Moore’s Law, the venerable maxim coined by Intel’s Gordon Moore in 1965, stated that the number of transistors on a microchip would essentially double every two years, all while prices go down.

He said nothing about the exponential rise of microchip company investments.

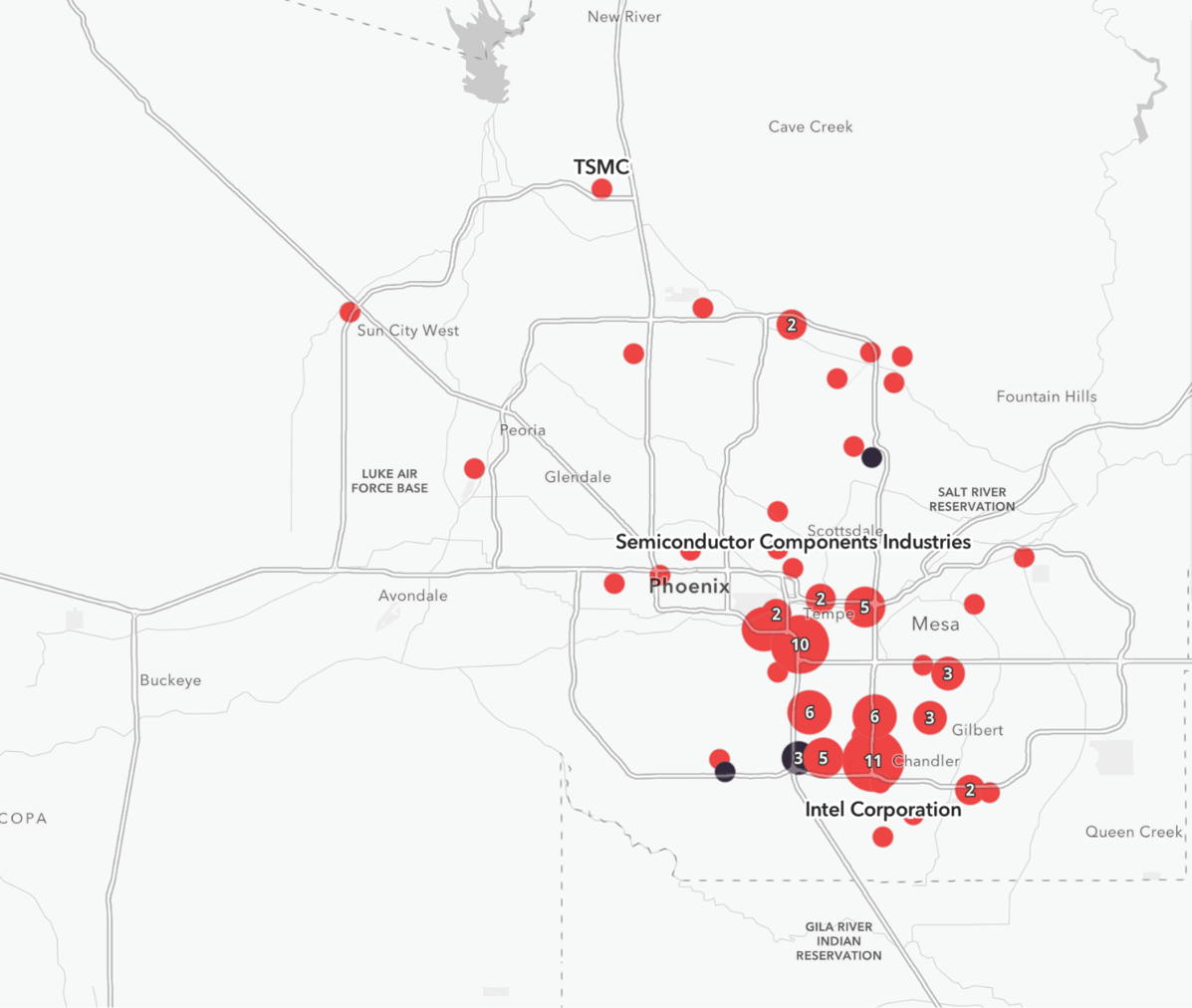

With the $280 billion federal CHIPS and Science Act passing in August 2022, and with anchoring expansions now under way on opposite ends of Greater Phoenix from Taiwan Semiconductor Manufacturing Co. (TSMC, $12 billion) and Intel (3,000 jobs), active deals under construction in the area represent around $33 billion in capital expenditure with 5,743 phase one jobs. Investors include Fujifilm, JX Nippon, Linde, Crest Technologies, Air Liquide and EMD Electronics, among others. Microchip Technology, Amkor Technology, ASM and onsemi are all headquartered in the region.

Oh, but there’s more.

An entire regional industrial ecosystem now employs more than 100,000 residents in fields relevant to semiconductors. “Ecosystem investments in Greater Phoenix,” says the Greater Phoenix Economic Council, “link 25 semiconductor companies with 9,500+ new jobs and $118 billion in capital investment considering the region.”

How fast does this supply chain network buildout happen? I asked TSMC Head of Public Relations Nina Kao.

TSMC’s $12 billion fab north of Phoenix is attracting its own ecosystem of international suppliers and partners.

