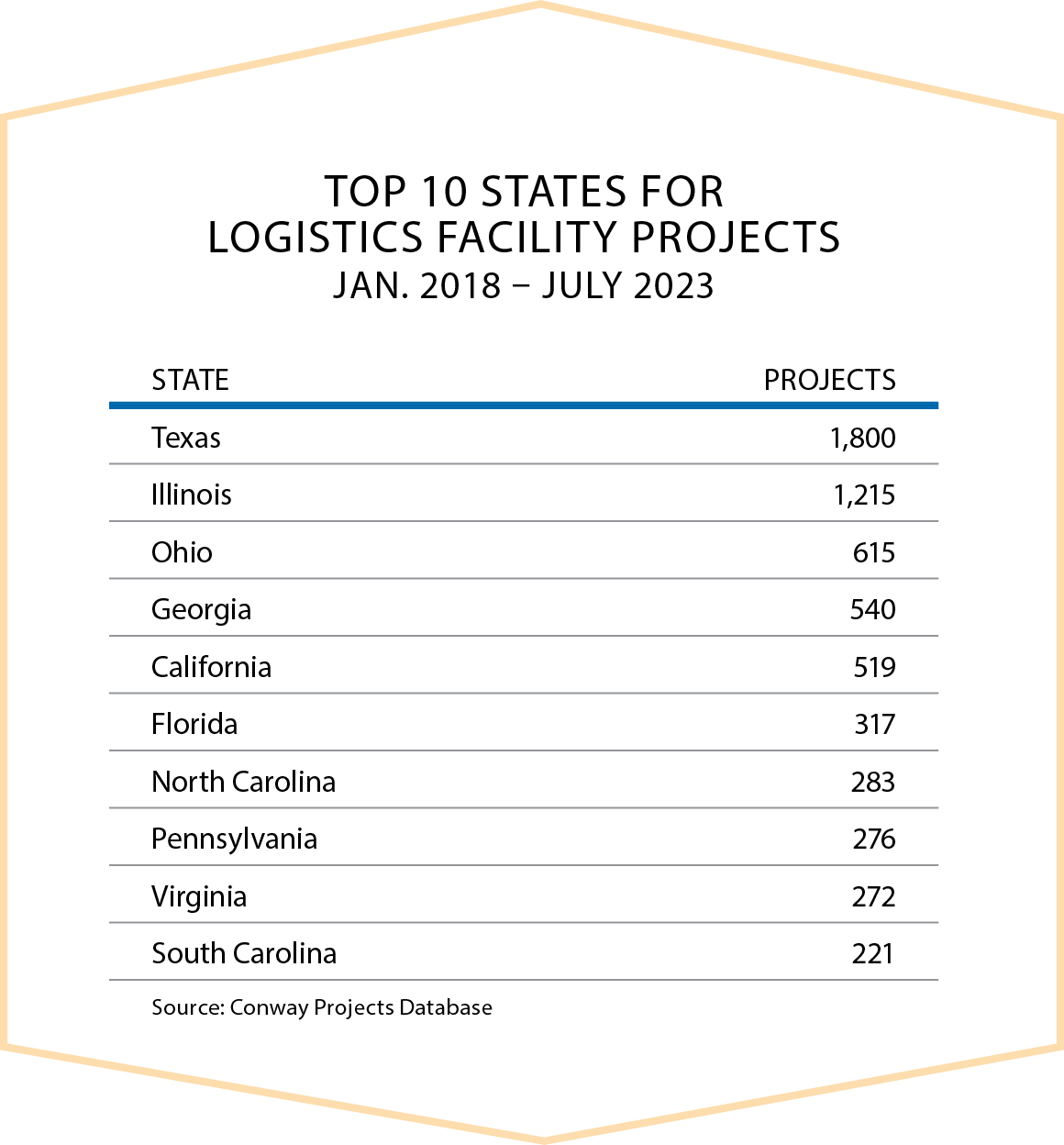

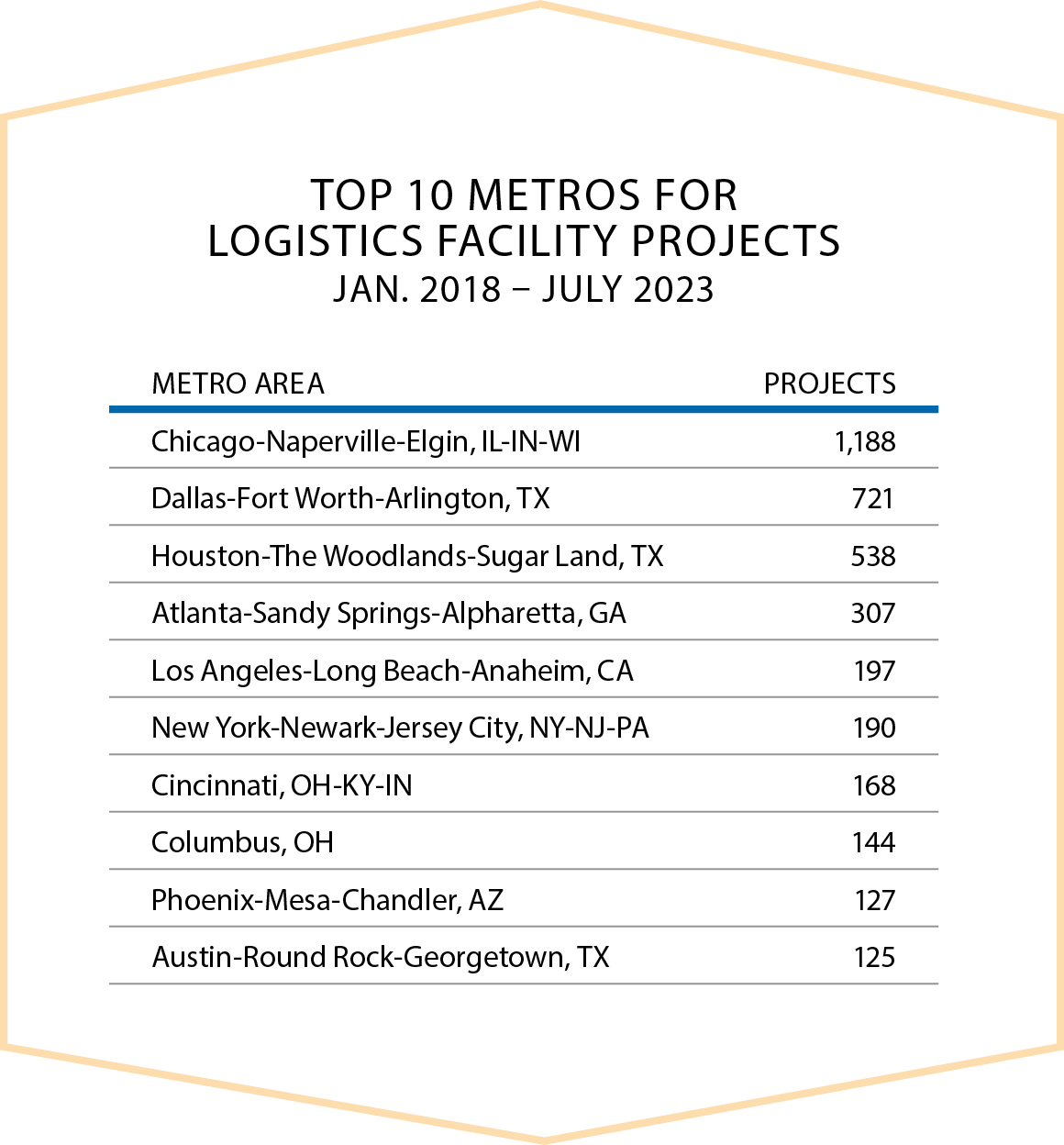

Texas, Illinois and Ohio top the Top 10 states for logistics facility projects documented over the past five years by Site Selection’s Conway Projects Database. Chicagoland, Dallas-Fort Worth and Greater Houston top the Top 10 metros.

Significant upsurges in distribution center activity have occurred in Texas, Florida and Pennsylvania, the data show, as well as in new Top 10 state South Carolina. Among the metro areas, Greater Los Angeles and the Phoenix metro show the most growth since the five-year totals published here last year, and Miami jumps into the upper echelon at No. 10.

Significant upsurges in distribution center activity have occurred in Texas, Florida and Pennsylvania, the data show, as well as in new Top 10 state South Carolina. Among the metro areas, Greater Los Angeles and the Phoenix metro show the most growth since the five-year totals published here last year, and Miami jumps into the upper echelon at No. 10.

