India aims to fulfill half of its electricity needs through renewables by 2030, an ambitious target that promises to unleash unparalleled opportunities for global investors. The country is not merely embracing renewables; it is swiftly becoming a global frontrunner.

With abundant solar, wind and hydro potential, coupled with a robust regulatory framework, India presents an inviting landscape for renewable energy ventures. Ranked No. 4 globally in renewable energy installed capacity, wind power capacity and solar power capacity by the UN’s REN21 community in the organization’s 2022 global status report, and No. 3 in new solar photovoltaics and bio-power capacity, India offers ample opportunities for investments and expansion.

Commitments and Milestones

The pivotal moment came at the COP26 Summit in Glasgow, Scotland, in November 2021 when Prime Minister Narendra Modi unveiled an ambitious vision — 500 GW of renewable energy generation capacity by 2030. This commitment not only positioned India as a leader in the fight against climate change but also drew global recognition, securing the country’s sixth-place ranking on the EY Renewable Energy Country Attractiveness Index 2023 and an eighth-place position on the Climate Change Performance Index 2023.

According to data provided by the Ministry of New and Renewable Energy, as of October 2023, the installed renewable energy capacity (excluding large hydro power) in the country reached an impressive 132 GW, constituting a remarkable 42.3% of the overall installed power capacity. Projections paint an even more staggering picture, with the government expecting to reach 280 GW by 2025.

One catalyst propelling India’s renewable energy growth is the significant reduction in the costs of solar and wind power, attributable to economies of scale, enhanced module efficiencies, technological advancements and the availability of debt financing at highly competitive interest rates. According to the Institute for Energy Economics and Financial Analysis, solar power costs in India have witnessed an 84% reduction since 2010, surpassing coal-based power in many regions. In parallel, wind power costs have experienced a remarkable 49% drop in the last decade, solidifying their status as one of the most cost-effective sources of energy in India.

