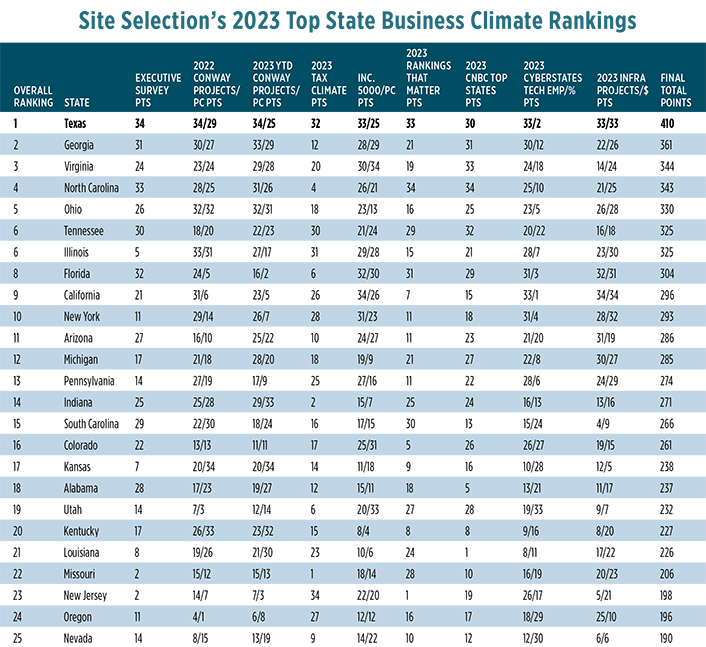

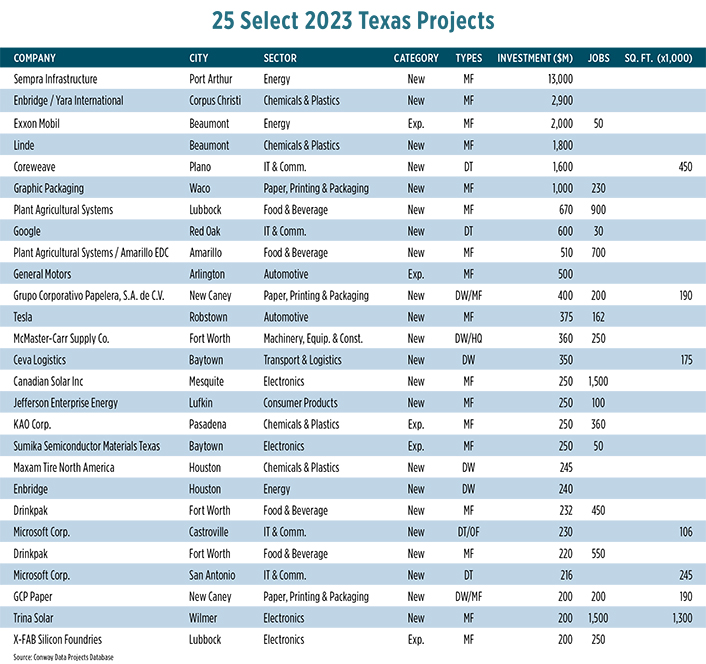

Fresh from winning its 11th consecutive Governor’s Cup for total capital investment projects earlier this year, Texas is finishing 2023 with top billing in Site Selection’s annual ranking of state business climates. The ranking is based on 10 criteria, including a survey of corporate site selectors, qualified projects logged in the publication’s Conway Projects Database and independent measures of states’ attractiveness to capital investors.

Texas has always performed well in the business climate ranking, routinely finishing in the top five — it placed third in 2022. This year’s first-place finish is decisive with a total point score of 410, well ahead of second-place Georgia, which earned 361. Rounding out the top five are last year’s winner Virginia (344), North Carolina (343) and Ohio (330).

