U.S. Foreign-Trade Zone Activity in Gulf States Leads to a Record-Breaking Year

Over 90 years after the Foreign Trade Zone Act of 1934 was first established and subsequently introduced the nation’s first FTZ in Staten Island, New York, in 1936, a robust network of activity continues to flourish.

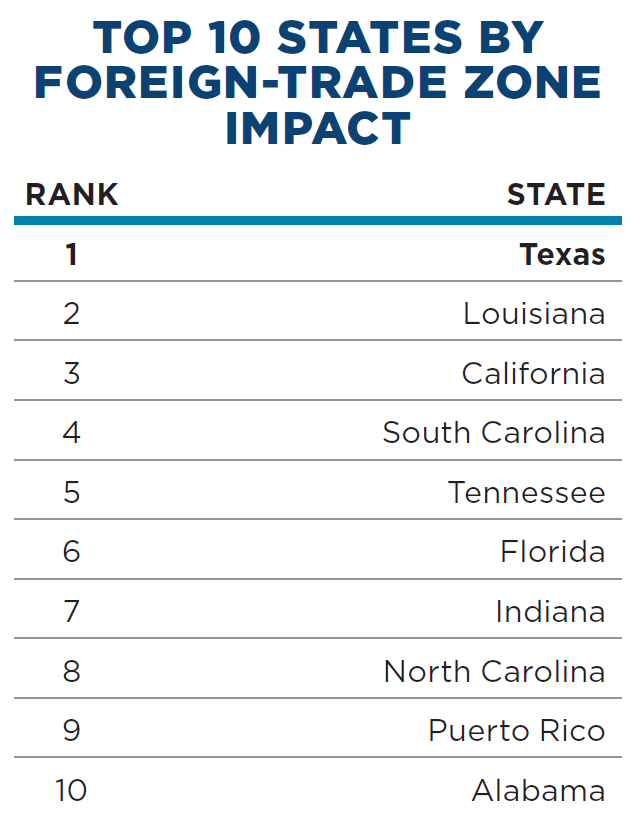

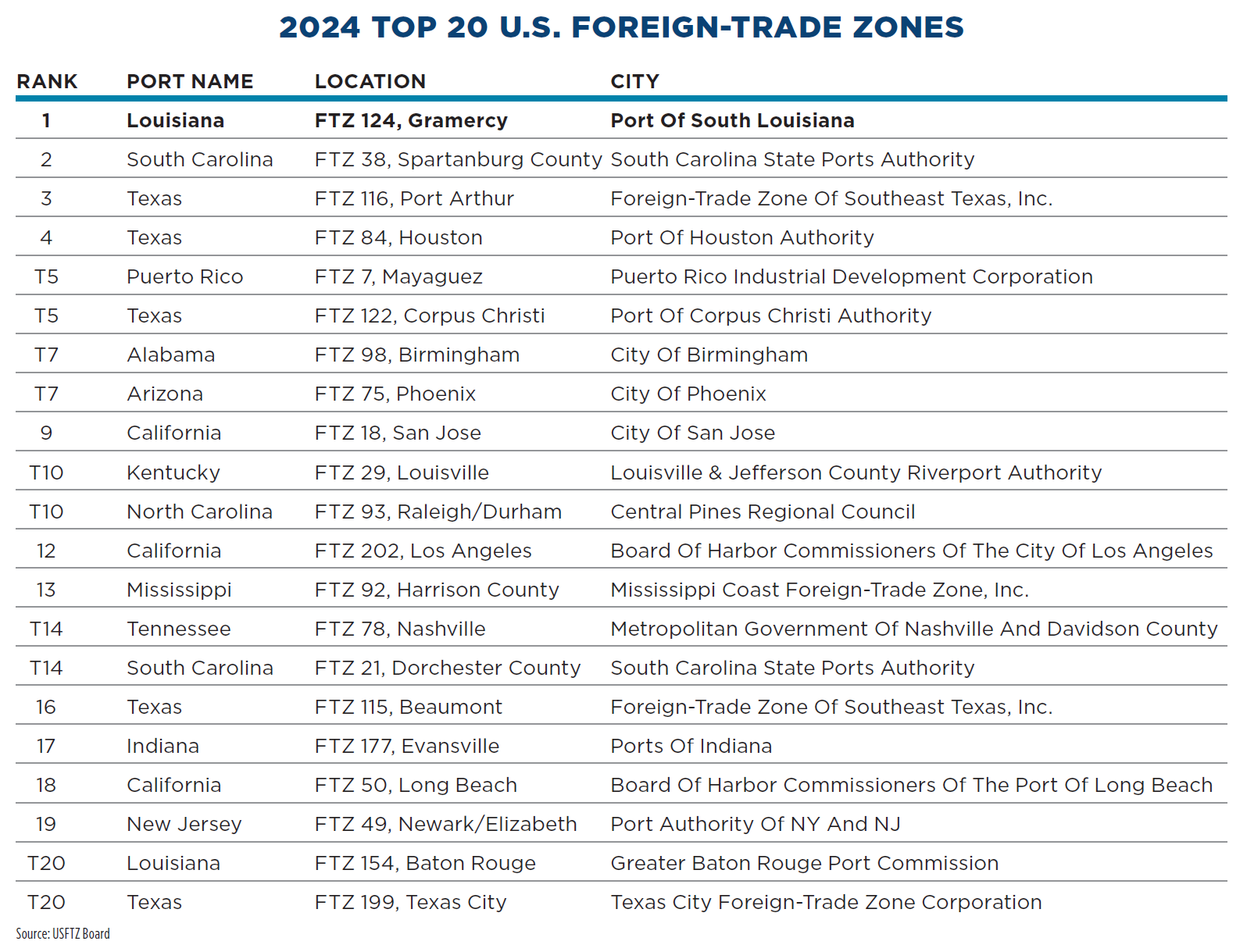

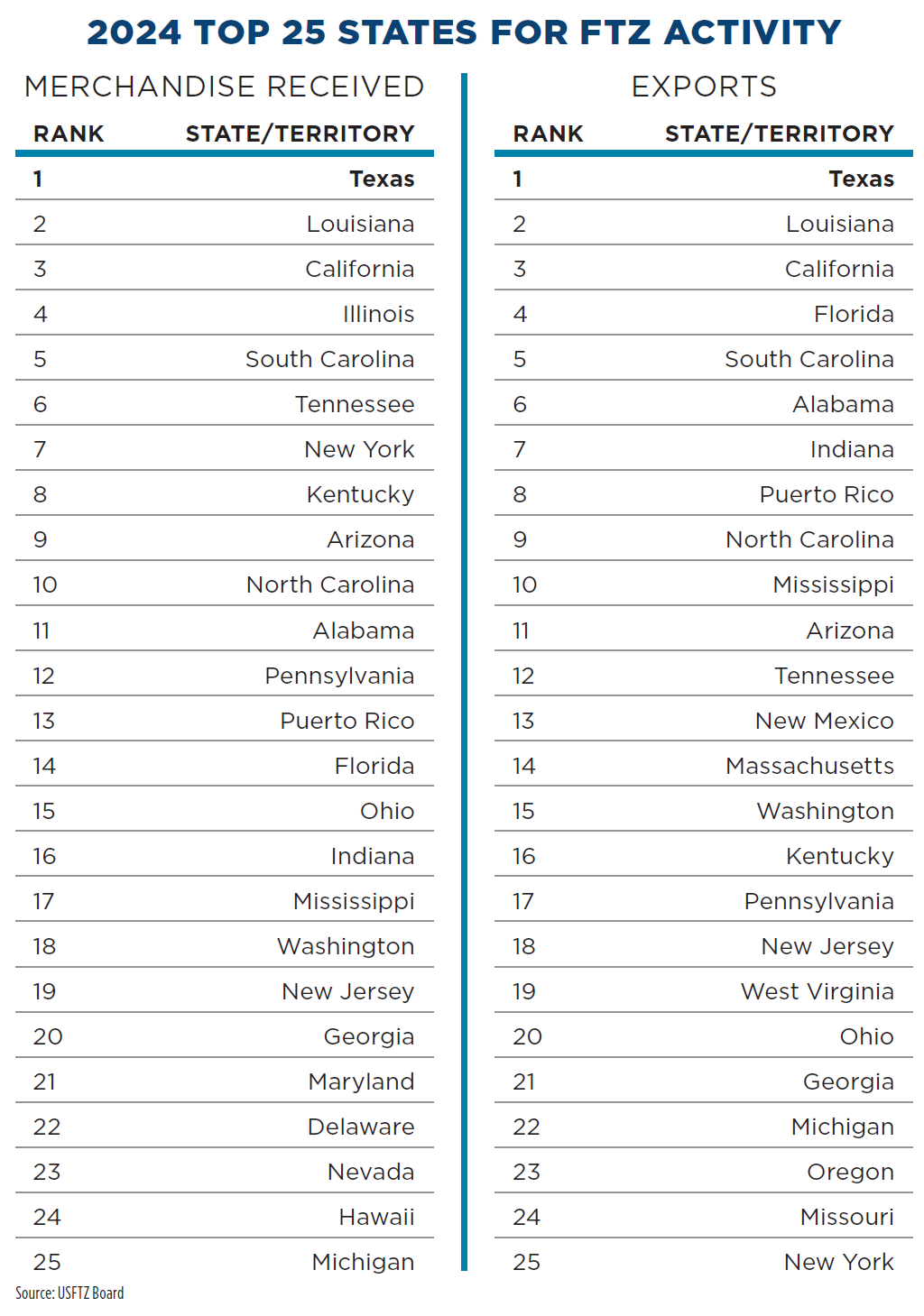

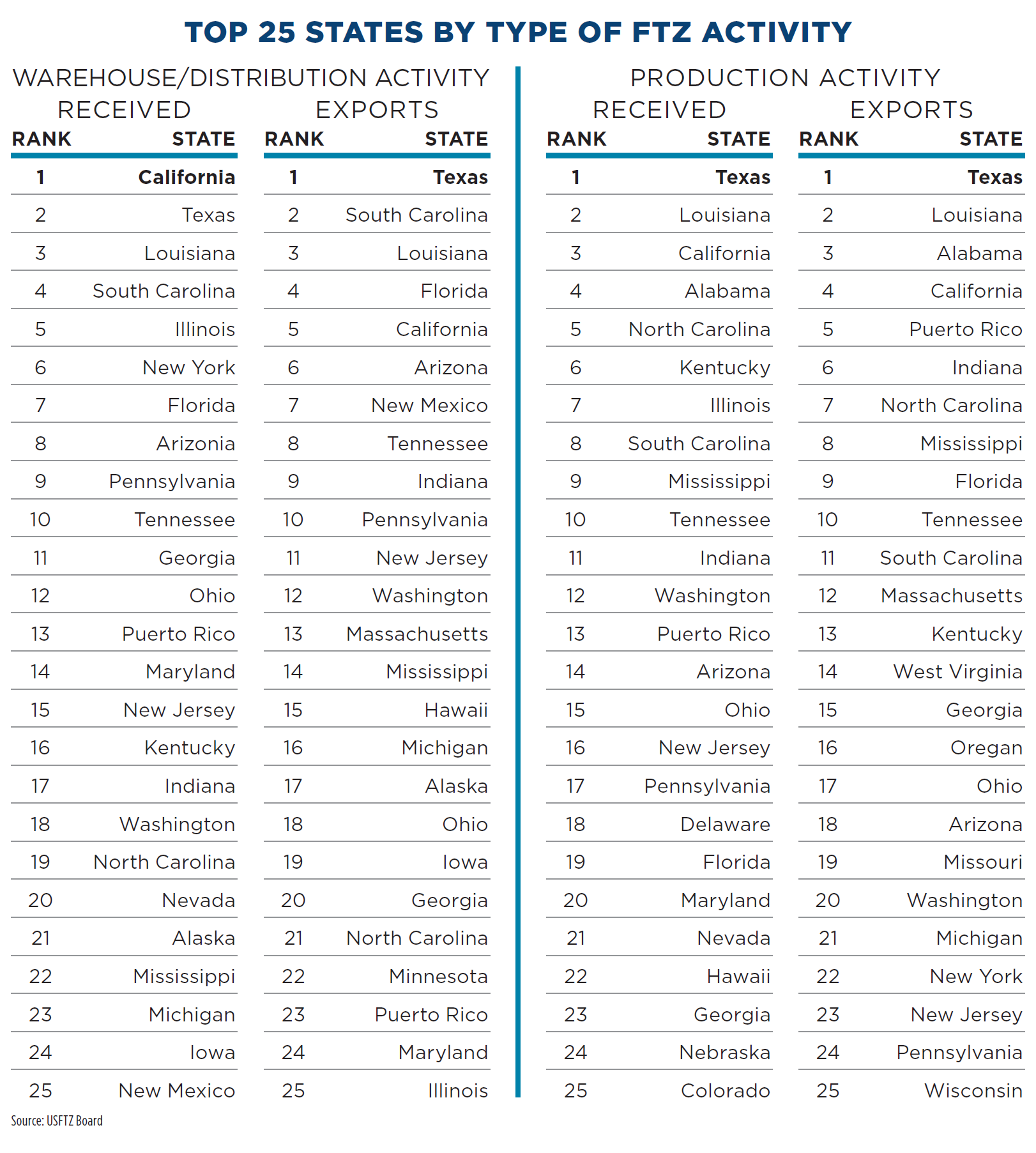

