Think your workforce challenges are growing? You’re not alone.

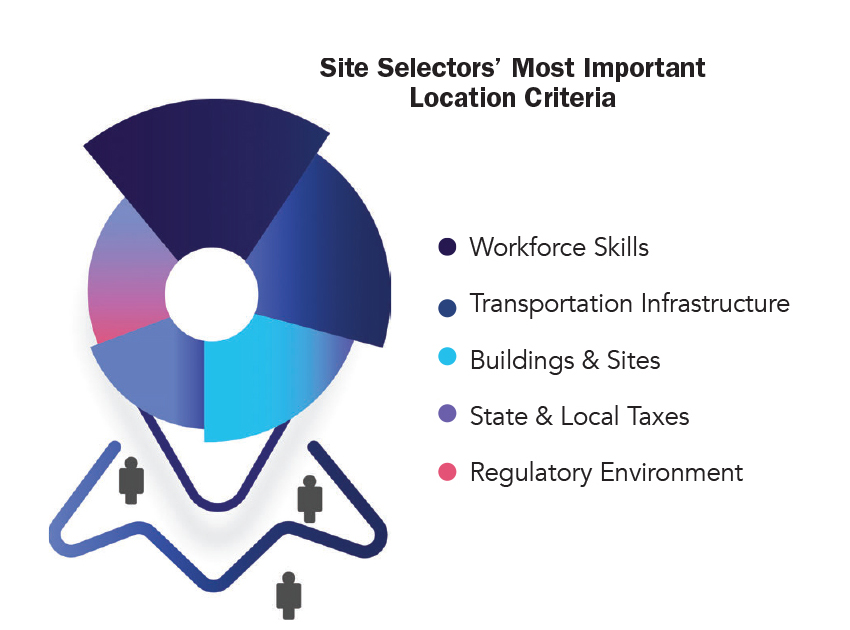

Site consultants surveyed by Site Selection magazine in October say that workforce is the No. 1 factor driving expansion or greenfield location decisions for their corporate clients today.

Outpacing No. 2 factor transportation infrastructure and third-place available buildings and sites, workforce is now the location variable dictating where projects are going.

This theme has been constant for several years now, as consultants increasingly say they are struggling to identify critical skillsets in sufficient numbers for their corporate clients. As a result, workforce training and development incentives are increasing in importance as well.

State and local tax structure now ranks as the fourth most important location factor, just ahead of regulatory environment and incentives. Utilities check in at No. 7, followed by university and college resources at No. 8 and cost of real estate at No. 9.

The 60 responding site consultants also noted that:

- Headquarters and back-office operations tied with advanced manufacturing as the most active project sector, just ahead of logistics projects

