What’s still moving forward and what’s not in the pandemic era?

You’d think data center growth would be stronger than ever, if only to support the stay-at-home shopping and Zoom calls alone.

Facebook in late June committed to invest $800 million in a new data center campus in DeKalb, Illinois. The 907,000-sq.-ft. (84,260-sq.-m.) facility, Facebook’s 12th U.S. data center, will be supported by 100% renewable energy, and will support 100 operations jobs and 1,200 construction jobs at peak construction.

“There are many variables that enter into the decision process for data center locations, and DeKalb provided many compelling reasons for Facebook to bring our newest data center to Illinois,” said Rachel Peterson, vice president of data center strategy for Facebook, citing strong collaboration with the City of DeKalb, the DeKalb County Economic Development Corporation and the Illinois Department of Commerce & Economic Opportunity.

Google earlier this year promised to spend $10 billion this year alone on its U.S. data centers and offices. Those plans are still in place even if the pandemic is delaying their implementation. The company spent $13 billion on digital infrastructure in the U.S. in 2019.

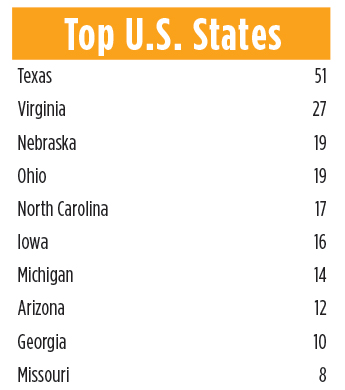

“Google has a presence in 26 states across the country,” said Google and Alphabet CEO Sundar Pichai in February, “and our new investments will be focused in 11 of them: Colorado, Georgia, Massachusetts, Nebraska, New York, Oklahoma, Ohio, Pennsylvania, Texas, Washington and California.”

Google plans to expand offices and data centers in Texas, Alabama, South Carolina, Virginia and Tennessee. A new data center is coming to Ohio. And further investment is on the way for data centers in Nebraska and Oklahoma — Pichar visited the company’s site in Pryor, Oklahoma, last year to announced a $600 million investment, the fourth expansion there since 2007. Out west, the Google Cloud campus is expanding in Seattle, and both office and data center investments are coming to Oregon.

Alibaba 0n the Move

China-based Alibaba Cloud in May pledged to invest $28 billion over three years in its cloud infrastructure and next-generation infrastructure. Alibaba said its investment aims to help businesses in different sectors to speed up their digital transformation after the pandemic.

“The Covid-19 pandemic has posed additional stress on the overall economy across sectors, but it also steers us to put more focus on the digital economy,” said Jeff Zhang, President of Alibaba Cloud Intelligence. “By increasing our investment on cloud infrastructure and fundamental technologies, we hope to continue providing world-class, trusted computing resources to help businesses speed up the recovery process, and offer cloud-based intelligent solutions to support their digital transformation in the post-pandemic world.”

“The COVID-19 pandemic has posed additional stress on the overall economy across sectors, but it also steers us to put more focus on the digital economy.”

The No. 1 cloud service provider in the Asia Pacific and No. 3 globally, Alibaba Cloud has data centers in 63 availability zones across 21 world regions, serving millions of customers. Asked for further details, Alibaba spokesperson Luica Mak says, “We are yet to announce more detail on the investment plans.”

However, the company in June announced an additional huge goal with a short time frame: The cloud-computing division will hire 5,000 technology staff globally over the course of the next 10 months. Asked where the company wants those workers to be located, Mak says the company does not have a regional breakdown to share. “We are looking for global talents in areas including network, database, servers, chips and AI,” she says. “It’s more the skillsets that we are focusing on.”

The best location, it seems, is everywhere.

Among the major data center infrastructure investments by Alibaba leading up to this new wave of investments were the launches of two Alibaba Cloud availability zones in Mumbai, India, and two zones in London, in 2018. Previous EMEA zones were launched in Dubai and Frankfurt in 2016. Its first data center in Malaysia was launched in 2017, followed by other projects in that country, including an Electronic World Trade Platform (eWTP) hub and office in Kuala Lumpur. Such digital commerce activity is crucial to that country’s Digital Free Trade Zone initiative as well as its short-term economic recovery plan known as Penjana.

Initiated in 2016 by Jack Ma, founder and executive chairman of Alibaba Group, the eWTP is a private sector-led, multi-stakeholder initiative that facilitates public-private dialogue around best practices in e-commerce, trade and the digital economy.

Alibaba’s latest eWTP hub is located in Yiwu, Zhejiang Province, China. It’s the company’s fifth since that first hub launched in Malaysia, with others in Hangzhou (China), Belgium and Rwanda.

Speeding Solutions

Data centers, it turns out, are more than just a corridor or warehouse for numbers. They’re the lab and the plant too.

Alibaba Chairman and CEO Daniel Zhang in April said the company would foster 10 digitized manufacturing clusters and help 1,000 factories generate over $14 million in sales, partly through the company’s data-enhanced consumer-to-manufacturer strategy. Alibaba’s divisions also are providing detailed assistance to medical personnel and life sciences researchers around the world.

So it’s no surprise that Synergy Research Group reports the pandemic will not affect the IT giants’ hyperscale data center spending, which surpassed $120 billion in 2019.

“While there are many unknowns, what is clear is that the hyperscale operators generate well over 80% of their revenues from cloud, digital services and online activities,” John Dinsdale, chief analyst at Synergy Research Group, told CRN. “The radical shifts we are seeing in social and business behavior will actually provide some substantive tailwinds for many of these businesses. These hyperscale firms are much better insulated against the current crisis than most others and we expect to see ongoing robust levels of capex.”

CBRE corroborates: Gabriel Harris, senior director in the UK for Advisory & Transaction Services within CBRE Data Center Solutions, noted this spring that the four main European data center markets, fueled by hyperscale operators, grew by 24% in 2019. “Given the dominance of demand from the hyperscale cloud providers, we expect strong demand to continue in Europe over the next two years,” he stated. “Most negotiations for new capacity that started prior to the pandemic will complete, and in some cases, will be accelerated.”