AIRPORTS

Wheels Up:

Global Airport Projects Increase in 2015

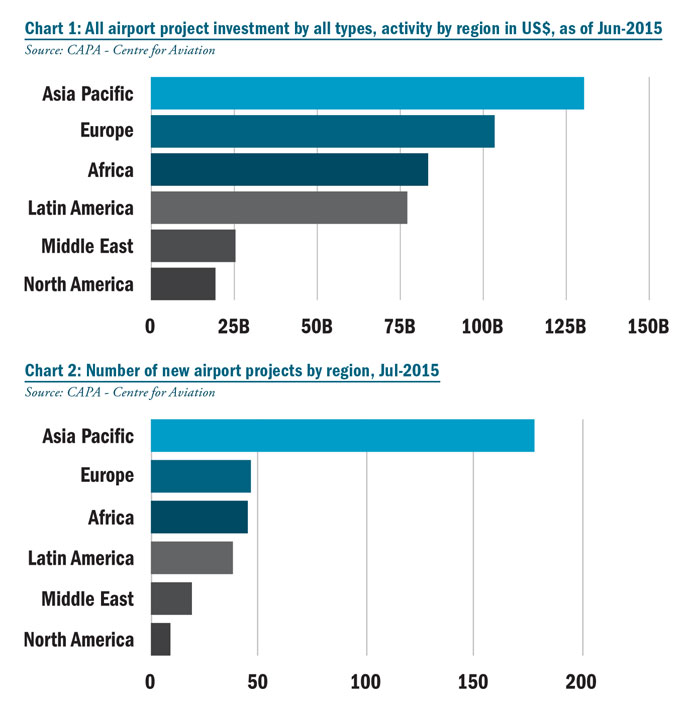

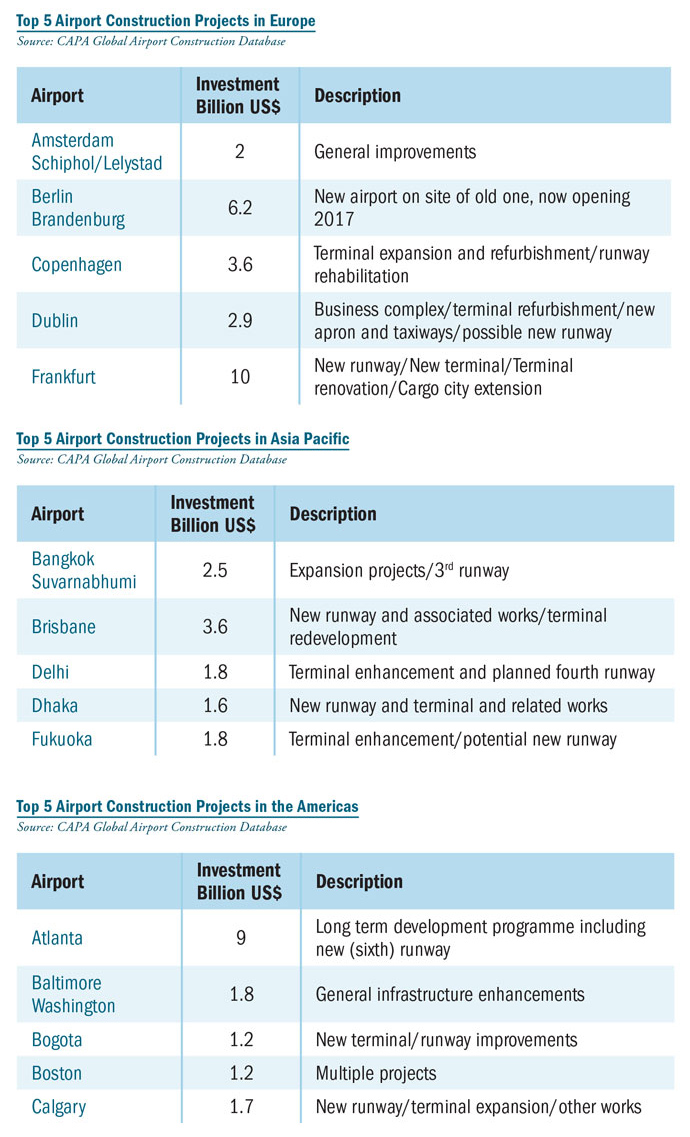

Global airport construction activity is on the rise, according to Sydney, Australia-based CAPA – Centre for Aviation and its CAPA Global Airport Construction Database. As of July 2015, CAPA was tracking 2,520 construction projects worldwide worth a combined US$441 billion. Just over 2,300 were reported at the beginning of 2015. Europe is seeing the most airport construction activity, with nearly 800 projects under way. But the Asia Pacific region’s just over 600 projects are seeing the most investment (see Chart 1).

