Real estate, as the mantra goes, is all about location, location, location. Site selection is more complex: transportation, work force, and taxes.

Site Selection’s October 2009 survey of corporate real estate executives (right) identified transportation infrastructure as the factor most important in location decision- making, followed by work force, taxes, utilities, and land and buildings.

It is not that highways, railways, seaports, or airports are more important than labor force, available land, suppliers, or educational institutions — it is that transportation infrastructure is how these resources are linked together.

In today’s complex global economy, transportation connections enable a business to locate in any region offering the best possible combination of labor, land, tax, and cost — while competing worldwide.

“Connecting cities and regions across the state is as important to Florida’s future as connecting to major gateways and nations across the globe,” says Tony Carvajal, executive vice president of the Florida Chamber Foundation, a nonprofit research group affiliated with the Florida Chamber of Commerce. For Carvajal, many of Florida’s key industries — from established industries like agriculture, tourism, and aerospace, to emerging strengths in life sciences and robotics — depend on market access. “The Chamber believes in the importance of infrastructure and our members indicate year after year that transportation is of the highest priority. It is clearly one of the drivers of Florida’s future.”

Transportation expenditures directly account for as much as one out of every six dollars in the U.S. economy, according to U.S. Chamber of Commerce research. As the national economy recovers from the recession, the role of transportation is becoming even more important:

Ever expanding growth increases demand for moving both people and freight. The U.S. Census indicates the nation’s population may grow more than 25 percent and reach 390 million in 2035. The nation’s gross domestic product is projected to grow even faster — resulting in a near doubling of freight volumes by 2035.

Markets are shifting from local and regional to national and global, requiring more long-distance travel for both people and freight. Global Insight estimates the value of international trade will more than triple by the year 2030, increasing the importance of both traditional and emerging trade gateways such as Los Angeles-Long Beach, New York-New Jersey, Seattle-Tacoma, Houston, and Savannah.

The U.S. economy is shifting from natural resources and manufacturing industries to service industries and innovation sectors. A diverse industry mix requires all modes of transportation — highway, transit, rail, water, and air — to connect people to jobs, supplies to businesses, and goods to consumers.

Logistics patterns are evolving from mass production and bulk distribution to manufacture-to-order and quick-response delivery systems. Businesses can more efficiently manage inventories but rely heavily on transportation systems to respond and reach markets on time.

Business and personal travel continues to grow, with the Travel Industry Association expecting over two billion long-distance tourist trips next year. Tourism is now among the top 10 industries, as measured by employment, in all but two states.

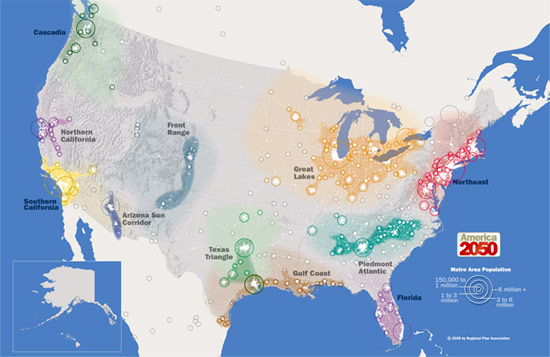

New urban development is favoring clusters of communities across broad areas with interdependent commuting and business-to-business relationships. Emerging regions are increasingly growing up around transportation corridors, from I-85 between Charlotte to Atlanta, to I-4 between Tampa Bay to Orlando and the I-15 ‘Sun Corridor’ between Phoenix and Tucson (see sidebar).

Florida’s Super Region

These trends are increasingly influencing how business location decisions are made.

Manufacturing and distribution companies tend to locate in close proximity to highway interchanges or rail systems. And with heavy trucks costing about US$1 per minute to operate, the distance from the highway interchange — or the level of congestion along the road — does impact a firm’s bottom line. Similarly, high-technology companies often choose to locate in close proximity to major airports for easy access for business travelers and low-weight, high-value freight shipments.

Transportation investments can reshape regional economies by increasing access to labor and markets. A study of major cities worldwide found a 10-percent increase in average urban driving speeds results in a 15-percent increase in the labor pool available to area businesses — and a nearly 3-percent increase in business productivity — big dollars in big markets. Transportation investments also better connect businesses to buyers and suppliers—increasing the market area a business can reach by truck in a single day.