In August 2024, the 85th Annual Report of the Foreign-Trade Zones Board to Congress of the United States was released, showing that Texas, Louisiana, California, South Carolina and Tennessee remained firm in their respective top five ranks for overall FTZ economic impact since 2022.

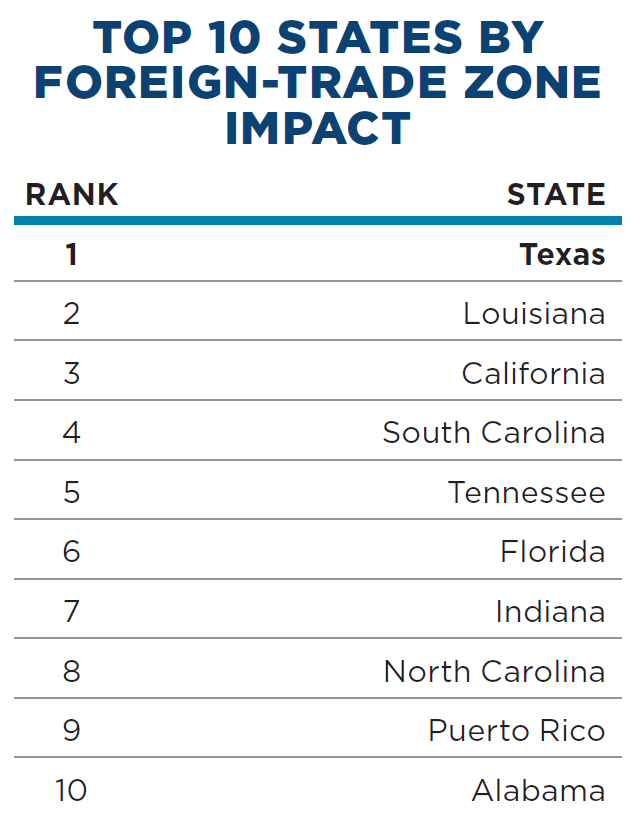

Fresh data from the report, including aspects such as value of merchandise received, value of exports and number of employees in the zone, helped guide Site Selection in cultivating its own top 20 U.S. FTZs. In 2023, FTZ No. 124 located at the Port of South Louisiana (PortSL) took the lead, followed by FTZ No. 28 in Spartanburg County, South Carolina. Port Arthur’s FTZ 116 in Texas come in at No. 3, followed by fellow Texas FTZ No. 84 overseen by Port Houston. Tied at No. 5 are Puerto Rico’s FTZ No. 7 in Mayaguez and FTZ No. 122 at the Port of Corpus Christi. Three Texas FTZs in the top six provide ample evidence of which state leads the way in overall FTZ impact (chart).

