Before digital imaging took over, photography was a chemical-intensive business (often leaving behind toxic traces as well as beautiful photographs). Today the photo industry giants have shifted that chemical expertise to active pharmaceutical ingredients (APIs) and other biopharma applications. That shift is gaining further impetus from the pandemic-induced push to reshore to the U.S. some of the biopharma supply chain.

A decade ago Site Selection profiled in these pages the $1 billion investment decision by Novartis to construct a flu vaccine plant in Holly Springs, North Carolina, that would employ 400 people (it now operates as Seqirus). Ten years later, the stakes have doubled in Holly Springs: In March 2021, Fujifilm Corp., the Japanese corporation with $21 billion in revenues, announced the town near Raleigh in the Research Triangle Park (RTP) region would be the location for the company’s new $2 billion large-scale cell culture production site, scheduled to create 725 jobs by the end of 2028. Fujifilm Diosynth Biotechnologies will operate the facility, which will be the largest end-to-end cell culture contract development and manufacturing organization (CDMO) facility in North America. It is expected to be operational by spring 2025.

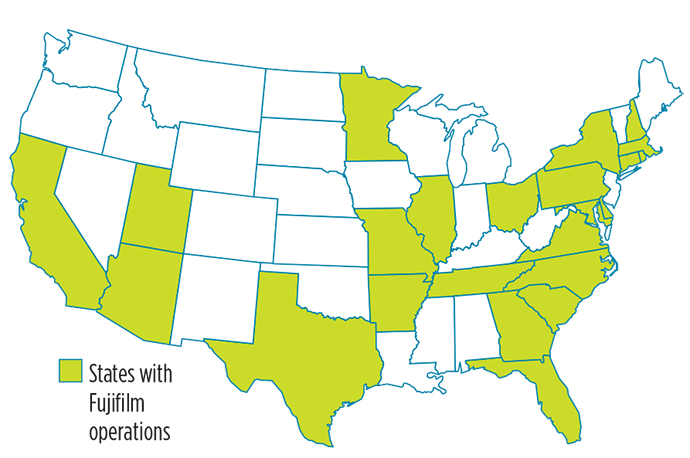

The decision came after the company earlier in the year had announced its intent to invest at one of its U.S. sites, without yet knowing where that final decision would land. I checked in with FUJIFILM Diosynth Biotechnologies CEO Martin Meeson before and after the final decision, and learned that initially all company sites in the U.S. (in 25 states) were on the table, not just the major sites in College Station, Texas, and North Carolina, where Fujifilm Diosynth has its HQ. The company in January announced production had begun for two COVID-19 vaccine candidates at its flexible biomanufacturing facility in College Station that had just expanded. Fujifilm is a subcontractor of the Texas A&M University System Center for Innovation in Advanced Development & Manufacturing (CIADM).

Did the deliberate choice to announce the $2 billion intent without having chosen a final location mean states came courting?

“Yes, we are getting contacted by many locations and having discussions with many states within the U.S.,” Meeson told me in February from company offices located on the borderline between Cary and Morrisville in Greater Raleigh. “It’s really just about the way we transact our business. We try to be open about what we do … there’s only so much we can do in secret. Ourselves and the board felt it was best to be open about our desire to be in the U.S., and it sends a good and strong message to our customer base.”

“Obviously the U.S. is the largest market for this particular class of molecules we make, so it was a natural choice.”

After the April decision favoring Holly Springs, he told me, “We had some strong partnership conversations with several locations. As you can imagine, we had quite a strong bid from North Carolina from the start. Governor Roy Cooper has focused on biotech and is maintaining that focus. But there was a strong push from Texas too. North Carolina was always a strong contender, and as we went through the last weeks, we really started to lock in on why that would be a good place for us to choose.”

Among the leading questions to be answered: “How easy is it going to be to create this asset and stand it up into operation?” says Meeson. Alignment with future goals was important too, as the company looks years and decades ahead.

Sustainability Showcase

Part of the wider RTP region, Holly Springs itself has assembled a strong biotech community, he says, with strong links to North Carolina State University, UNC-Chapel Hill and Duke University.

“The Holly Springs council really came forward with some strong proposals about how they would help us to run that facility, and make it very attractive,” Meeson says.

