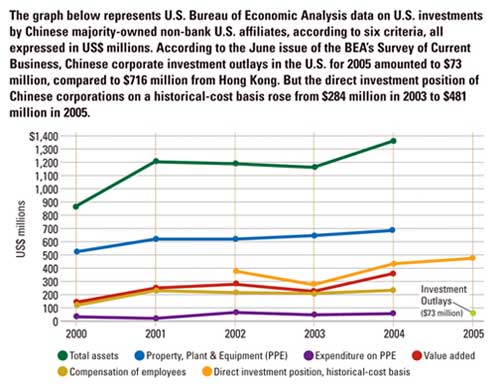

|

Reverse Osmosis

Chinese corporate dollars discover North America.

n May 2006, Qingdao, China- based appliance company Haier Group announced it had just secured a major order from Coca Cola Canada to make chest- type coolers for selling the Atlanta- based company’s drinks. The coolers will be made in Canada. That, in a frosted nutshell, describes a curious trade and investment dynamic: After watching their corporate bases fly to China, many cities, states and regions in North America are currently boarding airliners to go woo Chinese corporate investment.

|

| Chinese concern Haier Group is poised to grow even more at its Haier America complex in Camden, S.C. |

Minnesota state leaders led a high- profile China mission in late 2005 that was part of the state’s new Minnesota- China Partnership program. Kentucky and Georgia have both just opened trade centers in Beijing. And local officials from both rural and metro communities are boning up on their bowing as they conduct their own trade and fact- finding missions. As elected officials debate the merits of Chinese currency revaluation and possible tariffs, some free- marketeers see Chinese corporate project investment as one concrete way to get some of that currency back on North American shores. After all, accumulated foreign reserves in China have neared the $1 trillion mark.

Analysis by McKinsey consultants Martin Hirt and Gordon Orr published in August 2006 refers to a 66- percent compound annual growth rate in overall Chinese outbound FDI between 2000 and 2005, to more than $6.9 billion in 2005 from just over $2.8 billion in 2003. But even that surge may be underestimated, they note, due to inconsistent tracking of investments by China’s Ministry of Commerce and by international bodies such as UNCTAD.

In the background, but decidedly in the foreground of site selection, is the forthcoming award by the U.S. Dept. of Transportation of a new U.S.- China flight opportunity. The leading contenders are American Airlines and United Airlines flying to Beijing from Dallas/Fort Worth and Dulles, respectively, and Continental Airlines’ addition of a Shanghai flight from Newark in addition to its existing Beijing flight.

East Meets North

The small Coke deal may be more suitable to the Canadian palate than the failed bid in 2004 by China Minmetals to acquire Canadian mining concern Noranda. But there are two oilsands investments in Alberta and one gold investment in British Columbia by Chinese firms, including a $150- million stake in MEG Energy Corp. by China National Offshore Oil Corp., the same firm whose offer to acquire U.S.- based Unocal was stoutly rejected by U.S. lawmakers. The other Chinese oilsands investment of sorts is a pledge from PetroChina to purchase half the supply of oil (or 200,000 barrels a day) that Enbridge Inc. plans to pump through its forthcoming $2- billion Gateway pipeline connecting Alberta oilsands to the port at Prince Rupert, B.C.

The Canadian Chamber of Commerce thinks there ought to be even more Chinese investment. In a September report, “China and Canada: The Way Ahead,” the organization said China’s primary interest in Canadian investment “appears to be resources but potential investments are certainly not limited to that sector. For Canada, a country that must attract foreign investment and build leverage from it, the possibility of Chinese overseas investment into Canada is enticing.”

Canadian corporate investment in China in 2004 was estimated at a mere US$580 million, while Chinese investment in Canada was around $180 million. Nevertheless, the Canadian Chamber says a bilateral foreign investment protection agreement between the two nations should up the totals on both shores. Rewriting the Investment Canada Act to remove language that unfairly singles out state- owned foreign enterprises may also be a key step, says the Chamber.

“Right now we don’t have any security provision in our Investment Act,” says Shirley- Ann George, vice president- international for the Canadian Chamber of Commerce. A proposal to add such a clause died when the Canadian government changed, but just its introduction has added uncertainty. The Chamber wants a clear statement from its government about its intentions and parameters for foreign investment review so that, unlike “some countries,” says George, national security does not become a code word for “any xenophobic reason why you don’t want ‘those guys’ to invest. Chinese investment should be treated like any other investment. The nationality of the investment is not the question. The question is, ‘Is this a good investment for Canada?'”

