Canada’s clean even as it continues to clean up with natural resources plays. Texas is a nexus for renewables as well as for oil and gas. And Austin’s longstanding sustainability ethos is, thankfully, not as weird as it used to be — sustainability has become a standard performance metric for places and employers worldwide.

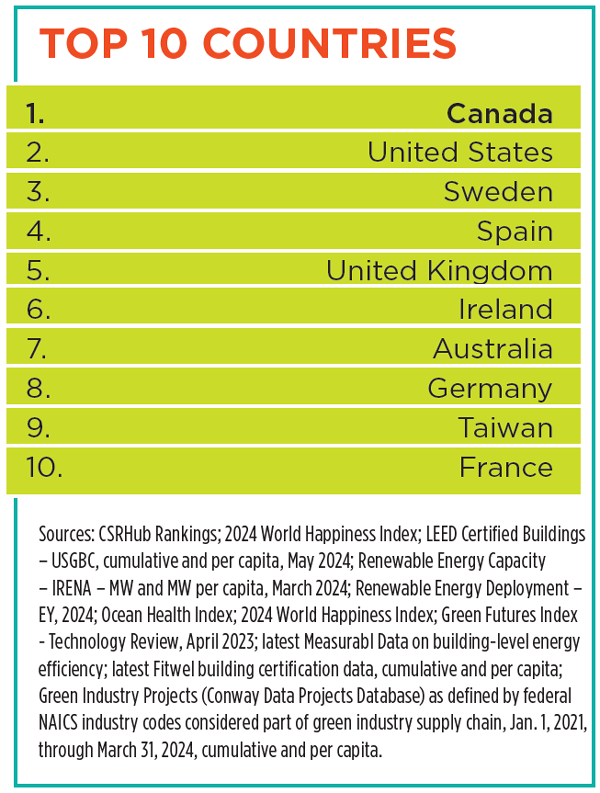

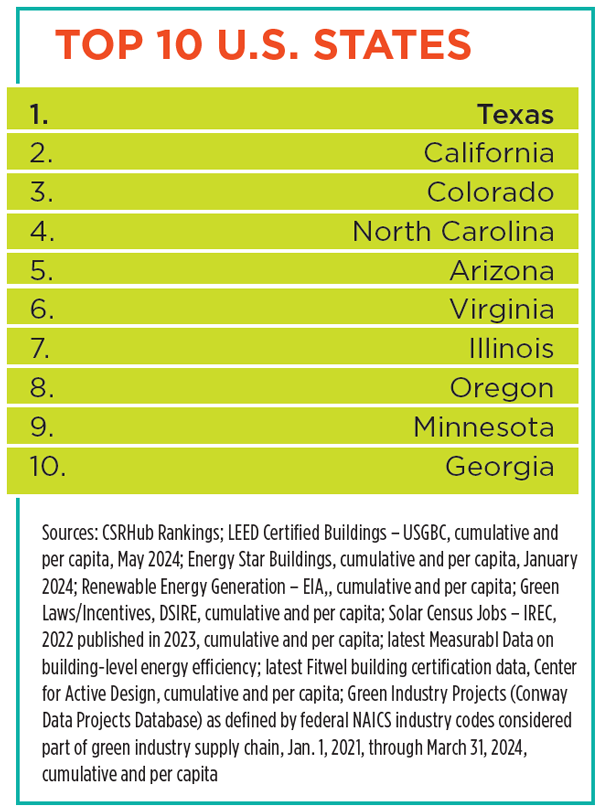

Those three places top the 15th annual edition of Site Selection’s Sustainability Rankings, which reveal the countries, U.S. states and U.S. metros cultivating the most fertile environment for a sustainable economy. The rankings are based on a unique index incorporating everything from green building square footage per capita and overall happiness to manufacturing of renewable energy products and a territory’s number of sustainability-oriented incentives and policies.

For perspective on the sustainability leadership of some of our top-ranked territories I turned to Panu Pasanen, CEO and founder of Finland-based One Click LCA, a software platform used by such firms as Skanska, AECOM, Foster+Partners, LafargeHolcim and Saint Gobain for life-cycle assessment and environmental product declaration in construction and manufacturing.

For perspective on the sustainability leadership of some of our top-ranked territories I turned to Panu Pasanen, CEO and founder of Finland-based One Click LCA, a software platform used by such firms as Skanska, AECOM, Foster+Partners, LafargeHolcim and Saint Gobain for life-cycle assessment and environmental product declaration in construction and manufacturing.

“The Canadian federal government has introduced several mandatory policies for federal projects, including concrete carbon performance,” he says of our No. 1-ranked nation. “Two of the largest metros, Toronto and Vancouver, have municipal regulations that mandate and incentivize decarbonization of construction projects. In Vancouver, this also applies to re-zoning requests that must be more sustainable. That said, there is of course more work to do in other provinces and territories.”

“Our customers see that when they implement sustainable investments, they are able to get better anchor tenants, sometimes rent premiums, favorable mortgages and ability to de-risk portfolios without stranded assets.”

— Panu Pasanen, CEO and Founder, One Click LCA

Meanwhile, the Nordic countries continue to lead the way globally on policy, he says, committing to regulations that limit carbon in new buildings and “driving forward a series of reforms on energy, including renewable energy, while adding new jobs to the economy. Sweden has already decoupled carbon emissions from economic growth. And, based on the progress to date, it appears the Nordic countries are on the right track to replicate this in the near future.”

He also says of our No. 2-ranked state, “California government has managed to institute statewide mandatory accounting for new construction in the form of CALGreen, the first of its kind in the United States, as well as mandatory greenhouse gas disclosure regulation for large firms. California is driving legislation forward, which makes these kinds of practices stickier.”