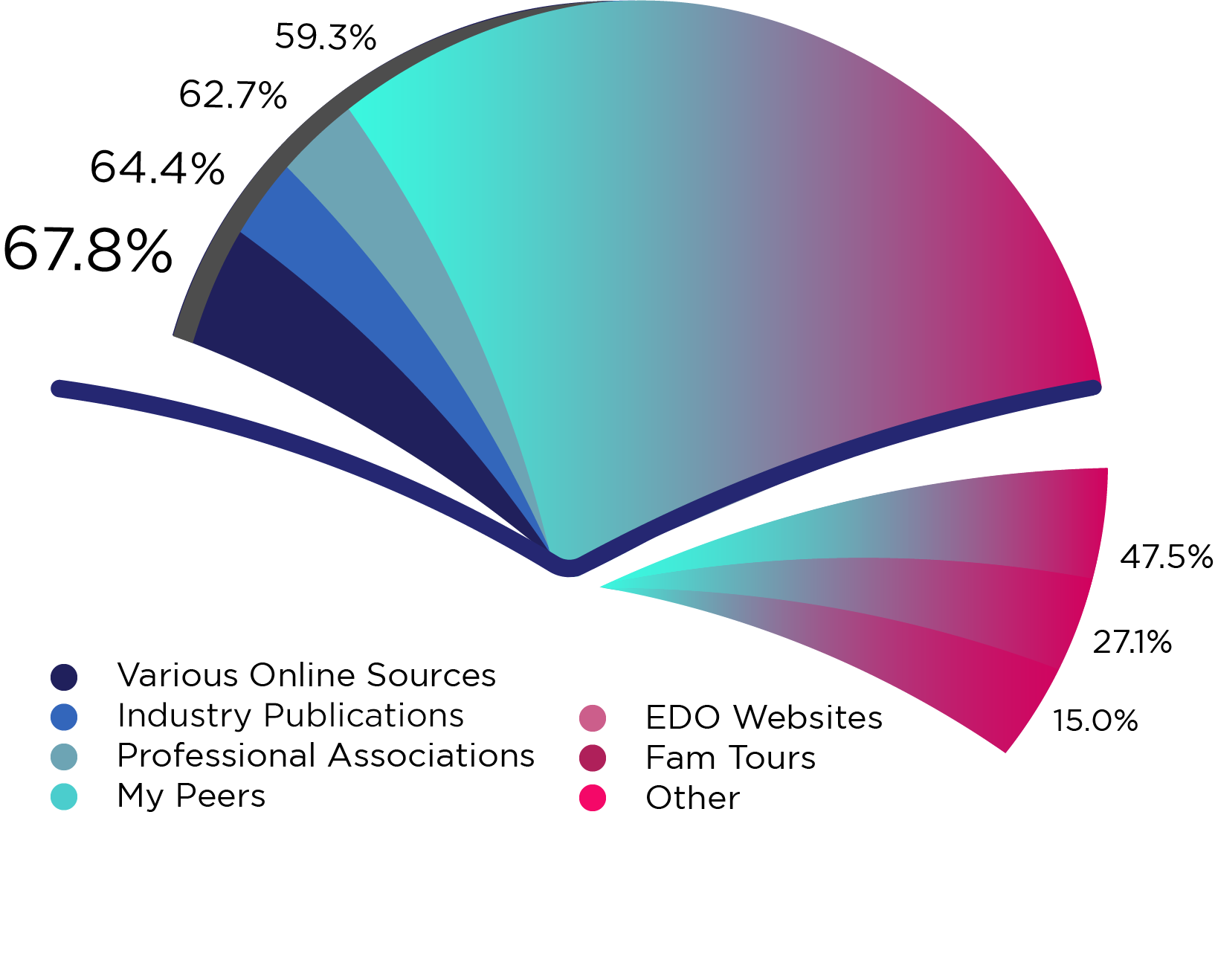

- They are increasingly turning to various online resources, industry publications and professional associations for information in their field. Their peers came in fourth, just ahead of economic development websites

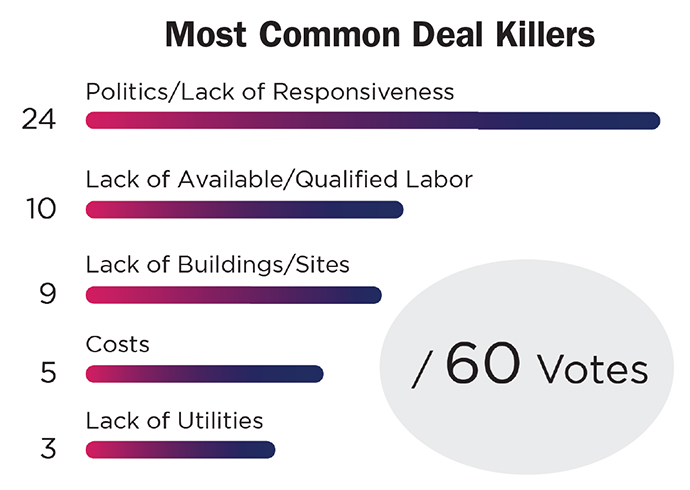

- The No. 1 deal-killer was politics or lack of responsiveness, followed by lack of available qualified labor. Adopting better incentives is the policy change they most recommend, followed by improving education and the workforce.

- Accurate and up-to-date data is the resource they most want to find on an EDO website, followed by a contact name and information.

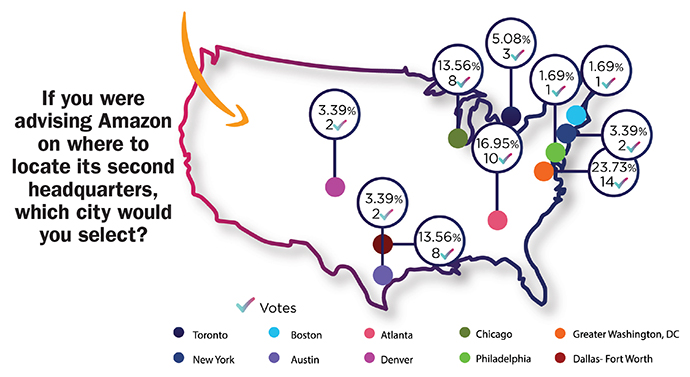

- Greater Washington, D.C., was far and away the leading vote-getter as the top choice for Amazon’s HQ2, getting 14 nods, while New York City garnered only two votes. Atlanta received 10 votes, while Chicago and Dallas each got 8.

The consultants also shared some interesting views on locations and their competitiveness. When asked to name the state that had done the most to improve its overall attractiveness to business and industry over the last 5 years, Texas garnered the most votes, with 12. North Carolina finished second with 5 votes, followed by Ohio and South Carolina with 4 votes each. Georgia, Michigan, Indiana, Nevada and Wisconsin each secured 3 votes.

When asked to name the U.S. region or metropolitan area that had most improved its attractiveness, respondents said the Midwest and the Southwest tied for first, with 7 tallies each. The Southwest, Greater Columbus, Ohio, and Dallas-Fort Worth were all next with 5.

Finally, the consultants offered advice to states and communities on how to improve their chances of landing more projects. Here is a sampling of their comments:

- "Create a program that incentivizes students to remain in the state after graduation."

- "Reduce the overall tax burden on businesses."

- "Have less channels for regulatory decision-making."

- "Offer flexible incentive programs that can be tailored to a company’s needs, rather than a one-size-fits-all program."

- "Fully fund the cost of technical education."

- "Offer employers an excellent public school system."

- "Embrace the Work Ready program."

- "Eliminate all sales tax associated with energy usage."

- "Incentivize localities and regions to work together on infrastructure."