In response to this growing need of life sciences companies for comprehensive and unbiased information on various countries and their ability to host key value drivers, KPMG, in collaboration with Venture Valuation and EuropaBio, has published the third edition of its report “Site Selection for Life Sciences Companies in Europe. ” The new report supports life science companies in smart site selection in Europe, taking into consideration the expansion and redesign of their value chains following the introduction of new Base Erosion and Profit Shifting (BEPS) regulations.

Below are excerpts from the report and from a June 6th blog from report co-author André Guedel, head sales and business development for KPMG Tax in Switzerland, whose team contributed an exclusive analysis on the topic to the May issue of Site Selection.

Life sciences companies can future-proof their value chain by strategically locating functions, assets and risk in different European countries.

Value chains consist of different value drivers such as R&D, Manufacturing, Centralized Services, Marketing and Sales, Design and Branding or Procurement. Life sciences (LS) companies usually locate these key value drivers across different locations, depending on their operational and tax models. Taxes have traditionally been a significant consideration for life sciences companies whose assets mainly consist of intellectual property (IP) and brands. Because such intangible assets can be shifted easily from one location to another, they are also instrumental in reducing the global effective tax rate (ETRs) of the companies who own or exploit them.

In order to counter the excessive use of special tax regimes, which often include special tax treatments for income from IP, the OECD has developed a Base Erosion and Profit Shifting (BEPS) action plan designed to reduce the arbitrage between different tax rates and different interpretations of tax principles that arise as a result of tax sovereignty of individual countries. For life science companies, this means that they have to align their operational and their tax planning models in such a way that their value chain is compliant with the new BEPS regulations and offer potential for profitable growth and value creation. In other words, life science companies have to future-proof their value chain by placing functions, assets and risks in locations where they are planning to have their profits taxed. Structures where profit allocations are made in tax-beneficent locations with little or no substance are no longer viable.

This leaves executives of life science companies with the task of finding locations which offer the right mix of operational and tax benefits for certain value drivers. This is particularly challenging in Europe, which, on one hand, is one of the largest market for life science products but on the other hand is also the most rigorous in terms of applying the new BEPS standards.

Number of companies in the LS industry

| Country | Biotechnology | Biotech Therapeutics | MedTech | Pharma |

|---|---|---|---|---|

| Austria | 94 | 40 | 52 | 15 |

| Belgium | 265 | 50 | 135 | 74 |

| Denmark | 137 | 58 | 71 | 10 |

| Finland | 82 | 14 | 37 | 10 |

| France | 720 | 138 | 160 | 94 |

| Germany | 1,042 | 159 | 572 | 103 |

| Ireland | 65 | 18 | 39 | 11 |

| Israel | 334 | 154 | 545 | 36 |

| Italy | 518 | 59 | 104 | 87 |

| Netherlands | 409 | 86 | 117 | 40 |

| Norway | 120 | 27 | 32 | 8 |

| Spain | 421 | 83 | 80 | 60 |

| Sweden | 408 | 115 | 301 | 41 |

| Switzerland | 346 | 104 | 230 | 47 |

| United Kingdom | 979 | 246 | 275 | 110 |

| BayArea | 380 | 214 | 199 | 13 |

As in the past years, the newly published “Site Selection for Life Sciences Companies in Europe” report offers a comprehensive and unique overview of the various aspects relevant for smart site selection, such as size and specialization of the clusters, business-friendly legislation, macroeconomics and, naturally, the tax system. This combination of operational aspects and tax considerations gives life sciences companies a first insight how their new or redesigned value chain could look from a location point of view.

Three Flavors

According to the report, there are basically three types of European countries attractive to locate key value drivers of life science companies

- Countries with strong clusters of life science companies and an attractive tax and business environment

- Countries that have significant clusters of life science companies in their jurisdictions, but lack the benefits of an attractive business environment

- Countries which have attractive business and tax regimes without the support of a strong domestic biopharmaceutical industry