The Way Toward the Future

Recognizing these linkages, economic development organizations, businesses, and transportation agencies are increasingly working together to expedite strategic investments to strengthen the economy.

The Florida Department of Transportation (FDOT) estimates every dollar invested in the state’s five-year transportation capital program produces about $5 in economic benefits. Florida’s Strategic Intermodal System, a high-priority network of the state’s most critical airports, spaceport, seaports, waterways, rail corridors and terminals, and highways, is intended to enhance economic competitiveness by better connecting Florida’s regions to other states and nations. The Florida Chamber and Enterprise Florida, the state’s lead economic development organization, are among FDOT’s partners in this effort.

The Southeast Michigan region, adapting to declines in traditional manufacturing sectors, is seeking to capitalize on an available skilled labor force, state and regional incentives, and transportation connectivity to transform the region. The Detroit Region Aerotropolis is a future economic cluster centered on the dual airports of Detroit Metropolitan and Willow Run, and accessible in less than a 10-mile radius to Interstates, rail terminals, and ports within the region. “We are attempting to link our transportation assets and create the physical environment to help export the next generation of Michigan-made goods,” says Robert Ficano, Wayne County’s chief executive. “Our state-of-the-art airport and mature road and rail infrastructure, world class universities, and proximity to markets are among the key reasons why businesses are choosing to locate in the Aerotropolis region.”

Transportation investments enable many rural or remote areas to become more viable business locations. Blake Wilson, president and CEO of the Mississippi Economic Council, points to the success of the state’s 20-year effort to expand four-lane highways to all regions of the state. “This program brought economic development to communities previously cut off from opportunity,” says Wilson. “This is a perfect example of how a shared vision, sustained over a long period of time, creates incremental progress year after year that results in exponential progress over time.”

Grading on the Curve

Will transportation continue to be a key driver of regional and national growth in the future? The combination of increasing demand, aging infrastructure, and constrained funding is eroding the competitiveness of the U.S. transportation system. Federal and state governments are spending more to just maintain what they have, and are less and less able to fund the future plans to meet economic opportunities. A series of national studies conclude that underinvestment has led to increased congestion, longer trip times, and higher costs for businesses, which weakens industry productivity and competitiveness.

The American Society of Civil Engineers’ 2009 report card gave the nation’s overall infrastructure a grade of “D” and identified $2.2 trillion in investment needs over the next five years — double current planned investment levels.

The American Association of State Highway and Transportation Official’s 2009 “Bottom Line” report identified investment needs exceeding an additional $130 billion for highways and $45 billion for transit, each year, over the next 20 years.

The Association of American Railroads estimates that an investment of $148 billion is needed just to keep pace with economic growth and to ensure that railroads can carry the 60-percent expected growth in freight over the next 20 years.

Seaports must accommodate a doubling of national cargo volumes, with some ports facing a tripling or quadrupling of containers moving through these gateways.

The Airports Council International/North America projects more than $94 billion will be needed for necessary infrastructure capacity and security upgrades through 2013.

Households and businesses are feeling the impact of underinvestment in transportation. The Texas Transportation Institute estimates congestion in 2007 forced Americans to travel an extra 4 billion hours and purchase an extra 3 billion gallons of fuel at an annual congestion cost of $87 billion. The Council of Supply Chain Management’s annual “State of Logistics” report shows logistics costs continue to trend upwards reaching $1.3 trillion, or 9.4 percent of GDP in 2008, reflecting the impact of congestion and higher fuel prices.

The World Bank’s Logistics Performance Index shows that on most indicators, the United States is on par with other developed countries, and only marginally better than emerging economies of Brazil or India.

China and India are rapidly building interstate systems larger than our own, and Europe and Southeast Asia are investing billions in newer airports, seaports, distribution hubs, and transit systems unrivaled in operation and accessibility. U.S. travel hubs are being fast eclipsed by the capacity and connections available in other regions of the world.

These are important issues as the U.S. Congress prepares for reauthorization of the nation’s highway, transit, and aviation programs over the next year, and as state and local governments weigh the value of transportation investments under tight budgets. At a time when transportation is increasingly critical in business decisions, economic development organizations and the broader business community must play a pivotal role in this debate.