions locating here that could ultimately lead to new healthy choices for consumers,” says Susan MacIsaac, site lead for Monsanto at NCRC. “The synergy that exists at a campus like this could lead to truly innovative research and products with long-term benefits for all of us. Having access to the cutting-edge technologies that the campus provides its tenants also will help new scientific breakthroughs in the areas of human health and nutrition.”

MacIsaac says Monsanto expects to be operational this summer with about 12 employees.

“Teamwork and third-party collaborations are at the core of Monsanto’s R&D leadership.” MacIsaac says. “The NCRC offers a unique opportunity for new partnerships between academic institutions and companies like Monsanto to foster collaborative research in human health, nutrition and biotechnology and to accelerate development of foods with enhanced flavor and greater nutritive value.”

In April, Monsanto completed the purchase of the

Monsanto has also opened a new corn breeding station in Flora, Miss. The $2.4 million, 26,000-sq.-ft. (2,415-sq.-m.) facility in the

Corn production in the South has been growing in the last several years, and the new site’s research focus will be on using the latest breeding techniques to develop higher-yielding corn hybrids with greater resistance to disease and other environmental stresses, specifically adapted to the region. The site will complement Monsanto’s global breeding program and become part of a network of more than 50 corn breeding locations around the world.

“Our focus on research and development is what makes Monsanto a leader in agricultural productivity,” said Ted Crosbie, global breeding lead for Monsanto. “Our new facility in Flora will help further strengthen our R&D capabilities, and also is a great opportunity for us to strengthen relationships and collaborations in the southern states.”

Also in April, Monsanto broke ground on a soybean seed production facility in

University Projects

The new 90,000-sq.-ft. (8,361-sq.-m.) facility will feature flexible, open laboratory spaces, offices, growth rooms, growth chambers, a 220-seat auditorium and a central collaborative space for meetings and informal interaction. The project will also include physical connections between the existing plant biology, plant and soil sciences and greenhouse facilities on campus to facilitate improved connectivity and collaboration between researchers. SmithGroup is providing architecture, engineering, interiors, lab design, lab planning and site design services for the new facility, which is scheduled for completion in 2012.

The first of four planned buildings at the UT Southwestern BioCenter in

“We anticipate that BioCenter will become an engine for development of innovative treatments and medical device technologies that will fill unmet patient needs,” said Dr. Daniel K. Podolsky, president of UT Southwestern.

BioCenter was one of nine Dallas-area companies and organizations to receive Momentum Awards in 2009 from the Dallas Regional Chamber. BioCenter received the Technology Catalyst Award, which is presented to a company or organization working to develop and encourage new technology that yields economic growth.

“We’re in an active recruitment mode for bringing in companies,” said Dr. Dennis Stone, vice president of technology development. “We are seeking companies that are complementary to research and clinical activities at UT Southwestern. That is the main driver for why a company would want to locate in this facility. The ability to collaborate with UT Southwestern’s top-tier scientists, as well as access to the world-class research facilities on our campus, sets BioCenter apart from other incubator-type facilities.”

The technology development group is in discussions with a number of companies, including local businesses with interests in medical device technologies, West Coast groups interested in establishing a drug development consortium, and companies based in Hong Kong and

“The fact that most of these companies are from elsewhere is the norm for units such as ours,” Stone said. “If you look nationwide, and in Canada and Asia, about 85 percent of the occupants of a university-associated commercialization center come from elsewhere to draw on university intellectual and technical resources.”

Looking for VC

A recent PricewaterhouseCoopers LLP (PwC) report indicates that companies in the life sciences sector captured the largest share of overall venture capital during 2009, reflecting the sector’s relative strength during the economic downturn. Funding for 2009 totaled $6 billion in 715 deals, accounting for 34 percent of all venture dollars invested, compared to 28 percent in 2008.

“Venture capitalists see real opportunity for growth within the sector. As the worldwide population ages and more people enter their years of greatest healthcare need, demand for new pharmaceuticals, diagnostics and medical devices has the potential to go higher than we’ve ever seen,” said Tracy T. Lefteroff, global managing partner of the venture capital practice at PricewaterhouseCoopers. Compared with 2008, dollar investments into life sciences plunged 22 percent in 2009, while the number of deals dropped 19 percent during the same time period, marking its lowest point in the past six years. Despite the decline, life sciences investment has outpaced overall venture capital funding since the third quarter of 2008, according to PwC.

