Catherine Smith, Connecticut’s Commissioner of Economic and Community Development, explains how her state competes to win in the fiercely competitive global aerospace industry. A pipeline of skilled labor, an enthusiastic consortium of suppliers to OEMs and an improving business climate are just part of the story, she explains.

Aerospace has been an important industry sector in Connecticut for many decades. What has been the key to keeping this industry strong for so long?

It helps that we have anchor tenants in the aerospace industry. We have UTC here, particularly Pratt & Whitney, Sikorsky and Hamilton Sundstrand. They have helped us retain and grow some very interesting companies here.

About 10 years ago, the supply chain companies formed the Aerospace Components Manufacturers, a business alliance of 94 companies that work together on very important areas like workforce development and training. That’s helped us, too – these companies being so closely knit creates an ecosystem that is outstanding, even if it’s not as big as can be found in some other states. It’s given us an edge, I think, in terms of meeting the needs of OEMs here in the state, of course, but also Boeing, Airbus, Rolls Royce and others as well.

The state, under Governor Malloy’s leadership, has tried to create the environment that helps keep these companies here. Asnuntuck Community College, in Enfield, has a fantastic manufacturing facility insider of it that is geared to the aerospace community. An advisory board has many aerospace company members. They are able to create a workforce pipeline that has been very helpful to the companies as well. So a lot of things have helped us build this very strong niche, and now, with this potential for real increases in demand for aircraft from Asia and here in the US, the industry here in Connecticut is very well positioned and ready to go as we move forward.

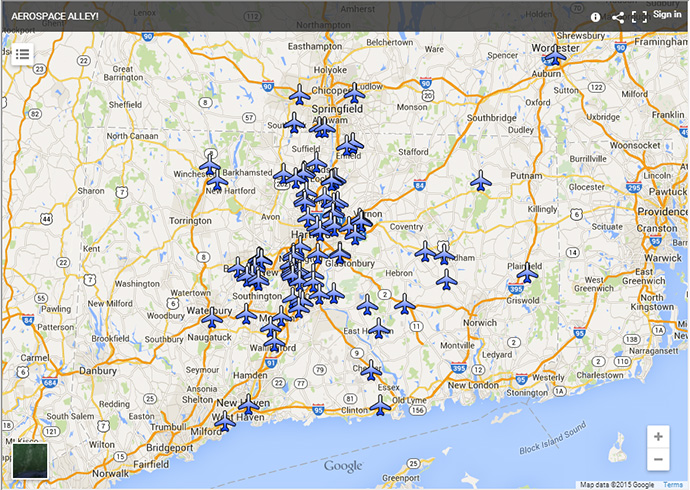

A lot of the aerospace companies are located along the I-91 corridor, and about half of them are in the northern half of the state [as is Enfield, on the Massachusetts border]. The governor and I have been told by companies that Asnuntuck is exceptional and that we should replicate it. The first year the governor was in office he asked the legislature for the funding to do that, and they agreed. We expanded the same program that’s at Asnuntuck to three other community colleges, and we’re now expanding it into three more. We really believe that framework has made a difference, so we’ve been making a lot of changes to support the industry, to help them continue to have a pipeline of workers. That’s on the community college side. There’s also UCONN and its gigantic engineering school, which has been expanded dramatically.

A lot of the aerospace companies are the innovation chain for the Pratt & Whitneys of the world, and they hire students from the community colleges. The regular undergraduate level and the PhD level, too, for their design work. The investment at UCONN is essentially doubling the number of graduates over the next couple of years.

How is the sector evolving in terms of what it actually does in Connecticut? Is there more R&D now than manufacturing, for example?

Over the last 25 years, a lot of manufacturing jobs have gone away – not as much in aerospace as in widget-oriented manufacturing. We’re probably best known for R&D and manufacturing of prototypes and other front-end [applications] on the learning curve in manufacturing. Having said that, though, there are still a number of companies that produce real parts for engines on a regular basis. Especially in the supply chain, some are doing very leading edge work with Pratt & Whitney or Rolls Royce, for example. And we have a lot of companies that are churning out a lot of very precise, nano-modeled components.

If you look at UTC and Pratt & Whitney, they had a lot more manufacturing jobs here about 15 years ago. They still have manufacturing in Connecticut – a big plant in Middletown among others. But they’ve also moved a lot of their manufacturing closer to where the work is actually being put on the plane. They have manufacturing now in Asia, Europe and other parts of the US. But we’re pleased they still have manufacturing in Connecticut, and a lot of the suppliers are pretty large and do manufacturing here in the state.

