usinesses have been intently focusing on their supply chain for almost 10 years now. Combined with globalization of production, this has created a demand for logistics locations that allow efficient receipt and distribution of products. These trends impact all distribution functions, whether a stand-alone distribution

facility or a manufacturer managing just-in-time inventory flows.

Supply chain efficiencies start with meeting customer demands and flows back to distribution facility operations and the geographic alignment of a firm’s distribution centers. Keeping shelves stocked, keeping parts arriving in a timely fashion, etc., is the driving consumer demand at the heart of logistics planning.

The focus on distribution operations has resulted in such macro trends as the growth in third party logistics service providers (3PL) and such micro advances as highly sophisticated warehouse management software solutions for material handling, now typically integrated as part of an overall enterprise management system. One additional impact of these supply chain efforts has been to preserve capital. Finally, companies have looked to unlock value in real estate across the organization, and the leasing of distribution facilities is no exception. The standard nature of the basic “box” and the dynamic nature of distribution networks encourage firms to capture the flexibility associated with leased facilities.

Global supply chains result in significant production cost savings, but carry additional schedule and disruption risks. As a result, once goods arrive “on-shore,” it is very important that goods move quickly and reliably to market.

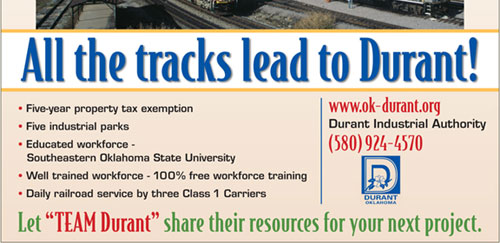

The presence of available and ready sites is especially important to distribution operations, as this is all about getting started and getting to market quickly. However, there is great variability in site requirements by companies and site availability by communities. Large sites in uncongested areas are critical for companies such as retailers that develop their own very large facilities (1 million square feet or more). However, such sites typically can’t be found, or are prohibitively expensive, in very developed areas such as port cities or major transportation hubs such as Los Angeles or Chicago.

So these projects will seek sites in less developed areas. Other distributors, however, will not have the need for hundreds of truck movements a day, and so will seek minimal-sized sites to house their buildings. For all centers, sites should have easy and safe ingress and egress. For example, having to cross rail lines to enter or exit a facility is a major drawback to a distribution site. The site should allow quick access to a divided four-lane highway. Infrastructure demands are primarily focused on electricity. Many locations do not anticipate the level of electric use and electric reliability demanded by these operations; however, electric supply redundancy is a strong asset for a potential distribution site.

It is important to note that one emerging trend over the past couple of years has been the sensitivity of companies to proximity to all modes of transportation. Even if a firm currently uses only truck or truck and rail, companies value the proximity to strong port and air cargo operations. The dynamic nature of logistics, including the uncertain future of where and how supplies may arrive, places a premium on those locations that can offer access to all modes of transportation.

The most important operating cost for logistics centers is, of course, transportation. Properly defined, our search region places us in areas of optimal transportation costs. So, the focus here will be on other key operating costs.

The nature of labor for logistics has changed with the sophistication of logistics operations. While the very large centers will still employ 500 or more people, many distribution operations now run with a smaller work force. The nature of “material handling” has changed to include technically demanding jobs focused on systems operations. However, these projects still seek a pool of relatively low-skilled labor, ideally supported with an effective training program. Many distribution centers operate with a relatively high turnover rate (20 percent or more) so the labor pool must be such that it can support on-going replacement hiring.

Taxes vary with every location and so will be a location factor for distribution operations. Of critical importance will be property taxes. Distribution centers typically involve investments of $25 million to $75 million, with half or more of that being the racking and conveyors and handling systems inside the building. The tax and incentive treatment of distribution operations has begun to “catch up” with manufacturing and so this issue should be closely investigated during site selection.

With so much of the logistics activity being driven by foreign trade, the designation of a site as part of a Foreign Trade Zone may be important. This federal designation provides tax and duty savings for many inbound goods that are used in a finished product. Companies whose site search is driven by international shipments will be very sensitive to this tax benefit.

It is important to note one stalwart characteristic of logistics operations – the demand for low cost. While distribution centers are recognized as critically important to an enterprise, they are still cost centers, so operating costs will be a critical focus during site selection. For the large labor-intense centers, this is another factor that will push their location away from developed centers.

While quality-of-life factors come into play at some point in almost every project, this is a relatively lightly weighted factor for distribution centers. These facilities hire almost entirely from the local work force, and the facilities are not usually the focus of a company’s customers or customer visits. The recruitment and retention of the center manager will be a factor, but generally quality of life is not a major driver for these facilities.

