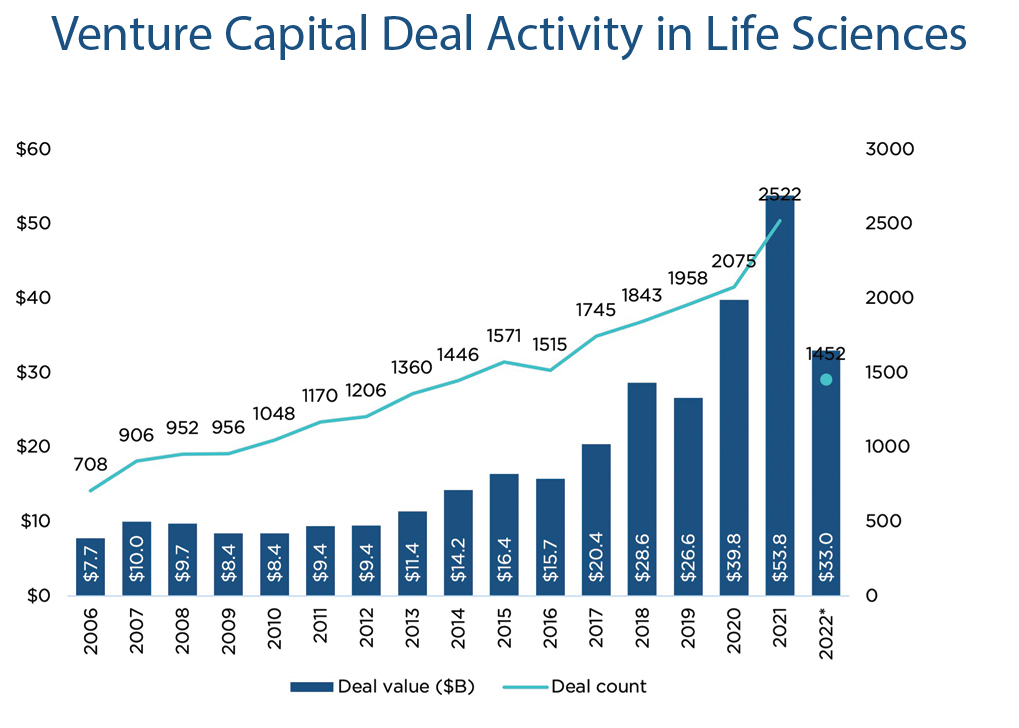

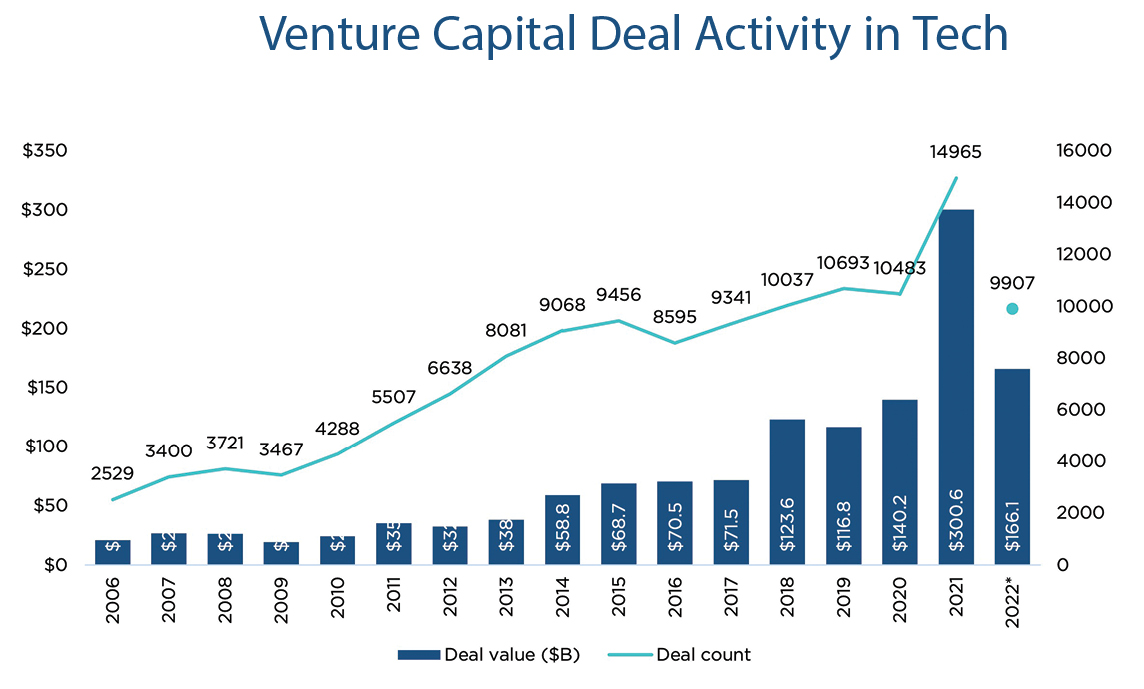

Year-end 2022 figures from the National Venture Capital Association and Pitchbook tell the story best.

In 2006, there were 156 venture capital deals involving healthcare services and systems, a category that includes what’s come to be known as health tech. The number of deals grew gradually in ensuing years: 384 deals in 2011, 620 in 2016. By 2019 — before the onset of the pandemic — the total had breached 1,000 to reach 1,087, and that total ballooned to 1,545 deals in 2021 — essentially 10 times the number of deals reached 15 years before.

What kind of value are we talking about? In 2019, Dassault Systèmes acquired clinical cloud solution provider Medidata Solutions for $5.8 billion. Medidata’s AI platform helps nearly all clinical research organizations and two-thirds of the world’s biggest pharmaceutical companies with clinical development, commercial and real-world data. The company maintains its HQ in New York City and operates a global network of 14 other offices in such locations as Boston, Cincinnati, Houston and three locations in California — San Francisco, Davis and San Mateo. The firm also has offices abroad in Shanghai, Beijing, Seoul, Tokyo and Singapore, as well as European site in London and Dusseldorf.

Medidata, like many health tech companies today, is in hiring mode. As of mid-April, it had 130 open positions in 10 cities, including more than 50 jobs in its hometown of New York; 23 jobs in London (Hammersmith); 11 positions in Tokyo; and 10 software development slots in Pune, India. The company moved into a larger EMEA office in London in 2017, and in 2019 aimed to grow its presence in Boston’s financial district to between 600 and 800 employees by 2024 after acquiring Shyft Analytics (based in the growing nearby life sciences city of Waltham).

Florida Company Diagnoses HQ Needs