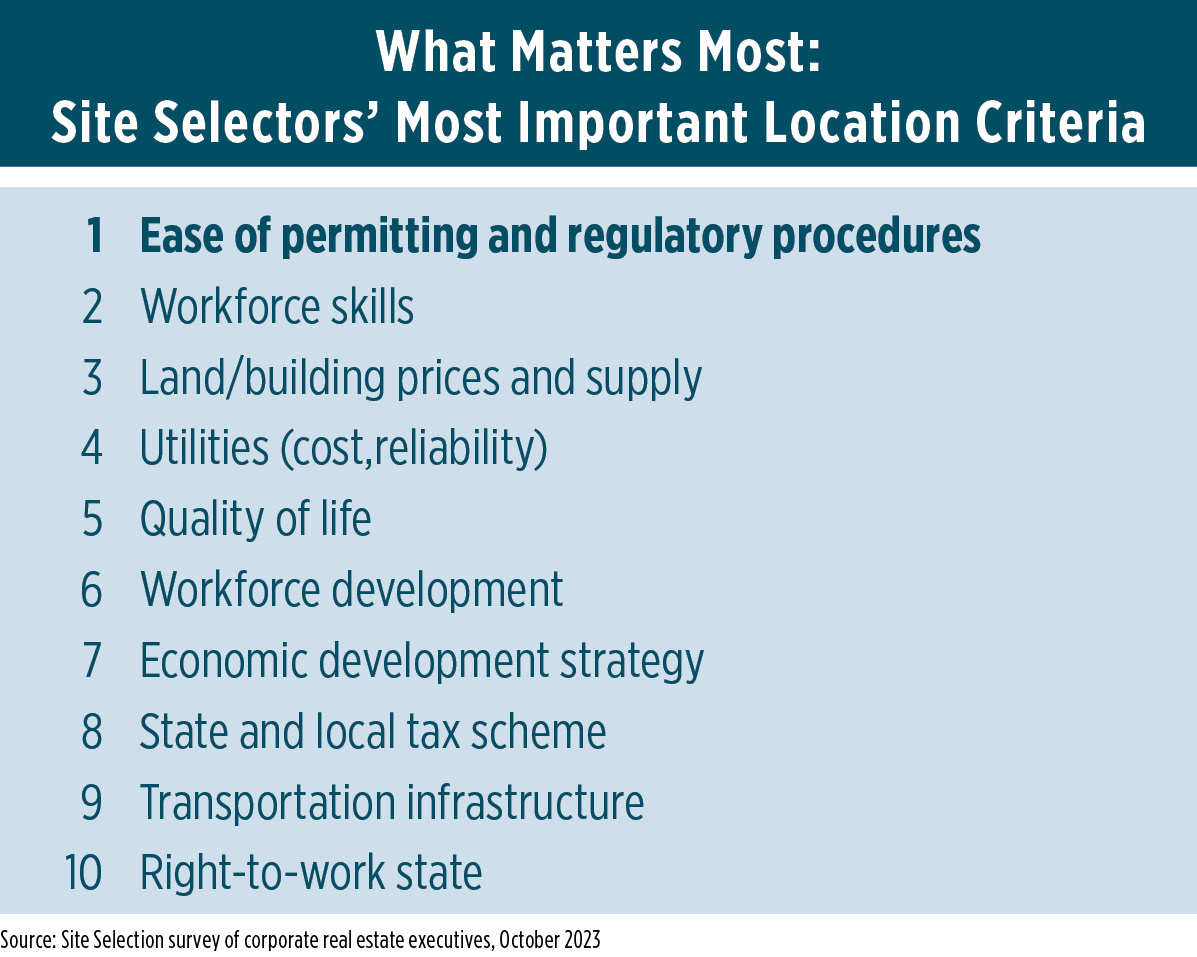

The survey of corporate site selectors asked respondents to rank the states according to their experience of locating projects in them. Texas placed first in that criterion, followed by North Carolina, Florida, Georgia and Tennessee. It also asked them to prioritize the location factors most important to them. Topping that list this year is ease of permitting, followed by availability of needed workforce skills, land, utilities and quality of life.

In the following interview with Site Selection, Governor Greg Abbott explains, among other topics, how two key pieces of legislation signed earlier this year will keep the eighth largest economy in the world the go-to state for capital investors from around the world.

CREDIT: Photo courtesy of the Governor’s Office of Economic Development

The most recent legislative session was particularly productive in terms of economic development. The Texas CHIPS Act and the Jobs, Energy, Technology and Innovation Act will bear fruit in the future, but what do you think helped Texas claim Site Selection’s “Top State Business Climate” ranking in 2023?

The most recent legislative session was particularly productive in terms of economic development. The Texas CHIPS Act and the Jobs, Energy, Technology and Innovation Act will bear fruit in the future, but what do you think helped Texas claim Site Selection’s “Top State Business Climate” ranking in 2023?

Gov. Abbott: We are proud to be recognized by Site Selection Magazine as the No. 1 business climate in the nation. The secret to our success is not complicated. In Texas, we want businesses to succeed. Whether a company is new to our great state or has been in operation for years, when those businesses succeed, Texans succeed. We see the impact of that economic development model year after year as we continue to attract new jobs and capital investment from across the country and around the globe. As a result, we are now the eighth-largest economy in the world.

