The quality of a message to stay with you long enough to spark action is called the Stickiness Factor. The Pacific Northwest apparently has it where people are concerned, as Oregon (No. 1) and Washington are in the Top 10 in percentage of inbound-vs.-outbound moves in United Van Lines’ annual National Movers Study. “Of moves to Oregon, a new job or company transfer (53 percent) and wanting to be closer to family (20 percent) led the reasons for most inbound moves,” said the moving company.

Has the region proved equally sticky in economic development? Low cost of power helps when it comes to the region’s wealth of data centers. High levels of fiscal solvency, workforce education, urban center redevelopment and Asian connectivity help with everything else. Corporate facility investment project data from the Conway Projects Database show healthy numbers across a number of industry sectors such as metals, aerospace and engineering, with particular strength in the life sciences. Greater Seattle and Portland lead the way as one would expect, often thanks to significant project activity in suburban locations such as Hillsboro in Oregon, and Bothell, Vancouver, Kent and Everett in Washington.

“When it comes to the 21st century, the winners will be smart cities. The unique business ecosystems of urban cores, universities, and unencumbered access will mean cities like Seattle and Portland will be winning locations,” says Marc Ross, co-founder of DC-based public affairs and global business PR firm Caracal Strategies, and former communications lead at the US-China Business Council. Asked if the area’s longstanding connections with Asia are only getting stronger, he says, “With the continued rise of business, commerce, diplomacy, education, and hospitality across the Pacific Ocean, cities like Seattle and Portland are well positioned — geographically and psychically — to fully take advantage of exceptional growth opportunities in markets across Asia.”

Trans-Pacific Ties

The Trans-Pacific Partnership has been making headlines over the past year. But the Pacific Northwest was trans-Pacific before it was cool.

Asian companies continue to invest in the region. Among them is Toray Industries, whose prepreg carbon fiber investment in Tacoma was officially opened in September 2015. Established in 1992, the site in Tacoma’s Frederickson industrial area, including a research lab, now operates 24/7 to provide materials to aerospace, sports, and industrial customers around the world, and employs 400.

Last August, Mitsubishi Aircraft Corp. launched full operations of its Seattle Engineering Center (SEC). “The opening of a development center in Seattle, the global hub of the aviation industry, enables Mitsubishi Aircraft to tap professional expertise on aircraft development and to accelerate the development of the MRJ (Mitsubishi Regional Jet),” said a company release. Testing will take place at Grant County International Airport at Moses Lake in Washington, later this year, after the first MRJ test flight took place in Nagoya, Japan, in November. Delivery of the first MRJ aircraft is scheduled to take place by Q2 2018. SEC is staffed by approximately 150 employees, including about 100 engineers recruited mainly in Seattle and about 50 engineers from Japan.

At the Port of Vancouver, Wash., near Portland, Maruichi has opened a $30-million, 50-job structural tubing mill on the Columbia River, with both highway and rail access. The port also just renewed a lease agreement with Boise Cascade Building Materials Distribution, and is soliciting bids on new mixed-use development.

Cushman & Wakefield/Commerce says the Pacific Northwest ports, including Tacoma (No. 9 US port by volume) and Seattle (No. 4), are well positioned with regard to the Panama Canal expansion, offering timely and affordable shipping to inland locations such as Chicago and Minneapolis that will be competitive with East Coast ports.

Perhaps the best illustration of the Asian connection, however, is the Global Innovation Exchange (GIX), a partnership between the University of Washington and Tsinghua University with $40 million in funding from Microsoft. Announced last summer, GIX will open in fall 2016 at a new building in Bellevue’s sustainable and transit-oriented Spring District, on Seattle’s East Side. According to recent media reports, the Spring District also is in the running for a possible REI headquarters relocation from its current home campus in Kent.

The GIX project marks the first time a Chinese research university has established a physical presence in the United States.

