|

Honda’s Sure Thing

A new assembly plant in southeast Indiana is just

part of the solution for both a region and a company. uring his first weeks as director of the U.S. Office of Management and Budget under President George W. Bush, Indiana Gov. Mitch Daniels had to turn around budget numbers with preternatural speed: The 2000 general election dispute had delayed staff appointments, but it had not delayed budget deadlines.

So when he first heard about Honda’s “Project Zoom” – the assembly plant component of a multi- state facilities build- out announced

|

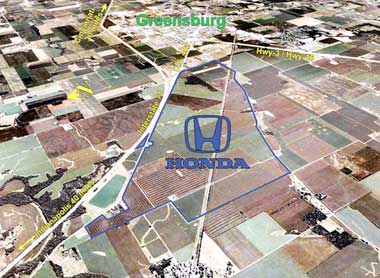

| Honda will locate on 1,700 acres (688 hectares) in Greensburg, some 50 minutes southeast of Indianapolis. Murray Clark – a lawyer with Baker & Daniels law firm, a former state lawmaker and the current head of the state Republican Party – was hired by Honda to pursue land acquisition for the project. According to multiple published reports, offers for property came in at 175 percent of assessed value, including a $6,000 signing bonus.

Photo: American Honda Motor Co., Inc. |

in May by Honda of America – its speed and the pressure that accompanied it were not exactly alarming.

“I received the first phone call [asking] whether I could be available within a week or two,” Daniels tells Site Selection. “I said, ‘No, I’ll be at a place of your choosing tomorrow morning. I took a plane to a private location, and while there I called our Secretary of Commerce [Michael Maurer] cell to cell and asked him to fly the following day to meet with Honda, and that occurred too.”

In the parlance of Daniels’ old poker buddies at Princeton, that’s called raising the stakes. But given the pace of projects just since January from companies like Pfizer, FedEx, Nestle and Toyota – in fact, 110 deals committed to 14,300 new jobs and US$3.7 billion in private capital investments – it wasn’t a case of all- in.

Daniels, a former president of Eli Lilly and Co.’s North American operations, knows exactly what the speed of business requires, and has put that knowledge to good use in his first 18 months in office.

“I have sat where they sit on making investment decisions,” he says. “Sometimes I hear from businesses we talk to that the questions we ask seem to come from a business perspective, as opposed to lifelong politicians they have dealt with elsewhere.”

But by anyone’s standards this one was fast – “the quickest of the many major deals we’ve done,” says Daniels. Upping the ante may have accomplished just what it’s supposed to at the card table: Getting attention. Four months after that first phone call, the dignitaries had assembled for the 2,000- job announcement in downtown Greensburg, which reportedly beat out finalist sites in Van Wert, Ohio; Fithian, Ill.; and two other nearby locations in Decatur Co., Ind., where the land options were not as easy to assemble into a winning hand.

Get Your Money Back

The card playing doesn’t stop there. Key to making the $550- million Honda project happen is a $10- million contribution from the City of Lawrenceburg, 50 minutes from Greensburg, to the incentive package. Nestled on the Ohio River at the state line with Ohio, Lawrenceburg boasts a ski slope, but its real claim to fame is riverboat gambling. Having now caught up with the infrastructure deficit that the first wave of gaming tourism wrought, the forward- thinking leaders of Lawrenceburg decided some time ago to devote a significant portion of gaming money to helping their region at large. Does Daniels think this arrangement provides a new model for collaboration between two frequently warring sides of economic development?

“Yes I do,” he says from RV One, his customized 2001 Beaver Patriot Thunder RV from Monaco Coach of Oregon, one of many RV manufacturers with plants in Indiana. Daniels has just boarded from a $16- million expansion announcement by automotive supplier in the southeast Indiana town of Madison, not far from Greensburg. “Coincidentally, I’m going to Lawrenceburg to talk about this very subject,” he says of the incentives boost.

