The North American data center market made gains in construction and net absorption in this year’s first half as cloud service providers and social media companies drove demand, according to CBRE. The world’s largest commercial real estate services and investment firm released its latest North American Data Center Trends Report in September. It shows that providers brought 214.3 megawatts (MW) of new wholesale colocation supply online in the seven primary U.S. data center markets in the first half of 2021, an increase of 7% from the year-earlier period. However, vacancy remained low across those markets — as scant as 1.6% in Silicon Valley — amid persistent demand. CBRE defines the primary markets as Northern Virginia, Dallas, Silicon Valley, Chicago, Phoenix, New York Tri-State and Atlanta.

The report also reveals three markets that are attracting the attention of the data center world. It explains:

- Columbus, Ohio, is growing thanks to its direct connection to hyperscale networks and its location near the Ohio-IX (Ohio Internet Exchange), which can be accessed for peering. Columbus is also rich with tech talent from local universities, has affordable land prices and relatively low power costs and minimal natural disaster risk. Geography will play a key role in the future growth of data centers in the region as providers eye the area for deployments of edge data centers.

- Miami offers low latency access to Latin American network service providers. It’s a critical network hub, predominantly supporting retail colocation driven by regional enterprise demand. There has been a flurry of activity in Miami due to the fact that it’s so heavily network-centric.

- Salt Lake City: Favorable tax incentives for data centers in the form of sales and use tax exemptions were introduced a year ago. New entrants to the market are now taking advantage, which has led to a more competitive marketplace. Salt Lake City also features a relatively mild climate and does not pose much of a natural disaster risk.

Relief from tight vacancies likely will come from the 527.6 MW of capacity currently under construction in primary markets. That figure marks a 42% increase from a year earlier, according to the report.

"Users are beginning to position themselves closer to end users to support technologies including 5G, artificial intelligence and edge-computing technology.”

— Pat Lynch, CBRE Executive Managing Director, Global Head of Advisory & Transaction Services, Data Center Solutions

“We’ve seen no indication that the amount of data created and utilized is leveling out, so demand for data centers likely will continue increasing across both primary and secondary markets,” said Pat Lynch, CBRE executive managing director and global head of Advisory & Transaction Services, Data Center Solutions. “Users are beginning to position themselves closer to end users to support technologies including 5G, artificial intelligence and edge-computing technology. We continue to see a heavier appetite for data centers from investors who are starting to view data centers in the same category as more traditional real estate sectors.”

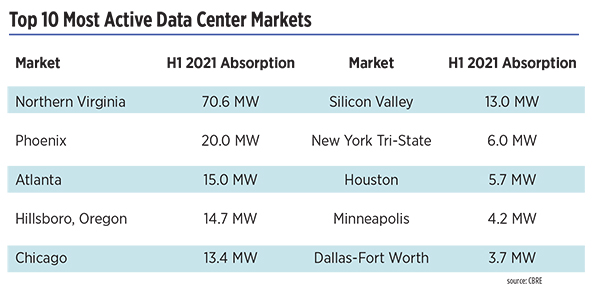

Top North American Data Center Markets

Northern Virginia remained the most active data center market with net absorption of 70.6 MW in H1 2021 — more than triple that of Phoenix, the next highest market. Net absorption totaled 142.7 MW across the seven primary markets in the first half, an increase of 3.4% from the first half of 2020.

Data center users leased more space in the first half of 2021 than in H2 2020 despite fewer deals being signed during this period. Phoenix saw more leasing activity in Q2 2021 than any other quarter in the previous five years. However, several markets, including Northern Virginia and Dallas, saw a drop in absorption year-over-year as some users consolidated their operations.

Of the construction underway in primary markets at second quarter’s end, 317 MW (60%) has been preleased. Markets with notable pre-leasing activity include Silicon Valley, where 70 MW (82%) of the total MW under construction was spoken for, as well as Dallas (17.5 MW), Chicago (17.1 MW), New York Tri-State (13.1 MW), Phoenix (6 MW) and Atlanta (3.5 MW).

JLL Weighs In

JLL’s Data Center Outlook, also released in September, says cloud, technology, and social media companies are driving near-record levels of data center demand around the world, signaling another strong year in 2021.

As vaccination rollouts continue and lockdowns are lifted, spend on public cloud services is projected to jump 8.4% in 2021, reaching $4.1 trillion, according to Gartner.

"The pandemic forced organizations to tighten their budgets amid economic uncertainty, including IT spend. Much of this growth is fueled by technology initiatives and employee management platforms.”

— David Barnett, Director, Americas Research, JLL

“The pandemic forced organizations to tighten their budgets amid economic uncertainty, including IT spend,” said David Barnett, director, Americas Research, JLL. “Much of this growth is fueled by technology initiatives and employee management platforms. Though COVID-19 accelerated digitization and connectivity for many organizations to maintain regular business activity last year, overall global IT spending reached a historical low.”

Amid reentry, companies are making more decisions related to their workplace strategies and hybrid work arrangements. JLL Research found that while hybrid work will remain durable in a post-COVID-19 environment, the office will remain the central component of the working ecosystem. To maintain flexibility, manage facilities and implement dynamic occupancy plans, companies will need to invest in smart technologies to drive real-time decision-making. As a result, these investments will increase demand for data center capacity.

“The resurgence of enterprise activity reflects the evolving landscape of the pandemic and the global progress on vaccine administration and restriction lifts,” said Andy Cvengros, managing director, JLL. “Employees and C-suite leaders are eager to work face to face with colleagues. Adopting comprehensive connectivity applications, healthy assets, and workplaces that use data to enhance health and well-being are more critical than ever.”

Global construction remained robust during the first half of 2021, according to the report. U.S. activity ramped up from 611.8 MW in the end of 2020 to 680.8 MW in the first half of 2021, just shy of the record set in first half of 2020 when the pipeline reached 694.5 MW under construction. Northern Virginia leads domestic markets in construction activity, while major gains were made in the notably tight markets of Northern California and Northwest, which saw vacancy levels fall to single digits.

In Europe, the construction pipeline stayed virtually the same in the first half of 2021 compared to year-end 2020. Over 8.8 MW were delivered in London, reducing the pipeline from 117.5 MW in year-end 2020 to 108.7 in the first half of 2020. JLL Research forecast an additional 117 MW to deliver by year-end.

The report also discusses new insights on occupier and investor sentiment toward sustainability initiatives for data centers, which historically require significant power and water. According to JLL’s latest Sustainable Real Estate survey of over 550 corporate real estate leaders, seven in 10 occupiers are willing to pay a rental premium to lease green buildings in the future, and 83% of occupiers and 78% of investors understand that climate change imposes a financial risk to their business.