In addition to the project data presented here, another barometer of the global logistics scene is to check in with the major package, supply chain and 3PL giants. Here’s a glimpse of what they’re up to.

United Parcel Service

An agreement reached with the International Brotherhood of Teamsters union in late July averted a strike that could have had a multi-billion-dollar economic impact. As Tractus pointed out in recent analysis, UPS handles 25% of all U.S. packages and shipped 5.2 billion parcels in 2022, ahead of 4.1 billion shipped by FedEx.

Photo courtesy of Stream Realty Partners

The company in 2022 hired more than 100,000 seasonal workers, not quite equal to one-third of the 330,000 Teamsters members employed by the company — a number that grew by 25% between 2018 and 2021, according to the company’s first “Jobs and Opportunity Report” issued in February in an early maneuver in advance of the labor negotiations. But where are all those jobs located? Among the company’s global moves:

In May 2022 UPS partnered with Indian travel and hospitality conglomerate InterGlobe Enterprises to launch a new logistics brand in India called MOVIN. “India’s growth towards a $5 trillion economy will be largely supported by the growth of local businesses and logistics which are key contributors to India’s economy,” said JB Singh, the director of InterGlobe Enterprises who will oversee the new brand. “I am confident that InterGlobe’s deep understanding of the Indian market combined with UPS’s 114 years of logistics expertise will make this venture a success.”

Headquartered in Gurugram (also known as Gurgaon) southwest of New Delhi in the northern India state of Haryana, MOVIN launched operations in a phased manner with ramp-up starting last summer in Mumbai, Delhi NCR and Bengaluru, “with more expansions to other metros and cities across the nation to follow,” said UPS.

The move followed another Asian investment in December 2021: the opening of the UPS Supply Chain Solutions Asia Pacific Innovation Centre in Singapore.

DHL

Germany-based DHL is growing right in UPS’s Atlanta backyard.

DHL Express Americas, based in Plantation, Florida, in July announced the grand opening of its $84.5 million, 100,000-sq.-ft. Americas region hub based at Hartsfield-Jackson Atlanta International Airport. The hub, capable of sorting 20,000 pieces an hour, “establishes direct connections among 19 cities in the U.S. Southeast and key global markets, including Europe and major DHL hubs worldwide,” the company said. “Future plans involve adding flight connections to Hong Kong, Mexico, the UK, and Puerto Rico.”

In addition to the hub’s sustainability attributes, it “exemplifies our belief in the power of international trade and recognizes the significance of Atlanta and the Southeast U.S. in the global marketplace,” said Mike Parra, CEO of DHL Express Americas.

There are other strong southeastern cities too: In June, DHL eCommerce Solutions, based in Weston, Florida, announced it had moved its distribution center in Orlando to a 129,000-sq.-ft. location two miles from Orlando International Airport where 145 full- and part-time employees work.

The doubled Orlando footprint is part of a five-year growth plan for the company that since February 2023 has seen it move its Stow, Ohio, operation to a wholly-owned building; move its Salt Lake City distribution center to a larger facility; and open a brand new $18 million distribution center in Kansas City, Missouri, in June that also doubled the size of its previous digs. That facility is five miles from Kansas City International Airport, known in recent headlines more for its new central passenger terminal than for its cargo capabilities.

The doubled Orlando footprint is part of a five-year growth plan for the company that since February 2023 has seen it move its Stow, Ohio, operation to a wholly-owned building; move its Salt Lake City distribution center to a larger facility; and open a brand new $18 million distribution center in Kansas City, Missouri, in June that also doubled the size of its previous digs. That facility is five miles from Kansas City International Airport, known in recent headlines more for its new central passenger terminal than for its cargo capabilities.

“The Kansas City metropolitan area is rapidly expanding, and it’s the perfect location for DHL eCommerce Solutions to have a larger, fully customized facility that will assist us in growing our footprint in the Midwest,” said Lee Spratt, CEO of DHL eCommerce Solutions, Americas.

In July, DHL Supply Chain announced what it called “a landmark investment” of €500 million through 2028 into strategically located Latin American markets. These investments made until 2028 are supposed to strengthen DHL’s operations in Latin America. Projects include decarbonizing the domestic fleet through greener alternatives; building, developing and retrofitting its real estate assets and warehouses in the market; as well as significant investments into new technologies, robotics and automation solutions. The investment is part of DHL Supply Chain’s strategic investment plan to further strengthen logistics capabilities in high-demand sectors such as healthcare, automotive, technology, retail and e-commerce.

