For the past six years, KPMG every other year has released its popular Site Selection Report for Life Sciences Companies in Europe, which helps bio, pharma and medtech companies to get an overview on legal, tax and business conditions across Europe. The 2018 edition of the report looks beyond site selection to include operational aspects related to a successful market entry in Europe. The 60-page report also puts a brief spotlight on Brexit and related issues life sciences companies are facing. Here we present an adaptation of the full report.

Europe is a highly attractive pharmaceutical market with a total population of over 500 million and annual expenditures of US$145 billion.

The EU5 countries (United Kingdom, Germany, France, Italy and Spain) account for a combined share of around 20 percent of the branded global pharmaceutical market, behind only North America (about 44 percent). More importantly, EU5 per-capita healthcare spending remains high and supportive of innovative therapies with demonstrated safety and efficacy. For novel drug developers, this is critical for the success of premium-priced therapies aimed at niche patient populations.

With its 28 member states, the European Union marketplace also presents a variety of general challenges, from numerous official languages to a complex regulatory framework. For certain industries, such as Life Sciences, the EU has made considerable progress in introducing common standards and regulations. Member states benefit from central regulatory bodies such as the European Medicines Agency (EMA), currently located in London but moving to Amsterdam soon. It is however important to notice that not all countries with an important healthcare market are part of the EU, however. Switzerland, Norway and – post-Brexit – the United Kingdom define their own regulations related to marketing of healthcare products.

Market Entry : License or Launch?

This is a question biopharmaceutical companies at the end of their successful drug development process have to ask themselves. Do they prefer to follow the path toward licensing out of their products and largely give away control over commercialization for Europe or would they rather aim at launching their own distribution and marketing organization in Europe? The 2018 report provides in its first section high-level information on the latter, and explains the operational steps which need to be undertaken for a successful launch.

Licensing

Working with the right partner organization in Europe, out-licensing may be an attractive prospect. Given the complexity of the legal, regulatory and healthcare landscape as well as pricing and reimbursement frameworks, out-licensing models often appeal to non-EU biotech and small pharmaceutical companies. As the seemingly easier option, this approach can save problems on the back end and shed sizable chunks of risk from the business model. In addition, revenues from license fees from Europe might help to finance development in the country where the biopharmaceutical company is headquartered. Negotiating an attractive license deal is complicated, however, and companies should seek sound legal advice to avoid the many pitfalls.

Launch

An alternative is the direct product launch where a life sciences company can choose to set up its own operational structure. This might be the right path for an aspiring small biotech company with an innovative product on its way to becoming a fully integrated pharmaceutical company, or for a company that wants to increase its valuation in view of a future acquisition or merger.

When a company has made the decision to commercialize their products in Europe — through a full or partial own market entry and own product launch — it needs to plan and to drive the implementation for best results in this complex and competitive market, and needs to set up and manage different work streams in parallel. A crucial success factor is management skills with in-depth operational know-how in Europe and/or the availability of experienced advisors with a focus on life sciences.

Direct market entry does not preclude outsourcing of business functions such as logistics, regulatory, quality control, pricing and reimbursement.

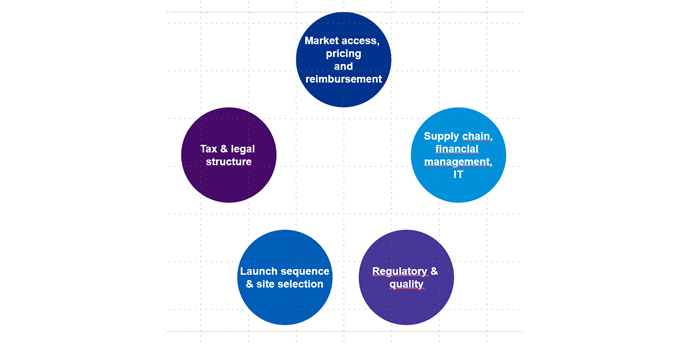

The set-up of a successful Operations in Europe can be split into five key work streams. They are interdependent and need to be worked on — as the situation requires — concurrently:

Every plan regarding the expansion into Europe starts with market access, pricing and reimbursement study, which gives an early indication of the market potential, the competitor situation and the possible staffing needs, and allows for financial forecasts. If this study shows encouraging results, the next steps will be to design the supply chain model and to clearly understand how the flow of physical goods, the flow of finances and of information and titles are structured.