Energy is indeed the kingpin when it comes to potential Chinese investment in Canada, but Chinese steel and automotive firms are also flush with cash. “Look at any of the companies of a world- size scale,” says George. “They are all looking to diversify out of China.”

Here to Make Money

As if to illustrate George’s point, the aforementioned Haier is among an elite group of 100 companies from 12 rapidly developing economies that Boston Consulting Group recently labeled “New Global Challengers” because of their quick rise from developing economy to global player. But Haier was not alone: 44 of the 100 were from China. And the fact that two- thirds of those 44 are state- owned or state controlled gives further credence to the mission of the Canadian Chamber to ease national regulations’ suspicion of such enterprises.

Many of those 44 firms are in consumer electronics or home appliances. Johnson Electric is now the world’s leading maker of small electric motors. In 2003, the firm added 36,000 sq. ft. (3,344 sq. m.) onto its plant in Plymouth, Mich.

While Nanjing Automotive and others prepare the way for their own facility development or acquisitions in North America, China’s automotive sector made its way to Elgin, Ill., some years ago. Wanxiang Group Corp., another of the Boston Consulting Group’s 100 companies to watch, opened a headquarters and distribution center there in 2001, followed by a $13- million expansion in 2002.

Wanxiang Group is named for the word meaning “universal joint” and was started by a former blacksmith’s apprentice, Lu Guanqiu, under the specter of the Great Leap Forward industrialization policy of the early 1960s. In late 2004 the company had more than 30 plants in China, 31,000 employees worldwide and $2 billion in business. Now it has 40,000 employees and $4.2 billion in business, and is involved in large- scale agriculture, aquaculture, real estate development, infrastructure development, and a China Bridge program to aid U.S. companies doing business in China.

Much of its U.S. footprint comes thanks to stake acquisitions in struggling parts makers. Some of the growth is organic. But all of it is focused on turning a buck.

Leo Nelson, president of the Elgin Area Chamber, admits to some amusement when he learned from company leaders at their first meeting five years ago that among their many property holdings was a golf course in Michigan. “I asked why, and they said, ‘because it makes money,’ ” Nelson says.

Wanxiang America President Pin Ni, contacted by Site Selection, reiterates that point.

“We’re all here to make money, so as long as there is an asset that makes sense, we would have an interest,” he says. That includes a potential warehouse project in Ohio. The company’s affiliates include automotive parts companies in Rockford, Ill. Wanxiang’s only self- owned and operated facility is the one in Elgin, but according to Ni, Michigan may be suitable for more than fairway ownership.

“We have a letter of intent signed with a landowner to build a technical center in the Detroit area,” he says, for an automotive headquarters and distribution center similar in scope to the Elgin complex. He says negotiations in Michigan still involve “a lot of moving targets,” but the company would like to establish the center “as soon as possible.”

Meanwhile, Chicago and China continue to come together, most recently at the “Luncheon in Honor of The Honorable Shoupu Sun Vice Governor of The Shandong Provincial Government The People’s Republic of China,” organized by the Office of the Illinois State Treasurer, Illinois Strategic Investors, LLC, and KKJ Holdings, LLC, and sponsored by John Deere and Caterpillar, Inc.

“Chicago, being one of the largest industrial markets in the nation, has a real potential to generate a wealth of opportunities by researching and developing industrial partnerships with China,” said William Schmitz, RPA, president of Arthur J. Rogers & Co., the only real estate firm on the panel. “The Shandong Province has already established relationships with many companies in the United States and is looking for additional cooperative partnerships,” added Felyce Lewis, SIOR, senior vice resident at Arthur Rogers. “As Illinois is located at the heart of the country, we focused our presentation on the business infrastructure and transportation networks throughout the state of Illinois, while also highlighting the available real estate options, including both existing buildings and available land for build to suit opportunities.”

Carolina Rhymes with China

Asked in general about the U.S. climate for more facility investment, Ni says the north has the engineering talent, but the south is more attractive overall. That seems to apply across the board where Chinese investment is concerned. Look no further than Pacific Gateway Capital’s incubator in the site selection advisory capital of Greenville, S.C. Many on its long Chinese corporate roster are interested in joint ventures for marketing China- made products in the U.S. (one firm’s choppy English self- description speaks of “importing” a production line from the U.S. in the 1980s). But a growing number of relationship fostered by the center are working in the direction of making things in the U.S. too.

“The companies from China, when they come here, first of all need somebody to set up their marketing,” says Vivian Wong, chairwoman of Pacific Gateway Capital Group, LLC. “Then they look at distribution, and then they want to be close to their customer and they start thinking about building a plant.”

