Sixteen months after President Trump launched his opening tariff salvo on Chinese goods, today there are ample economic data accentuating the trade war’s detriment to bilateral trade and investment. Even more compelling are the stories of small business layoffs and factory closures that humanize the conflict and remind us that trade wars are not without casualties.

While U.S. exporters endure economic pain at home, hundreds of American multinationals in China are caught behind enemy lines. While “in China, for China” manufacturers have largely avoided the crossfire, export manufacturers are taking tariff bullets. Non-tariff weapons targeting American firms — measures such as unofficial purchasing boycotts and increased regulatory scrutiny in the form of environmental audits, customs inspections and delayed license approvals — are hindering both groups and hitting bottom lines.

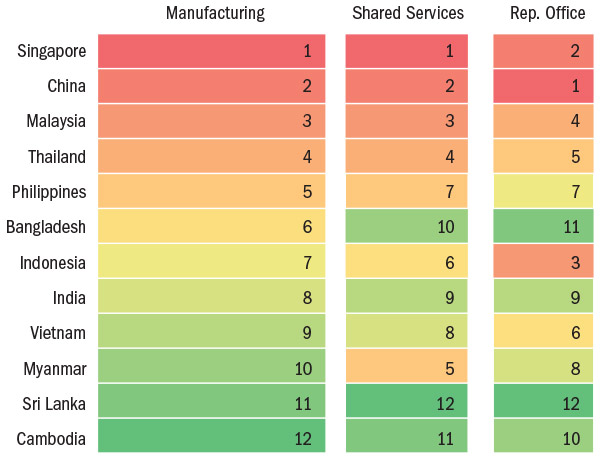

Total Operating Costs in Asia for Select Investment Types

The trade war is compounding an already difficult situation for American manufacturers in China. Slowing economic growth, rising labor and material costs, and greater competition from, and favoritism for, domestic firms in strategic industries threaten long-term viability of foreign manufacturing operations in China. Beijing’s mandate to replace export manufacturing with domestic consumption as the main driver of future economic growth is writing on the wall for companies seeking low-cost manufacturing solutions in China for the purpose of serving other markets.

The future is instead more promising for “in China, for China” manufacturers, who, according to the American Chamber of Commerce in Shanghai, account for 55% of its manufacturing member companies. These manufacturers aim to tap the Middle Kingdom’s vast consumer market — a goal that aligns well with Beijing’s policy objectives.

Options for ‘China Plus One’

These broader challenges in China’s “new normal” economy have compelled a growing number of firms to consider “China plus one” expansion strategies, as well as partial and complete relocation of existing manufacturing operations.

The American Chamber of Commerce in Shanghai reports that, in the past year alone, over a quarter of U.S. manufacturers with operations in China have shifted investment originally intended for China to other markets, namely the manufacturing bases of ASEAN, Mexico and emerging manufacturing opportunities in India. Short-term tariff mitigation strategies such as HS code reclassification, country of origin adjustments, transfer pricing and outsourcing to third parties, while viable tactical measures to combat the impact of the tariffs, are not viewed as viable long-term solutions, forcing export manufacturers to seek out more favorable economic conditions elsewhere.

Developing ASEAN economies such as Myanmar, Cambodia and Vietnam are attracting manufacturers with substantially lower labor costs, despite higher logistics, electricity and telecommunications costs. This trend is especially apparent in Cambodia, which has the lowest fully loaded employer costs in Asia, but relatively more expensive communications, electricity and logistics costs to most common export destinations. Myanmar has the lowest cost of doing business for manufacturing in the region, followed closely by Cambodia and Vietnam.

Vietnam, with a better manufacturing infrastructure than Myanmar or Cambodia, is in a highly competitive position. With a larger and more productive labor force that is lower cost than China’s and its more developed neighbors in ASEAN, Vietnam has seen a significant influx of investment over the last five years, and this is only expected to increase.

Vietnam benefits from its shared border with China, allowing manufacturers to source from their existing China supply chain. Significant investment in infrastructure projects is improving the nation’s connectivity for global distribution and growing consumer markets in ASEAN. Strong similarities in government regulations and a society with similar cultural norms to China make for a familiar operating environment. Vietnam’s business climate continues to improve, and its favorable tax incentives make an already cost-competitive location a profitable one as well.

“The trade war may drive companies toward new market opportunities they may have otherwise overlooked.”

Conversely, while countries such as Singapore, China, Malaysia and Thailand consistently rank as some of the most expensive places in Asia to operate a manufacturing operation, key qualitative factors can provide an important counter-balance to higher costs. World-class physical and utility infrastructure, the availability of skilled talent, deep manufacturing and services supporting industries and clusters, ease of doing business, and market access can make these countries very attractive to certain types of businesses, where higher productivity and other operational efficiencies and access to raw materials, suppliers and markets can offset higher absolute factor costs.

Because of the depth of its manufacturing supporting industries linked to world-class industry clusters, Thailand is an ideal choice for companies seeking to add value to manufactured products. Finding an alternative to China and an export base to the U.S. requires more than simply exporting components and sub-assemblies from existing suppliers in China and doing final assembly in another country such as Thailand due to country-of-origin requirements. Thailand is a country where companies in diverse industry sectors can and do “add value” and use Thailand as a cost-competitive export base for high-value products. The nation’s strategic location at the crossroads of Southeast Asia and its planned linkages to China’s Belt & Road Initiative qualify it as a strategic location for a “China plus one” manufacturing strategy. Considering the long-term consumption growth potential of ASEAN markets, relocation is an opportunity to increase regional infrastructure that will also serve those regional markets. In this way, the trade war may drive companies toward new market opportunities they may have otherwise overlooked.

Manufacturing’s ASEAN migration predates the U.S.-China trade war, but the tariffs have added a greater sense of urgency to companies’ expansion and relocation considerations. The broader trends of manufacturing regionalism and automation will only further accelerate export manufacturing’s migration out of China. Companies seeking a more balanced manufacturing strategy in the Asia Pacific that mitigates the risk of overdependence on China should mull the move.

For more information about this topic, please contact the authors at john.evans@tractus-asia.com or hank.hulick@tractus-asia.com.