Here the full understanding of true complexity of Europe in different dimensions (transport, regulations, taxation, labor law, etc.) becomes an important factor. In parallel, discussion of marketing authorizations, regulatory and quality control aspects and decisions whether to move forward with a decentralized or a centralized model have to be kicked off.

Finally, site selection and tax-related discussions have to be included in order set up a sustainable operational structure which can support a successful and timely launch. If planned and executed efficiently, the entire process can be completed in seven quarters or just under two years.

Site Selection

Despite significant efforts — and considerable progress — in bringing Europe closer together, the continent remains complex and fragmented in many respects. That’s why the success of every operational activity in Europe heavily depends on the right location. The second section of the report focus on the following site selection factors that have been found to be particularly relevant for life sciences companies:

- Innovation — the life source of life Sciences — often works best in collaboration with peers, universities and suppliers.

- The ability to attract financing is a good indicator of a life sciences cluster’s strength and potential.

- General business environment, focusing on the availability of workforce, flexibility of labor law, legal requirements, infrastructure and quality of life.

- Finally, countries’ tax planning and incentive models are highly relevant factors in site selection. This is especially true for intellectual property — a key value driver in industries such as life sciences. Our high-level overview of incentives provides insights at a glance.

In conclusion, the 2018 edition of the KPMG Site Selection report for Life Sciences companies provides a useful starting point for bio, pharma and medtech companies which are considering a launch of marketing and sales (and possibility also manufacturing and R&D) operations in Europe. It explains the various work streams necessary to achieve operational efficiencies and helps to select the right countries in Europe to start and expand operations.

The Site Selection for Life Sciences Report 2018 can be downloaded here: https://home.kpmg.com/ch/en/home/insights/2015/12/site-selection-for-life-sciences-companies.html. A short version of the report is also available on YouTube: https://www.youtube.com/watch?v=uoIKMaGRiGE&feature=youtu.be

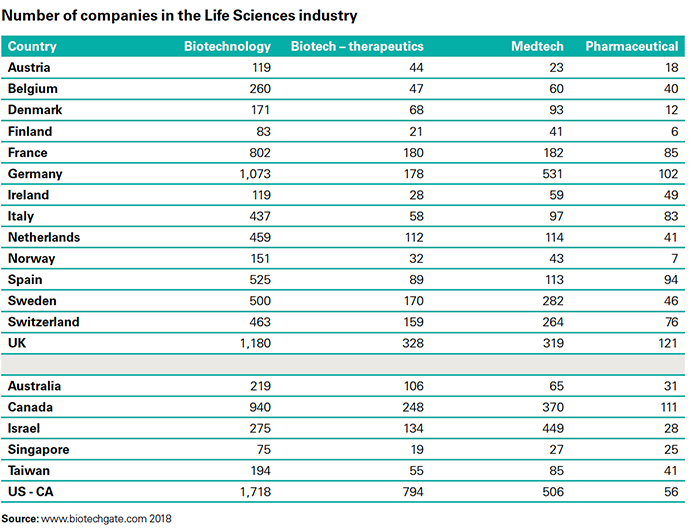

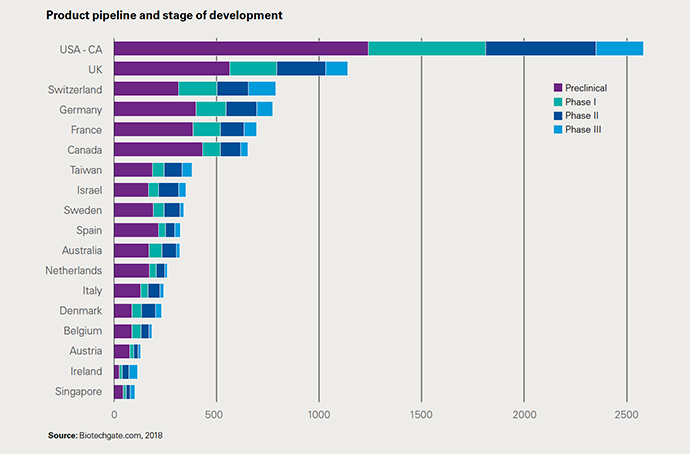

The report was produced in collaboration with Venture Valuation, which provided data on the size and specialization of the different Life Sciences Clusters in Europe; and with EBE, the Association for European Biopharmaceutical Enterprises.

André Guedel, based in Switzerland and editor in chief of the report, is an expert in site selection for life sciences companies in Europe. Along with the Global KPMG Life Sciences Team, he supports bio, pharma and medtech companies in the launch of their products and in the selection of the right locations in Europe.