Investment Activity

Although regional malls have generated negative headlines over the past few years, the recent acquisitions of the Westfield Group (Westfield) by Paris-based Unibail-Rodamco (Unibail) and General Growth Properties (GGP) by Brookfield Property Partners (Brookfield) may signal new opportunities in the space. Unibail purchased Westfield in 2017 for $15.8 billion in a deal that included acquiring 35 regional malls plus the Westfield World Trade Center retail complex. Brookfield, which had acquired a stake in GGP during the latter’s 2009 bankruptcy, took control of the entire company in March 2018 for $9.3 billion in cash. These large acquisitions demonstrate that investors see value in prime retail assets and are looking to implement strategies to improve the relevancy of the brick-and-mortar model for retailers. Malls will come out of the downturn in the retail industry if the assets are characterized by key factors, including location in a densely populated area, attractive appeal to a diverse mix of tenants, dynamic consumer base and sustainable strategies to drive foot traffic.

The Problem: Physical Retail Is Stagnant, and E-Commerce Is Dominating

According to IBIS World, the annual growth for the shopping mall industry between 2012 and 2017 was -0.8%, which is a slight decline in annual revenue growth. CoStar Group reported that in the United States, 77.0 million square feet (sf ) of national and regional retail stores have closed year-to-date in 2018, already surpassing 2016’s store closures of 75.7 million sf and well on the way to surpassing last year’s closure numbers of 105.0 million sf. Meanwhile, e-commerce continued to assert its dominance in the consumer market, as e-commerce sales grew 16.0% in 2017 to approximately $435.5 billion (representing 13.0% of total retail sales), per the United States Commerce Department.

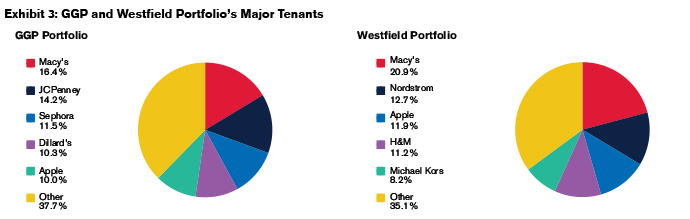

Malls are being hit especially hard, since most U.S.-based malls are tenanted by traditional department stores like Macy’s (which closed 30 stores across California, Florida, Indiana, Idaho, Michigan, Ohio and Vermont in 2018, according to a company announcement made in January), Nordstrom (which saw its shares decrease 7.3% by the end of 2017) and JCPenney (which closed 138 stores across 2017 and an additional eight stores in 2018). The current retail environment has allowed real estate investors to capitalize on undervalued portfolios of mall assets across the United States.

The Value of Core Assets

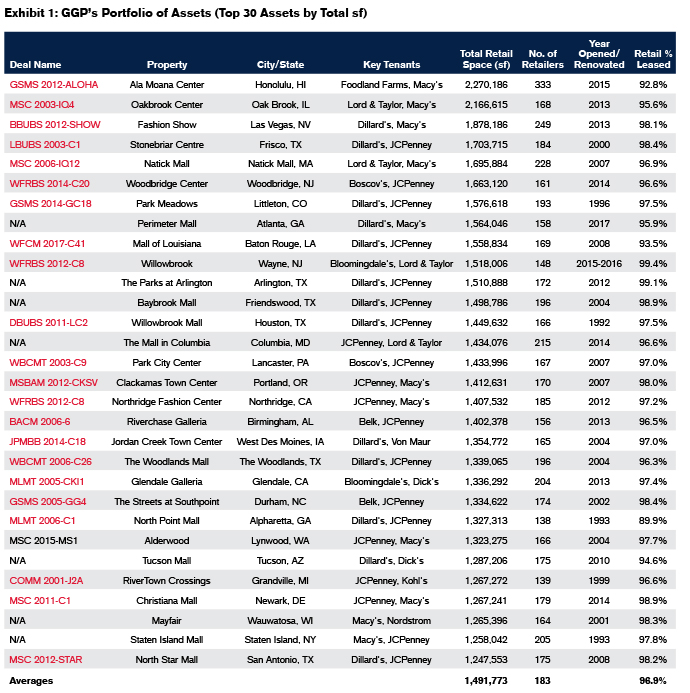

When Brookfield reached an agreement with GGP, it took on an impressive nationwide portfolio of 122 properties. These well- located properties are largely newer constructions, with approximately 67.2% of the properties built after 2000. GGP’s diverse portfolio includes premier assets such as the Ala Moana Center (secured in GS 2012-ALOHA), a 2.3 million sf super regional mall in the Waikiki area of Honolulu; and the Fashion Show Mall (secured in BBUBS 2012-SHOW), a 1.9 million sf mall located on the Las Vegas Strip that is home to 249 retailers.