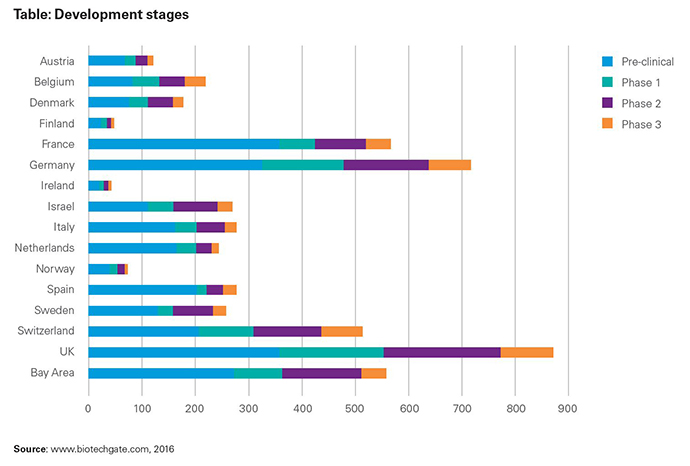

All three types of countries can offer appealing opportunities for hosting certain key value drivers of life science companies. Collaboration with suppliers, peers and/or academic institutions is a key factor for LS companies to expand their capabilities along the value chain from R&D to manufacturing to distribution. There are significant differences between the various LS clusters (size, workforce, specialization, etc.) in countries covered in this report. The number of products in development may also be an important consideration for site selection decisions, as well as the ease of raising capital and tax benefits and incentives.

There are substantial differences between locations when it comes to raising capital. For privately owned LS companies, Germany, the UK and Switzerland appeared to be the best places to raise money in 2014 and 2015. These three accounted for 86 percent of European LS financing. For financing of publicly listed companies, Ireland and the UK are followed by France, the Netherlands and Belgium. This is due to the large number of publicly held companies in these countries compared to Switzerland and Germany and also based on one-time effects from single transactions.

Number of employees in the LS industry

| Country | Biotechnology | MedTech | Pharma | Total |

|---|---|---|---|---|

| Belgium | 15,000 | 5,000 | 40,000 | 60,000 |

| France | 11,000 | 40,000 | 95,000 | 146,000 |

| Germany | 37,000 | 100,000 | 110,000 | 247,000 |

| Ireland | 6,000 | 9,000 | 12,000 | 27,000 |

| Netherlands | 8,000 | 9,500 | 9,000 | 26,500 |

| Switzerland | 20,000 | 45,000 | 40,000 | 105,000 |

| United Kingdom | 30,000 | 71,000 | 73,000 | 174,000 |

Intangible assets play a crucial role in LS, and it is essential to consider in forward-looking planning the development and exploitation of IP in the form of patents, technology and trademarks. All countries in the report — with the exception of Germany — have or are planning to put in place systems that offer beneficial tax treatments of income from IP or incentives for R&D. Given the ongoing developments with regard to BEPS, however, these measures might be subject to significant change.

Below are some edited highlights by selected countries, charts and illustrations from the report.

Belgium

Belgium has a sizeable Pharma sector (74 companies), which is fourth among the countries in scope. It has a reasonable number of Biotech companies (265), though very few are focused on drug development. Almost 60 percent of LS companies in Belgium manufacture in the country — the highest proportion in Europe. Of these companies, 32 percent undertake R&D there. It should be noted that pharmaceutical R&D centers located in Belgium account for one-fifth of the total worldwide R&D expenditures by those companies. Belgium also proves an attractive location for regional HQs (23) while it hosts 36 global HQs, including the recently attracted HQ for fast-growing company Biocartis.

France

France has a strong LS sector, especially in Biotech and Pharma. Both have a certain focus on the cosmetics, food and environmental sectors and a strong focus on R&D within the country. France has the third largest number of products in development, with a heavy focus on early-stage products, particularly in oncology, though the country is weaker in clinical stage products where its focus is more on infectious diseases. France has seen the most IPOs in Europe since 2007, with 34 companies raising money from the public market.

Germany

The largest country in Europe also has the greatest number of LS companies. German companies focus more on services, diagnostics and environmental. Medtech numbers are very strong, with a large number of innovative SME companies. These companies are often active globally, translating into a high number of global HQs. Germany has the second-highest number of Pharma companies, and the highest percentage of global HQs with manufacturing in country.