Following are highlights from CAPA’s mid-year analysis of this global airport construction activity. Full analysis can be found at CAPA’s website, www.centreforaviation.com.

There are some apparent contradictions between the total of projects and the total of investment, with Europe leading the way in the former category but only coming in fourth in the latter, while Asia’s investment exceeds its projects by some margin in the tables. This is explained by the considerably greater value of individual projects in Asia Pacific, and in the Middle East.

There are two notable developments that will push both the regional and global investment totals up considerably. The first one is the announcement that China may invest up to $78 billion to build a string of regional airports, raising the total number of airports there from the 202 reported at the end of 2014 (itself nine more than in 2013) to 260 by 2020. The other factor that will influence the Jul-2015 airport investment pipeline chart is the announcement that Hong Kong International Airport has commenced preparations for the third runway at the airport, a project valued at $19.3 billion based on anticipated completion year exchange rates. In total these two announcements added $110 billion of anticipated expenditure on airport infrastructure in Asia Pacific on their own. They are needed, make no mistake. Passenger numbers in China increased by 10.2 percent to 832 million in 2014.

The other region that will affect the July chart to a large degree is the Middle East. In the first instance CAPA decided to accept as fact that US$50 billion will be spent in Iraq over an unspecified — possibly 10-year — period, on airport infrastructure including several new airports, new or refurbished terminals at existing ones (many of which have crumbled into a state where they are not functional) and on air traffic control buildings and equipment. Iraq has 19 civilian airports for a population of 33 million.

Traditionally CAPA takes a cautious line where forthcoming airport construction activity is suggested in countries where there are wars and/or large scale insurgent activity or where the projected investment is large and how it will be financed is unclear.

Iraq falls into all those categories. In this instance, a year after the plans were revealed, the decision was taken to give the benefit of the doubt to the government. As always, it will be kept under review so the investment figure could go down (or up). It is also necessary to be mindful of the fact that announcements, whether they are made by airport authorities or governments, can be dictated by public relations requirements. For example it has recently (June 2015) been reported that $32.7 billion in airport investments are under way or planned in the UAE.

However, a figure greater than this is already reported separately by CAPA in respect of the Dubai International Airport (where expansion is drawing to an end for the time being) and at the Dubai World Central (Al Maktoum) Airport where by comparison it is only just starting.

In the January 2015 report, 315 new airport projects were identified. In July 2015, this has risen to 340 despite several completions during the intervening months. Total investment in new airports amounts to $157 billion, so when added to the total of investment in existing airports, the grand total presently is $597.6 billion. See Chart 2 for the regional breakdown.

CAPA Analysis Takeaways

In August 2015, David Bentley (right), CAPA’s Chief Airports Analyst, based in Manchester, UK, shared these observations with Site Selection:

- Global Construction Unabated.

“Airport construction activities continue unabated throughout most of the world, and are on the increase. Because of their very long time span from conception to completion, they tend not to be adversely affected by economic downturn, for example current events in China. That will influence planned construction eventually if it continues, but not for now. Europe leads the way in the number of projects at existing airports, but many of them are relatively small projects, so that is not reflected in their overall value, and they are not usually runway extensions or new runways.” - Capacity Crunch in Europe?

“There is particular concern there about a looming ‘capacity’ crunch with people ‘unable to travel.’ Personally, I think this concern is overstated. There is still ample spare runway capacity in the UK, for example, for all the hand-wringing over a third runway for the southeast of England. Two of the reasons I think it is overstated are: (1) many airports are inefficient and could handle more take-offs and landings if they did something about that inefficiency (there has been a row about that at Rome after a fire destroyed a terminal there — my report on it just went up on the CAPA website); and 2) we are going through another spell of larger aircraft, meaning less frequency/landings are required at the main capacity constrained airports.” - The Biggest Greenfield Projects.