Netherlands No. 1 Connector

DHL in May launched a new thrice-weekly intermodal rail freight service for full-truckload shipments between Duisburg, Germany and Padborg, Denmark. The transport takes 12 hours and will reduce carbon emissions.

Photo courtesy of DHL

DHL and New York University’s Stern School of Business in March released the DHL Global Connectedness Index 2022, an in-depth report analyzing 171 countries and territories to form a picture of the state of globalization and its prospects.

DHL and New York University’s Stern School of Business in March released the DHL Global Connectedness Index 2022, an in-depth report analyzing 171 countries and territories to form a picture of the state of globalization and its prospects.

The data indicated that international trade in goods was 10% above pre-pandemic levels in mid-2022. International travel remained 37% below 2019 levels in 2022, but doubled compared to 2021. Even as the U.S. and China decouple in a number of areas, the report found the two countries “are still linked by far greater flows than any other two countries that do not share a border.”

Ah, but those that do share borders are supremely connected because, well, they have to be. Netherlands was No. 1 in the index, followed by Singapore and fellow Benelux country Belgium.

“It remains an open question whether trade patterns will become significantly more regionalized in the future,” said Steven Altman, senior research scholar and director of the DHL Initiative on Globalization at NYU Stern’s Center for the Future of Management. “Many companies and governments are focused on nearshoring to regionalize supply chains, and there are substantial business benefits that can come from regionalization. On the other hand, more than half of all trade already happens within regions, and the benefits of long-distance trade are still important, especially as inflation remains high, economic growth has slowed, and container shipping rates have come back down.”

“Companies all around the globe are looking for more diversified sourcing and supply chain strategies by bringing stock points closer to their production and sales markets,” explained Oscar de Bok, global CEO of DHL Supply Chain. “Therefore we see increasing demand for logistics support in Mexico, Brazil and the other strategic markets in Latin America. That trend of investing in multiple source points closer to the large sales markets — which we call omni-sourcing — helps industry customers to build more resilient, robust and flexible supply chains to better cater to the needs of their end customers.”

Photo-rendering courtesy of DHL

As part of the ceremony, DHL Supply Chain Mexico inaugurated a new Center of Excellence for Electric Vehicles. The company is also investing in new warehouses in Tijuana and Monterrey, as well as a new campus in the State of Mexico that will serve the e-commerce, retail, fashion, consumer, medical devices, aerospace, electronics, and automotive sectors.

In Brazil, the company recently announced the expansion and modernization of its distribution center in Goiás and is expanding its operations and presence in Extrema Minas Gerais. In Chile, a new distribution center has risen in Pudahuel.

Amazon

As widely reported, Amazon pulled back on its fulfillment and distribution center development after a flurry up to and during the pandemic. But projects and job creation are still unfolding.

Photo courtesy of CBRE

The company’s Welcome Door program launched in the U.S. in April 2022 to provide tailored immigration support to Amazon’s refugee and humanitarian-based immigrant employees, part of a pledge to hire 5,000 refugees in the U.S. by 2024. This year that program has been expanded to Germany, Poland and Australia as part of a pledge to hire 5,000 refugees in Europe over the next three years. On top of that, Amazon Web Services, the company’s data center division, aims to provide training to 10,000 Ukrainians through its ITSkills4U program.

Last year the company hired 150,000 seasonal employees for the holiday push. And it committed to hire 2,500 new corporate and tech employees at multiple cities in California as it expands its Tech Hubs in San Diego and the Los Angeles area, including Irvine and Santa Monica. “These latest investments come after Amazon opened more than 15 sites across Southern California and created more than 17,000 jobs statewide in 2021 alone,” the company said in May 2022.

The news followed 2021 announcements of 550 new jobs at Amazon’s Phoenix Tech Hub in Tempe and 1,000 new jobs at its Austin Tech Hub in Texas, the No. 1 state for logistics facility projects according to the latest five years of data in Site Selection’s Conway Projects Database. Between 2010 and 2021, Amazon created more than 70,000 full- and part-time jobs in Texas and invested more than $29 billion across the state.

Ryder Logistics: New HQ and Much More

Perhaps no logistics company has been busier than Miami-based Ryder System, which in May 2022 announced expansion of its Ryder Last Mile network with new distribution centers in Boise, Idaho, and in Smyrna, Tennessee, in the Nashville metro area.

