There’s a reason international semiconductor industry leaders continue to give credence to the Central Texas city of Round Rock.

Simply put: The city is not playing from behind.

A key pull to obtaining foreign direct investment in Round Rock is the leadership’s willingness to show companies the advantages of doing business in Texas. To appeal to manufacturers, toting one of the lowest property tax rates in the state alongside no state income tax is always a good starting point.

Innovative manufacturing has found its footing in the Austin-Round Rock metropolitan area, employing over 62,000 in the region to date. For decades this has drawn automotive, life sciences, semiconductor, defense and clean-tech companies who depend on a wide array of skilled talent.

Today the semiconductor industry in particular is taking a keen interest in new developments within the city of Round Rock and region.

“Our job as a city is to create the economic environment,” says Round Rock Mayor Craig Morgan. “Having the semiconductor industry playing such a prevalent role in Central Texas, I think Round Rock has already positioned itself to continue those successes without having to go through the growing pains.”

A Long-Awaited Arrival

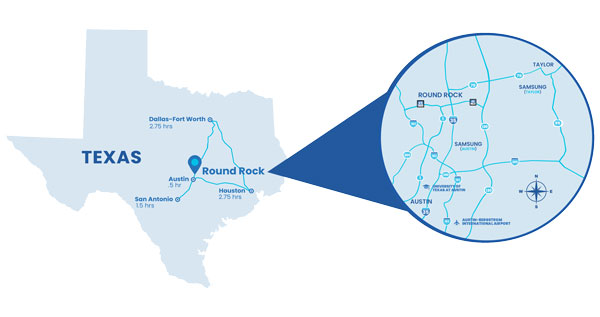

Over the past four years, the state has drawn 59 major new or expansion semiconductor-related manufacturing projects as calculated by Site Selection’s Conway Projects Database. Of those, 22 of those projects landed in the Austin-Round Rock metropolitan area and two projects located within 25 minutes of the city in Taylor, Texas.

Among the region’s suite of investors are global industry leaders Samsung, Micron Technology, NXP and Applied Materials.

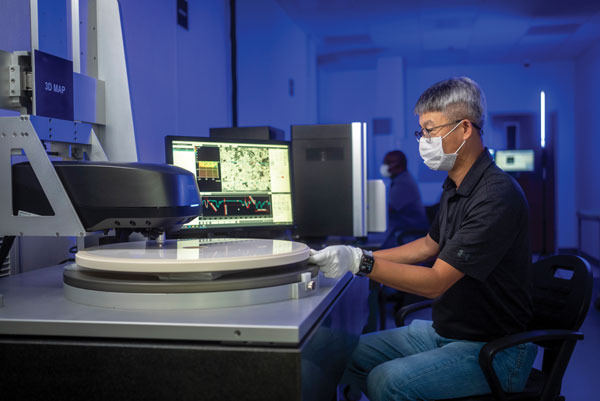

The inevitable influx of manufacturers investing in operations around the nation is no surprise following the implementation of the federal CHIPS and Science Act. But, for a semiconductor equipment part cleaning and coating company like KoMiCo Technology, the rise of investment in Central Texas is not by chance.

South Korea-based KoMiCo brought its first U.S. location to Round Rock in 2007, servicing the likes of Samsung, Intel, Micron, Texas Instruments and NXP. The company’s U.S. President James Jin says that Texas was the prime location to enter and support the market long term, and choosing a site near Samsung’s manufacturing facility in Austin was a strategic move.

“We built here and we penetrated all of the U.S. market after that,” says Jin. “It looks like this area is now considered the next Silicon Valley. All of the semiconductor customers are coming to Austin and continuously expanding. The future major semiconductor area is Texas. That’s what we believe.”

KoMiCo nears completion of its expansion in Round Rock.

KoMiCo nears completion of its expansion in Round Rock.

Photo courtesy of KoMiCo Technology USA

The company is 70% finished with a $30 million expansion (right) set to be complete in May 2024. The investment will add an additional 40,000 sq. ft. to the company’s existing 62,000-sq.-ft. facility. Informed by customer needs, Jin states, the company will look to make further investments in 2025 based on infrastructure and processing room.

“Companies like ours need semiconductor clusters to survive,” says Jin. “That’s why KoMiCo has been thriving as of late. Our facility operates like an extension of a fab, we require a lot of the same things. When companies like Samsung and Intel are doing site selection, they’re looking for the same things — infrastructure, workforce development, universities, taxes — and Round Rock was a good place to land for those reasons.”

That industry cluster is indisputable as expansion projects queue up, and KoMiCo isn’t the only resident supplier gearing up for future growth in Round Rock. For more than 38 years, Toppan Photomasks Round Rock Inc. has supplied the semiconductor industry with its photomask technology. After a global site search to cater to increased demand, the company decided in 2023 to move forward with a $185 million expansion to modernize its existing facility in Round Rock.

The growing cluster also has drawn new foreign supplier investment, further diversifying the supply chain in the process. MSS International announced in December 2023 that Round Rock was selected as the location of its U.S. headquarters. As a key supplier of gas sensor and piping used by Samsung, the company noted that the city’s pro-business climate and proximity to Samsung’s $17 billion Taylor facility sealed the deal.

“It’s been over 20 years since Dell Technologies put us on the map with their headquarters here,” says Mayor Morgan. “And what we’ve done is got out of businesses’ way by not overregulating, a low tax environment, we’re business friendly, great schools and great quality of life. Right now, I think all this growth speaks for itself.”

The Ideal Location

That growth is supported by a city that appeals to a live-work-play lifestyle.

Site Selection’s Top Metros of 2023 data show that among the Top 10 U.S. metropolitan areas, Austin-Round Rock ranked No. 3 in the South Central region and No. 7 within the Tier 1 Metros Per Capita nationally for two years in a row.

The city’s central location in the state offers companies access to 65% of the state’s population within a three-hour drive, in addition to a talent pool of over 2.2 million encompassing the entire Austin-Round Rock metro.

Investment announcements have brought thousands of jobs to the region. With institutional assets like Austin Community College, Texas State University and Texas State Technical College, companies have direct access to build educational partnerships that aim to train or retrain talent based on current industry needs.

As Round Rock continues to check all the boxes leading semiconductor companies are looking for with no sign of slowing down, the city soon could represent a one-stop-shop for all of the industry’s needs.

One might call that ecosystem simply fab-ulous.