“Within a decade, we expect that more than 3,000 learners will be studying at GIX, in a holistic, project-based environment,” says a GIX statement. “GIX’s emphasis on the interplay between technology development, design, and entrepreneurship will prepare students to contribute solutions to a range of global challenges, including on issues such as mobile health, sustainable development, and the continuing advance of cloud computing and the Internet of Things.”

High Performance

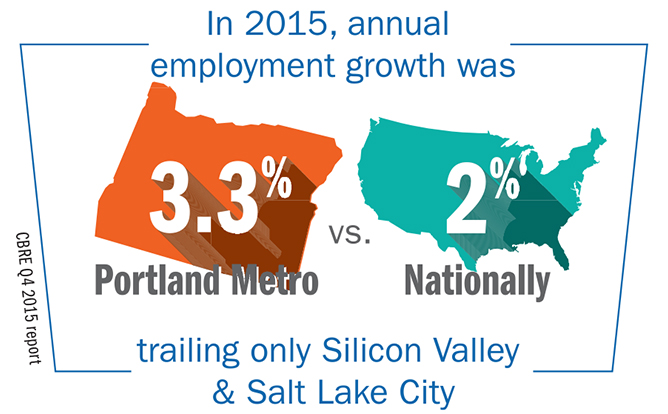

The 2015 Best-Performing Cities report from Milken Institute ranks the 200 largest US metro areas, as well as 201 smaller metros. The Pacific Northwest stands out, as Seattle-Bellevue-Everett moved up four spots to No. 7, and Portland-Vancouver-Hillsboro leapt eight spots to No. 8 in the country.

Among the smaller metros, Bend, Ore., was No. 8 in the nation. Other strong small cities in the region include Wenatchee, Wash. (No. 14); Bellingham, Wash. (No. 18); and Medford, Ore. (No. 28).

Bend’s performance — a leap of 38 spots — was driven by job growth, pure and simple.

“Notable tech-startups in the metro include Element1, G5, and Agere Pharmaceuticals — all of which have expanded rapidly in recent years,” said the Milken report. Bend Research, a division of Capsugel that makes gel capsules used by pharma and other sectors, just completed a two-year, $25-million expansion. “High-tech output growth in the metro grew 19 percentage points above the national average between 2009 and 2014,” said Milken.

A Healthy Life Sciences Sector Gets Healthier

The prowess on display at Bend Research is just the tip of the iceberg when it comes to biopharma momentum in the region.

Last March, Roche Group’s Genentech announced plans to invest more than $125 million for the expansion of its fill/finish facility in Hillsboro, Ore., which originally opened in April 2010. The expansion means up to 100 new manufacturing jobs, and a total of more than 500 Genentech jobs statewide, over the next five years.

Recent investments in Greater Seattle have included Zymogenetics and CMC Biologics in Bothell. Juno Therapeutics has invested twice in the State of Washington over the past year: a $15-million manufacturing plant in Bothell, and an $8-million, 175-job expansion at its headquarters in Seattle.

The institutional strength of Seattle continues at the Allen Institute, which opened its new headquarters in Seattle’s South Lake Union neighborhood, the city’s biotech hub, in December 2015.

Power Conversion

The Bonneville Power Administration (BPA) recently invested $370 million into modernizing the Celilo Converter Station, including six new transformers that each weighed more than a Washington-made Boeing 747.

Celilo is a crucial piece of electrical power infrastructure that “tames and transforms” high volumes of electricity flowing through the northern end of the Pacific Direct Current Intertie, the 846-mile “electron super-highway” between Los Angeles and the Northwest that has attracted visits from utility leaders as far away as Asia and Africa. Affordable power from BPA and others is a chief reason why both Washington and Oregon continue to attract data center investments. A January data centers report from JLL stated, “Northwest U.S. markets such as Oregon and Washington will experience increased demand from California-based technology companies and Asian companies accessing new trans-Pacific wiring.”