“The construction of TSMC’s 5-nanometer fab in Arizona has driven investment from leading semiconductor suppliers to the state,” she says. “Those include companies that make materials and components which are required in semiconductor fab operations. Some are starting their first U.S. operations in Arizona, and others are expanding their U.S. operations. They bring new strengths to the U.S. semiconductor supply chain and will contribute greatly in ramping up leading-edge chip manufacturing.”

Multifaceted Suppliers Bring Broader Opportunity

Among the expanding suppliers cited by Kao and others are a number whose products reach into fields beyond semiconductors. The breadth of their offerings, therefore, may point to a wide swath of future growth opportunities catalyzed by that core connection to chips.

Sunlit Chemical, the first manufacturer of hydrofluoric acid and fluoride in Taiwan, broke ground on its first U.S. site, a two-phase, $100 million investment in north Phoenix. Phase one of the 900,000-sq.-ft. facility will be operational in 2023 and will produce hydrofluoric acid and other high purity grade industrial chemicals. Phase 2, expected to be operational in 2025, will involve raw material purification. Sunlit’s business is broader than chips: It has 75% of global market share in sodium fluoride for the oral care industry, and produces various grades of hydrofluoric acid and function chemicals for customers spanning from semiconductors, TFT-LCD and solar cells to steel manufacturing.

“Sunlit is excited to expand into Arizona and this new milestone marks Sunlit’s commitment to our partners that we are ready to expand our reach beyond Asia and set sights on the global front,” said Bryan Lin, president of Sunlit Group, in January 2022. “This new facility enables Sunlit to be the leading main supplier of high purity hydrofluoric acid to semiconductor fabs in the U.S. We are also equally committed to allocating considerable resources and to bring along the know-how in adhering to the highest standards of environmental and safety management, water efficiency and energy management.”

“In choosing Phoenix as its first U.S. facility, the company is joining a number of Taiwanese businesses that recognize the advantages our region provides,” said Chris Camacho, president and CEO of the Greater Phoenix Economic Council.

Ecosystem investments in Greater Phoenix link 25 semiconductor companies with 9,500+ new jobs and $118 billion in capital investment considering the region.

That same month, EMD Electronics announced a $28 million investment in a new factory in Chandler to expand its gas and chemical delivery systems business in North America and Europe.

Taiwan Puritic Corporation, also new to the U.S., has executed leases for operations in both Phoenix and Glendale.

Among investors new to Arizona, Rinchem is expanding in Surprise; Kokusai Semiconductor Equipment Corporation has located in Glendale for spare parts distribution, training centers and office space; and CTCI (engineering, procurement and construction) has opened an office in Phoenix.

In a panel discussion I participated in at the Southern Legislative Conference annual meeting in Oklahoma City this summer, Benjamin Hsu, director of the economic division for the Taipei Economic and Cultural Office in Houston, noted the core importance of semiconductors and electric vehicles for Taiwan’s economy. He said many Taiwanese companies reacted to U.S. tariffs on products made in China by either moving operations back to Taiwan or other Southeast Asia countries; looking to Mexico in order to take advantage of low-cost labor; or “even considering the U.S. because the U.S. is the market, the U.S. provides incentives, and because of the ‘Made in the USA’ requirement.”

I asked Hsu this fall about the cluster effect.

This map illustrates how many semiconductor companies have invested in Greater Phoenix. Numerals represent the number of companies in that specific municipality or neighborhood.

Map courtesy of GPEC

“There are many factors contributing to TSMC’s success in Taiwan, and I think an integrated semiconductor cluster in Taiwan is one of the most important factors,” Hsu says. “Those companies around TSMC help facilitate technical support and reduce the cost of production. Another cluster will need to establish around TSMC in Arizona to ensure its success.”

“When our Arizona fab is complete,” TSMC’s Nina Kao tells me, “TSMC’s customers will benefit from having the proximity of a world-class foundry and the supply chain that surrounds this industry.”

YES Says Yes

That supply chain continues to fill out space all over Greater Phoenix.

Edwards Semiconductor Service has opened a 200,000-sq.-ft. facility in Chandler — home of Intel’s major site — where it anticipates creating around 200 new jobs.

“Edwards went through an exhaustive site selection process,” said Chandler Mayor Kevin Hartke in March 2022, “and ultimately chose Chandler due to our first-class labor pool, excellent transportation access, and great quality of life.”

Companies are coming from neighboring states too: California-based Yield Engineering Systems (YES) recently signed a 123,000-sq.-ft. lease along Chandler’s Price Corridor where it will employ around 100, mostly in technology and engineering positions. YES develops and manufactures thermal, deposition, and wet process equipment that is used in the semiconductor, life sciences and display manufacturing fields. The Chandler facility will house a technology center with R&D functions, cleanroom operations, advanced manufacturing, customer support and office space.

“YES marks another California-based company drawn to Arizona, highlighting the state’s unmatched business climate,” said Sandra Watson, President and CEO of the Arizona Commerce Authority.

It’s a climate that only figures to improve, if YES’s neighbor Intel’s track record is anything to go by: Since 1979 the company has invested close to $32 billion to support its Arizona operations. The company’s $20 billion investment in those two new fabs at its Ocotillo site is well underway — which means the cluster serving those fabs figures to keep growing at a healthy rate too.

Gordon Moore would no doubt approve.