by JOE HINES, TIMMONS GROUP

Artificial intelligence (AI) is driving the data center market and the data center market is driving the energy market. I remember 20 years ago when the regulated utility companies were wondering where the next major power users were going to come from. Little did we realize consumer demand for Netflix, Facebook, iPhone pictures, Instagram and TikTok would ultimately drive the energy market.

Who is creating this energy demand? The “hyperscalers” are typically companies that need large data centers to manage and process their data in an efficient and timely manner. These companies include Microsoft Azure, Amazon Web Services, Facebook (Meta), Apple and Google Cloud, and some lesser known data center deployers like IBM, Alibaba Cloud or Oracle. All of these companies were founded and rooted in innovation, and these innovators literally changed the landscape of how we function as individuals and as a society on a daily basis. They created markets we didn’t know existed by helping society become more efficient, but also more dependent upon their technologies.

How Is AI Affecting the Data Center and Energy Markets?

Conservative estimates anticipate that AI data centers will require seven to 10 times the power of a conventional data center due to the densification of the AI servers. In addition, these AI data centers will require significantly more cooling capacity than ever before, with increased water energy demands. While the industry is exploring other cooling technologies, conventional wisdom is that if water is available, it will lend itself to a more efficient AI data center that will significantly increase processing capacities while minimizing costs.

So how do we solve this problem we helped create? As a licensed Professional Engineer by education and training, I know as engineers we put a man on the moon, and soon will put a woman on the moon (Astronaut Christina Koch with NASA’s Artemis 2 Mission). Give the engineering profession enough time and money, we can do anything. In this business (or industry), it’s a matter of how much time, how much money and, more importantly, who pays.

I’ve always been a fan of nuclear energy, and nuclear done right (key words are “done right”) is one of the best carbon-free energy solutions that exists today and well into the future. According to the U.S. Energy Information Administration, in 2023 the U.S. energy mix was 60% fossil fuels, 18.1% nuclear and 21.4% renewables, so there is plenty of opportunity for nuclear to grow.

How does this affect data center and site development? We are working with a number of clients that are trying to maximize the land they currently have available and already zoned and/or entitled for technology or data center uses, especially given the pushback they are receiving in some communities that have become “anti-data center” and with land prices exceeding $3 million per acre in Northern Virginia. With the densification of these servers and the move toward multi-story data centers, it is not uncommon for a reasonably configured 1,000+-acre data center site to need 1 to 2+ Gigawatts of power long term. As a matter of perspective, a typical nuclear power plant will generate 1.5 to 2.5 GW of power. This was further exemplified by AWS purchasing 1,200 acres of data center campus from Talen Energy (???) and then recently rezoning 1,600 acres for the data center campus that is powered by the Talen Nuclear Power Station in Pennsylvania, which has a generation capacity of 2.5 GW.

As we lay out data center sites, the typical substation size is 300 MW, which requires anywhere from 10 to 20 acres of reasonably configured land. The Small Modular Reactors (SMRs) that are considered commercially viable will range from 60 to 300 MW in capacity, with Westinghouse and GE Hitachi currently developing and permitting 300-MW SMR prototypes for deployment. It is anticipated these SMRs will need approximately 10 to 20 acres to site a facility dependent upon the size of the SMR, very similar to the size of currently substation layouts. It is entirely possible for a 300-MW substation to be removed and a 300-MW SMR to be put in its place to take on the data center load.

Wars and natural disasters don’t need permits, but everything else does, and that takes time. As the industry looks to develop these SMRs, there will still be significant permitting hurdles to get over and a corresponding timeline, which will ultimately drive costs. With the advent and evolution of AI, data center energy demands are projected to double by 2030, going from 4% of total energy today, to upwards of 9.1% in 2030 as noted by the Electric Power Research Institute (EPRI) in their May 2024 “Powering Intelligence: Analyzing Artificial Intelligence and Data Center Energy Consumption” report, creating an energy demand curve like we’ve never seen before.

Desperation leads to innovation, and innovation leads to transformation — as we become “desperate” to meet the energy demands, it’s this increasing demand that will help us come up with innovative solutions that will get us over the permitting hurdles. Keep in mind that during The Great Depression, the Empire State Building was designed in two weeks and constructed in 407 days in 1930 and 1931. If you’re motivated (and desperate), you can literally build skyscrapers or move mountains to make a project happen.

The Golden Rule of Business: ‘He (or She) Who Has the Gold Rules!’

