A positive by-product of the pandemic in Southeast Asia was the rapid pace of digitalization — encouraging the tech sector and its stakeholders to continue on the path of innovation and growth. A diverse region with a wide range of market demands and more than 100 million new internet users since 2020, Southeast Asia presents ample opportunities across the board. More than $43 billion in startup equity and debt funding occurred between 2021 and 2022.

Known as the ASEAN-6, Singapore, Malaysia, Indonesia, Thailand, Vietnam and the Philippines (the region’s largest economies) continue to develop their tech ecosystems for startups/companies.

Singapore, with a population of only 6 million but a 97% internet penetration rate, is on the advanced end of the spectrum in terms of adoption and use of digital platforms across various aspects of daily life, from payments (PayNow platform) and e-commerce (headquarters of Lazada, Grab and Shopee) to government services (SGGov) and healthcare. On another point of this spectrum is Indonesia, with 280 million people and an internet penetration rate of 77%, which has displayed a growing preference for e-wallets and digital banking, the rise of 13 unicorns and a plan to bring 30 million SMEs as well as millions of unbanked individuals into the digital fold.

Driving this digital transformation are a few important, predominantly government-led themes:

National Digitalization Initiatives

Singapore’s SmartNation Program is implementing truly transformative digital solutions across three key pillars: digital economy, digital government and a digital society.

Other initiatives such as Thailand 4.0, Indonesia’s 2021-2024 Digital Roadmap, Malaysia Digital and Vietnam’s National Digital Transformation Program 2025, are targeting specific industries in their respective countries deemed to be of national strategic value, for expedited transformation through faster digital adoption, attracting relevant investors, and inculcating a sense of innovation by encouraging local startups. Others, such as the Philippines’ National ICT Ecosystem Framework (NICTEF), prioritize development of a robust framework of ICT regulations/policies, upskilling talent and developing supporting infrastructure.

Sandboxes

Sandboxes are paving the way for true public-private partnerships in digital transformation across ASEAN. Government-mandated digital sandboxes are providing tech startups and companies a “safe space” to test their solutions without affecting real networks and stakeholders, while enjoying exemptions from specific regulatory obligations.

Singapore, Malaysia, Indonesia, Thailand and the Philippines have started digital sandboxes for fintech, e-commerce, healthcare, govtech, regtech, cybersecurity and cleantech, among others. Vietnam is also joining this movement and released its fintech sandbox decree in 2022 for government approval.