When choosing where to relocate and expand their businesses, more and more innovative industry leaders choose Texas. They recognize the competitive business advantages found only in Texas.

Leading CEOs cite our pro-growth policies — with no corporate income tax and no personal income tax — along with our young, growing, skilled and diverse workforce, easy access to global markets, robust infrastructure and predictable regulations.

Photo courtesy of Texas Instruments

These business advantages found only in Texas grow more than the bottom line. When freed from the stranglehold of over-taxation and runaway regulation, new ideas flourish here. Working with the Texas Legislature and state agencies, we continue to ensure that Texas remains the nation’s economic leader.

As I talk with business leaders and employers each week, they point to that freedom and our welcoming business climate as the Texas advantages that allow their companies to grow and their employees to thrive in Texas.

Was there ever any doubt that Chapter 313 would be replaced? How is the JETI Act or HB5 an improvement on it?

Gov. Abbott: Every year I have been governor of this great state, Texas has been awarded the Governor’s Cup by Site Selection for attracting the most business relocation and expansion projects in the nation. But we cannot be complacent. We are in competition with locations not only across the United States but around the world.

That is why I signed into law this year the Texas Jobs, Energy, Technology & Innovation Act. This new competitive economic incentive program will help ensure our communities have the necessary economic development tools to continue attracting new capital investments that will create good-paying jobs for generations.

This strategic economic development tool offers a school property tax value limitation to attract large-scale economic development projects with a focus on manufacturing facilities; dispatchable electric generation facilities; natural resource development facilities; research, development or manufacturing facilities for high-tech equipment or technology; and the construction or expansion of critical infrastructure.

Texas also offers a robust incentive program portfolio, including one of the most competitive deal-closing funds in the nation — the Texas Enterprise Fund — along with other state, local and regional economic development programs to attract diverse industries to communities all across Texas.

The semiconductor sector is already very strong in Texas. How will the Texas CHIPS Act make it even more successful?

Gov. Abbott: Texas is where the microchip was first born and where the future of America’s semiconductor industry is already building for tomorrow as Texas has led the nation for 12 years in the export of semiconductors and other electronic components.

I signed the Texas CHIPS Act into law in June of this year to further accelerate semiconductor manufacturing in Texas and reduce our nation’s reliance on foreign production and supply chains.

The Texas CHIPS Act establishes the Texas Semiconductor Innovation Consortium (TSIC) and the Texas Semiconductor Innovation Fund (TSIF) to leverage Texas’ investments in the semiconductor industry, encourage semiconductor-related companies to expand in our state, further develop the expertise and capacity at Texas higher education institutions and maintain the state’s position as the national leader in semiconductor manufacturing. Both programs will be administered by the Texas CHIPS Office, a newly formed division within my economic development office.

How is your office working with economic developers away from the large metros to secure capital investment statewide?

Gov. Abbott: My economic development team markets and promotes the state of Texas and all of our diverse communities, both urban and rural, across the country and around the world as a premier business location and travel destination.

In Texas, economic development is truly a team sport. Our success is thanks to a decentralized process that results in close partnerships with our local and regional economic development organizations along with our private-sector partners and innovative industry leaders.

From our vibrant urban centers to our hometown rural communities, Texas offers room for businesses of all sizes to grow — and succeed. In fact, across every region of Texas, innovative startups are growing alongside the world’s biggest brands, 55 Fortune 500 headquarters, hundreds of publicly traded firms and more than 3 million small businesses.

We continue to attract a diversity of industries that are drawn by the operating advantages found only in Texas as well as the unique strengths of each region and communities both large and small.

What’s on the agenda in the coming months that will help maintain Texas’ business climate momentum into 2024?

Gov. Abbott: The economic momentum we are seeing in Texas today is record-setting as our project pipeline continues to expand. Meeting the needs of employers is paramount to ensure Texas remains the top state for economic development and business climate.

Our greatest natural resource is the people of Texas, and they are the number one reason businesses relocate and thrive here. The state’s young, skilled and diverse labor force, now more than 15 million strong, is growing faster than the nation. And Texas is blessed to be the “stickiest” state in the nation: more than eight in 10 born in Texas stay in Texas.

Much of the state’s high-performing workforce is drawn from Texas’ top-ranked colleges and universities, including 11 Tier One research universities. Demand is also growing for middle-skill workers. That is why Texas continues to invest in workforce training programs, with an average of 4.4 million Texans participating in workforce system programs and services annually.