As the Pitchbook graphs presented here show, VC activity in the separate categories of life sciences and tech directly parallels the health tech boom. And as the above city locations from one company illustrate, areas strong in life sciences or tech will do just fine for the merged-sector niche of health tech.

Graphs courtesy of Pitchbook/NVCA

Orlando, Florida, knows both sectors well, which stood the region in good stead in February when Fountain Life, which describes itself as a preventative health and longevity company, announced it would not only open its fourth precision diagnostic center in the nation at at Tavistock’s Lake Nona community, but move its headquarters there too. The center features AI technologies to collect and assess data that can aid in diagnosing conditions such as cancer, heart disease, and neurodegenerative disease.

The company is only moving a few hours north from its former home in Naples. But the allure is strong.

The 17-square-mile Lake Nona master-planned community, located next to Orlando International Airport, has been known as a health tech hub for a while. Among the organizations already there: HCA Healthcare, Nemours Children’s Health, Johnson & Johnson, Orlando Veterans Administration Medical Center, and the University of Central Florida (UCF) Academic Health Sciences campus, which includes the College of Medicine, Burnett School of Biomedical Sciences, UCF Lake Nona Cancer Center, and UCF Lake Nona Hospital. It was Tavistock’s $12.5 million, 50-acre donation to UCF in 2005 that originally launched the community.

A Fountain Life spokesperson says the company’s other four precision diagnostics centers are located in Naples; White Plains, New York; and another master-planned community, The Colony, located in north Dallas, Texas. Lake Nona’s targeted life sciences mission offers even more opportunity — including the potential of tourism as a customer base.

