Green technology has emerged as a critical trend in the global effort to combat climate change and promote sustainability. Multinational forums like Davos foster shared well-being, but politics often cloud international partnerships, risking planetary health. Where cooperation must be increasingly prioritized to advance multilateral goals, synergy between Western innovation and Chinese production capabilities will be pivotal to making green technology accessible and affordable worldwide.

China’s Role in Global Green Technology Implementation

For the last four years, the renewable energy sector has accounted for the largest share of global cross-border investment, with US$348 billion expended in 2023. Investments in electrical components, including batteries, have also surged. Beyond just renewable energy and storage, however, green technology encompasses all practices and products designed to reduce environmental impacts and promote sustainability. The primary goals are to minimize carbon emissions, conserve natural resources and protect the environment for future generations.

According to the International Energy Agency (IEA), China was the largest public spender on energy R&D in 2023, accounting for one-quarter of global public investment in this sector. Chinese private-sector firms including CATL, BYD and Huawei are at the forefront of developing advanced green technologies, each investing billions of US dollars.

On August 11, the Chinese authorities generated a 33-point document aiming to “establish a green, low-carbon and circular development economic system” by 2035. They set ambitious goals for as early as 2030, such as raising the share of non-fossil consumption to 25% and gradually increasing the annual utilization of bulk solid waste, reaching about 4.5 billion tons. By that year, the Chinese government estimates that the scale of China’s energy conservation and environmental protection industry will reach about 15 trillion yuan ($2.09 trillion).

China’s green manufacturing efforts reflect a commitment to sustainable development and addressing environmental challenges while maintaining economic growth. The effectiveness of these initiatives will be crucial in shaping China’s environmental impact in the coming years, affecting in-country markets and exports. Key industries where China is exporting green manufacturing products and technologies include:

- Renewable Energy: China is a global leader in the production and export of renewable energy technologies, such as solar panels, wind turbines and energy storage systems. Chinese companies have significant global market shares in solar photovoltaic (PV) panels and wind power equipment. According to the IEA 2022 report, China’s share in all stages of solar panel manufacturing (including polysilicon, ingots, wafers, cells and modules) exceeds 80%. Based on manufacturing capacity under construction, the same report states that China’s share of global polysilicon, ingot and wafer production will soon reach almost 95%.

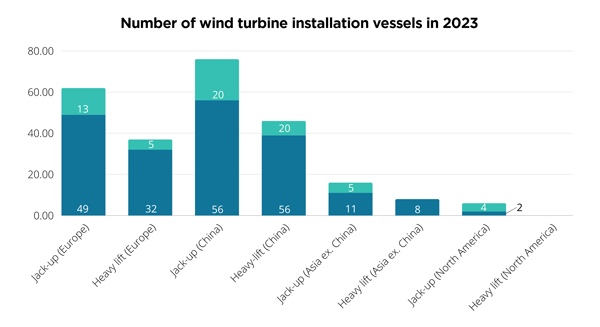

Chinese manufacturers also captured 65% of the global wind turbine manufacturing capacity in 2023, a significant milestone that propelled four Chinese wind technology companies into the top five global rankings for the first time. Sungrow and Hyperstrong, both Chinese companies and leaders in energy storage systems, are now among the top five system integrators globally due to substantial growth in China’s domestic energy storage market. Among battery manufacturers, CATL (Contemporary Amperex Technology Co., Ltd.) achieved a 43% global market share by 2022, while BYD and Eve Energy secured the second and third positions, with market shares of 12% and 7%, respectively.

Another critical area in renewable energy in which China has invested enormous efforts is hydropower, with massive projects like the Three Gorges dam. The world’s largest hydropower project, China’s Three Gorges Dam hydroelectric power project on the Yangtze River has generated over 1,600 terawatt-hours (TWh) of clean electricity since its first generator unit was implemented in 2003. This energy has saved over 480 million tons of standard coal and reduced carbon dioxide emissions by about 1.32 billion tons.

- Energy efficiency: Chinese companies are involved in exporting advanced metering infrastructure (AMI), grid management systems and energy storage solutions, mainly composed of smart grids to optimize energy distribution and reduce wastage. Chinese companies have also become larger producers and exporters of energy-efficient appliances — namely air conditioners, refrigerators and washing machines — with effective use of IoT technology. Moreover, China is a leader in the promotion of green buildings with sustainable materials and energy-efficient designs, exporting energy-efficient windows, insulation and sustainable construction products.

Cost Comparisons and Economic Implications

The cost dynamics of green technology projects vary significantly depending on the manufacturing source. Understanding the financial impact of using Chinese-manufactured green technology components versus Western-manufactured ones can be achieved through the examination of a few key categories:

- Wind Turbines

- European companies have been at the forefront of engineering innovative green technologies, often utilizing cost-effective Chinese-manufactured components. One prominent example is the European offshore wind farms that use turbines produced by Chinese companies such as Goldwind and Mingyang. These collaborations have enabled Europe to expand its renewable energy capacity efficiently and economically. According to BloombergNEF, prices for Chinese-made wind turbines delivered outside mainland China are 20% lower than those of U.S. and European companies, allowing significant savings and broader deployment of wind energy projects. In 2023, steep turbine price reductions enabled China-based firms to commission 1.7 GW of wind projects in 20 markets overseas, including five EU member states.