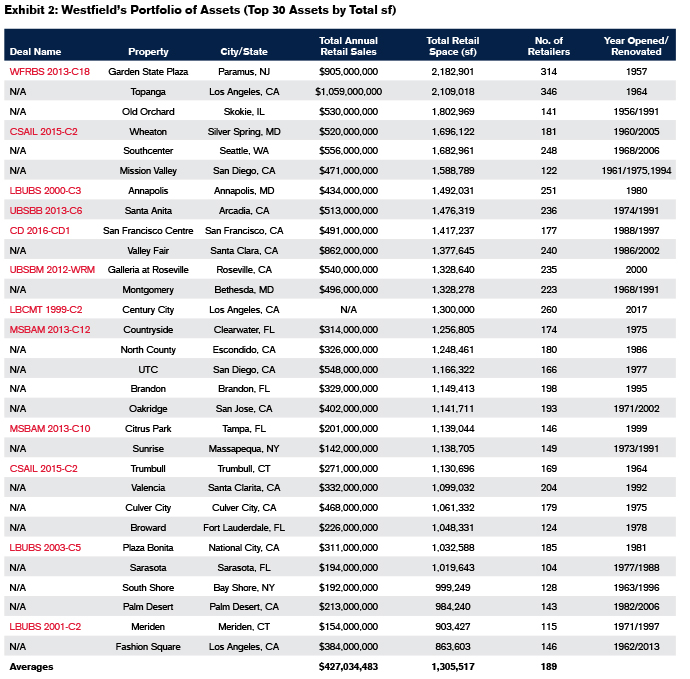

Unibail’s acquisition of Westfield’s portfolio of 35 regional malls included premier assets such as Garden State Plaza (secured in two 2013 CMBS transactions), a 2.2 million sf regional mall located in Paramus, New Jersey, featuring top-tier tenants; and Topanga & The Village, a 2.1 million sf mall that generated $1.1 billion in annual sales last year.

The average number of retailers in GGP’s top 30 assets was 183, with an average square footage of 1.5 million sf, compared with Westfield’s average number of retailers and square footage of 189 and 1.3 million sf, respectively, for its top 30 assets. Core assets, such as some of those in the GGP and Westfield portfolios, share common characteristics that define them compared with non- core assets. Many core assets that are in major gateway markets attract high-end tenants and have sales that significantly exceed those of traditional malls. The properties also have upside potential where opportunities exist to add additional value through redevelopment or renovations of existing spaces.

Investors like Brookfield and Unibail could have trouble finding value in assets that do not exhibit these characteristics and that are considered non-core assets. Non-core assets are typically situated in low growth markets, have threats to sustainability, are in a poor location and exhibit a high reliance on a small number of anchor stores. Neither core nor non-core retail assets are fully immune to the downturn in retail, and it remains to be seen whether malls can implement sustainable strategies in the long term. DBRS believes that malls will be successful in the future if they are well located in densely populated metropolitan statistical areas that are accessible and have tourist appeal and a dynamic consumer base. Malls must appeal to a diverse mix of tenants, and investors must deploy tactics to increase foot traffic on a sustainable basis.

Asset Highlights

GGP and Westfield have a collection of premier, well-located core assets in their respective portfolios. As mentioned, the Ala Moana Center is one of the most successful malls in GGP’s portfolio. The mall is uniquely situated in Honolulu at a location within one mile of Waikiki Beach, and it introduced a 660,000 sf Ewa Wing expansion in November 2015 — an expansion that was enabled by the sale of Sears’ space to GGP in 2013. In 2014, GGP, Blacksand Capital and two other Hawaii-based developers partnered to build the ONE condominium complex on top of the Nordstrom parking garage of the Ala Moana Center and followed with the construction of a 200-unit condominium complex on the oceanside parking lot of the mall. DBRS believes that its premier location and strong tenant base makes Ala Moana Center a core asset with tremendous upside. The mall will benefit from the development of the Kapiolani residences, a 485-unit residential tower that is a two-minute walk from the mall, which can create additional value for GGP . The subject will also benefit from the Honolulu Rail Transit project, a 20-mile elevated rail line with expected completion in 2019 that will include the Ala Moana Center as its final station stop. In-line tenants less than 10,000 sf generated sales per sf (psf ) of $1,202 in 2017, with key tenants such as Macy’s, Apple and Barnes & Noble reporting sales psf above national averages.