- There were 200 active FTZs during 2023, with a total of 374 active production operations.

- More than 550,000 persons were employed within 1,300 active FTZ operations during the year.

- Value of shipments into zones totaled nearly $949 billion (down $62 billion from more than $1 trillion the previous year).

- About 68% of shipments received involved domestic merchandise.

- “The levels of domestic status merchandise used by FTZ operations — 80% for production operations and 48% for warehouse/distribution operations — indicates that FTZ activity tends to involve domestic operations that include significant domestic inputs alongside foreign inputs.”

- Warehouse/distribution operations received nearly $364 billion in merchandise while production operations received nearly $585 billion (62% of zone activity).

- The largest industries accounting for zone production activity include the pharmaceutical, oil refining, automotive, electronics and machinery/equipment sectors.

Notable findings from the annual report include:

- There were 200 active FTZs during 2023, with a total of 374 active production operations.

- More than 550,000 persons were employed within 1,300 active FTZ operations during the year.

- Value of shipments into zones totaled nearly $949 billion (down $62 billion from more than $1 trillion the previous year).

- About 68% of shipments received involved domestic merchandise.

- “The levels of domestic status merchandise used by FTZ operations — 80% for production operations and 48% for warehouse/distribution operations — indicates that FTZ activity tends to involve domestic operations that include significant domestic inputs alongside foreign inputs.”

- Warehouse/distribution operations received nearly $364 billion in merchandise while production operations received nearly $585 billion (62% of zone activity).

- The largest industries accounting for zone production activity include the pharmaceutical, oil refining, automotive, electronics and machinery/equipment sectors.

In comparison to data accounting for FTZ activity in 2022, South Carolina’s FTZ No. 38 in Spartanburg County jumped up six places. The zone was responsible for receiving than $25 billion in merchandise last year, due in large part to activity from BMW. The company led FTZ activity in both merchandise received and exports, reflecting $10 billion and between $750 million and $1 billion, respectively. As a whole, the majority of products by value coming into the zone are made up of 48% vehicles and 45% vehicle parts.

The BMW Manufacturing Company looks to grow those product values as it submitted a notification of proposed production activity for its Spartanburg plant to the FTZ Board in May 2024. From the proposal, BMW seeks to add production authority in subzone 38A for foreign-status materials and components including glass adhesive, spring-operated actuators and head unit high navigational map controllers.

A month later, the company began operations at its first North American press shop, located at the Spartanburg site, in preparation for the new BMW X3 launch. The investment is part of a larger $1 billion investment at its 30-year-old facility in the state, which will look to begin manufacturing six fully electric vehicles by 2030.

XL Growth at Port SL

To no surprise, No. 1 FTZ 124 in Gramercy at Port SL announced it experienced a 10-million-ton increase in 2023. It handled more than 248 million short tons, marking the second consecutive year of growth. The 2023 Tonnage Report showed notable increases, such as a 40% cargo increase in animal feed, a 75% increase for chemicals/fertilizers and a 463% increase in sugar/molasses.

Louisiana FTZ 124 at the 54-mile-long, three-parish Port of South Louisiana (headquartered in Reserve) rose to No. 1 in Site Selection’s top FTZ rankings.

Map courtesy of Port SL

“Numbers tell the story, and the Port of South Louisiana is telling a tale of resurgence,” said PortSL CEO Paul Matthews. “Through relentless innovation and strategic leaps, we’re scripting a narrative of growth, and the recent tonnage numbers underscore our port’s global appeal and versatility. Our team is focused on strengthening our partnerships with global shippers and industry along the Mississippi River, demonstrating that the Port of South Louisiana is ‘A Better Way to Cargo.’ ”

The zone accounted for more than $50 billion of merchandise received in 2023. While Port SL is still considered the nation’s top grain exporter, new international sustainable project investments landing at the port show room for industry diversification.

With $46 million on hand, Ireland-based recycling tire company Life for Tyres (L4T) plans to establish its first U.S. processing facility on 10 acres of Port SL’s Globalplex Intermodal Terminal. The company will utilize old tires to create sustainable commodities such as advanced biofuel feedstock and recovered carbon black and scrap steel. L4T CEO Tilen Milicevic announced that Port SL was selected for the project due to a strong industrial ecosystem, availability of talent and supplies, connectivity, abundance of feedstock and proximity to clients.

The Port of Port Arthur houses FTZ 116, which landed at No. 3 just ahead of No. 4 FTZ 84 operated by Port Houston.

Photos courtesy of the Port of Port Arthur

“While navigating the complexities of global trade, the Port of South Louisiana has not only reversed a historical trend with a remarkable surge in cargo but also demonstrated adaptability and resilience in an ever-evolving market,” said PortSL Board of Commissioners Chairman Ryan Burks. “As we witness transformative initiatives like the Life for Tyres project and the construction of the second dock access bridge, these endeavors underscore our commitment to sustainable practices and operational excellence. It’s a testament to the port’s strategic vision and the collaborative efforts of our dedicated team which is driving progress, sustainability and prosperity for our region.”

Seven months later in September 2024, Woodland Biofuels selected Port SL for the world’s largest carbon negative renewable natural gas plant at the Globalplex multimodal facility. The $1.35 billion investment from the Canada-based company is set to begin commercial operations by 2028.