Accelerators

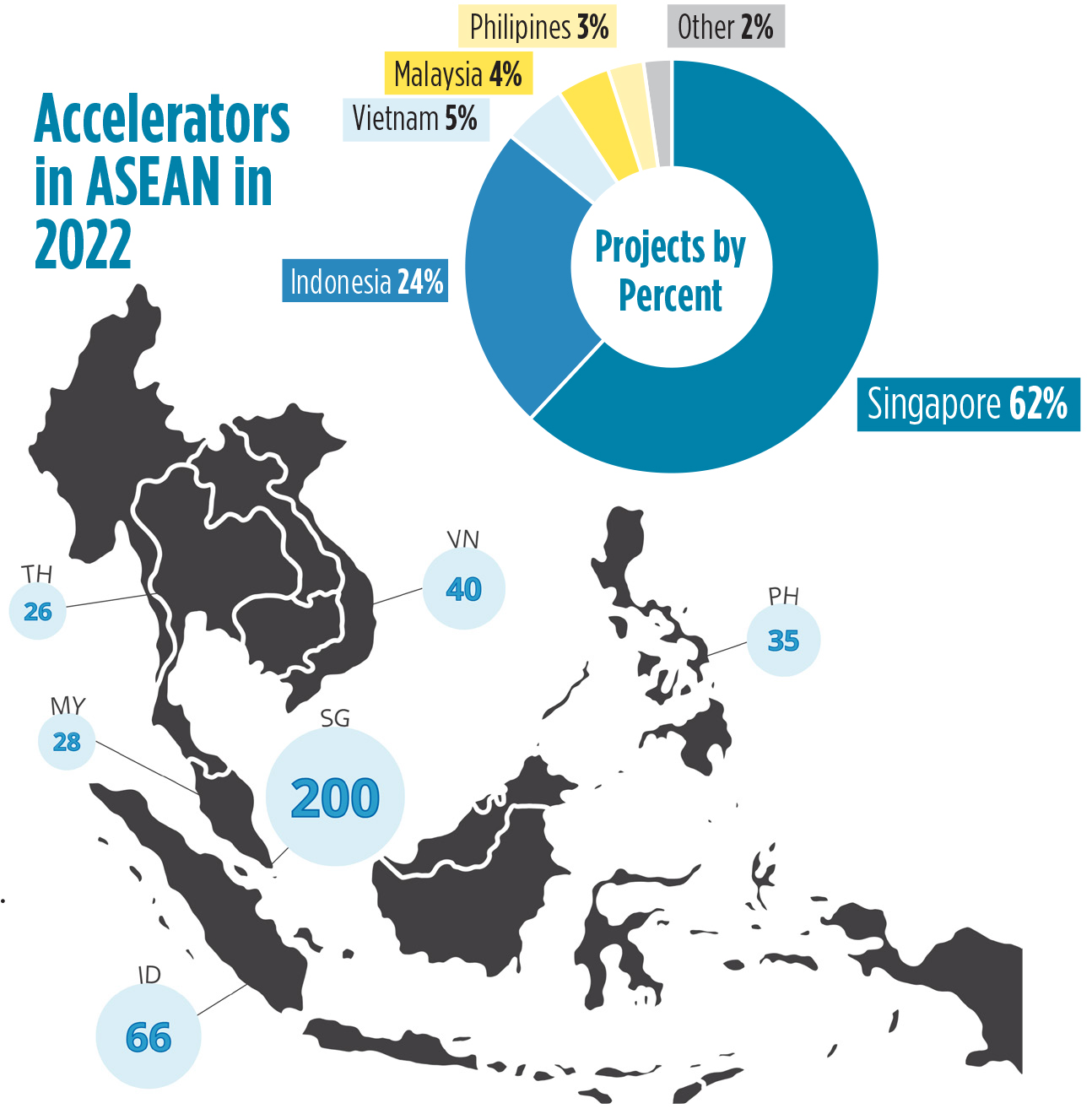

By providing mentorship and access to investors, accelerators have sprung up across the ASEAN-6 to ride the tech startup wave (see map). Mirroring global models, the trend with the best accelerators in these markets involves having core knowledge partners, access to government support, providing physical infrastructure to startups as well as strong relationships with local and international investment firms. Singapore created StartupSG to support accelerators through a collaborative network of the National University of Singapore, media players and VC/PE firms.

In response to a decline in the number of sector-agnostic accelerators since 2017 and specialized accelerators between 2020 and 2022, Techsauce launched its Thailand Accelerator — a great example of a community of seasoned tech sector leaders supporting local startups by providing them guidance and exposure to their network of strategic partners/investors.

Access to Funding

In terms of access to private-sector funding, according to a Cento Venture study, Southeast Asia has seen a steady rise with over $65 billion invested in technology startups between 2013 and 2022.

As a global financial hub, Singapore is the undisputed top location for tech startups looking to engage investors. Indonesia comes second, offering tech companies opportunities as the largest market in the region, driven by the rise of e-commerce and fintech adoption over the last three years. According to a 2022 BCG report, there are over 330 fintech players in Indonesia, a six-fold increase since 2011 and in the limelight of investors. Vietnam, a sizeable market of 100 million people, saw its 3,000+ startups raise over $1 billion in 2021.

Sources: Singapore Ministry of Trade and Industry, Innovation Club Thailand, Swiss Entrepreneurship Program, Tracxn, Tractus Asia research. *Note: This list does not include incubators.

Each country has its own unique set of complexities for tech companies looking to enter, invest and grow. Per Tractus’ experience and feedback from tech clients entering ASEAN, the main challenges new entrants might face include:

Hiring the right talent: This can be a challenge depending on the type of tech talent you need to hire and the numbers as demand is high, but supply is short.

Finding the right partners: If your business model relies on strategic partners, it is important to vet them face-to-face, if possible. Investing in relationships is a core cultural component of doing business in the region.

Building your Southeast Asia story: Besides assessing product-market fit, thinking about how your company will add value to the country will go a long way in building a sustainable platform for growth. Unfortunately, many companies realize too late that a “one size fits all approach” might not get traction in terms of adoption, investments or incentives.

In the end, depending on your appetite for risk and whether you want to start with one country or multiple simultaneously, the Southeast Asian market and its tech ecosystem are wide open. Just remember to do some homework before you head to the playground.

Udai Panicker is Singapore Country Manager and Pei Wen Ng is Senior Research Analyst at Tractus Asia Ltd., (www.tractus-asia.com), a leading Asia-based global site selection firm.

Udai Panicker is Singapore Country Manager and Pei Wen Ng is Senior Research Analyst at Tractus Asia Ltd., (www.tractus-asia.com), a leading Asia-based global site selection firm.