“Our ongoing real estate collaboration with Tavistock is essential to successfully integrating Fountain Life into the Lake Nona life science community,” said Fountain Life COO Shawn Buchheit. “This working partnership has allowed for our seamless entry into the innovative healthcare destination being established here and we look forward to providing services to both area residents and visitors to central Florida.”

The company says other centers are planned for several other U.S. and global locations in the coming years. “The expansion will include partnerships with additional real estate developers, hospitality management companies, payors, and other wellness-oriented businesses,” Fountain Life says.

Why did the headquarters come along for the ride this time?

“Lake Nona is a premier mixed use community focused on health and wellness, and that alignment with Fountain Life’s mission to help people experience longer and healthier lives made it an easy choice for our company headquarters,” says Buchheit in an email. “Building a new and expanded corporate headquarters in the same community as our flagship precision diagnostics center is a natural step in our company’s continued growth and evolution.”

Reports Document Tech/Science Overlap, Top Markets

An update from Cushman & Wakefield released in March further documents the impact of tech on life sciences activity and processes.

“New technologies and artificial intelligence (AI) will continue to be integrated into processes, leading to significant changes in the way life science firms utilize their workspaces,” says the report, which finds that the total U.S. life sciences real estate inventory of 32 million sq. ft. grew by over 34% in the last seven years and 19% in the last three years.

“The synergy between technology and science is driving the development of processes to streamline production and distribution of drugs and therapies,” stated Sandy Romero, research manager at Cushman & Wakefield. “As the sector matures, the real estate associated with life sciences will mature as well.”

One might call Greater Boston the most mature of life sciences markets. But apparently there’s room for growth even in the capital of the sector.

“Across all markets, Boston has the largest construction pipeline with 14.1 msf [million sq. ft.] of new space under construction, comprising 40% of Boston’s current lab space inventory,” says the Cushman & Wakefield report. “After Boston, the largest construction pipelines are in San Francisco (6.6 msf), San Diego (4.7 msf), Raleigh-Durham (2.2 msf) and Seattle (1.4 msf). In the UK, total lab inventory is expected to grow 27%, with a total of 1.9 msf of new space currently under construction.”

The 10 million sq. ft. of completions in Boston over the next two years comprise a big chunk of the 25.5 million sq. ft. expected to be delivered in the U.S. as a whole. The talent is expected to keep pace. “Boston’s life sciences labor pool is forecasted to grow nearly 20% through 2026,” the report said, the strongest growth forecast among the 15 markets tracked.

“Demand for talent in the U.S. life sciences sector was strong in 2022, with 700,215 unique job postings, nearly 160,000 more than the previous year, based on an analysis of Lightcast job postings data,” the report stated. Canadian unique job postings also accelerated 52% YoY, with 21,008 jobs in 2022. The report singled out Montreal in particular as the leading life sciences R&D hub in Canada in patents and R&D spending, with 1,487 life sciences and health technologies (LSHT) companies, 171 research centers, eight university-level institutions and three engineering schools.

“Montreal features some of the lowest research and operational costs in North America,” the report stated, “due in part to substantial provincial tax credits, including a 29% tax credit for scientific research and experimental development.” Montréal InVivo, which the LSHT cluster of Greater Montréal, says the cluster represents approximately 80% of Québec’s LSHT activity in a sector representing approximately 1.6% of Québec’s GDP.

Among other findings in the Cushman & Wakefield report:

Nearly a quarter of all unique job postings were for the top position: laboratory technician — a position that does not require a four-year degree but can pay handsomely.

“With 260,736 life sciences degree programs completed in 2021, a 3.7% increase from the previous year, there is a robust influx of future employees entering the workforce,” the report states. The top two markets of Los Angeles and New York “produced over 26,000 life sciences program completions in 2021 and consequentially were the fifth- and first-ranked markets in 2022 hires, respectively.