But Daniels is clear: Incentives were “the very last thing we talked about with Honda. Honda was very modest in its requests, and the only incentives they were interested in were funds for infrastructure. The accurate number for Indiana’s investment is $80 million, and while we’re at it we’re going to build additional infrastructure that Honda doesn’t need at all.”

Combined state and local direct investment to support the Honda project includes EDGE tax credits, training assistance, and real and personal property tax abatements totaling up to $41.5 million. In addition, there will be infrastructure support for water, wastewater and road improvements of approximately $44 million. To accommodate future growth in the region, the state is expediting the long- sought interchange upgrade on Interstate 74, along with water, wastewater, and other road upgrades totaling approximately $56 million.

Daniels calls Lawrenceburg’s substantial commitment “very material” to the process. “It’s important in two dimensions,” he says. “We would have found another way, but it made the transaction easier, and more balanced among state, local and regional entities. And it’s a great model for regional cooperation, with the recognition two counties away that the whole area would benefit if Honda chose us.

“Before they knew anything about Honda, they were looking to invest something like $10 million in the region each year,” he explains. “Then this opportunity came, and this will be their Year One investment.” Daniels hopes Lawrenceburg officials might see the Honda- related development as a good target for Years Two and Three as well. But for now, the pace has been set.

“I think it’s a good model to be able to leverage those gaming receipts over a region,” says Don Schilling, CEO of Decatur County Rural Electric Member Cooperative and also board president of the Greensburg- Decatur County Economic Development Corp. “Obviously a lot of those receipts are generated by people across the region, so it makes sense to return it to the region.”

Decatur Co. REMC may serve some 7,300 meters in the six counties in its territory, but it’s likely none carries a potential economic surge equal to new customer Honda. In the utility’s case, the last stage of this site selection may have been lightning fast, but the early stages began more than two years ago.

“We started working to develop an industrial park on 260 acres [105 hectares] about two and a half years ago, which is now part of the Honda site,” says Don Schilling. “About a year ago, we were able to get options on that acreage and the adjacent 180 acres [73 hectares] of land. From that point, the EDC, with the help of Executive Director Vicki Kellerman, was able to put a package together and apply for the new state program Shovel- Ready Sites. A little before we put in the application, we learned of a company looking at a site east of Greensburg. They were not successful in getting all the options they needed there. They went to a second site west of Greensburg and had similar results. We decided to offer our acres, they took it, and were able to assemble their 1,700- acre [688- hectare] site from that point.”

One reason for the third option’s success: a handful of landowners, versus several dozen at the other sites.

As part of the utility arrangement, power supplier Hoosier Energy is constructing two 138- kilowatt transmission lines to the site initially, with one more to come over the next year to serve the area. The total investment by Hoosier Energy and Decatur Co. REMC will be around $25 million. But it’s a good bet that investment, like Lawrenceburg’s, will pay dividends.

“There has been a lot of debate in Indiana about taking money away from Lawrenceburg and other communities – this will end that debate,” says Daniels. “This is a great model for using those proceeds to benefit an entire region in a very direct way.”

The newly announced 117- acre (47- hectare) Markland Business Park in Switzerland County – across the Ohio River from a growing industrial area of Kentucky – also serves as testament to that model. With only 10,000 residents, but within a commuting circle that can capture as many as 250,000, the county’s swift economic ascent has also been helped by riverboat gambling, with the Belterra Casino and Resort on the way to being home to the biggest hotel in the state. Jon Bond, president of the Switzerland County Economic Development Corp. says the region is poised to capitalize on both automotive and logistics growth. After all, the county is practically in the geometric center of recent huge facility expansions by DHL (southwest Ohio), FedEx (Indianapolis) and UPS (Louisville).

Further helping matters in the county is the extension of Kentucky Highway 1039 to the Markland Dam Bridge, which when completed this fall will enable a direct cross- river connection to growing Kentucky industries like North American Stainless in Ghent as well as to I- 71.

“The county hasn’t nailed down the exact funding, but we’re pretty sure gaming revenue will be involved” in funding the industrial park, says Bond, who expects to call the park shovel- ready when the property closing occurs in September.