“Some of the largest projects are new-build, greenfield airports, the biggest two being Istanbul ‘Grand’ and the new Mexico City airport, both well into the double-digit billions of dollars for the basic infrastructure, never mind the surface access/egress that goes with it. There are some question marks over Istanbul following a change of government.” - Scarcity of New Projects in North America.

“The US has its fair share of big projects at existing primary/hub airports, in New York, Chicago, Los Angeles and so on. But there is concern that there is no apparent desire to build new, bigger primary airports — only 10 known ‘new build’ projects in the whole of North America, and almost exclusively at the secondary/tertiary level, in some cases just one step up from ‘general aviation’ class. The lack of private capital may be a reason.” - Where the Real Action Is.

“Overall, the greatest amount of activity at existing and new build airports is in Asia-Pacific, and not just in China and India. Numerous Southeast Asian countries (Indonesia, Vietnam, the Philippines), are building airports like crazy or planning for it. There is more construction activity in both Latin America and Africa than might be expected. Outside of the ‘Big 3’ in the Middle East, projects are increasing in number, notably in Bahrain, Kuwait, Saudi Arabia and Oman, while there is the prospect, at least, of multiple projects in Iraq, totaling $50 billion.”

— Mark Arend

PORTS

Won’t Get Fooled Again

Nothing shifts momentum like a massive slowdown. That’s exactly what happened at West Coast ports in the US when a labor dispute caused months-long work slowdowns in 2014. Container ships, unable to offload their cargo, were stuck waiting in the Pacific. Shipping companies don’t intend to let that happen again.

“The recent congestion at US West Coast ports has placed a spotlight on labor and port efficiencies,” according to CBRE Group’s North America Ports Logistics Annual Report released in May 2015. “In response, supply chain users are exploring diversification strategies that move some portion of inbound cargo to the East and Gulf Coasts.”

Not surprisingly, the report states that East Coast ports grew faster than those on the West Coast in 2014. And the numbers were dramatic. East Coast ports volume grew 7.6 percent, double the 3.2-percent growth rate of West Coast ports. Despite that, the ports of Los Angeles and Long Beach still have the competitive advantages to surpass the rest of the field — superior infrastructure capability, proximity to vital markets in Asia and a robust local economy and industrial real estate market.

Included in the CBRE report is the first-ever Ports and Logistics Index, which ranks the top 15 North American ports based on an analysis of port infrastructure capabilities and the strength of the industrial real estate market in the port region.

Global Ports: The Difference Between Quantity and Quality

Bigger isn’t always perceived as best. The list of top 15 international ports in total throughput published by the World Shipping Council is dominated by Chinese ports, a total of eight in all. Just two European ports, Rotterdam and Hamburg, made the top 15 in total 20-ft.-equivalent units (TEU).

Data from the World Economic Forum’s Quality of Port Infrastructure index is strikingly different. The index measures business executives’ perception of the quality of their country’s port facilities rather than the size or the amount of activity taking place. Opinions of thousands of respondents from 140-plus countries make up the data. Respondents were asked to score their nation’s port infrastructure from 1 (port infrastructure considered extremely underdeveloped) to 7 (port infrastructure considered efficient by international standards).

Ports in eight European countries are viewed as having superior infrastructure. Singapore and Hong Kong rank high on both lists, as do ports in the United Arab Emirates. Though Chinese ports dominated the total throughput index, the country’s ports come in at No. 53, with a middling score of 4.6, on the WEF index.

— Patty Rasmussen

ROADS

Where To Go For a Drive

When it comes to beautiful roads, Tennessee and North Carolina have a lot more in common than scenic drives through the Smoky Mountains.

