The REITing of Corporate America

by Stephen Finn

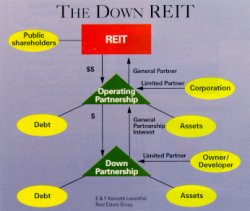

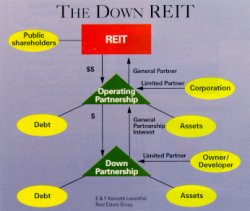

Real Estate Investment Trusts (REITs) are once again a force to be reckoned with. Institutions and other investors seeking to diversify their stock-heavy portfolios have concluded that real estate isn’t such a bad investment after all and have poured billions into the asset class. Traditional REIT structures involve the transfer of real estate assets into REITs and the sale of stock in the new REIT corporation to investors.

Despite their fall from grace in the 1980s, REITs deserve careful consideration by both owners of real estate assets and investors. Their growing pains are largely behind them, investors have stronger stomachs thanks to enhanced liquidity, and alternative REIT structures are making it easier for users of the securities to find a REIT structure they can live with. Despite their fall from grace in the 1980s, REITs deserve careful consideration by both owners of real estate assets and investors. Their growing pains are largely behind them, investors have stronger stomachs thanks to enhanced liquidity, and alternative REIT structures are making it easier for users of the securities to find a REIT structure they can live with.

In the last two years, the equity market capitalization of REITs has ballooned – from US$50 billion to more than $160 billion today. Even the most conservative projections anticipate that the REIT industry will top $300 billion before the year 2000. There are now more than 140 equity REITs and, although the feverish pace of new Initial Public Offerings has slowed, new REITs continue to emerge.

This popularity in the equity markets has brought REIT themselves some crucial financial benefits, including a lower overall cost of capital, access to a wider range of capital structures and economies of scale.

The paired-share REITwas created in the 1960s, is rarely used, and was grandfathered to just five REITs in 1986. It rose to prominence in the 1990s only when a few enterprising entrepreneurs realized the importance of the structure to owning and operating real estate in a tax-beneficial manner.

Like the paired share REIT, the paper-clip structure allows REIT management to run non-REIT businesses through a separate “sister” company. Unlike the paired-share, the stock of the two (or more) corporations in a paper-clip structure do not legally trade as one unit. So, while the alignment of interests of shareholders in the paired-share structure are excellent, shareholders in the paper-clip structure only benefit from the alignment of interest if they are shareholders in both the REIT and the operating company.

The current administration’s focus apparently is to limit the REIT tax advantages to what they believe was the intent of the original legislation-limited tax relief for a narrow market segment. Still, today’s growing market acceptance and visibility is giving lawmakers cause for alarm. Paired-share, paper clip and controlled private REIT’s may have a limited future, but plain vanilla REITs will survive.

— Stephen Finn is managing partner in the Atlanta office

of E & Y Kenneth Leventhal Real Estate Group.

Subscribe to Site Selection Magazine

|

JUNE/JULY 1998

JUNE/JULY 1998 Despite their fall from grace in the 1980s, REITs deserve careful consideration by both owners of real estate assets and investors. Their growing pains are largely behind them, investors have stronger stomachs thanks to enhanced liquidity, and alternative REIT structures are making it easier for users of the securities to find a REIT structure they can live with.

Despite their fall from grace in the 1980s, REITs deserve careful consideration by both owners of real estate assets and investors. Their growing pains are largely behind them, investors have stronger stomachs thanks to enhanced liquidity, and alternative REIT structures are making it easier for users of the securities to find a REIT structure they can live with.