The county’s take from gaming and admissions receipts is not quite as large as some of its casino- hosting brethren, but it’s enough to matter. “We’re probably going to incur debt to fund this project, but we’re looking at obligating gaming revenue to do that,” says Bond, a native of the area who once served as director of operations for the state’s economic development council and work force development efforts. And there is more land nearby, even though, as is usually the case in a river town, the availability of flat land out of the flood area is always a challenge.

“We have about four times as much [land] that’s adjacent, and if we fill that up, we’ll build a road to the top of the hill,” Bond says. After all, he says, this is an unprecedented opportunity, and “this community is sophisticated enough that they’re not going to pass that up.”

Pleasant Surprises

Daniels likes direct. That’s why he leaves the phone to climb down from the RV at the general store in rural Cross Plains, Ind., not far from Canaan and China. Once back on the line, he reports that several men in general construction just told him they’re excited by the Honda project because they think more homes will be built.

Industrial prospects are anything but waning. Even after already announcing three major Japanese supplier expansions in the state in June and July (totaling $116 million in investment and more than 266 jobs), Daniels

|

| Greensburg, Ind., Mayor Frank Manus and Indiana Gov. Mitch Daniels mark the words of Koichi Kondo, COO of Honda’s North American region and president & CEO of American Honda, in announcing the location of Honda’s new $400- million assembly plant. The company had announced its intent to build the plant on May 16, along with several other expansion projects in neighboring Ohio. |

says his lead development contact for the southeast region just told him that within the past five days, four different Tier 1 or Tier- 2 suppliers were scouting the area.

“More rapidly than I would have thought, the possibility of knock- on effects may be showing up,” he says. “We’ve seen the same with Toyota, adding 1,000 jobs in Lafayette.”

It’s no surprise that the companies are Japanese, either, following on the governor’s two visits to Asia in his first 18 months in office. Like neighboring Kentucky and Ohio, Indiana boasts a large contingent of Japanese companies, now numbering over 200. Daniels likes taking an active role in business recruitment and retention, and says hardly a day goes by when he doesn’t call one or two companies to either thank them or encourage them. At the same time, his approach with the Indiana Economic Development Corp. is to look at recruitment deals as if the state were investing shareholder dollars. In other words, try to “win every deal, but at the lowest possible number.”

The de- emphasis on incentive cash was right in line with Honda’s outlook, but so were other factors that have laid the general economic development groundwork. Asked to assess the influence of certain initiatives on this deal and others, Daniels says yes, his $12- billion “Major Moves” transportation infrastructure plan was “unquestionably” a factor. For one, with its lease of the Indiana Toll Road, it means “we have cash in the bank earning interest we can use to pounce on opportunities like this.” That includes new highway interchanges, bridge construction and relocation of rail lines.

Moving to single- factor corporate taxation is also a big deal, says Daniels. “Indiana has had a three- part basis, which meant the more investment and employees you had in the state, the higher your taxes were,” he says. “There must have been logic to that, but I couldn’t find it.”

Neither can companies. Daniels recounts his conversations with Toyota officials prior to their Lafayette announcement, which like Honda carries a modest state incentives package, amounting to $14 million.

“Toyota said an admirable thing to me,” says Daniels. “They said, ‘Listen, more important to us than any incentives is that eventually you move to the single factor taxation, so we no longer have a disincentive to invest here.’ At the time, I said we’re working on that, but to my surprise we did get it through this legislature. And Toyota will forego some of the small package we had agreed to.”

Asked his thoughts on the efforts by U.S. Senator George Voinovich (R- Ohio) and others to pass national legislation freeing states to offer economic development incentives as they choose, Daniels says it’s a tough issue, but erring toward more freedom for the states is preferable.

“I do favor letting freedom reign here, and letting states make their own mistakes if they’re dumb enough to make them,” he says. “There’s no question it’s a risky thing to let politicians loose with money that’s not their money. They go to the ribbon cuttings and if the deal goes bad in a few years, they’re probably somewhere else. Our approach at IEDC is to try to replicate the rigor and caution that a business takes with its own money. I think the better side of the argument is to allow states to compete aggressively, and the competition on a net basis will be good just like global competition is. It makes businesses better. And those who tax too much or move too slowly will sooner or later see the error of their ways.”