Our workforce is extremely productive. We may not be the lowest cost location, but the value from the workforce here has been very good, and we continue to see companies expanding here, such as EDAC, which is expanding here and adding a couple of hundred jobs.

How does the state compete against other aerospace powerhouse states, such as Washington and Oklahoma?

We do think about how we compete, not just with other states, but globally. These days, the choice of where you put your workforce is not limited to the 50 states. That’s why we’re looking holistically at creating the right environment. For every company I’ve spoken to, whether an aerospace company or one in financial services or healthcare or others, it’s the people who drive their decisions about where they will do the work. They really need access to a skilled workforce, which is particularly true in aerospace because of the changing and much more technical nature of the industry. That’s one of our true advantages. That’s not to say other states don’t have great people, but it’s an area where we’re making great progress. Relative to Europe, Connecticut looks low cost; we’re on the East Coast right next to these huge markets, we have a major OEM right in the state. All of these things are advantages to the state. We won’t get all the projects, but we have some real advantages that are very competitive when you look at other locations.

Executives in other sectors in other locations cite high taxes in Connecticut (9 percent corporate income tax) as a barrier to their expanding operations there. Is this a problem in terms of growing the aerospace sector?

On a total business tax basis, I think the state is in the top 10 states by one measure in terms of the cost of our overall taxation on business. The business side of the taxation world is pretty reasonable. People talk about income tax and that we have it and some states don’t is an issue. Relative to nearby neighbors like New York and New Jersey we look very good. But clearly we’re not the lowest cost location in the nation. But again I would argue that there is value you get for those taxes in the way of education, access to markets and so forth. Being a low-cost state is not in our cards, but we focus on the rest of the business environment to make sure we have a very highly trained workforce and that a pipeline of productive workers are available to companies. That is extremely important to them.

If Connecticut were a country, it would rank 5th in Gross Domestic Product (GDP) per capita, at $69,312 in 2013 US dollars, according to the International Monetary Fund and the US Bureau of Economic Analysis.

| 1 | Luxembourg | 112,473 |

| 2 | Norway | 100,579 |

| 3 | Qatar | 98,986 |

| 4 | Switzerland | 81,276 |

| 5 | Connecticut | 69,312 |

| 6 | Australia | 64,578 |

| 7 | Denmark | 59,129 |

| 8 | Sweden | 58,014 |

| 9 | Singapore | 55,182 |

| 10 | United States | 53,001 |

If you go out and ask businesses in Connecticut right now about the business climate in general, there are a few things they’ll complain about. But in general, it’s been improving. Gov. Malloy has done so much to make the business climate better. When he came into office four years ago, there was a $3.5 billion deficit and a $20 billion spend. It was a big problem. We’ve since had balanced budgets every year, and we haven’t had to make enormously painful changes to make that happen. We are looking at another deficit for the next biennium right now, but the governor is confident he can solve the problem. His goal is to shrink government, to make it more nimble. We’ve brought lean principles into government, and we’ve eliminated thousands of pages of regulatory requirements. The business community recognizes that things are definitely getting better.

How does the state supply the highly skilled labor the aerospace industry requires?

In addition to the cornerstone legislation in 2014 involving UTC’s commitment to expanding in Connecticut [see the following article], we asked the legislature last year to pass legislation called the Manufacturing Innovation Fund, which was passed – unanimously, I believe, by both houses in June. That fund essentially provides opportunity for the small- to mid-sized companies to gain access to more technological resources to support their growth and innovation. This is particularly important to the aerospace guys, because they’re looking at a very fast ramp-up to keep up with the large OEMs who are talking about tripling their production in the next few years. The piece already out the door is a voucher program that provides training, access to IP lawyers or a UCONN professor if you need help solving an engineering problem and so on. It’s a program for $5,000 to $50,000 investments. That’s the first piece. The second will be for training. The Board of the Fund [the Commissioner is the Chair] is very keen that we are providing the resources to get a workforce up and trained to meet this very fast ramp-up. So the second part will be for incumbent worker training, and the third will be for apprentices. This is a bit unique if you look at other states. We have some things here that will be really helpful to our manufacturers and will help us draw more here from around the globe.

Where Aerospace Components Manufacturers (ACM) Members Are Based