While such regulations at first blush seem connected to the many reports of companies leaving the state, California continues to climb in Site Selection’s annual Governor’s Cup tally of corporate end-user facility investments, ranking No. 4 for the past two years with a combined 747 projects.

Deep Data, Trustworthy Sources

Exclusive data partners for the 2024 Sustainability Rankings include San Diego-based Measurabl, which again contributes to our location-based analytics from a proprietary database of building-level ESG data from more than 15 billion sq. ft. of real estate across more than 90 countries.

“As in previous years, we at Measurabl are elated to see that, by and large, the trends that are materializing from our building and meter level data, the most comprehensive data source of its kind, are mirrored in similarly potent sources of data from across the globe as they’re ultimately synthesized for these rankings,” says Chad Boyle, business applications analyst at Measurabl. “Notable this year, however, is the emergence of a new heavy-hitter: Taiwan. I think the inclusion of Taiwan in this year’s rankings demonstrates that ESG is increasingly top of mind on a global scale, with APAC entering the fray in earnest (on this stage, anyway) for 2024.”

The sun sets behind the T-bone Wind and Ribeye Wind farms near Dumas, Texas, a state where 40,556 MW of wind power in 2022 accounted for more than 26% of all U.S. wind-sourced electricity.

The sun sets behind the T-bone Wind and Ribeye Wind farms near Dumas, Texas, a state where 40,556 MW of wind power in 2022 accounted for more than 26% of all U.S. wind-sourced electricity.

Photo by Werner Slocum courtesy of NREL

The Center for Active Design shares with us its latest global data and analysis from the Fitwell healthy building certification standard it oversees that currently has more than 2.5 billion sq. ft. registered on its platform, impacting more than 2.6 million people in 50 countries. Among many Fitwel case studies is a recent report performed with QuadReal Property Group across 60 properties showing that healthy building strategies “not only improve human health — they drive occupant satisfaction and financial outcomes.” An updated Fitwel standard was released in early June that introduces a “Smart Scorecard.” In May, the Global Wellness Institute reported that the wellness real estate market — defined as homes and buildings that are proactively designed and built to support the holistic health of their residents — grew from $225 billion in 2019 to $438 billion in 2023.

Another data partner is CSRHub, the organization that tracks environmental, social and governance (ESG) metrics for more than 56,000 companies across 210 countries using more than 900 sources.

CSRHub co-founders Bahar Gidwani and Cynthia Figge cross-reference their data on companies with Site Selection’s proprietary company facility project investment data in its Conway Projects Database to see where high-CSR companies are investing.

“The number of entities touched by both of our studies has grown,” Gidwani says. “We can now track the difference between the average rating and the siting company rating for 61 countries and 48 U.S. states. One thing that strikes me is that siting companies have average ratings that are almost always above the scores of the local country ratings. (They are always above the average for our state comparison.) This confirms that the entities that expand into other areas are, in general, those who have good sustainability profiles.”

More Than Virtue Signaling

That pattern appears to be in contrast to regulations some localities have introduced that seek to limit or completely eliminate ESG departments or remove it as an allowable consideration in investment prioritization by states. More than 20 states have passed or introduced legislation to prohibit ESG considerations in state investment decision-making.

S&P Global reported last fall that at least 165 bills and resolutions against ESG investment criteria were introduced in 37 states between January and June 2023, “despite legislative analyses that pointed to billions of dollars in potential losses.” But that didn’t mean they moved forward. As of June, according to a report S&P cited by climate risk consultancy Pleiades Strategy, just over half of those initiatives had failed, although “the North Carolina Legislature overrode a veto from the state’s Democratic governor June 27, securing the 20th anti-ESG law so far this year,” S&P reported.

North Carolina continues to score well in our sustainability rankings at No. 4 in the nation, with the Charlotte metro region ranked No. 3 among all U.S. metros. The state is also home to the U.S. DOE-supported North Carolina Clean Energy Technology Center at North Carolina State University, whose data feed into our rankings. Established in 1995, the center is the operator of the DSIRE national database of state and local incentives and policies that support renewable energy and energy efficiency in the United States. Across the areas of distributed solar, grid modernization, transportation electrification, and power decarbonization, the organization’s Autumn Proudlove reported in December, the DSIRE team tracked more than 2,500 actions taken by states and utilities in 2023.

Can green policy itself drive business attraction and a greener building and tenant portfolio? CBRE in New York City reported in January 2024 that over a three-year period from 2021 through 2023, 31 energy-related firms (24 of which were renewables companies) signed leases in the city, motivated in part by the state’s $55 billion commitment torenewavle power goals.

In other words, companies with sustainability on their minds, far from weighing down regions with their moral priorities, appear to be helping those regions’ economies soar. Measurabl CEO Matt Ellis, for one, has some thoughts on ESG and real estate:

“When it comes to real estate, the political attack on ESG is superficial and has not impacted the longstanding, day-to-day efforts to acquire and apply ESG data toward more profitable business,” he tells Site Selection. “Real estate owners, investors and their counterparts in appraisal, lending, insurance, leasing and so on are focused on maximizing income with minimum risk and know ESG has a material difference in how they underwrite that equation.

“For example,” Ellis says, “one thing we do at Measurabl is take energy consumption across an entire portfolio to calculate carbon impact and the resulting regulatory exposure a given building and ultimately a portfolio faces. Not only does that help net operating income (NOI), which is often the largest controllable expense in a building, but it informs capex investment and tradeoffs between asset value and cash flow.

“Our industry knows that a rose by any other name is still a rose,” Ellis says. “Some politicians have tried to redefine ESG in real estate as mere virtue signaling. But, for the last 20 years, it has instead been an increasingly well informed, judicious calibration between risk and reward — the exact thing politicians and regulators say they want from business. And that’s where real estate is, in fact, setting the leading example.”