Governmental Initiatives

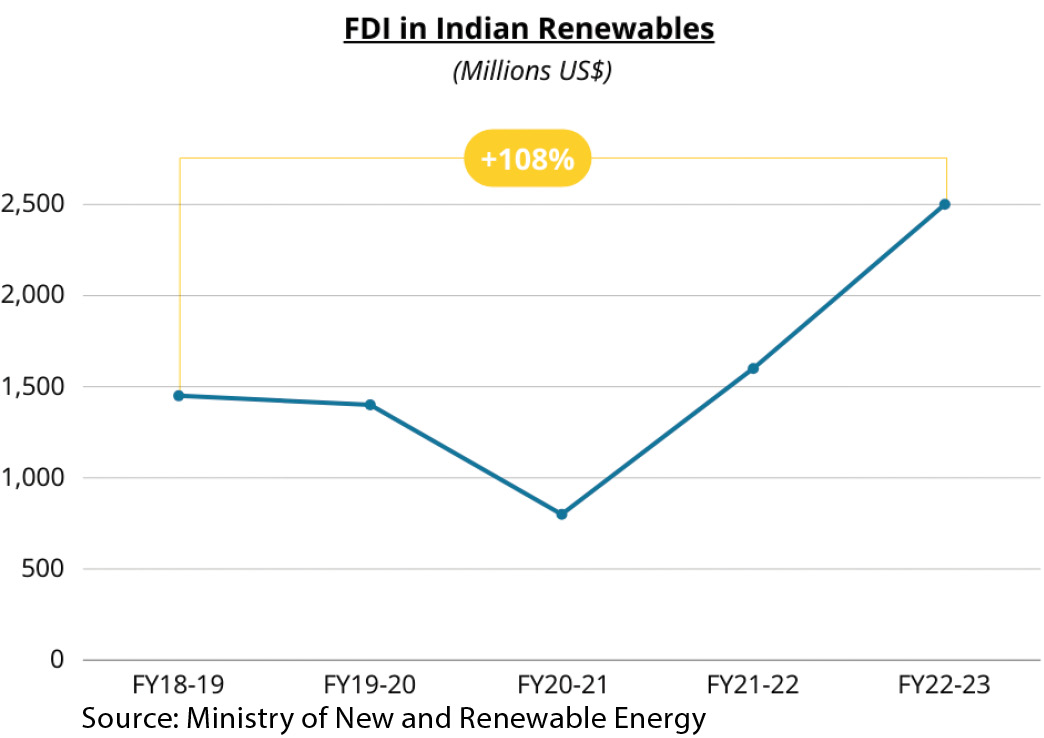

India’s appeal to foreign investors in the renewable energy sector is underpinned by a meticulously designed policy framework and the government’s proactive approach. The initiatives include permitting 100% foreign direct investment (FDI) under the Automatic Route, eliminating the need for government approval, and the exemption of Inter-State Transmission System (ISTS) charges for solar and wind power.

Strategic initiatives further demonstrate the government’s commitment, such as the Green Energy Corridor project, Ultra Mega Renewable Energy Parks spanning 14 states, the National Green Hydrogen Mission, and the production-linked incentive (PLI) scheme for high-efficiency solar modules. Complementary policies like the Wind-Solar Hybrid Policy further encourage the development of a grid-connected wind-solar PV hybrid system, effectively addressing intermittency challenges and enhancing overall grid stability.

The clarity and consistency in these government policies have played a pivotal role in significantly de-risking renewable energy projects in India.

Foreign Investment Plentiful

The roster of international investors actively engaged in India’s renewable sector reflects the global acknowledgment of its potential. Global Infrastructure Partners (GIP), a prominent U.S.-based infrastructure investor, entered India in 2018, injecting $500 million and establishing the 1 GW platform Vector Green Energy. Equally impactful is Goldman Sachs, which has deployed $3.6 billion in India since 2006, with a significant stake in Renew Power Ventures Pvt Limited, a major player in India.

Shell, a global player, invested $1.5 billion in acquiring Indian renewable firm Sprng Energy from Actis Solenergi. French multinational TotalEnergies ventured into an agreement with Adani Enterprises Limited, acquiring a 25% interest in Adani New Industries Limited for green hydrogen production. Norway contributes significantly, with the embassy earmarking $1 billion in CIF finance for India’s renewable energy projects, and Scatec, in collaboration with ACME, establishing a 900-MW solar power plant in Rajasthan. Adding to the diverse mix of international renewables investors over the past few years are Enercon (Germany), Vestas (Denmark), Ebgie (France), Fortum (Finland) Applied Materials (U.S.), Asian Development Bank, Enel (Italy), Gamesa (Spain), Orix (Japan), Nordex (Germany), Sembcorp (Singapore) and Mudajaya (Malaysia).

Challenges in India’s Dynamic Market

While companies looking to enter the market have numerous avenues for doing so, navigating India’s renewable energy sector is not without its challenges. The market’s complexity and dynamic nature can pose obstacles for firms aiming to establish a successful entry strategy. Challenges include over-dependency on foreign supply chains, inadequate transmission and distribution infrastructure, and the costs associated with renewable energy storage. The country’s high demand for energy, spurred by its large size and ever-booming population, is a double-edged sword; even as demand creates a strong incentive for India to invest in and adopt renewable energy technologies to meet its power needs while mitigating environmental impact, the simultaneous challenges of scaling up infrastructure to meet such demand, addressing economic considerations, and ensuring continuous and reliable power supply underscore the complexity and need for strategic planning in navigating the country’s path towards sustainable energy.

Despite these challenges, investor confidence persists, reflecting faith in India’s long-term renewable energy demand and the central government’s commitment to resolve sector issues. With ongoing projects valued at $197 billion and a plan to auction 50 GW annually for the next five years starting in FY24, the opportunities for global investors are vast.

Nalin Patel is Country Manager; Disha Singh and Delicia Dsouza are consultants at Tractus Asia Ltd. Tractus has been assisting companies in making informed decisions about where to invest and expand in Asia and beyond for over 25 years. For more information, visit www.tractus-asia.com.