Back Home Again

Leaders and employees from Experior Global & Transport and other key stakeholders broke ground in July for a new four-building, $65 million headquarters and logistics campus in Schaumburg, Illinois, part of No. 1 logistics metro Chicagoland.

Located near several major expressways and 10 miles from O’Hare International Airport, the campus will serve logistics clients while leasing one building to third-party users. It will feature a shared parking lot that will accommodate parking for up to 800 trucks and trailers; a fully equipped gas station and convenience store, and a truck sales and repair shop.

The new headquarters brings Experior’s total number of locations to six across the country, with two in Illinois, three in New Jersey and one in No. 1 logistics state Texas. The new development marks the company’s return from Alsip, Illinois, to the suburb where it was founded 25 years ago, said a release from NAI Hiffman.

“With burgeoning populations and quick access to highway and rail networks, these two new markets increase speed-to-market, which is critical in today’s highly competitive environment and vital to our customers’ growth strategies,” said Steve Sensing, president of supply chain solutions for Ryder.

Befitting the No. 1 logistics metro in the nation, in December 2022 the company announced its 10th multiclient distribution center in Chicagoland, a nearly 550,000-sq.-ft. facility in North Aurora. Noting the metro area’s location a one- to two-day drive from about half of the U.S. population, Darin Cooprider, senior vice president of consumer-packaged goods for Ryder, said, “Chicagoland also has a dense labor force, and with other Ryder warehouse operations nearby, we can offer the flexibility customers often need to manage seasonal and market changes.” The company aimed to hire around 100 people at the new site.

Photo courtesy of Ryder

Ryder operates more than 330 warehouses encompassing more than 80 million sq. ft. of space across North America, where it employs 48,000 people. Its clients include nine of the Top 10 U.S. food and beverage companies. It also operates more than 760 maintenance shops. Which explains why the company in July announced a major expansion of its diesel maintenance technician training programs. The company said it plans to expand its three existing Ryder Technician Excellence Centers in Doraville, Georgia (Atlanta); Philadelphia and Houston “to include several new locations throughout North America in the near future.”

The company’s training program updates include the launch of the Ryder Accelerated Maintenance Program (RAMP), which offers high school seniors an opportunity to obtain hands-on experience by working part-time. Other programs include an 18-month technician trainee program and the company’s seven-year-old Pathway Home program, a 12-week diesel maintenance technician training program for personnel exiting military service.

Also in July, Ryder announced the establishment of Baton, A Ryder Technology Lab in Silicon Valley. “Baton’s mission is to pioneer a suite of groundbreaking customer-facing technologies designed to revolutionize how Ryder’s customers interact with their transportation and supply chain networks,” the company said. “These technologies will digitize and optimize networks at a level not currently available in the industry and will prepare Ryder for the coming artificial intelligence (AI) wave.”

Photo courtesy of Business Wire

“The establishment of a Silicon Valley-based technology lab is a natural evolution for Ryder, as we build on the $1.3 billion in strategic investments we’ve made over the past five years to develop, acquire, and invest in innovative technologies, products, and services that help make our customers’ logistics networks more efficient and resilient,” said Karen Jones, CMO and head of new product development for Ryder.

Founded 90 years ago in Miami, the company also made a headquarters move this year. Its former 16.8-acre campus was sold to Bridge Industrial in March for $42.1 million. Some 800 South Florida employees work for the HQ, though many have have worked remotely or in a hybrid manner since March 2020.

“Like many companies post-pandemic, we determined we needed much less office space than we were utilizing at our headquarters building,” said Ryder Chairman and CEO Robert Sanchez. “We were pleased with the current location of our headquarters office, but with the vacant space in the building and the very attractive rates for a buyer to move in or redevelop the site, we knew selling and downsizing was the right decision to make.”

The company leased back the sold HQ campus for 12 months as it searched for other options in Miami-Dade County. It didn’t take long. In May, Ryder signed a long-term lease for a new headquarters location at the Colonnade office tower in Coral Gables.

“In our 90th year, it was important that we honor our founding and remain headquartered in Miami-Dade County which continues to be a logistics gateway and a county with a growing technology and innovation footprint,” Sanchez said. “Coral Gables is a nationally recognized and business-friendly city that will enable us to continue to attract and retain the best talent, and we look forward to calling it our new home. Ryder expects to occupy the space by early 2024.