“Woodland is thrilled to announce that we plan to build, right here at the Port of South Louisiana, the world’s largest carbon-negative RNG facility,” said Woodland Biofuels CEO Greg Nuttall. “Our sustainable biofuel plant will be an economic driver for St. John Parish and beyond. We look forward to establishing deep ties with the local community and drawing on the existing world-class workforce and utilizing Louisiana’s exceptional infrastructure to execute on our project.”

The first phase will permanently remove 210,000 tons of CO2 per year, while phase two will scale CO2 removal by 660,000 tons annually. Waste biomass will be used to create sustainable biofuel that can be applicable to transportation, heating and electricity generation.

“Port of South Louisiana is the second-ranked port in the nation for energy transfer,” Matthews said. “This significant investment by Woodland Biofuels to construct the world’s largest carbon-negative renewable natural gas plant and a large-scale green hydrogen facility at our Globalplex Intermodal Terminal proves that PortSL and the state of Louisiana are leading the way in diversifying our energy industry, which will result in the creation of hundreds of high-paying jobs for River Region families.”

Puerto Rico’s FTZ 7 in Mayaguez moved up Site Selection’s rankings by two spots to land in the tie for No. 5. Increased activity is tied to bustling pharmaceutical industry including the likes of Eli Lilly and Company, Bristol Myers Squibb Company and AbbVie. Together they accounted for more than $6.1 billion in production activity in 2023.

Oil and petroleum refining companies Citgo and Valero led FTZ 122 at the Port of Corpus Christi for production activity, drawing in $10 billion. Overall activity in the zone resulted in an 8.1% increase in annual tonnage in 2023. In total, 203 million tons were moved last year, marking the highest tonnage in the port’s history. Crude oil exports made up 126.1 million tons alone, reflecting a 12.5% increase from 2022.

“The reaching of this newest milestone in the Port of Corpus Christi’s lengthy history is a testament to the strength and commitment of our customers, who supply much-needed goods to our trading partners around the world,” said Port of Corpus Christi CEO Kent Britton. “Closing out 2023 on such a strong note sets the right tone as we go into 2024, which we expect to be another solid year for our customers.”

About 297 miles northeast to FTZ 116, the Port of Port Arthur has experienced the same industry success behind neighboring FTZ 122. A combined $20 billion in merchandise received and $2 billion in exports between Motiva Enterprises and Premcor Refining Group made for a profitable year.

Just shy of a top five rank comes FTZ 98 in Birmingham, Alabama. Out of the state’s five FTZs— Mobile (FTZ 82), Huntsville (FTZ 83), Birmingham, Montgomery (FTZ 222) and Dothan (FTZ 233) — FTZ 98 was the highest-performing zone in 2023. A $10 billion influx of production activity from Mercedes-Benz U.S. International, whose Tuscaloosa site was the company’s first major automotive manufacturing facility in the nation, made for an impressive year at Port Birmingham. The company was additionally responsible for $5 billion in export activity, landing it the No. 1 rank in Top 25 Production Operations for exports in the FTZ Board annual report.

Mercedes-Benz received approval from the Foreign-Trade Zone Board in October 2023 to expand Subzone 98A to include the company’s operations in Moundville, Vance and Woodstock, Alabama.

Coming Back for Texas

Texas was again able to cement its status as the No. 1 state for FTZ impact in 2023. In total, 16 FTZs around the state can be found within Site Selection’s Top 100 U.S. FTZs.

After Port Arthur, Port Houston and Corpus Christi, FTZ 115 in Beaumont comes in at No. 16 and FTZ 199 in Texas City finishes in the Top 20 at No. 19.

FTZ 301 aims to bring new opportunities for businesses in western North Carolina counties once things return to a semblance of normal after Hurricane Helene recovery.

Map courtesy of the Economic Development Partnership of North Carolina

Port Freeport came in at No. 26 with activity from FTZ 149, tying with California’s FTZ 3 in San Francisco. In September 2024, Port Freeport announced that its Port Commission voted to adopt a zero tax rate for the first time in its history. Increased activity at Port Freeport has led to a $23.5 billion taxable value of the district — 794 times its $29.6 million value in 1927 just two years after the port was established

The move removes a tax burden on voters, while the port becomes tax independent and self-sustainable. In 2023, the Port Commission voted to bring the Maintenance & Operations rate to zero, returning a year later to additionally approve a zero tax rate for Interest & Sinking. Beginning in 2025, port operating revenues will be used to cover ensuing debt payments for bonds approved by voters in 2018, which backed the $295 million Freeport Harbor Channel Improvement Project.

“This achievement represents the culmination of dedication and vision from both current and past commissioners and employees,” said Port Freeport Commission Chairman Ravi Singhania. “It all began with the visionary decision of Brazoria County voters in 1925, who laid the groundwork for the creation of Port Freeport. The steadfast trust and commitment of taxpayers, combined with tireless efforts, have fueled growth and opportunity in the region for decades, and we look forward to even more in the future. We are immensely proud to be part of this moment and to have achieved this together.”

Once the Freeport Harbor Channel Improvement Project wraps and becomes operational in 2025, Port Freeport will be the deepest port in Texas. Project details include deepening the current depth of 46 feet to between 51 and 56 feet, thus accommodating the needs of modern ships and enabling larger ships to access the port. To do so, the project aims to enhance upper turning basins, implement selective widening of the channel and lower channel bend easing.