Factors in the site selection included ease of access to the space by clients; the cost of creating and maintaining infrastructure; time and ease of further development; and the sustainability of the location in environmental, human and asset longevity terms.

“You need to see five to 10 years out to make sure you have the line of sight for infrastructure that has what you need,” he says. For the corporate sustainability profile, he says, it’s important to determine how the operating environment will help Fujifilm attain its governance goals. “This is becoming an increasingly important factor, and can be a real differentiator.”

Now that the location is chosen, it’s an opportunity to put sustainability at the heart of a facility design, rather than trying to inject it into an older complex, Meeson says.

“We’re working strongly with the team and local colleges in terms of the actual build,” he says. “The state itself has a push for clean energy as well, so we’re early on having talks with Duke Energy. We’re excited to see how we can really build and showcase some of the sustainability aspects of this project.”

Transformation Right Before Your Eyes

But back up a minute: How do we trace the threads between photography and life-changing advances in biochemistry? A helpful explainer sent to me by Fujifilm brings the picture to life as clearly as a print in a darkroom tray:

“At the turn of the current century, Fujifilm’s ‘photo related’ product lines — including cameras and film — were more than half of its revenue,” says the company. In March 2020 the company reported that figure has been reshaped to less than 20% as part of the company’s diversification strategy.”

Fujifilm was already predicting digitalization by the beginning of the 1980s, and by the early 2000s had launched “a rigorous evaluation to determine what ways the company could thrive, if analog film production were to go away. Fujifilm leveraged its centers of excellence, including its proprietary core assets — nanotechnologies in chemistry, mechanics, optics, electronics and imaging — breakthroughs that its film and camera legacies had given the company.”

Fujifilm’s expertise in its main product — color photographic films — proved particularly fruitful in the development of businesses in biopharmaceuticals, regenerative medicine, display materials and cosmetics. “Color film requires very advanced technologies for evenly applying as many as 20 different photosensitive layers of different functions into film measuring just 20 microns,” the company explains, “then precisely arranging in each of the layers over 100 types of compounds — including color-sensing and color-producing particles. The disciplines of process control, quality assurance, and microscopic analysis from Fujifilm’s color film advances have proved to be very transferable to the current state of microbiological and pharmaceutical research and manufacturing.”

That includes the high-precision world of regenerative medicine R&D, where “Fujifilm now is one of the only companies in the world that possesses the tissue engineering triad necessary for regenerative medicine — cells, scaffolds, and cell culture medium/cytokine.”

Like a highly engineered therapy itself, today’s Fujifilm grew from being able to steer legacy assets and capabilities toward new targets.

Busy Portfolio

It’s just one project among many for the Japanese giant, whose investments over the past several years include expansions in both College Station and Raleigh; Billingham on Teesside in the UK; Tilburg, Netherlands; Madison, Wisconsin; Tokyo and Hillerød, Denmark, where the company last fall pledged to invest $928 million after acquiring the site for $890 million from Biogen. Ground was broken for the new Denmark expansion earlier this year. Meeson says the team is leveraging that work in Denmark for its U.S. project with the goal of a globalized standard for how the facilities are operated.

In January, Fujifilm Diosynth announced a $40 million investment in a new process development and manufacturing facility for viral vectors and advanced therapies in the growing Boston-area life sciences magnet of Watertown, Massachusetts. The company secured $76 million in financing and signed a lease for a 40,000-sq.-ft. site in at The Arsenal on the Charles, owned and operated by Alexandria Real Estate Equities, Inc. Fujifilm and Alexandria are two of many prominent partners in the new Massachusetts Center for Advanced Biological Innovation and Manufacturing (CABIM) located at The Arsenal.