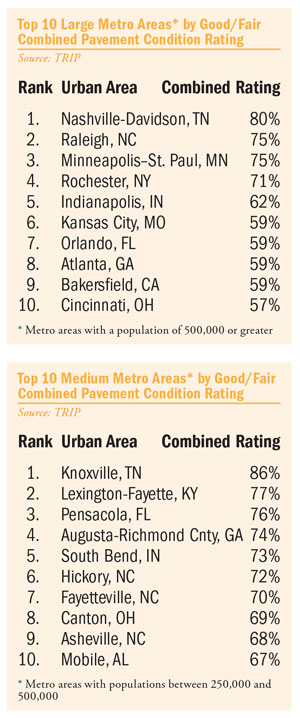

A new report, “Bumpy Roads Ahead: America’s Roughest Rides and Strategies to Make our Roads Smoother,” was released by TRIP, a national nonprofit transportation research group, in July, just ahead of the July 31 expiration of federal surface transportation funding. The report evaluates pavement conditions in the nation’s large and mid-sized urban areas and calculates the additional vehicle operating costs borne by the average motorist in each urban area as a result of driving on deteriorated roads.

Designed to point out the urgent issues of America’s bumpiest rides, the report did nothing to highlight which areas performed best. At Site Selection’s request, the core data, based on analysis of 2013 Federal Highway Administration survey findings, was made available by TRIP.

Of the 75 metro areas with a population of 500,000 or greater, only 18 had a combined percentage of fair and good pavement conditions better than 50 percent. Below are the Top 10.

Of the 63 US metro areas with populations between 250,000 and 500,000, only 25 had a combined percentage of fair and good pavement conditions better than 50 percent. Below are the Top 10.

These model communities notwithstanding, the report’s focus on problem areas was apt, as urban roadways carry 53 percent of the approximately 3 trillion miles driven annually in America. Among the report’s findings:

- Travel by large commercial trucks in the U.S. increased by 79 percent from 1990 to 2013. The level of heavy truck travel nationally is anticipated to increase by approximately 72 percent from 2015 to 2030, putting greater stress on the nation’s roadways.

- The 2015 American Association of State Highway and Transportation Officials’ (AASHTO) Transportation Bottom Line Report found that the U.S. currently has a $740-billion backlog in needed improvements.

- The Federal Highway Administration estimates that each dollar spent on road, highway and bridge improvements results in an average overall benefit of $5.20.

A late July report from the American Trucking Associations projects freight volumes will increase by nearly 29 percent by 2026.

“The outlook for all modes of freight transportation remains bright,” said ATA Chief Economist Bob Costello. “Continued population growth, expansion of the energy sector and foreign trade will boost trucking, intermodal rail and pipeline shipments in particular.” Among the report’s findings:

- Due to tremendous growth in energy production in the US, pipelines will benefit more than other modes. Between 2015 and 2026, pipeline volumes will increase an average of 10.6 percent a year and their share of freight will increase from 10.8 percent in 2015 to 18.1 percent in 2026.

- While railroads’ share of freight tonnage will drift down from 14.2 percent in 2015 to 12.3 percent in 2026, intermodal freight will be the second-fastest-growing mode at 4.5 percent annually through 2021, and increase 5.3 percent per year thereafter.

Some drivers might argue with Costello about the brightness of those numbers. The most foreboding statistic of all: The number of Class 8 trucks in use will grow from 3.56 million in 2015 to 3.98 million by 2026.

—Adam Bruns

RAIL

Leadership By Design

The transportation network has become increasingly integrated. The days of just relying on one mode to complete the freight move are limited. Freight logistics are cost-sensitive and drive such change. Public policy drives change as well.

The resurgence of rail freight has been an intentional part of federal policy to reduce the demand for highway investment. The trucking industry has increasingly used more rail service in long haul moves. Much of what consumers buy comes through ports. Agriculture is a big export. Global trade requires a fully integrated multi-modal system to be effective and low-cost solutions require incorporation of efficient modes such as rail and marine transport. To that end, for the past 13 or so years since federal policy started smiling upon rail, the rail industry has had significant free cash flow to invest. And they have.

Today the US railroad industry spends $64.1 billion annually. While 66 percent of that spend goes to operations, the balance goes to toward reinvestment in infrastructure as maintenance or new facilities and equipment. A full 20% or some $13 billion annually goes into growth of the network including lines and terminals, as well as equipment, according to the Association of American Railroads. Of the $13 billion spent on growth, over two-thirds ($9.3 billion) goes into infrastructure annually.

