Let’s say Johnson County, Indiana, is deemed the perfect location in which to open a manufacturing operation or distribution center. It’s close to Indianapolis — itself a logistics powerhouse — and is well served by north-south Interstate 65.

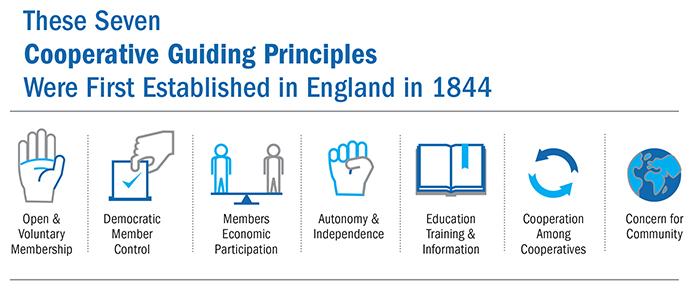

Now the question becomes whether to locate at a site, in a business park or otherwise, served by an Investor Owned Utility (IOU) or Hoosier Energy. The latter provides wholesale power to distribution cooperatives — independent member-owned businesses established to provide at-cost electric service. In this scenario, that would be Johnson County REMC, one of 18 Hoosier Energy cooperatives.

“We serve roughly two-thirds of the surface territory in the county, and an IOU serves one third,” says Chet Aubin, CEO of Johnson County REMC, based in the county seat of Franklin. “It’s the reverse on the number of consumers. Both service territories have industrial parks. We do compete, but it’s a friendly competition. We both know that if a company locates in the community, the community benefits by being able to improve the quality of life here. If we win it, a lot of people employed by the company will have homes in and do business within the IOU service territory, and the reverse is true.”

Johnson County REMC was a founding member of the Johnson Co. Development Corp., says Aubin, and works closely with site developers to help them open new industrial parks in the county. Five are in place today, and two more are in development. “When a developer opens a site, we work with the cities and other utilities to make sure there is plenty of gas, water and sewer. We always loop the individual sites with electric so there is a dual feed. We also provide a looped service for fiber, because we have a subsidiary fiber business in which we sell off bandwidth to industries and commercial operations.”

‘Reliability Is Very High’

Aubin says capital investment prospects begin looking at cost competitiveness “right up front — one of their first questions is about the cost of electricity based on their usage pattern. We’re very fortunate that with our mix of members and industrial customers we are very competitive on energy rates. Reliability is a big issue for a lot of industries, and one advantage we do have is with our service territory being capable of dual feed or back feed for almost all our services. Reliability is very high.”

If rates are a wash, then what’s the motivation for taking the REMC route? In fact, there are two — one intangible and one tangible.

“Energy provision is just one factor,” Aubin relates. “Building a relationship with prospects and their being comfortable with the service we give is where our real benefit is. Being a small organization we can react quicker. A key accounts person will meet with the company on a quarterly or monthly basis, depending on their size, always looking to see if they have some additional needs down the road or if they have issues with power quality. There is an interaction between us and the industry, and we let them know that right up front, which helps sway them over to our service area.”

CEO

Johnson County REMC

The tangible benefit is the high-quality internet service Johnson County REMC makes available to its customers. “We can provide up to 10 gigabits at an industrial site if they’re interested in that,” says Aubin. The REMC has networked its 12 substations around the county with high-speed fiber, he explains.

“When we built that fiber out, we made sure we built through where the industrial parks were going to be so we could provide bandwidth to the parks,” says Aubin. “Our partner, NineStar, provides the bandwidth for us to sell off. Most of our industrial customers are taking advantage of this, which is an additional revenue source for us. That helps us control costs. One of the nice things about commercial and industrial accounts is it helps us spread our costs so we can control our rates for all our members.”

This Investment Profile was prepared under the auspices of Hoosier Energy. For more information, visit www.hoosiersites.com, or contact Harold Gutzwiller at (812) 876-0294