Photo courtesy of RWE Renewables

The state is also moving to performance-based funding for community colleges. I signed House Bill 8 into law this year, which aligns with that model, and we continue to make historic investments in higher education to ensure Texas can support the innovative leaders and workforce of tomorrow. Investments in expanding the state’s already robust infrastructure and transportation network are also critical. In August 2023, I announced a record $142 billion in total investment to further improve roadways and the connectivity of Texas’ transportation infrastructure.

With a strong vision for the future, the support of the Texas Legislature and the broad portfolio of economic development programs unique to Texas — including the new Texas CHIPS Office, the Texas Semiconductor Innovation Fund and the Jobs, Energy, Technology & Innovation Act — we will continue to work with our economic development partners throughout the state to ensure Texas is long recognized as the best business climate in the nation.

Largest Texas Workforce in History

One indicator of a state’s business climate is whether or not its labor force is growing. On October 20th, Governor Greg Abbott’s office announced that based on September employment data Texas for the past two years has exceeded previous jobs totals and that the state’s labor force is the largest it has ever been with more than 15 million workers.

Photo: Getty Images

The Texas Workforce Commission and the Bureau of Labor Statistics report that Texas employers added 61,400 jobs in September and that from September 2022 to September 2023 the state added 435,800 jobs at a 3.2% rate — faster than any other state. The national growth rate was 2.1%.

The Texas Workforce Commission and the Bureau of Labor Statistics report that Texas employers added 61,400 jobs in September and that from September 2022 to September 2023 the state added 435,800 jobs at a 3.2% rate — faster than any other state. The national growth rate was 2.1%.

“Jobs are surging in Texas thanks to the best business climate and strongest workforce in the nation,” said Governor Abbott in a statement. “Texas employers added 61,400 jobs in September across diverse industries, marking 24 months in a row that the state has surpassed all previous records for total jobs. We are America’s jobs leader because Texas moves at the speed of business, cutting red tape and getting out of the way so businesses thrive, jobs grow, and Texans prosper. That is why the Texas economy is the eighth-largest economy in the world. With more Texans are working than ever before, we continue to build an even bigger, bolder Texas of tomorrow.”

There’s more to Texas’ business climate than record job growth, notes Texas rancher Linda Burns, site consultant and incentives practice leader at Wadley Donovan Gutshaw Consulting.

“Texas has several major metro areas that can satisfy headquarters recruiting and operating requirements,” she relates, “including a growing population, depth of executive/professional talent, the presence of other HQs, large talent pipeline from colleges and universities, global air access, no corporate income tax, a favorable business regulatory climate, reasonable cost of living, quality of life for relocating talent, and available real estate as well as developers willing to partner on build-to-suits.”

Signature Legislation

As the governor noted in his interview with Site Selection, replacing the Chapter 313 incentives program with the Jobs, Energy, Technology and Innovation Act was a signature measure of the 2023 legislative session in the economic development context. The Texas Economic Development Act, the Chapter 313 program, was intended to lure large companies to Texas — primarily capital-intensive manufacturing projects — by discounting their local school district property taxes, says Burns.

“That was the case for one of our manufacturing clients who was one of the last companies approved in 2022 for the Chapter 313 incentive,” she notes. “Approved companies would receive a 10-year limitation on their appraised property value for the M&O [maintenance and operations] portion of the school district property tax, which typically accounts for over half of the local Texas ad valorem taxes. Companies had to meet a minimum threshold of capital investment in new construction, equipment and job creation in the district to qualify for the limitation. The program specified lower eligibility thresholds for investment and qualifying jobs in rural districts with comparatively low populations. Because it could take up to 150 days for final approval, we have experience with clients who could not consider this incentive.”

The pros that stand out are a shorter 90-day minimum timeline versus the possible 150 days and elimination of the supplemental payments to the school districts, so companies are able to retain the total tax savings benefit.”

— Linda Burns, Site Consultant and Incentives Practice Leader, WDG Consulting, LLC

The sunsetting of Chapter 313 in 2022 had some investors wondering what, if anything, would replace it. Burns says the general consensus was that a comparable program would materialize because of the statewide advocacy to continue to offer competitive incentives like Chapter 313 as well as the Type A & B Economic Development Corporations at the local level. The state continued to offer several other incentive programs, such as Chapter 380 and Chapter 381 property tax rebates for city and county, respectively, property tax abatements of up to 10 years, the governor’s “deal-closing” Texas Enterprise Fund grants, Texas Enterprise Zone Project sales & use tax rebate grants, and training funds.