“This is a proud and transformative moment for the entire community and a reminder of the incredible legacy and responsibility we carry,” said Port Freeport Executive Director and CEO Phyllis Saathoff. “The Freeport Harbor Channel is a gateway for global trade that will continue to fuel growth and prosperity for future generations.”

New FTZs Established

Three new FTZs were approved in 2023, opening new opportunities in Louisiana, North Carolina and Texas.

All new zones were pursued under the alternative site framework which allows the grantees to designate a service area that allows for subzone operators to streamline the FTZ designation process.

FTZ 300 established a new zone at in Plaquemines Parish, Louisiana, at Plaquemines Port in January 2023. The new zone was approved less than a year after the Plaquemines Port, Harbor & Terminal District submitted an application for designation under the alternative site framework.

The port provides water access to 33 states in the U.S., in addition to barge, rail and Interstate proximity, with more than 80 miles of deep draft access at a 50-foot minimum. Its location in southeastern Louisiana positions FTZ 300 some 20 miles south of No. 32 ranked FTZ 2 at the Port of New Orleans.

Plaquemines Port announced a partnership with terminal operator APM Terminals in January 2024 to build a new container terminal on the West Bank of the parish. A 30-year agreement enables the port to lease 200 acres of land to APM in an effort to draw new business west of the Mississippi River. Future terminal expansions would allow for up to 900 acres if needed. APM Terminals expects the privately funded project to cost around $500 million initially, featuring on-dock rail and a berth capacity fit to support ships carrying a maximum of 14,000 20-foot-equivalent units.

“Our collaboration with the Plaquemines Port and local stakeholders is key to developing a facility that sets new industry standards and serves as a boon to the economic vitality of the region.”

— Wim Lagaay, Senior Investment Advisor, APM Terminals

“In time, this greenfield site has all the potential to evolve into one of the big ship gateways into the U.S.,” stated APM Terminals Senior Investment Advisor Wim Lagaay. “This venture allows us to build from the ground up, integrating cutting-edge technologies and sustainable practices to create a modern logistics hub that prioritizes safety, efficiency and productivity. Our collaboration with the Plaquemines Port and local stakeholders is key to developing a facility that sets new industry standards and serves as a boon to the economic vitality of the region.”

The Land of Sky Foreign-Trade Zone, now known as FTZ 301, represents North Carolina’s fifth FTZ — the others are FTZ 57 in Mecklenburg County, FTZ 93 in Raleigh/Durham (tied for No. 10), FTZ 214 in Lenoir County and FTZ 230 within the Piedmont Triad Area (No. 56). The goal in establishing this zone was to better serve new and growing businesses operating in counties throughout western North Carolina. The new FTZ will cover all of Henderson County and include sites in Buncombe, Haywood, Jackson and Transylvania Counties.

The Land of Sky Regional Council’s 2023 Annual Report noted that with the approval of FTZ 301 in June 2023 the council would soon partner with the Asheville Regional Airport (AVL). The duo will aim to establish a U.S. Customs Port of Entry at the airport and allow AVL to clear flights originating in a foreign nation.

“Western North Carolina is home to over 1,000 manufacturing firms representing around 40,000 jobs. Foreign-Trade Zone 301 will provide Western North Carolina companies another opportunity to expand their business while giving our economic developers another tool to help existing firms expand and new businesses locate in the region,” the report noted.

The FTZ approval process and projections all occurred before western North Carolina was devastated by Hurricane Helene. Contacted by Site Selection, Land of Sky Regional Council Deputy Executive Director and Economic & Community Development Director Erica Anderson said, “We are in the very early stages of FTZ 301 and hope that in the recovery process from Hurricane Helene, we can support our region’s businesses through the FTZ. Due to response and recovery efforts, this process will be longer than we like, although we are hopeful to assist companies as they return to production.”

In November 2023, the Foreign-Trade Zones Board approved FTZ 302 in the city of Socorro, located in El Paso County, Texas. The U.S. Customs and Border Protection Tornillo Port of Entry will be responsible for governing operational activity within the zone. The objective of establishing FTZ 302 was to spark fresh economic development, create and retain jobs while increasing capital investment within the community. The new zone will be located about 14 miles away from FTZ 68 located at El Paso International Airport.

A Look Into International Ports Growth

Data analyzed by the World Bank Group, while not as detailed as information one would find from the U.S. FTZ Board, enables a peek into international ports activity.

Over 80% of global merchandise trade is moved by sea, as more than 60% of commercial value is carried by containers. The Container Port Performance Index (CPPI) is a technical report created by a partnership between the Transport Global Practice of the World Bank and the Global Intelligence & Analytics division of S&P Global Market Intelligence, which in June 2024 released the report’s fourth iteration.

The 2023 CPPI takes a look into 405 global container ports and analyzes the largest dataset to date as it incorporates over 182,000 vessel calls, 238.2 million moves and 381 million twenty-foot equivalents over the course of the year. In addition, the 2023 CPPI added 57 new ports to its study, which include Estonia’s Muuga Harbour and the Port of Al Duqm in Oman.

“While the challenges caused by the COVID-19 pandemic and its aftermath eased further in 2023, container shipping continues to be an unpredictable and volatile sector,” said World Bank Lead Transport Economist Martin Humphreys at the time of the new CPPI’s announcement. “Major ports need to invest in resilience, new technology and green infrastructure to ensure the stability of global markets and the sustainability of the shipping industry.”