Having its own fiscal house in order has also helped Indiana, something which has surprised even a former OMB director. As its debt ratings rise, the state has its first balanced budget in eight years, and is also setting things straight fiscally with its school systems.

“I probably underestimated the attention some would pay to this,” says Daniels. “If people believe a balanced budget and a stronger fiscal position reduces the possibility of tax increases, they’d be exactly right as far as we’re concerned.”

Tri- State Triumph

Honda officials declined to be interviewed for this story, saying all involved in the site selection were too busy moving the project forward. That’s a sentiment to which many parties many North American communities can attest.

In April, a new $123- million, 234,000- sq.- ft. (21,739- sq.- m.) paint shop went online at the company’s plant in Marysville, bringing Honda’s total capital investment in the state to $6.3 billion over the past 26 years. There’s also a $100- million expansion under way at a transmission plant in Russells Point, an $89- million expansion of a parts warehouse in Troy and a $75- million, 40- job expansion of the company’s engine plant in Anna. That last project will mean more production of parts formerly supplied by Japanese plants, with some of them shipped to the company’s engine plant in Alliston, Ont. – which is also expanding with a $140- million, 340- job project.

The projects comprise Honda of America’s “2010 Vision” for North America, which adds up to $665 million and 1,900 new jobs, including a ramped- up transmission parts plant in Tallapoosa, Ga., that will now see $150 million in capital investment and 440 associates at full capacity. Meanwhile, the parent company is even ramping up a business jet manufacturing venture with Piper Aircraft.

It may very well be the case that southeast Indiana is poised to mirror the fertile crescent of facilities that Honda already has worked to maximal productivity in central Ohio – another state that has reveled in recently upgraded bond ratings. The Ohio- Indiana- Kentucky momentum in the logistics and automotive sectors is undeniable. As Jon Bond points out in Switzerland County, “in an area divided by a river, bridges dictate where activity can happen.” And as metaphorical bridges between economic developers continue to be built as well, the hard infrastructure also rises to the occasion, also through collaboration. A case in point is the CIND line, a short line railroad operated by RailAmerica that is serving the new Honda project.

“The actual assembly plant will rest square in the middle of our mainline, so we will relocate our mainline to accommodate the plant and we will be the main carrier serving the plant out of Cincinnati and Indianapolis,” says Tom Owen, senior vice president of business development and corporate strategy for RailAmerica, owner of 42 short lines in North America. Owen says there’s quite a bit involved in serving a plant of this size, which will include a large amount of traffic interchange with Class 1 partners CSX and Norfolk Southern. Leading the punch list is an upgrade of parts of the main track that can’t handle loads of 286,000 lbs., as well as bridge construction and some tie replacement. All totaled, Owen says the cost will be in the single- digit millions of dollars.

Charles McSwain, vice president, CSX, calls the project “a great example of how Short Lines and Class 1 railroads are working together to provide solutions to industry.” Owen seconds that notion, and says he’s seen dozens of industrial development decisions on the company’s 42 lines in the past two years, and 80 percent of them involve access to multiple Class 1 railroads. Helping RailAmerica is its affiliation with industrial developer Agracel, which specializes in “agurban” facility development along short lines. As for land, he says, “There is a lot of soybean and corn growing out there on either side of our track, so there is abundant land.”

Don Schilling concurs: “There is some other land that will be converted to industrial use over the next few years,” he says of Greensburg’s future. “It appears that there’s some understanding that that corridor out I- 74 is a prime area for additional development.”

Will the area be ready? Do Hoosiers know how to shoot free throws?

“It has every possibility,” says Gov. Daniels of the region’s potential. “As you look at the large Toyota plant in Princeton, clearly it had that sort of effect on other communities there, so we already see the first signs that could happen here. And we won’t just sit back and hope for the best.”

|