Westfield’s Garden State Plaza is one of Westfield’s premier assets, just outside Manhattan, and has seen its cash flow increase every year since issuance. Westfield has invested approximately $260 million into the asset since issuance, opening a 55,000 sf wing in 2014 and allocating $100 million toward renovations. Ongoing projects include building out a food hall with an urban bistro and implementing aesthetic improvements. Despite the mall’s losing JCPenney (8.0% of the net rentable area (NRA)) in April 2018, DBRS believes that strong sales psf and Westfield’s historical commitment to the asset with steady capital investments to expand and upgrade the property suggest the mall is well positioned to capitalize on the opportunity to repurpose that vacated anchor space for a more desirable use.

Some of GGP’s and Westfield’s assets can be considered non-core and high-risk assets due to their secondary locations, declining sales psf and exposure to underperforming national retailers. Westfield Palm Desert (secured in two 2015 CMBS transactions) in Palm Desert, California, can be considered a non-core asset with limited upside potential because of its location in a small market. Palm Desert is a small town of 48,000 residents, located 120.0 miles east of Los Angeles. The mall also lost the Cinémas Palme d’Or in June 2016, and its replacement, Tristone Cinemas (a local movie theater chain), may be a victim of declining national movie theater sales. Although the mall has maintained occupancy above 90.0% since issuance, its short-term outlook is not positive, as its cash flow has declined 5.1% from DBRS estimates at issuance.

DBRS considers GGP’s Woodbridge Center (secured in two 2014 CMBS transactions) a Tier 2 regional mall. The mall has a weak anchor mix that includes Sears (16.4% of NRA), stagnant sales ($358 psf ) and cash flow since issuance that are all indicators of the mall’s status within the market, which is a concern. With the property’s proximity to Garden State Plaza (32 miles northwest), Jersey Gardens (secured in WFRBS 2013-C18; 16 miles northwest), which are both considered Tier 1 regional malls by DBRS, and the future development of the American Dream in East Rutherford, there may be limited opportunity to renovate and enhance the retail performance. However, with the mall’s location in densely populated Middlesex County between the Garden State Parkway and the New Jersey Turnpike, there is potential for future redevelopment that extends beyond retail that could be unlocked in the future. Malls with similar performance in secondary and tertiary locations may not have similar potential, and DBRS would view those properties as riskier assets.

GGP’s portfolio already includes successful redevelopment stories where the company improved the performance of malls that experienced the loss of traditional department store anchors. The Sears at the Alderwood Mall (secured in two 2015 CMBS transactions) in Lynwood, Washington, in suburban Seattle vacated its 177,679 sf in March 2017. Thanks to its location in the rapidly growing Seattle MSA, GGP saw an opportunity to create a food and entertainment village in part of the Sears box and, per news reports, could lease 120,000 sf of that space to Dick’s Sporting Goods (Dick’s), Cheesecake Factory and Dave & Busters. While the mall’s cash flow has increased since issuance and is considered a Tier 1 regional mall based on DBRS’s threshold of $400 sales psf, the redevelopment of the Sears space could be accretive to cash flow, making this a stronger asset than before the Sears closure. These factors paint a positive picture for the mall’s outlook, along with a growing population base, despite the competition from Northgate Mall (984,000 sf ) and Everett Mall (673,000 sf ).

Bellis Fair Mall (secured in GSMS 2012-GCJ7) in Bellingham, Washington, provides an example of a lost anchor creating opportunity for new tenancy when that property lost its 80,620 sf Sears in 2013. Although Bellingham is two hours north of Seattle in a relatively tertiary location, the property has traditionally benefited from strong cross-border traffic from Canada. The mall had in-line sales of less than $300 psf, which DBRS considers to be relatively weak, and saw its occupancy decrease by 21.1% from issuance in 2016. After Sports Authority, which originally backfilled the space, filed for bankruptcy and liquidated the chain, GGP re-leased the space to Dick’s and Ashley Furniture. The property’s Target anchor is also in the process of a major renovation, and multiple smaller tenants have taken occupancy in the last year.

In-line sales have increased 10.4% year over year as of March 2018, and despite a 4.5% decrease in cash flow from 2016 to 2017, cash flow has increased approximately 35.0% since issuance. With occupancy inching closer to issuance levels, and the property showing the ability to adapt to changing consumer preferences in attracting new tenants over the last few years, DBRS has a positive outlook on this asset.