For the second year in a row, China’s Yangshan Port in Zhejiang and the Port of Salalah in Oman claim the respective No. 1 and No. 2 ranks.

In East Asia, Yangshan Port has consistently ranked the highest in throughput accounting for more than 4 million TEUs per year, ship size range and in areas such as port times and call sizes.

The Port of Salalah is preparing to finish its $300 million expansion by the end of 2024. The project includes the addition of six new ship-to-shore cranes, upgrades to the port’s electricity grid, yard expansion and implementing a new access road. In total, the port will have 27 cranes operational by the end of the year, in addition to a plethora of gantry cranes, terminal trucks and other equipment. The port anticipates increasing its annual container handling capacity by another 1 million TEUs, reaching 6 million TEUs per year.

The Port of Algeciras, located in Spain, aims to increase sustainability in Europe’s maritime industry. It handled more than 377,600 TEUs in 2023.

Photo: Getty Images

“We expect these cranes to help us reduce port stay even further by giving us faster access to top tiers on the ship,” says Port of Salalah COO Scott Selman. “They will also increase our capacity to bring in the world’s largest ships built to date — fulfilling a need for our customers and giving us an opportunity to handle more volume.”

Colombia’s Port of Cartagena jumped to the No. 3 rank in the 2023 CPPI, up two from No. 5 in 2022. Meanwhile, Tanger-Med in Morocco remained firm at No. 4 followed by the Port of Tanjung Pelepas in Malaysia.

Moving forward, 2024 is proving to be a promising year for the Port of Cartagena. In July, the port broke its record for the largest monthly volume of cargo moved with 330,084 containers. It was a 6% increase from the 311,439 containers moved four months earlier in March.

“It has been a goal to provide the best logistics and port service possible. The numbers indicate that we are doing well,” says Cartagena Port Group Manager Alfonso Salas Trujillo. “We are honored and satisfied that Colombia has a globally competitive port that can serve to boost its foreign trade and improve its economic indicators with the opportunities that these achievements make possible. We will continue working to become increasingly relevant in international maritime trade.”

In general, the 2023 CPPI showed a lot of movement within the Top 25 container ports. Notable moves include the Chiwan Port, a part of the Port of Shenzhen, which moved into the No. 6 rank from No. 24 the year prior. Khalifa Port in Abu Dhabi fell from No. 3 to No. 29, while Qatar’s Port Said and Spain’s Port of Algeciras swapped positions at No. 16 and No. 10, respectively.

“It spotlights our level of operational excellence, as well as giving us an incentive that proves we are on the right path,” noted Port of Algeciras Chairman Gerardo Landaluce.

In an effort to boost capabilities in becoming the first green hydrogen sea corridor from the north to south of Europe, officials look to connect the Port of Algeciras and the Port of Rotterdam in the Netherlands. In 2023, King of Spain Felipe VI and King of Netherlands Willem-Alexander joined petroleum business company Cepsa and European multinationals Yara and Gasunie in the underwriting of agreements to establish the corridor.

The goal will be to reduce carbon emissions within the maritime and transportation industries by connecting the $3 billion Cepsa-led Andalusia Green Hydrogen Valley to the Netherlands, which carries one of the highest energy demands in Europe. The project is expected to produce up to 300,000 tons of green hydrogen per year once operational. Green hydrogen transported to Rotterdam from the Port of Algeciras will enable easier pipeline distribution to northern and central Europe.

“There is a greater awareness and focus on resilience and efficiency of maritime gateways and greater understanding of negative impact of port delays on economic development,” said S&P Global Market Intelligence Head of Port Intelligence & Analytics Turloch Mooney. “The highly interconnected nature of container shipping means the negative effect of poor performance in a port can extend beyond that port’s hinterland and disrupt entire schedules. This increases the cost of imports and exports, reduces competitiveness and hinders economic growth and poverty reduction.”