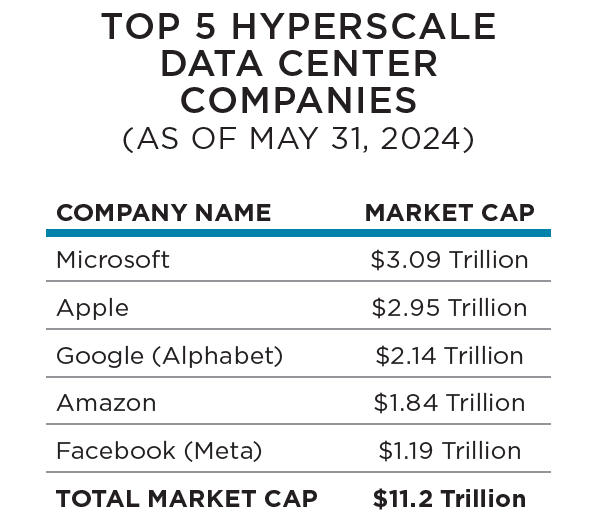

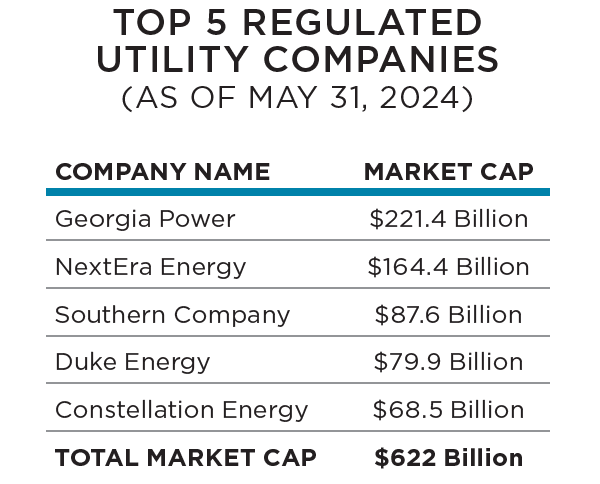

As we look out over the landscape of who can solve this problem, it becomes obvious that the hyperscalers are going to be central to the solution. And as you look at their market capitalization (or valuations) relative to the regulated utility providers, it’s obvious who has the financial capacity, or “gold,” to help creatively solve these problems.

As of market close on May 31, 2024, the top five hyperscalers have a combined market capitalization of approximately $11.2 trillion as compared to the top five regulated energy companies in the United States, which have a combined market capitalization of about $622 billion, or just 5.5% of the top five hyperscalers (See charts left).

How much and who pays for the SMR deployments? In May 2023, Westinghouse announced it will produce a new 300-MW small modular reactor (AP 300) that will be commercially available in 2027 and cost around $1 billion installed. Meanwhile, AWS is making significant investments in multiple data center sites: $35 billion announced in Virginia, $10 billion announced in Mississippi, $11 billion announced in Indiana, over $10 billion in Ohio. And, according to a report by tech publication The Information in April, Microsoft and Open AI plan to invest almost $100 billion in a data center complex that will house an AI supercomputer called “Stargate,” set to launch in 2028. I doubt these hyperscalers will let these investments and assets sit idle without helping solve the energy crisis themselves.

In fact, as this issue went to press, Duke Energy, Amazon, Google, Microsoft and Nucor on June 10 announced at the White House Summit on Domestic Nuclear Deployment that they have already started exploring these opportunities via an MOU that proposes new rate structures under the Accelerating Clean Energy (ACE) tariffs. These tariffs will allow large customers “to directly support carbon-free energy generation investments through innovative financing structures and contributions that address project risk to lower costs of emerging technologies.”

No power, no project. So, what happens if a hyperscaler brings its own SMR to the negotiating table, or if it decides to invest heavily in a regulated utility company? What happens if hyperscalers help bring SMRs to market sooner rather than later and help put power back on the grid in the process?

Historically, hyperscalers are risk mitigators as much as they are risk takers. Historically, it’s also true that the consumer ultimately ends up paying for everything. That may be the case here too. But it also stands to reason that hyperscalers could foot the bill up front for a nuclear solution to our insatiable hunger for data.

Joe Hines, PE, MBA, is a Senior Principal and Director of Economic Development / Site Selection for Timmons Group, an engineering and technology firm that has been recognized as an ENR Top 500 design firm for over 30 years. For more information, visit www.timmons.com.