|

T

|

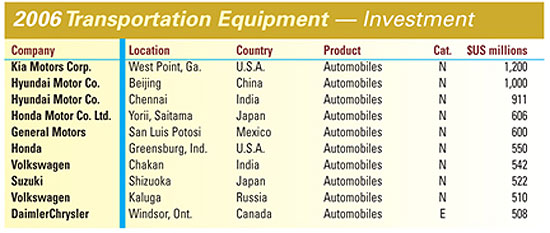

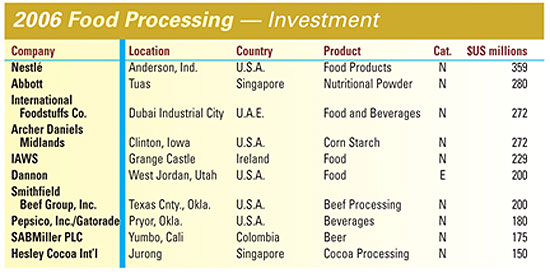

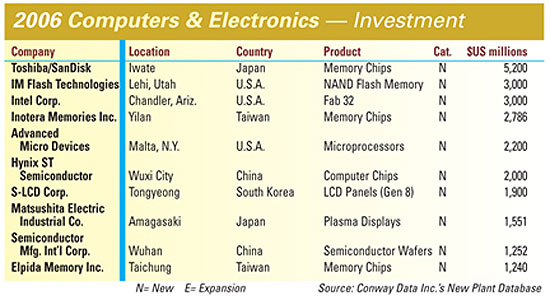

he usual suspects are back on the list of the top industries of 2006, based on Conway Data Inc.’s New Plant database of qualifying new and expanded facilities announcements. Computer and electronic product manufacturing replaces plastics and rubber products manufacturing, but the other four are regular staples on the list. (See chart on p. 219.)

Chemicals and pharmaceuticals takes first place this year, up from second place in 2005; that industry simply swapped places with transportation equipment manufacturing (see industry spotlight on page 220). But the reason has everything to do with transportation: Of the sector’s 657 projects, 274 were ethanol or biodiesel plants.

Regardless of where they finished, all four repeat industry finishers saw an increase in their total number of projects over the previous year. The first place chemicals sector is up 55 percent with 657 total projects; transportation equipment is up 17 percent; fabricated metal product manufacturing is up 29 percent; and food processing is up 21 percent.

This cross- sector growth is proof that the global economic engine is firmly in growth mode. Between plants being built in China and plants making goods destined for China to support that nation’s explosive growth, it’s easy to see the Chinese market’s impact on world economic development.

But this ranking is also useful as evidence against the argument that the U.S. market and others are mainly service- based economies now. If that is the case, then it is hard to explain why in all but one of these industries – chemicals and pharmaceuticals – the U.S. has the most, or is tied in having the most, new or expanding facilities. Clearly, foreign direct investment remains a two- way street.

|

|

|

|

|