Headquarters projects and other projects of a more significant scope, like data centers, were still able to take advantage of these programs as well as the aggressive programs offered at the local level, she adds. Texas’ Development Corporation Act gives cities the ability to provide incentives through Type A and B economic development corporations who receive a percentage of the local sales tax annually to use in recruitment. Although manufacturing and industrial projects are eligible, so are regional or national corporate headquarters, R&D facilities, training facilities and some infrastructure improvements.

JETI Pros and Cons

Will JETI be an improvement on Chapter 313?

“The Comptroller is currently working on the rulemaking,” says Burns. “Since the program is not up and running yet, the verdict is still out on its overall impact on company recruitment. Although there are improvements, there are some cons that could make the program not as accessible to some companies, like the higher job creation requirement. Plus, the standardized application fee and elimination of the supplemental payments to the school districts could impact a district’s decision to participate.”

Burns says JETI has other cons as well. These include a higher investment threshold for qualifying, elimination of renewable energy projects and data centers from eligibility, and a higher job requirement (except for non-renewable electric generation) that cannot be waived. Additionally, she says, it gives a straight “abatement” on the school district’s M&O rate at 50%, or 75% if in a federal Opportunity Zone (versus 100% under Chapter 313) — with the state still making the school district whole.

“Also,” she notes, “a Performance Bond is required — [the state is] currently working out how that works in rulemaking and at what rate. It is currently set at 20% of the minimum investment threshold for a respective tier but that could change. A tier represents a county’s population level, ranging from the smallest tier of less than 100,000 population to the largest at over 750,000, with a total of four tiers. The tiers also set the threshold for investment.”

JETI brings several advantages, too, says Burns, relative to Chapter 313.

“The pros that stand out are a shorter 90-day minimum timeline versus the possible 150 days and elimination of the supplemental payments to the school districts, so companies are able to retain the total tax savings benefit,” she notes. “Also, independent contractor jobs based at the facility can be included in complying with the headcount requirement. Other pros are the standardized application fee at $30,000 versus what the respective school district requested, and the incentive is a ‘compelling’ factor and not the ‘determining’ factor.”

Cashing in the CHIPS

The other signature economic development legislation of 2023, the Texas CHIPS Act, will continue to attract semiconductor operations and will be instrumental to leverage Texas’ investments in the semiconductor industry, encourage semiconductor-related companies to expand in the state, and further develop the expertise and capacity at Texas higher education institutions, Burns asserts. In June, the Texas Legislature appropriated $698 million for the new fund. In addition, the Legislature appropriated more than $600 million for the creation of advanced research and development centers at The University of Texas at Austin and Texas A&M University.

“Key to Texas’ continued success in growing the semiconductor industry in the state will be to ensure sufficient electric power, including green, water availability, and a qualified, abundant workforce, including during construction,” says Burns. “Per the Semiconductor Industry Association, the U.S. could be short 67,000 workers by 2030 because engineering students are not graduating fast enough. Technicians with certificates or two-year degrees are needed to staff the new fabs and install and configure equipment. According to the McKinsey Global Institute, semiconductors and artificial intelligence are the leading edge of technology. Referred to as integrated circuits or microchips, they are essential in computing, communications, healthcare diagnostics, military systems, transportation and energy, among others.”

Population Growth and Other Challenges

Looking to the future, Texas is not without its challenges, Burns points out. The state is experiencing a population boom, adding nearly 4 million residents over the past decade. “In addition to new residents, increasing numbers of businesses are relocating or expanding in Texas,” she notes. “Continued growth in population and industries means increased demand for energy and other resources, both natural and human infrastructure.

“Texas leads the nation in both energy production and energy consumption,” she continues. “For the last decade and a half, Texas has led in wind-powered electricity generation, and our state’s vast geography also makes it a leader in solar generation potential. Many additional renewable energy facilities are planned and underway in the state, including essential new transmission lines which can take decades to complete. Given the energy demands of our populous state, Texas must continue upgrading its diverse energy portfolio, because renewable sources alone are not up to the task of bearing the ever-growing load.”

The state Legislature and local governments should provide increased funding for public education and workforce development, says Burns, including retraining, to meet workforce demands and prepare them for the changes in cyber technology, manufacturing production processes, semiconductor industry, AI, and other disciplines.

“Texas’ state and local leadership should continue our pro-business, reasonable regulatory climate, which continues to appeal to businesses, as evidenced by our growth,” Burns points out. “And with this leadership should continue to approve legislation to enhance both state and local incentive policies to provide flexible incentives tailored for manufacturing companies to invest in new technologies. And lastly, we should continue our historical practice of long-range planning for the development of reservoirs and pipeline distribution to assure water to meet the growing demands of residents and new industries to the state.”