The number reaching that final stage is still small, she says, with around 10 percent of the companies her organization is working with looking to make things happen on this side of the Pacific. For one thing, many of the firms are state- owned, and have to exercise requisite caution. But, she says, “Because the trade deficit is so huge, the Chinese government has been encouraging the companies to come over here. It is closer to their customers. And it makes them look good, and shows that they are really trying to spend money here too. That’s one reason we started Pacific Gateway, because we see the influx, but we have to give them time. In the next five to 10 years you’ll see more and more companies coming.”

By dint of acquisitions, for every Noranda deal gone sour, there could be a Lenovo deal gone sweet. The latter’s acquisition of IBM’s PC division for $1.75 billion in 2005 resulted in a new $80- million campus in Morrisville, N.C., a project that saw $14 million in assistance from the state. While the firm has shorn the payroll since arriving, its presence is seen as a long- term boon, and lies at the center of new efforts by North Carolina to foster China- Tarheel business relationships.

In Georgia, China- based Lehui Enterprises has partnered with New Jersey- based W.Y. Industries to form Kingwasong LLC, a manufacturer and packager of condiments that will open a 200- worker complex in Newnan, Ga., that will attract an investment of between $12 million and $15 million.

“We investigated many areas such as New York, New Jersey, Chicago and California, but finally we chose Atlanta as the best location for our joint venture. We were very impressed with Atlanta’s investment environment as well as the state’s support of this project,” said Yunlai Lai, president of Lehui Enterprises, in early summer 2006.

“The fact is the Chinese investors are coming to the United States. The question is: Which state?” said Dr. Dex Shi, chair of the China Business Committee of World Trade Center Atlanta, who helped facilitate the deal. “The success of this project illustrates that when state and local governments and the international business community work together, we compete with other states and bring Chinese investment to Georgia.”

In a separate announcement, Binswanger took credit for the sale of the facility that the Chinese JV will occupy: a 225,750- sq.- ft. (20,972- sq.- m.) building on 13 acres (5.3 hectares) in the Shenandoah Industrial Park, formerly owned by Lanelco. According to Binswanger’s announcement, the building was not sold to the joint venture, but to W.Y. Industries. Lanelco made plastic and wooden toilet seats in the facility. In fact, plastic resin silos and process cooling equipment were included in the sale and will be used by W.Y. Industries in production. Other features of the facility include 12 tailgate doors and CSX rail service.

In September, the state’s Chinese corporate portfolio grew with the announcement by General Protecht Group Inc. that it would invest $30 million in an Atlanta- area manufacturing facility that will make ground fault circuit interruptors.

Haier Group, like China Minmetals and CNOOC, was stymied in its efforts to acquire a North American firm (Maytag). But that hasn’t prevented it from growing its presence on the continent. Haier America, founded in 1999, purchased a high- profile building in New York City for $15 million, where its design center employs 400. Haier also invested $40 million at its 110- acre (45- hectare) industrial campus in Camden, S.C., just northeast of state capital Columbia along I- 20 in Kershaw County. Now the company is poised to invest $100 million in a three- phase expansion that will add 800 employees to the 250- person Camden payroll. The facilities are part of a global portfolio that includes 46 factories employing 50,000, 12 technological research institutes, 48 development centers, 10 advanced laboratories and 6 design centers. R&D efforts in Camden are set to receive their own $14- million investment.

Nelson Lindsay, director of economic development for Kershaw County, says the R&D plank of the investment is currently in negotiation. But the global profile of Camden has taken a sharp rise since the happenstance that saw Haier make its initial investment after cocktail party chat at a China- U.S. investment group in Charleston escalated to real business.

“Because of Haier, we’re getting a lot more attention than we would have otherwise,” he says, including from other Chinese firms. “We’ve had several Chinese companies visit over the years, one just this month,” Lindsay says. “And we have another delegation coming in October.” The Steeplechase Industrial Park where Haier is located still has 220 acres (89 hectares) remaining.

Lindsay says Haier’s learning curve for U.S. business practices was bumpy at first, but has encountered fewer obstacles since a move was made to pull in more U.S. managers to lead the plant.

“Today it’s primarily American managers leading the facility, with a few Chinese technicians who come and go on an as- needed basis,” he says. “I think they knew fairly early on that they were going to need help understanding how to run a U.S. factory. Once they did that, their operations became more productive and efficient.”

If that sounds like a mirror version of the usual U.S.- China facility discussion, it is. Whether it reflects a trend in forthcoming Chinese projects will depend on a host of trade and investment factors that go well beyond the corporate boardroom.

|