Number of global and regional HQs

| Country | Global HQs of domestic LS companies | Main activities in addition to HQ activities | Regional HQs of foreign owned LS companies | Main activities in addition to HQ activities |

|---|---|---|---|---|

| Belgium | 36 | Manufacturing 67% | 23 | Manufacturing 78% |

| France | 112 | R&D/Manufacturing 63% | 25 | Manufacturing 84% |

| Germany | 158 | Manufacturing 77% | 25 | Manufacturing 76% |

| Ireland | 29 | Manufacturing 59% | 6 | Supply/Distribution and Manufacturing 83% |

| Netherlands | 46 | Manufacturing 72% | 17 | Supply/Distribution 82% |

| Switzerland | 97 | Manufacturing 68% | 22 | Supply/Distribution 64% |

| United Kingdom | 146 | Manufacturing 53% | 37 | R&D 54% |

| Bay Area | 110 | Manufacturing 49% | 6 | Manufacturing 83% |

Ireland

Although Ireland has the smallest number of LS companies among the 15 countries covered, it is an attractive hub for overseas groups. There is rather little in terms of SME Biotech activity. Despite a focus on attracting multinationals, the number of global and regional HQs shows Ireland at the bottom of the group of the countries covered. The small number of companies leads to a pipeline that is also one of the smallest among the evaluated countries, with an especial lack of early-stage projects. In terms of funding for publicly listed companies, Ireland is top of the list with almost US$1 billion in 2014 and more than U$2 billion in 2015. This high amount is principally due to Endo International, which raised US$2.7 billion in equity and debt over 2014 and 2015. Another major event was the acquisition of Irish Covidien by US group Medtronic and the relocation of Medtronic’s HQ to Dublin. In June 2015 Johnson & Johnson Vision Care announced an investment of more than EUR 100 million to expand its manufacturing operations at its site in Limerick’s National Technology Park.

The Bay Area has roughly the same number of LS companies as Switzerland, the Netherlands or Sweden. The proportion of innovative Biotech therapeutic companies is higher in the Bay Area, however, at around double that of the leading European countries.

Netherlands

The Netherlands has a strong LS cluster focused on Biotech services. These companies offer a broad range of services, though manufacturing is performed by 39 percent of LS companies here, and R&D by only 42 percent (which is about the European average). In terms of global and regional HQs, the Netherlands has a similar number to Belgium and more than Ireland, but is behind France, Germany, Switzerland and the UK. Due to a greater emphasis on Biotech services, the pipeline — especially clinical — is rather weak.

Spain

A pre-clinical pipeline of more than 200 projects and the R&D focus of the majority of companies (51 percent) shows potential and focus for innovative therapeutic companies. There has been decreasing investment since 2009, demonstrating Spanish companies’ difficulty in raising money.

Sweden

Sweden has seen a significant investment of between US$100 million and US$200 million in LS companies every year since 2011. There is a high number of companies, with strong Medtech and Biotech therapeutic sectors.

Switzerland

Traditionally strong in LS and fueled by the two Pharma giants Novartis and Roche, Switzerland has a keen focus on innovative therapeutic Biotech companies but also a strong Medtech sector. Aside from the two giants noted, the country has an average number of Pharma companies, however. Despite the presumed high cost, many companies carry out R&D and manufacturing in Switzerland. Switzerland performs strongly when it comes to financing private companies, raising the second highest amounts in 2014 and 2015, behind the UK. It is a less impressive picture for publicly listed companies, however, with only a few launched on the stock exchange since 2007. Switzerland is the fourth strongest Medtech country in Europe, with one private company raising U$180 million in 2015 alone. There is a high number of Biotech and Biotech therapeutic companies relative to the country’s size.

United Kingdom

The UK has the second highest number of LS companies in Europe, but the highest number of innovative companies in Biotech therapeutics. The UK also leads in Pharma companies. Surprisingly, however, only 40 percent of the companies undertake R&D in the UK, and only 35 percent manufacturing. The UK has the most regional HQs and the second most global HQs among the countries covered. For products in development, the UK has the strongest pipeline in Europe, with an emphasis on pre-clinical and a strong showing in clinical (primarily oncology). UK companies were able to raise record amounts in 2014 and 2015: Public companies raised more than US$2 billion in 2014. Privately owned companies have consistently raised more than US$400 million each year since 2011.