These are big numbers. As an industry, rail spends more than any other private industry in the US on plant and equipment investment. These funds are available through a combination of pricing power and the industry’s improved operating efficiency. Around the year 2000, operating ratios were in the high 80- to 90-percent range for some Class I railroads. Now they average below 70 percent. Moving more traffic to the highly efficient unit-train model for operations is a major source of improved operating ratio.

Safety is the single most important goal for rail. The cost of the alternative is horrendous. Positive Train Control (PTC), a federal mandate placed upon private sector operators, will improve safety, especially in areas where large traffic volumes interface with freight and passenger operations. PTC is designed to avoid train-to-train collisions; derailments caused by excessive speed; unauthorized incursions by trains onto maintenance areas; and movement of a train through a track with the switch improperly set (recall the Aiken, S.C. incident 10 years ago which left the town evacuated and death in the path of ruptured chlorine cars). The overall investment by the private rail companies on PTC was originally estimated at about $15 billion. The deadline for completion is next year. For the past few years Class I railroads have been pouring about 10 percent of their available capital investment into this program annually, according to SEC 10K reports.

The rest of the investment has focused on intermodal terminals and operating efficiency to further drive down cost. There are new terminals all over the US rail network. Some are located in places that may seem unlikely to the non-railroader. Railroads put them in their networks to maximize their operating efficiency. Others are located in market-centric locations to better serve the shipping customers.

The Chicago intermodal terminals have flourished. New intermodal terminals have been built in Florida, Quebec and elsewhere. New corridors have been designed through public-private partnerships to add double-stack container efficiency between major markets and ports. If there were a national transportation plan, it would be led by rail, which is backing its words up with investments. Rail is a competitive industry, competing for investment dollars and market share.

— Charles McSwain, former CSX economic development leader and officer, and former chairman, IAMC

BROADBAND

On the Cusp

The following comments are an edited excerpt from the prepared remarks of FCC Chairman Tom Wheeler, speaking at The Brookings Institution on June 26, 2015.

— Crystal Villarreal

Broadband is the defining infrastructure of the 21st century. Broadband networks facilitate today’s economic and social activity. But even more importantly, broadband networks ignite possibilities. Thanks to broadband, what is often unimaginable today becomes integral to life tomorrow. Today, the largest taxi company in the country doesn’t own any vehicles, the largest overnight lodging company doesn’t own any hotels and the fastest growing of the top-10 retailers has no showrooms.

What they do have is easy access to a broadband network, which enables them to assemble resources in new ways, present them to the public in new ways and define an economic future that is task-based, as opposed to the production-based economy of the pre-broadband era. As the success of broadband services increases the demand for broadband, it also increases the incentive for competitive broadband …

My message today is simple: the job of the FCC is to exercise its authority with both discretion and determination so that technology, competition, investment and consumer empowerment are able to reach our nation’s broadband goals. The exciting part about our time is that while broadband and the Internet may be the most important networks in history, their effects are not yet the most important in history. The simultaneous emergence of the mid-19th century railroad and telegraph networks reshaped the economy and society of that time more than the Internet and all that it has produced has shaped ours — thus far. The key phrase in that statement is “thus far.”

My conviction that we are on the cusp of when our broadband networks will prove even more transformative than the networks of the 19th century is based upon this: Broadband networks are new in a new way. The new way is evolution from hardware-based networks to ones that are software-based. There are multiple benefits of the network’s evolution from hardware to software. First, we are moving from networks with limited functions, to a world in which software expands network capabilities and makes them available to a wide variety of non-traditional applications.

Another impact of software replacing hardware is that the cost of expanding network capabilities decreases. In the old days, it was necessary to add a physical circuit if you wanted to increase capacity; today it often is only a matter of adding computing power. Finally, the evolution to software-defined networks with virtualized components means that network operating expenses decrease. Verizon reports that the replacement of central office physical switching systems with software reduces their real estate costs by up to 80 percent.

With all these advantages of software defined networks — expansion of network capabilities, economies in expanding capacity, and reduction in operating costs — no wonder AT&T has said 75 percent of its network will be controlled by software within five years …

As we push onward into the broadband future, our challenge continues to be assuring that the preconditions for broadband ignition are as widespread as possible. The best tools for accomplishing that are competition and consumer demand.