A number of metropolitan areas have developed over the past half-century as logistics hubs and continue to grow. However, the growth in these areas has pushed the definition of these areas to include more outlying areas. On the West Coast, Los Angeles/Long Beach continues to boom, driven by Pacific trade and continued population growth. Firms seeking Southern California locations will now find themselves looking at sites in such places as Ontario, Riverside and even in Apple Valley in the high desert.

In the Midwest, Chicago has long been a transportation and logistics hub. It continues to offer a mid-continent location that can be supplied from either coast and provide great access to much of the country. The “Chicago” market for logistics centers now extends a considerable distance with a considerable amount of activity to the south near Joliet and Tinley Park.

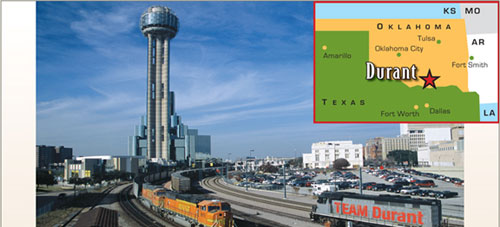

In the mid-south, Memphis and Dallas are the leading distribution centers. For Memphis, whose business identity is very much based on distribution, there are still viable sites in very close proximity to the city center, yet development continues to spread south into northern Mississippi and north in the communities along I-40 and US 51. The Dallas metro is large and spread out, and so continues to provide good locations for distribution centers. The Alliance properties near Ft. Worth continue to attract interest, and the communities to the south such as Midlothian have been active with these projects.

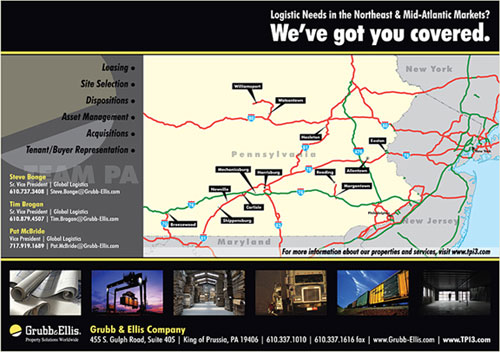

In the south, Atlanta has been and continues to be the logistics hub for the region. Atlanta’s strong growth has pushed much of the new distribution activity out to such areas as Commerce to the north and Macon to the south. In the northeast, the New York metropolitan area remains a distribution hub. Activity here grows south on the Garden State Parkway past the Meadowlands. Eastern Pennsylvania is also emerging as a N.Y.-N.J. metro location for distribution.

A number of other locations are emerging as viable logistics centers.

In line with the observation regarding sensitivity to all modes of transportation, a number of Gulf Coast locations are active. The multi-mode attraction of Houston, Texas; Baton Rouge, La.; and Mobile, Ala., has helped these areas overcome the risks associated with potential storm damage and interruption.

Along the east coast, port cities such as Savannah, Charleston and Hampton Roads continue to attract a high number of distribution operations. The I-95 corridor from Baltimore, Md., to Wilmington, Del., has been very active as a distribution center. Pittsburgh, Pa., is also a growing distribution center.

In the southeast, Charlotte continues to build on its history as a strong distribution center, and this presence has extended along I-85 and I-77 in both North and South Carolina. Knoxville is often overlooked, but offers an excellent distribution location central to the southeast and across the Appalachian Mountains.

In the Midwest, Indianapolis continues to build on its history as a distribution center, and has been joined by such locations as Columbus, Ohio; Louisville, Ky.; St. Louis, Mo.; and Kansas City, Mo.-Kan. The Illinois side of St. Louis is particularly active as a successful logistics center. In the mountains, Denver continues to build on its history as a distribution center, and has been joined by Cheyenne, Wyo., and Albuquerque, N.M., as alternatives for mountain state logistics centers.

On the west coast, Seattle and Portland continue to build on their history as distribution centers. In Washington, Spokane is emerging as an inland alternative location, and such areas as Aberdeen and Grays Harbor are working to develop their capabilities in support of logistics centers. Phoenix, Ariz.; Las Vegas, Nev.; and Reno, Nev., all continue to grow as distribution centers, providing affordable access to the California markets. An emerging competitor to these western locations is St. George, Utah.

Finally there are “specialty” areas emerging with high levels of distribution activity. These range from such major metro areas as Miami, Fla., to Mexican border cities such as Corpus Christi, McAllen and El Paso in Texas and Las Cruces in New Mexico.

When seeking a location for a logistics operation, companies need to do considerable optimization modeling to define their appropriate search region. Once the region has been selected, be sure to look at the locations within the region that best meet your particular needs, and do not overlook outlying areas.

Finally, be sure to understand the community’s sensitivity to your project. A number of locations that have emerged as logistics centers over the past five years have also begun to pull back from recruiting additional projects because of perceived negative impacts of so many new distribution centers.

Mark M. Sweeney is senior principal of McCallum Sweeney Consulting, based in Greenville, S.C. On the Web, visit www.mccallumsweeney.com.