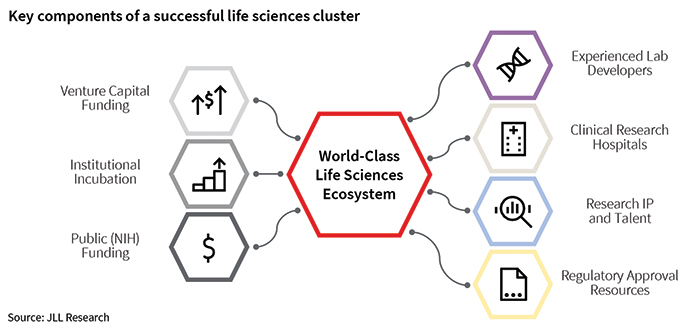

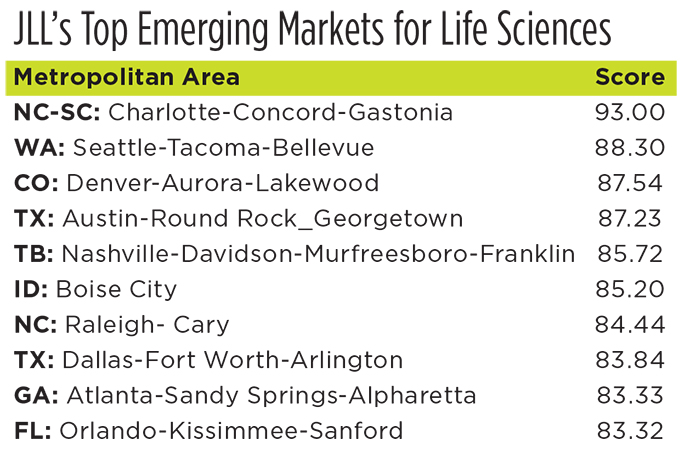

“I’ll take a risk and say it’s quite unique in the world,” Meeson says of the life sciences ecosystem in Greater Boston, though he says there are pockets in Europe and the UK in particular, and clusters are building in other areas that are similar in density.

Fujifilm’s Holly Springs project is not the only life sciences facility landing in North Carolina either. Recent investment announcements include medical genetics company Invitae’s April decision to open a 350-job lab and production facility in Wake County; pharmaceutical process development and manufacturing services company Raybow USA’s decision to triple capacity and workforce in Brevard with a 74-job, $15.8 million expansion; Thermo Fisher Scientific’s j500-job expansion in Greenville; Biogen’s newly announced $200 million, 90-job gene therapy facility at its 1,700-employee RTP campus; and San Diego-based contract manufacturer Abzena’s decision this spring to open a new 325-job facility in Sanford with a $213 million investment.

The 1.2-million-sq.-ft. pre-filled injector gigafactory from Apiject is rising in RTP as well, with 15 isolated production lines, a potential $785 million investment and 650 new jobs.

All told, says NC Biotech, expansions announced in 2020 will bring more than $2.3 billion in investment and 2,800 new jobs in biopharma manufacturing to the state in coming months and years.

De-Risking the Supply Chain

Meeson says all investment decisions are based on demand evaluation.

“That always has to be the place you start,” he says. “We get line of sight on demand, line of sight with the way the market is growing,” then evaluate the capabilities of the company and its supply chain partners against that. The Denmark decision came first because it leverages the capabilities of that site as the company looks to build its ability to do large-scale antibody manufacturing.

“But as you make that first decision,” Meeson told me in February, before the final U.S. decision was made, “it springs into your mind what the next will be. The conversation around that has been ongoing for several months. There was a lot of evaluation,” which led to a slightly more difficult decision. “Do you go again in Denmark? Or do you start to push out into other locations? Obviously the U.S. is the largest market for this particular class of molecules we make, so it was a natural choice. As we look as well to replicate what we have in Denmark, it’s attractive to the customer base to have the dual locations. It de-risks the supply chain to have the same capability in multiple locations.”

Talent provision was a key consideration. “I know we’re in a good place to have access to that talent, and a place committed to developing that talent as well,” Meeson says. As in its other locations around the world, being part of a regional industry group such as NC Biotech helps. “One thing I am constantly talking about is the need for partnership and a collective approach to the problems we face,” he adds. “We’ve created these vibrant hubs, and certainly one of the most vibrant in the U.S. and possibly the world is in North Carolina.”

There were challenges along the way, says Meeson. It’s how you address and tackle those challenges that separates the wheat from the chaff.

“ ‘Hurdles’ should maybe be the title of the last 12 months,” he says. “We’ve shown the power of what’s possible when people come together to solve quite big challenges we’re putting to ourselves and others. It really is the partnership mindset: Not just applying it to therapeutics and vaccines, but in working with everyone. When we have that, it’s amazing what we can get done.”