Brookfield’s Recent Sale Activity

Following the closing of its GGP acquisition, Brookfield began selling off stakes in numerous assets. CBRE Group, Inc. (CBRE) purchased interests in three GGP properties: the Cumberland Mall (secured in non-DBRS-rated transactions) just outside Atlanta, Ridgedale Center in Minneapolis and Parks Mall in Arlington, Texas. Brookfield then sold interests in three additional assets (not yet disclosed) for $714 million to TH Real Estate. For CBRE and TH Real Estate, these transactions represent an opportunity to buy into high-quality assets and realize a return over the long term, while Brookfield benefits from additional equity to fund the expansions of the subject malls and other malls in its portfolio. This strategy can reduce its exposure on a cost basis and leverage its redevelopment returns. Traditionally, GGP has played the role of an owner and operator; however, sales of partial interests unlock their potential as a manager and developer, with reduced risk.

DBRS will continue to monitor these news updates as they come and may release a follow-up report with further insight and speculation.

Factors Affecting Retail Potential

While the potential for core assets is evident, with more sales transitioning from in-store to e-commerce, investors and property managers will need to find unique solutions to increase foot traffic. What has not changed is that well-located assets in populated markets are the biggest driver of foot traffic to malls. Approximately 23.0% of GGP’s portfolio is in the top ten populated metropolitan areas in the United States. In comparison, 41.2% of Westfield’s portfolio is in these metropolitan areas. While many investors seek out the best markets, an area’s population density alone does not distinguish it as being favorable. Retail assets will perform in the long term if a market has a good mix of growth opportunities, high levels of disposable income, tourist appeal and a young and vibrant consumer demographic. Based on customer intercept surveys conducted by GGP, the approximate median age is 37.8, and the average household income is $105,000 within the markets in which their top ten properties are located. Furthermore, the average percentage of the population that has a bachelor’s degree or higher is 43.3% where these malls are located. Location continues to be one of the top factors driving retail performance; for assets in more remote locations, investors must be creative with attracting consumers.

Consumers in today’s market are seeking experiences more so than ever. Creative investors are implementing elements that change malls into mixed complexes that almost replicate downtown cores. GGP is in the process of renovating Stonebriar Center just outside Dallas, where it is converting a parking lot into a 300-key Hyatt Regency, an 800,000 sf KidZania, a conference center and a children’s library. Some of the best-performing malls in North America, like the West Edmonton Mall in Alberta, Canada, include a skating rink, movie theater, casino and nightclub, among various other entertainment options. One of GGP’s premier assets, Fashion Show, features high-end entertainment and dining options and hosts multiple runway events for the biggest names in fashion. The two malls are generating sales psf of CAD 727 and USD 975, respectively, well above DBRS’s threshold for Tier 1 Regional Malls of $400 psf. This is further proof that diverse entertainment options and high-quality tenant mix can generate higher sales per square foot.

Retail properties must have the appeal to attract top-quality brands, restaurants and entertainment companies. It is becoming more important for investors to re-develop the blueprint of their spaces and focus on distinguished structure and design. Unibail could look to implement its European influence into Westfield’s malls by focusing on smaller productive spaces that reflect the refinement and style of European retailers. Unibail has an opportunity to implement its European influence into Westfield’s malls that could reflect the refinement and style of European retailers. Seritage Growth Properties, which generally has rights to recapture between 50.0% and 100.0% of the square footage that Sears occupies in its properties, has plans to redevelop the vacated spaces and develop additional retail for multiple tenants. The individual designs of spaces may warrant some change, but the overall property design is also important, and as McKinsey & Company notes in its Future of the Shopping Mall piece, malls are incorporating natural ambience into their designs and focusing on open concepts.

There are fresh ideas and concepts that are helping malls generate higher foot traffic, with tactical approaches concentrating on making the best use of temporary spaces and the inclusion of niche stores. For instance, the Lion’esque Group builds out pop-up stores for brands to help them build a consumer-facing presence and reimagine the in-store experience. JCPenney is following a similar model, as it announced it was expanding the number of Fanatics store-within-stores to 650, enabling the brand to feature local collegiate and professional sports team merchandise. Retailers are also testing the "buy online, pick-up in store" concept, according to Forbes, enabling consumers to participate in the offline and online experience with a brand. Ultimately, this concept drives foot traffic and offers the ability for malls to make use of dead spaces. These examples are just some of the numerous ways the industry is helping malls improve foot traffic.

Conclusion

Despite the picture that retail industry headlines paint, well-managed core retail assets are continuing to evolve and improve their performance. Malls have faced new challenges in recent years with the growth of e-commerce, and it is now up to their owners to help redefine what malls mean to consumers as well. Unibail and Brookfield have capitalized on undervalued assets through their acquisitions, as their new assets have demonstrated that malls in well-located areas with a dynamic consumer base, high appeal and unique tenant mix will work cohesively with the growth of e-commerce. It will take a combined effort from retailers and developers to make the brick-and-mortar model important for consumers again.

For more information visit www.dbrs.com and DBRS Viewpoint (www.viewpoint.dbrs.com).