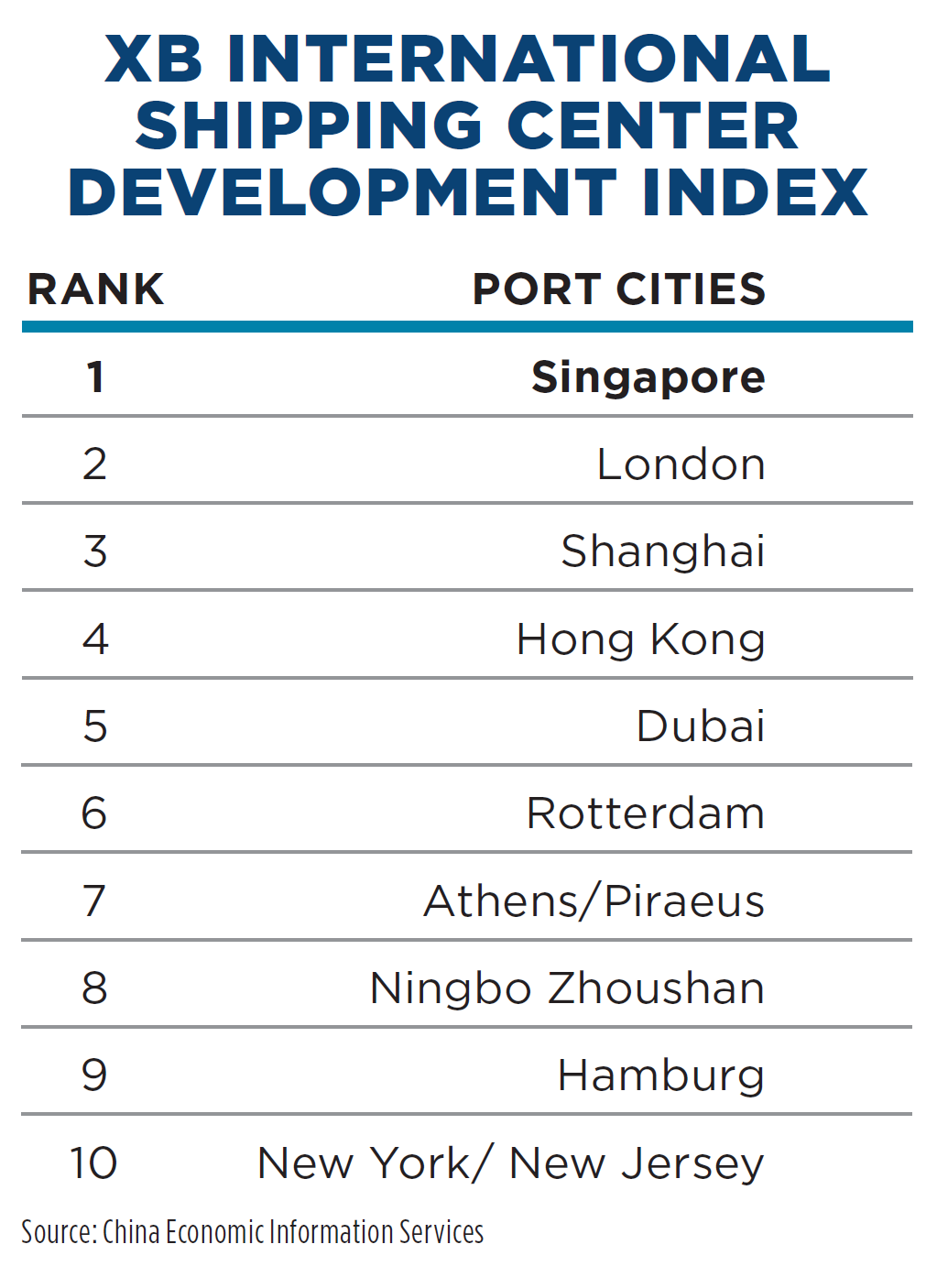

The Xinhua-Baltic International Shipping Centre Development Index, released in August 2024, focuses on the top 43 port cities and maritime centers. The new report shows that Singapore remains the top international shipping center for the 11th year in a row. London, Shanghai, Hong Kong, Dubai and Rotterdam maintained the following top ranks as they have since 2020.

Last year, the Port of Singapore pulled in 3 billion gross tons, a 9.4% year-on-year growth increase, which is the highest in the port’s history according to the index. The port’s throughput was 39.01 million TEUs, thanks to additions from the Tuas Port project. The project brought three new berths into operation, for a total of eight of the planned 66. Tuas Port began operations in 2022, although it is anticipated to be fully operational by the 2040s. Phase 1 of the project expects to handle 20 million TEUs across 21 deep-water berths by 2027.

Sustainability measures taking place in Europe are mirrored by steps taken between Singapore and Japan as the countries signed two MoUs to establish the Tianjin-Singapore Green and Digital Shipping Corridor (GDSC) and the Japan-Singapore GDSC, which will cover six ports in Japan. The Tianjin-Singapore GDSC MoU notes that this move is an effort to increase the maritime industries’ decarbonization and digitalization by exploring new fuel technologies and supporting innovative maritime startups.

“The new industrial revolution, including the application of autonomous driving and AI technologies, will significantly benefit port production security management, green development, intelligent decision-making and efficiency increase.”

— Yue Kim, Chief Technology Officer of Smart Road, Waterway and Port BU, Huawei

The same can be seen between the Piraeus Port of Athens and the Port of Guangzhou in China, as an MoU was signed in October 2023 to introduce their own green shipping corridor. The Piraeus Port of Athens (PPA) rose to No. 7 in 2023, as the Ningbo Zhoushan Port in Zhejiang, China, took its previous No. 8 rank. The Port of Guangzhou, which was ranked No. 8 in the World Bank’s 2023 CPPI, will work with the PPA to decarbonize the maritime supply chain, improve port operations and share new technology insights.

Northern China’s Tianjin Port entered the index’s Top 20 for the first time in 2023, having moved 22.19 million TEUs and a total cargo throughput of 558 million tons. The report notes that technological innovation was a large component in aiding the port in reducing cargo loading and unloading times by 26.2% and boosting operational efficiency.

A collaboration between the port and information and communications company Huawei brought the development of a smart terminal in 2022. The partnership led to integration of 5G, AI and autonomous driving technology, which reduced safety risks for workers and increased sustainability. In addition to initiatives like the Tianjin-Singapore GDSC, the port continues to expand its sustainability efforts by using wind and solar installations to provide power and reduce coal dependency.

“The new industrial revolution, including the application of autonomous driving and AI technologies, will significantly benefit port production security management, green development, intelligent decision-making and efficiency increase,” Huawei Chief Technology Officer of Smart Road, Waterway and Port BU Yue Kim said at the 2023 Mobile World Congress.st