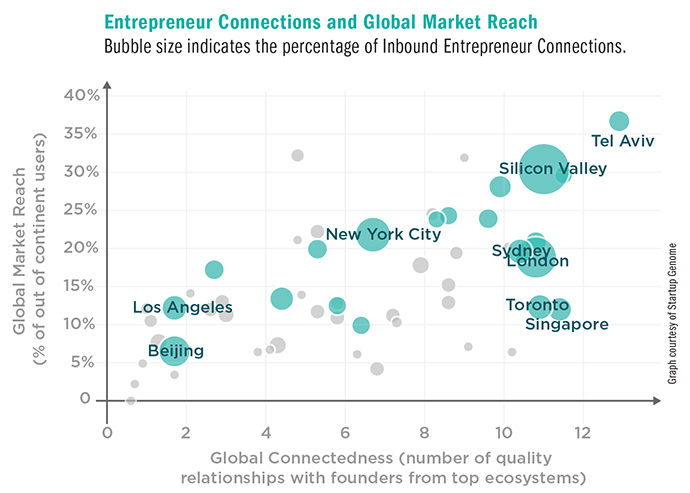

Startup Genome’s 2018 Global Startup Ecosystems report put it best: When it comes to global connectedness in terms of both entrepreneurial relationships and market reach, Tel Aviv — and by extension, Israel itself — shines brighter than the rest. That explains why more than 1,500 new high-tech companies are established annually in a nation barely larger than the U.S. state of New Jersey.

The report highlighted Tel Aviv’s leadership in such clusters as cybersecurity, automotive, fintech, ad-tech and blockchain, even giving partial credit for New York’s cybersecurity strength to a recent influx of office openings from top Israeli cyber firms.

As for automotive, “For a country that has no car manufacturing to speak of, Israel, and Tel Aviv in particular, has become a world center for autotech, with investment in the space jumping 200 percent over the past three years,” said Eugene Kandel, CEO at Start-up Nation Central.

“We might not make the cars here,” Kandel told Startup Genome, “but we make the brains for the cars.”

The organization itself has launched yet another successful focus called Israel Industry 4.0, or II4: “Currently, there are more than 200 companies in the Israel Industry 4.0 space, which is an increase of more than 50 percent over the last five years,” said a February 2019 report. “The Israel Industry 4.0 ecosystem is rich with start-ups, incubators, automation vendors, MNCs, government and academic initiatives, as well as R&D centers for multinational industrial manufacturers, including Siemens and Merck.”

II4 encompasses verticals from cybersecurity to aerospace to energy and metals, among other disciplines, and saw 36 deals totaling US$347 million in 2018 after 61 deals during 2016-2017 totaling $441 million.

Waze got its start here before Google bought it for $1.3 billion. Autonomous-driving company Mobileye got its non-autonomous start here too, before Intel (which operates a major and steadily growing fab in Israel) acquired it for $15.3 billion — a new record for an Israeli company exit.

Intel Capital’s latest investments include a newer startup called Pliops, which will use the funds to accelerate development of its storage processor technology for cloud storage and database applications, including expansion of its teams in the U.S., Israel and China. The firm, based in Ramat Gan, has developed technology that solves the scalability challenges raised by the cloud data explosion and the increasing data requirements of artificial intelligence and machine learning applications — in other words, the requirements that have come about in part because of other mind-blowing innovations by other Israeli firms.

Ecosystem for Ideas

This environment of constant discovery and connection has spawned a high degree of high-tech scouting activity. Some of these scouters, says Ziva Eger, Chief Executive at Invest in Israel and The Industrial Cooperation Authority (ICA) at the Ministry of Economy and Industry, “are lone start-up ‘hunters’ working for a multinational corporation (MNC) or foreign company, some are official MNC venture entities operated either by a local scouting team or by a scouting center, some operate as accelerators and incubators run by either MNCs or VCs, and some are agents trying to introduce local start-ups to potential capital.” A few of the 35 hubs include Citi Accelerator, Johnson Controls Open Innovation and Microsoft ScaleUp.

“They all share a common goal: to be the first to find the next best idea,” says Eger.

Those ideas are flowing in every direction, driven by an unparalleled national R&D infrastructure decades in the making; organizations such as Tel Aviv Global, HUstart, Jnext and BioJerusalem, among others; and a young population — 29 percent of Tel Aviv’s population is between 18 and 35 years old. While that city leads in high tech, Jerusalem leads in life sciences: Startup Genome noted some 150 life sciences companies employ more than 3,000 people and accounted for more than 27 percent of area VC investment over the past six years. The Hebrew University of Jerusalem is one of many institutions contributing to that heady mix.

“There is no question that health-related research and development currently being conducted in Jerusalem is among the world’s best,” Dr. Yaron Danieli, CEO of Yissum, the university’s tech transfer unit, told Startup Genome. Further illustrating Israel’s high degree of connectivity, Yissum in January 2019 announced the opening of three centers of international cooperation in Chicago, Illinois; Asunción, Paraguay; and Shenzhen, China.

The connections just keep multiplying — and that can accrue to the benefit of MNCs and entrepreneurs alike. Among the acquired companies that became new MNC R&D centers in Israel (often including advanced manufacturing too) are HP R&D center, established following the acquisition of Indigo; the Apple R&D center, established following the acquisition of Anobit; the Siemens R&D center, established following the acquisition of Solel Solar Systems; and Facebook’s R&D center, established following the acquisition of Onavo.

In a nutshell, Start-Up Nation’s II4 could easily be III4, with the extra “I” for innovation — an attribute and discipline that may be Israel’s best cluster of all.

This Investment Profile was prepared under the auspices of Invest in Israel, an integrative body within the Ministry of Economy and Industry that serves as a one-stop shop for a wide range of potential and existing investors, identifying lucrative investment opportunities, mapping potential obstacles and helping to fast-track investment. For more information, visit www.investinisrael.gov.il or send an email to InvestInIsrael@economy.gov.il.