- Solar Panels

- Chinese-manufactured solar panels and batteries are also considerably cheaper than their European counterparts. More than 90% of solar panels deployed in the EU are still imported from China, primarily because of their low price. Per a February 2024 Bruegel report, Chinese solar panels were estimated to be the cheapest globally at $0.26/watt, while German panels were approximately 40% more expensive at $0.38/watt. The disparity was driven primarily by higher input costs and labor, among other factors. Chinese solar panels have reportedly since dropped to as low as $0.15 per watt, while European panels cost nearly double, and U.S. solar panels even more.

- Battery Storage Systems:

- Battery storage system prices have also fallen, nowhere as dramatically as China. According to the BloombergNEF’s 2023 battery price survey, China boasts the lowest price of battery packs at $126/kWh. In the United States and Europe, the cost was 11% and 20% higher, respectively. While this gap has lessened in recent years, it reflects the “relative immaturity of these markets, higher production costs, lower volumes and the diverse range of applications.”

Cost advantage has made Chinese products highly attractive for large-scale projects, despite concerns over quality and geopolitical implications. Integrating Chinese-manufactured components into European and American projects demonstrates a pragmatic approach to achieving cost-effective solutions while maintaining high engineering and project management standards.

Mitigating Global Concerns

Despite China’s impressive advances in green technology, global investors are understandably wary. Forced technology transfers and IP appropriation had an essential role in the launch of the Chinese green technology giants. In addition, the government maintains direct and indirect influence in many Chinese corporations, and financial policies and subsidies as well as national security and compliance concerns give Western companies serious pause when partnering or contracting Chinese firms. The difficulty in distinguishing between public and private companies in China due to the links to the Chinese Communist Party (CCP) and differences in stock market reporting from the West transform due diligence into more of an art than a science and a must-have in any relationship with Chinese companies.

Moreover, the increasing prevalence of political acceptability — including compliance with the Committee on Foreign Investment in the United States (CFIUS) guidelines and assuaging cybersecurity concerns — as a critical factor in site selection and inbound investment decisions has added a layer of complexity to already opaque investment waters.

The Role of Multilateral Cooperation in Restoring Balance

In an era where climate change threats go beyond borders, worldwide intervention is needed. Historical precedents like the Kyoto Protocol and the Paris Agreement demonstrate the importance of international collaboration in addressing global challenges. Yet the importance of collaboration goes beyond policy. We can accelerate green technology adoption and implementation by leveraging the strengths of different countries, such as Western engineering innovation and Chinese manufacturing capabilities, with innovative multinationals leading the way. Success lies in differentiating which companies from China can be helpful to the projects without endangering the integrity of the Western participants and their business and ethics principles and legal compliance. This cooperation ensures shared technological advancements, cost management and scalable solutions, benefiting both developed and developing nations.

Impacts, Benefits, Challenges and Future Prospects

The partnership between global engineering and Chinese manufacturing in green technology projects has several significant benefits: innovation and quality, cost reductions, scalability and global reach. Collaborative projects demonstrate how multi-country cooperation can effectively address environmental challenges, benefiting both developed and developing nations.

While the collaboration between American and European engineering and Chinese manufacturing is promising, it faces several challenges: political and trade tensions, sustainability of supply chains, and ensuring that all components meet high-quality standards, which are crucial for the success of green technology projects. Looking ahead, the future of green technology depends on strengthening and expanding these international collaborations.

Due diligence plays a crucial role in foreign direct investment (FDI) approvals and multinational project consortiums, where selecting the right partners hinges on balancing national security issues with achieving sustainable development goals.

Innovations in artificial intelligence, nanotechnology and biotechnology are expected to enhance green technologies’ efficiency and effectiveness. As awareness grows, global cooperation is possible, provided the appropriate precautions are taken. China’s surge as a green technology leader, in addition to its challenges as a green technology supplier and partner, offers opportunities for progress. Cooperation between the rest of the world and compliant Chinese manufacturers will be indispensable in building a sustainable and resilient future.

In April, Power Construction Corporation of China (POWERCHINA) officially handed over the first site of the second phase of a microgrid photovoltaic project in Suriname in South America, providing remote villages with uninterrupted power using a combination of “photovoltaic, energy storage and diesel generation hybrid energy,” the company said.

In April, Power Construction Corporation of China (POWERCHINA) officially handed over the first site of the second phase of a microgrid photovoltaic project in Suriname in South America, providing remote villages with uninterrupted power using a combination of “photovoltaic, energy storage and diesel generation hybrid energy,” the company said.

Photo courtesy of POWERCHINA

About the Author

Herminio Andres Alija is the General Manager of the Tractus Asia Ltd. (Tractus) China office. Tractus has been assisting companies in making informed decisions about where to invest and expand in Asia and beyond for over 25 years. The Tractus team in China, specializing in due diligence, supports companies with optimizing their engagement and reducing risk to their investments and partnerships in China. For more information, visit www.tractus-asia.com.

Responses and comments to the author can be sent to Herminio.andres@tractus-asia.com and/or to editor@conway.com.