CBRE in April forecasted that “cumulative square footage of lab space in the largest 13 U.S. life sciences markets, already having expanded by 47% in the past five years, will increase by another 22% within the next two years to 220 million sq. ft. as projects currently under construction are completed.” Nearly one-third of that space under construction is pre-leased, the report found.

Among the report’s findings:

“Globally, the number of clinical trials increased to 444,567 by March 2023, up 36% from 2020, according to the U.S. National Library of Medicine. In the U.S., the number of new Phase 2 and 3 clinical trials – when life sciences companies most often expand their operations – ramped up over the past decade to exceed 3,000 in each of the past three years.”

“Annual funding from the National Institutes of Health has risen by 62% in the past decade, including an increase to $47.5 billion this year from $45.2 billion last year.”

Analysis of the largest 30 U.S. life sciences leases of 2022 documented 11 “megaleases” totaling 3.1 million sq. ft. in Greater Boston, with eight totaling 1.3 million sq. ft. in the San Francisco Bay Area. San Diego accounted for three, while Los Angeles and Raleigh-Durham nabbed two each.

Campus Connections

JLL reports that 34.9 million sq. ft. of lab space has been spoken for in buildings that came online in the last three years. The service provider also issued a report on higher education R&D that found R&D investments in higher education institutions have increased by almost 20% since 2017, with life sciences accounting for 58% of 2021 higher education R&D efforts.

What does that mean for R&D real estate on campus?

“Since 2016, over 26 million sq. ft. of higher ed R&D space has broken ground,” JLL reports. “California, Texas, Pennsylvania, New York, and Florida lead in planned R&D facility construction starts, with more than 5 million [sq. ft.] expected to commence either last year or this year.”

The Biden administration this year has requested $191 billion to go toward R&D, a 12.7% increase year-over-year and a 50.0% increase since 2017. JLL notes that at higher education institutions, “increased R&D spending doesn’t necessarily lead to increased enrollment.” But the top enrollment growth is in the precise area now merging in so many ways with precision medicine and health tech: computer and information sciences.

At a life sciences forum convened by Crain’s in New York in March, one prominent developer observed that the rising prominence of computing in the life sciences could be the savior of downtown office space. New York is investing $25 million in a pilot “Lab of the Future” in Midtown Manhattan that will rely on automation, AI and machine learning to “make the preclinical drug discovery process faster, fuel business growth and create more life science jobs,” said a release from Simone Development Companies.

“Life science laboratories are becoming less reliant on Bunsen burners and faucets in favor of advanced computers,” said Joe Simone, president of the company. “This ‘drying’ of wet labs means that owners of older office buildings or warehouses have new opportunities to reposition their properties for the medical research sector.”

Preventative health and longevity company Fountain Life liked Lake Nona so much it planted its fourth precision diagnostics center in the nation there and brought along its corporate headquarters too.

Photo courtesy of Fountain Life

Such developments can rejuvenate empty space of all kinds. In West Virginia in April, GATC Health Corp., which describes itself as a technology company transforming drug discovery and disease prediction using proprietary, disruptive AI, announced that, as one of the first tenants in the new West Virginia University Innovation Corporation (WVUIC), it is establishing an AI-based life sciences/biotech research and development hub to create safer and more effective therapeutics and accelerate personalized medicine. WVUIC’s 1.2-million-sq.-ft. building is the former Mylan pharmaceutical manufacturing facility adjacent to West Virginia University in Morgantown, rebranded just last year to attract science and technology occupants such as GATC’s.

“Moving its AI-driven lab operations to West Virginia positions the company to attract additional biotech and pharma partners and provide them with leading-edge artificial intelligence-based services within the facility. It also enhances and accelerates GATC’s own drug development programs with WVUIC’s medical chemistry infrastructure for highly efficient synthesis and testing of new therapeutic compounds.”

“The WVUIC facility will become a regional bioscience hub for GATC’s work and serve as an international example of how advanced AI can facilitate the development of safer and more effective drugs,” said GATC COO Tyrone Lam. “The WVUIC facility is ideal for our vision and will help bring these important treatments to people sooner. Together we are going to establish new best practices of leveraging advanced AI to discover better drugs faster.”