The top five metropolitan regions receiving life sciences venture capital funding during 2009 were

Funding in the

Lab Culture Healthy in

Innova was founded in 2007 by the Memphis Bioworks Foundation as a venture capital firm for early-stage life science companies. Ken Woody, president of Innova, says when the firm started, there was an opinion in

“It’s hard unless you are on the West Coast or the East Coast,” Woody says. “It’s hard to find, good, available venture capital money, particularly for early-stage companies. We created a fund for the sole purpose of early-stage companies, primarily in healthcare, biotechnology and medical devices.”

During its first two years, Innova looked at 250 business plans and has looked at 250 more in just the last several months, Woody says. So far Innova has invested in eight early-stage companies.

“We are located right on the campus of the University of

“We tell the folks that we counsel that it’s pretty tough,” Woody says. “We tell them you have to be almost perfect to get funds today. You’ve got to find a venture capital fund in your specific sector. They have to like your stage and then have to be willing to invest. A lot of funds are sitting on portfolio companies and taking any money they have to keep companies afloat.”

Woody says while funding conditions have improved over the past six months, competition remains fierce. Companies seeking funds should come armed with a good management team, good intellectual property and a clear plan to achieve profitability, he says.

Entrepreneurial companies in central

“We are very pleased with our venture funding numbers this year,” said Dean Harvey, executive director of the

Over the past two years more than $116 million in venture funds was raised by Lexington-area companies. Venture funding not only comes from angel investors and venture capital firms, but also from founders, friends and family; federal funds including SBIR and STTRs; Kentucky state funds; and from strategic partners.

Dow Keeps Growing

Indianapolis-based Dow AgroSciences announced in March that it would invest $340 million and create more than 550 jobs over the next five years in an expansion of its global headquarters. The first phase of the expansion includes the construction of a 175,000-sq.-ft. (16,250-sq.-ft.) research and development building, as well as a 14,000-sq.-ft. (1,300-sq.-m.) greenhouse on the company’s corporate campus. These facilities are part of a global growth plan for Dow AgroSciences’ research efforts.

“

In 2009, as previously reported in these pages, the company announced numerous plans for expanding its research capacity, including the signing of a 15-year lease on an 80,000-sq.-ft. (7,432-sq.-m.) research facility adjacent to its corporate headquarters in

The Indiana Economic Development Corporation (IEDC) offered Dow AgroSciences up to $12.5 million in performance-based tax credits and $205,000 in training grants based on the company’s job creation plans attached to the new project. In addition, pending IEDC board approvals, IEDC will provide the City of

The City of

Southern Initiatives

PMC Biogenix has established a new technical center devoted to the development of new products from renewable resources. The Center for Renewable Chemistry is located on PMC’s 42-acre (17-hectare) integrated oleochemicals [chemicals derived from animal fats] and derivatives manufacturing site in

The facility provides a technical platform to enhance commercial service to a variety of market segments, including plastics, lubricants, personal care, and consumer products, said William Hayes, PMC business manager.

Bayer CropScience officially opened its new Cotton Research and Development Laboratory in

“Bayer CropScience is driven by innovation, and cotton is a key crop focus for us. The Cotton Research and

The company has a goal of tripling its global sales in the bioscience segment to around $1.9 billion by 2018. Dr. Friedrich Berschauer, chairman of Bayer CropScience AG’s Board of Management, has said that the company’s goal is to further strengthen its role as a leading supplier of innovative technologies in all business segments, to grow its portfolio strategically, and to expand its business sustainably in rapidly growing emerging markets. The growth strategy revolves around chemical crop protection, plant traits, and high-quality seed.

The Texas Department of Agriculture (TDA), in cooperation with the Comptroller’s State Energy Conservation Office, plans a comprehensive bioenergy study for the state, aimed at diversifying its energy mix. “Creating a renewable fuels strategy that does not abandon market principles puts us on a path to energy independence while offering job growth and opportunities for rural economic development,” said Todd Staples, agriculture commissioner.

The report will identify the state’s bioenergy needs and investigate opportunities for

“With more than 15 different energy sources,

In 2009, the Texas Bioenergy Policy Council and the Texas Bioenergy Research Committee were created by the legislature to make the state a leader in biofuel and biomass-based electricity production. Staples chairs the 18-member board of the Texas Bioenergy Policy Council, which is composed of policy makers and industry experts.

The bioenergy industry study will examine various bioenergy feedstocks; the logistical challenges related to the production and transport of biomass; and the integration of bioenergy to meet the state’s energy demands.